Regarding the legitimacy of Tri forex brokers, it provides CYSEC and WikiBit, .

Is Tri safe?

Business

License

Is Tri markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

TRILT LTD

Effective Date:

2014-10-30Email Address of Licensed Institution:

info@trilt.comSharing Status:

No SharingWebsite of Licensed Institution:

www.trilt.comExpiration Time:

--Address of Licensed Institution:

51 Omonias Avenue, Christodoulou court, Office 201-2, 3052, LimassolPhone Number of Licensed Institution:

+357 25 510 210Licensed Institution Certified Documents:

Is Tri Safe or Scam?

Introduction

Tri is a brokerage firm that has made its mark in the forex trading landscape since its inception in 2017. Positioned as a platform catering to both novice and experienced traders, Tri offers a variety of financial instruments including forex, CFDs, and commodities. However, with the increasing number of fraudulent activities in the online trading space, it is crucial for traders to carefully assess the legitimacy and reliability of any broker before committing their funds. This article aims to provide an objective analysis of whether Tri is a safe trading platform or a potential scam. Our investigation is based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and expert opinions.

Regulatory and Legality

The regulatory status of a trading platform is one of the most critical factors in determining its legitimacy. A regulated broker is typically subject to strict oversight, ensuring adherence to industry standards and protecting clients' interests. Unfortunately, Tri lacks proper regulatory oversight, which raises significant concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a valid regulatory license indicates that Tri does not comply with the necessary legal frameworks governing forex trading. Without regulation, traders have limited recourse in case of disputes or fraudulent activities. Historical compliance issues have been reported, with numerous users expressing concerns about their inability to withdraw funds and the lack of response from the company. This lack of regulation is a red flag for potential investors, making it essential to question: Is Tri safe?

Company Background Investigation

Tri's history is marked by a lack of transparency, raising questions about its ownership structure and operational integrity. Originally established as a trading platform, Tri has undergone several name changes and rebranding efforts, which may suggest attempts to distance itself from previous negative feedback. The company's management team is not well-documented, and there is limited information available regarding their professional backgrounds and experience in the financial industry.

The overall transparency of Tri is concerning. Potential clients may find it challenging to obtain reliable information about the company's operations, which is a significant red flag for any trading platform. The lack of clear information about the company's ownership and management only adds to the skepticism surrounding its legitimacy. As such, it is crucial for traders to inquire about the background and operational history before engaging with Tri. This brings us back to the question: Is Tri safe?

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Tri claims to provide competitive spreads and various account types, but the actual fee structure may not be as favorable as advertised.

| Fee Type | Tri | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 3-5% | 1-2% |

The spreads offered by Tri appear to be significantly higher than the industry average, which could erode traders' profits. Additionally, the absence of a clear commission structure raises concerns about hidden fees that may be applied during trading. Such potentially unusual fee policies warrant caution, as they can lead to unexpected costs that traders may not be prepared for. Thus, it is essential for traders to read the fine print and fully understand the fee structure before engaging with Tri.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. Tri's lack of regulatory oversight means that there are no guarantees regarding the security of client deposits. It is unclear whether Tri employs proper fund segregation practices, which are crucial for protecting clients' money in the event of company insolvency. Furthermore, there is no mention of investor protection schemes, such as negative balance protection, which can safeguard traders from losing more than their initial investment. Historical reports of clients being unable to withdraw funds further exacerbate concerns about the safety of their investments with Tri.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Unfortunately, Tri has garnered a significant number of complaints from users, with many expressing frustration over withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Advertising | High | None |

Typical complaints include difficulties in withdrawing funds, lack of communication from customer support, and accusations of misleading advertising practices. One user reported waiting months for a withdrawal request to be processed, only to receive no response from the company. Such patterns of complaints raise serious concerns about Tri's operational integrity and customer service quality. This leads to the pressing question: Is Tri safe?

Platform and Trade Execution

The performance of a trading platform can significantly impact a trader's experience. Tri uses a trading platform that claims to offer fast execution and a user-friendly interface. However, user reviews often highlight issues with order execution quality, including slippage and rejected orders. Traders have reported instances where their orders were not executed as expected, leading to financial losses. Signs of potential platform manipulation have also been discussed, which could further compromise the integrity of trades executed on Tri's platform.

Risk Assessment

Engaging with Tri entails several risks that traders must be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Potential loss of client funds |

| Execution Risk | Medium | Issues with order execution |

To mitigate these risks, traders are advised to conduct thorough research before investing and to consider using regulated brokers with established reputations. It is crucial to remain vigilant and avoid platforms that exhibit red flags, such as poor customer feedback and a lack of transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tri exhibits several characteristics commonly associated with scam brokers. The absence of regulation, coupled with significant customer complaints and issues regarding fund safety, raises serious concerns about the platform's legitimacy. For traders considering using Tri, it is advisable to exercise extreme caution. Those new to trading should seek platforms that are well-regulated and have a proven track record of reliability. Consider alternatives such as established brokers with robust regulatory oversight and positive user reviews to ensure a safer trading experience. In summary, is Tri safe? The overwhelming evidence points towards a lack of safety and reliability, making it a platform that traders should approach with skepticism.

Is Tri a scam, or is it legit?

The latest exposure and evaluation content of Tri brokers.

Tri Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

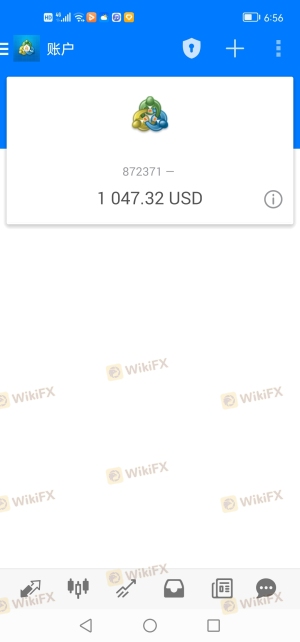

Tri latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.