Is TradeWorldfx safe?

Business

License

Is Tradeworldfx Safe or Scam?

Introduction

Tradeworldfx positions itself as a player in the forex trading market, offering various trading options for both novice and experienced traders. However, the forex industry is fraught with risks, and it is imperative for traders to conduct thorough evaluations of any broker before engaging with them. This article aims to explore the legitimacy and safety of Tradeworldfx by analyzing various aspects such as regulatory compliance, company background, trading conditions, customer fund security, client experiences, and overall risks associated with using this broker. Our investigation is based on data from multiple sources, including customer reviews, regulatory information, and industry reports, ensuring a comprehensive assessment of whether Tradeworldfx is safe or potentially a scam.

Regulation and Legitimacy

Regulatory oversight is crucial in the financial services industry, as it ensures that brokers adhere to specific standards and practices that protect traders. Tradeworldfx claims to be regulated by the Financial Services Authority of Seychelles (FSA), which is known for its relatively lenient regulatory framework compared to other jurisdictions.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | Not Listed | Seychelles | Active |

While the presence of a regulatory body is a positive indicator, the quality of regulation is equally important. The Seychelles FSA does not have the same reputation as more stringent regulators like the FCA (UK) or ASIC (Australia). Moreover, there is no publicly available information regarding Tradeworldfx's compliance history or any past regulatory issues. This lack of transparency raises concerns about the overall safety of trading with this broker. Therefore, traders should exercise caution and conduct further research before deciding to engage with Tradeworldfx.

Company Background Investigation

Tradeworldfx is relatively new to the forex market, having been established in recent years. The companys ownership structure is not entirely transparent, with limited information available about its founders or management team. This lack of clarity can be a red flag for potential investors, as it makes it difficult to assess the qualifications and experience of those running the firm.

The management team reportedly has experience in the financial services sector, but without verifiable details, it is challenging to gauge their credibility. Additionally, the companys website and promotional materials lack comprehensive information about its history and development, which further diminishes its transparency. In an industry where trust is paramount, the absence of clear and accessible information about a broker can be a significant deterrent for potential clients.

Trading Conditions Analysis

When evaluating whether Tradeworldfx is safe, examining its trading conditions is essential. The broker offers a range of trading accounts, including standard and raw spread accounts, with varying fee structures.

| Fee Type | Tradeworldfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.01 pips | 1.0 pips |

| Commission Model | $7 per standard lot | $5 per standard lot |

| Overnight Interest Range | Variable | Variable |

While the spreads offered by Tradeworldfx are competitive, the commission structure may be concerning for some traders. The commission of $7 per standard lot is higher than the industry average, which could eat into potential profits, particularly for high-frequency traders. Additionally, the broker does not provide detailed information about any potential hidden fees, which could pose a risk for traders who may not be fully aware of the total cost of trading. Transparency in fee structures is vital for ensuring that traders can make informed decisions, and the lack thereof may raise questions about the brokers overall integrity.

Customer Fund Security

The safety of client funds is a critical aspect of any forex broker's operations. Tradeworldfx claims to hold client funds in segregated accounts with reputable banks, which is a standard practice aimed at protecting clients in the event of the broker's insolvency. Furthermore, the broker asserts that it does not use client funds for operational expenses, which is a positive indication of its commitment to safeguarding client assets.

However, the absence of a clear investor protection scheme or negative balance protection raises concerns. Traders should be cautious, as the lack of such policies could expose them to significant financial risk, especially in volatile market conditions. The historical performance of Tradeworldfx regarding fund security is also unclear, and without documented evidence of successful fund management, potential clients may want to consider alternative brokers with a proven track record.

Customer Experience and Complaints

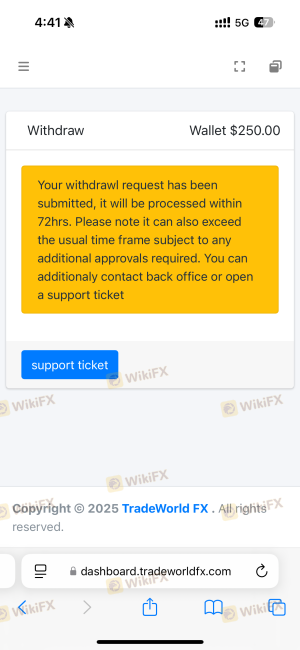

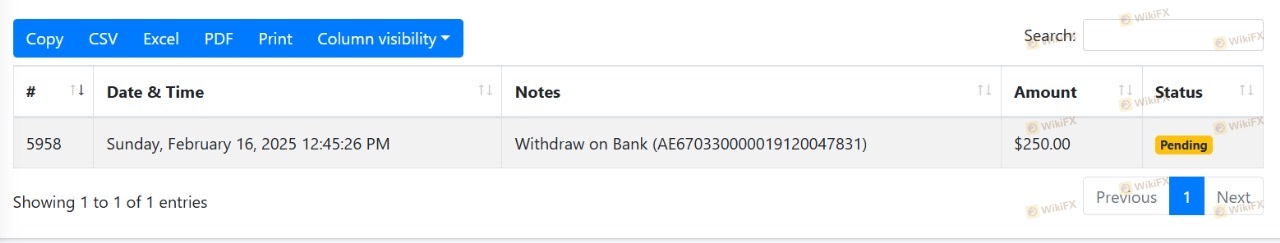

Analyzing customer feedback is essential to understanding the overall reputation of Tradeworldfx. Reviews from users indicate a mix of experiences, with some praising the trading conditions while others express dissatisfaction with customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Customer Support Issues | Medium | Slow Response |

| Account Management Problems | High | Unresolved |

Common complaints include difficulties in withdrawing funds and inadequate customer support. One notable case involved a trader who faced significant delays in accessing their funds, leading to frustration and a lack of trust in the broker's operations. It is critical for brokers to handle such issues promptly to maintain client confidence, and Tradeworldfx's apparent shortcomings in this area may lead potential clients to question whether Tradeworldfx is safe to use.

Platform and Execution

The trading platform provided by Tradeworldfx is based on MetaTrader 5, which is widely regarded as a reliable and efficient trading solution. However, user feedback regarding platform stability and execution quality is mixed. Some traders report satisfactory execution speeds, while others have experienced slippage and order rejections.

A thorough assessment of order execution quality is vital, as traders depend on timely and accurate trade execution to maximize their strategies. Any signs of platform manipulation or irregularities in order handling could indicate deeper issues within the broker's operational framework.

Risk Assessment

Using Tradeworldfx involves several risks that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak regulatory oversight in Seychelles. |

| Financial Risk | Medium | Higher commission rates could impact profitability. |

| Operational Risk | Medium | Mixed reviews about platform reliability and customer support. |

To mitigate these risks, traders should conduct thorough research, engage in risk management strategies, and consider starting with a demo account to familiarize themselves with the platform before committing real capital.

Conclusion and Recommendations

After a comprehensive analysis of Tradeworldfx, it is evident that while the broker offers competitive trading conditions, several red flags warrant caution. The lack of robust regulatory oversight, transparency regarding company operations, and customer service issues raise significant concerns about whether Tradeworldfx is safe for traders.

For those considering trading with this broker, it is advisable to proceed with caution. New traders might want to explore alternative options with more established regulatory frameworks and a proven track record of customer satisfaction. Brokers such as IG, OANDA, or Forex.com could provide safer and more reliable trading experiences. Ultimately, conducting thorough due diligence and being aware of potential risks is crucial for anyone looking to engage in forex trading.

Is TradeWorldfx a scam, or is it legit?

The latest exposure and evaluation content of TradeWorldfx brokers.

TradeWorldfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeWorldfx latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.