Is VANTAG safe?

Pros

Cons

Is Vantage Safe or a Scam?

Introduction

Vantage, established in 2009, has emerged as a prominent player in the forex and CFD trading landscape. Operating out of Australia, it offers a wide array of trading instruments, including forex, indices, commodities, and cryptocurrencies. With the rise of online trading, it has become crucial for traders to carefully evaluate their brokers to ensure they are engaging with a reputable entity. The forex market is fraught with risks, and the consequences of choosing an unreliable broker can be severe, including loss of funds or poor trading conditions. This article aims to provide an objective assessment of Vantage's credibility, examining its regulatory status, company background, trading conditions, and customer experiences. The analysis is based on extensive research, including reviews from trusted financial websites and user feedback.

Regulation and Legitimacy

One of the primary factors in determining whether a broker like Vantage is safe or a scam is its regulatory status. Vantage is regulated by several reputable authorities, which is a positive indicator of its legitimacy. Regulatory bodies enforce strict compliance standards to protect traders and ensure fair trading practices. Below is a summary of Vantages regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| ASIC | 428901 | Australia | Verified |

| FCA | 590299 | United Kingdom | Verified |

| CIMA | 1383491 | Cayman Islands | Verified |

| VFSC | 700271 | Vanuatu | Verified |

The Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority (FCA) are considered tier-1 regulators, known for their stringent oversight. The presence of these licenses suggests that Vantage adheres to high standards of financial practice. However, it is important to note that while Vantage is regulated in multiple jurisdictions, it has faced scrutiny regarding its compliance history. Some user reviews have raised concerns about withdrawal issues and alleged price manipulation, which could raise red flags for potential traders. Nevertheless, the overall regulatory framework supporting Vantage indicates a commitment to maintaining a safe trading environment.

Company Background Investigation

Vantage was founded in 2009 and has since developed a strong reputation in the trading community. The company operates under the ownership of Vantage Global Prime Pty Ltd, which is registered in Australia. Over the years, Vantage has expanded its operations globally, with additional offices in locations such as the Cayman Islands and Vanuatu. The management team at Vantage consists of experienced professionals with extensive backgrounds in finance and trading, which adds credibility to the broker's operations.

Transparency is a crucial aspect of any financial institution, and Vantage appears to prioritize this by publicly displaying its regulatory licenses and operational information on its website. This level of openness can enhance traders' confidence in the broker. However, some reviews have pointed out that while Vantage provides a wealth of information, there are still areas where clarity could be improved, particularly regarding fees and withdrawal processes.

Trading Conditions Analysis

When evaluating whether Vantage is safe, it is essential to consider its trading conditions, including fees, spreads, and overall cost structure. Vantage offers several account types, including Standard STP, Raw ECN, and Pro ECN accounts, each designed to cater to different trading strategies and experience levels.

The overall cost structure is competitive, with spreads starting from as low as 0.0 pips on certain accounts. However, traders should be mindful of the commission fees associated with the Raw ECN and Pro ECN accounts. Below is a comparison of Vantage's core trading costs:

| Fee Type | Vantage | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | From 0.1 pips |

| Commission Model | $3 per lot | $6 per lot |

| Overnight Interest Range | Varies | Varies |

While Vantage's spreads are competitive, some traders have reported unexpected fees, particularly concerning withdrawal processes. This has led to mixed reviews regarding the brokers transparency in its fee structure. Overall, while Vantage's trading conditions are generally favorable, potential traders should be aware of the possible hidden costs associated with their trading activities.

Client Fund Safety

The safety of client funds is a critical concern for any trader. Vantage employs several measures to ensure the security of traders' investments. Client funds are held in segregated accounts with top-tier banks, which means that they are kept separate from the broker's operational funds. This segregation is a standard practice among reputable brokers and helps protect client funds in the event of financial difficulties faced by the broker.

Additionally, Vantage provides negative balance protection, ensuring that traders cannot lose more than their initial investment. This feature is especially important in volatile markets, where rapid price movements can lead to significant losses. Despite these safety measures, some users have reported past issues related to fund withdrawals, raising concerns about the broker's overall reliability. Historical incidents involving fund access may serve as cautionary tales for potential clients.

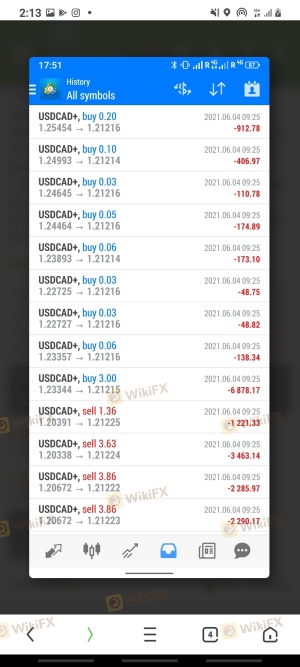

Customer Experience and Complaints

Customer feedback plays a vital role in assessing whether Vantage is safe. Overall, user experiences with Vantage are mixed; while many traders appreciate the competitive trading conditions and robust platforms, others have expressed dissatisfaction with the customer service and withdrawal processes. Common complaints include delays in fund withdrawals and challenges with account verification.

Below is a summary of the primary types of complaints received about Vantage:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Account Verification Issues | Medium | Moderate |

| Customer Service Responsiveness | Low | Generally Positive |

A few case studies highlight these issues: one trader reported a frustrating experience with withdrawal delays that took over two weeks to resolve, while another praised the broker's customer service for its responsiveness during a technical issue. These mixed reviews suggest that while Vantage has strengths, it also has areas that require improvement.

Platform and Execution

Vantage offers its clients access to popular trading platforms like MetaTrader 4 and MetaTrader 5, known for their advanced features and user-friendly interfaces. The broker's execution quality is generally regarded as good, with fast order processing and minimal slippage. However, some traders have reported occasional issues with order execution speed, particularly during high-volatility periods.

The potential for platform manipulation has been a concern among some users, particularly those who have experienced price discrepancies during trading. While Vantage's trading platforms are well-regarded, traders should remain vigilant and monitor their trades closely, especially during volatile market conditions.

Risk Assessment

Using Vantage as a trading platform comes with inherent risks that traders should consider. The overall risk profile of trading with Vantage can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | Well-regulated by ASIC and FCA |

| Fund Security | Medium | Segregated accounts, but past issues |

| Execution Quality | Medium | Generally good, but some delays |

| Customer Support | Medium | Mixed reviews on responsiveness |

To mitigate these risks, traders are advised to conduct thorough research and maintain a well-structured risk management strategy. This may include setting appropriate stop-loss orders and diversifying their trading portfolios to minimize exposure.

Conclusion and Recommendations

In conclusion, Vantage presents itself as a reputable broker with a solid regulatory foundation and competitive trading conditions. However, potential traders should exercise caution due to historical complaints regarding fund withdrawals and customer service issues. Overall, Vantage does not exhibit clear signs of being a scam, but traders should remain vigilant and conduct their due diligence.

For those considering trading with Vantage, it is advisable to start with a smaller deposit or utilize a demo account to assess the broker's services. Additionally, traders may want to explore other reliable alternatives such as IG Markets or OANDA, which also offer robust trading environments and regulatory oversight. Ultimately, the choice of broker should align with individual trading strategies and risk tolerance.

Is VANTAG a scam, or is it legit?

The latest exposure and evaluation content of VANTAG brokers.

VANTAG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VANTAG latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.