Is VANGUARD TRADING safe?

Pros

Cons

Is Vanguard Trading Safe or a Scam?

Introduction

Vanguard Trading is an online brokerage firm that has gained attention in the forex market for its low-cost investment options and user-friendly platform. As an entity that operates in the financial services sector, it is crucial for traders to assess the credibility and reliability of any brokerage they choose to work with. The forex market is notorious for its volatility and risks, making it essential for traders to carefully evaluate the regulatory status, customer feedback, and overall service quality of brokers like Vanguard Trading. This article aims to provide a comprehensive analysis of whether Vanguard Trading is safe or potentially a scam, utilizing a structured approach that includes regulatory assessments, company background investigations, trading conditions, customer experience reviews, and risk evaluations.

Regulation and Legitimacy

The regulatory status of a brokerage is a fundamental aspect that determines its legitimacy. Vanguard Trading operates without valid regulatory oversight, which raises significant concerns about the safety and security of traders' funds. Regulatory bodies are essential in ensuring that brokers adhere to strict guidelines, protecting investors from fraud and malpractice. Below is a summary of Vanguard Trading's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Vanguard Trading is not subject to the same stringent oversight as regulated brokers, which can lead to increased risks for investors. Without a regulatory framework, clients may have limited recourse in case of disputes or issues with the broker. This lack of oversight is a significant red flag and warrants caution for potential traders considering this platform. It is crucial for traders to prioritize working with brokers that are regulated by reputable authorities to ensure the safety of their investments.

Company Background Investigation

Vanguard Trading's history and ownership structure are essential factors in assessing its credibility. The company claims to have been in operation for several years, but there is limited publicly available information regarding its founding, ownership, and management team. This lack of transparency can be concerning for potential investors, as it raises questions about the accountability and reliability of the brokerage.

The management team's background and professional experience play a vital role in determining the trustworthiness of a brokerage. A strong leadership team with a proven track record in the financial industry can instill confidence in clients. However, without detailed information about the individuals behind Vanguard Trading, it is challenging to evaluate their expertise and commitment to ethical practices.

Furthermore, the overall transparency and information disclosure level of Vanguard Trading are questionable. A reputable brokerage should provide clear and accessible information about its services, fees, and regulatory status. The absence of such information can lead to skepticism regarding the broker's intentions and operational practices.

Trading Conditions Analysis

When evaluating whether Vanguard Trading is safe, it is essential to analyze its trading conditions, including fees and costs. A transparent fee structure is crucial for traders to understand the total cost of their investments. Vanguard Trading claims to offer competitive pricing, but the lack of detailed information on its website raises concerns about hidden fees or unfavorable trading conditions.

The following table summarizes the core trading costs associated with Vanguard Trading:

| Fee Type | Vanguard Trading | Industry Average |

|---|---|---|

| Major currency pair spreads | N/A | Varies |

| Commission model | N/A | Varies |

| Overnight interest range | N/A | Varies |

The absence of specific data regarding spreads, commissions, and overnight interest rates makes it difficult for traders to assess the overall cost of trading with Vanguard Trading. Additionally, any unusual or problematic fee policies could significantly impact a trader's profitability. It is essential for potential clients to seek clarity on these aspects before committing to the platform.

Customer Funds Security

The safety of customer funds is a paramount concern when evaluating a brokerage's reliability. Vanguard Trading's lack of regulatory oversight raises significant questions about its funds' security measures. A reputable brokerage should implement robust safeguards to protect clients' investments, including fund segregation, investor protection schemes, and negative balance protection policies.

Vanguard Trading's unregulated status means that it may not have the same level of investor protection as regulated brokers. This can leave traders vulnerable to potential losses in the event of broker insolvency or fraudulent activities. It is crucial for traders to understand the implications of trading with an unregulated broker and to consider the risks involved.

Moreover, any historical issues or controversies related to fund security should be closely examined. Traders should be aware of past incidents that may have affected the broker's reputation and their clients' trust.

Customer Experience and Complaints

Customer feedback and experiences can provide valuable insights into a brokerage's reliability. Analyzing reviews and complaints can help potential clients gauge the quality of service provided by Vanguard Trading. Common complaint patterns may indicate underlying issues that could affect the overall trading experience.

The following table summarizes the main complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

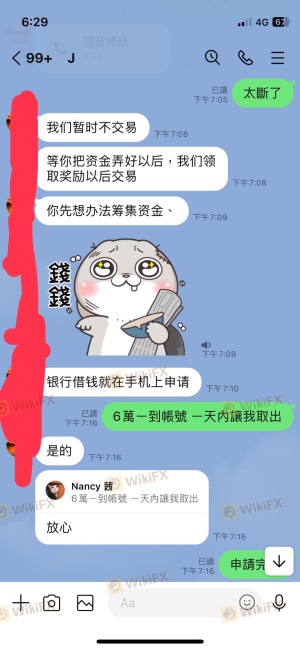

| Withdrawal delays | High | Unresolved |

| Poor customer service | Medium | Average |

| Lack of transparency | High | Unresolved |

Several users have reported significant delays in fund withdrawals, which can be a major concern for traders who need timely access to their funds. Additionally, complaints regarding poor customer service and a lack of transparency in operations further contribute to skepticism about the broker's reliability.

For instance, one user reported a frustrating experience when attempting to withdraw funds, noting that it took weeks to receive their money. Another user expressed dissatisfaction with the quality of customer support, stating that their inquiries went unanswered for extended periods. These experiences highlight potential issues that traders should consider before engaging with Vanguard Trading.

Platform and Execution

The performance and reliability of a trading platform are critical factors in determining whether a brokerage is safe. Vanguard Trading's platform should provide a seamless trading experience, including fast order execution and minimal slippage. However, any signs of platform manipulation or issues with order execution can raise concerns about the broker's integrity.

Traders should also evaluate the platform's stability and user experience. A well-designed platform should offer essential features, such as real-time quotes, advanced charting tools, and efficient order management. If Vanguard Trading's platform lacks these capabilities, it may not be suitable for active traders seeking a robust trading environment.

Risk Assessment

Using Vanguard Trading involves several risks that potential clients should consider. The absence of regulation, combined with limited transparency and customer complaints, contributes to an overall risk profile that may be unfavorable for traders.

The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about fund safety. |

| Customer Service Risk | Medium | Complaints about poor service and withdrawal delays. |

| Transparency Risk | High | Lack of information about fees and company operations. |

Traders should take appropriate precautions, such as conducting thorough research and considering alternative, more regulated brokers, to mitigate these risks.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Vanguard Trading raises several red flags regarding its safety and reliability. The lack of regulation, transparency issues, and customer complaints all contribute to a perception of risk that potential traders should carefully evaluate.

While Vanguard Trading may offer low fees and a variety of investment options, the absence of regulatory oversight and the potential for unresolved issues make it a less-than-ideal choice for many traders. For those seeking a safe trading environment, it is advisable to consider alternative brokers that are regulated and have a proven track record of reliability.

In conclusion, traders should exercise caution when considering Vanguard Trading and prioritize their safety by opting for brokers with robust regulatory frameworks and positive customer feedback.

Is VANGUARD TRADING a scam, or is it legit?

The latest exposure and evaluation content of VANGUARD TRADING brokers.

VANGUARD TRADING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VANGUARD TRADING latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.