TradeWorldFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive tradeworldfx review reveals significant concerns about this forex broker. Traders should carefully consider these issues before engaging with their services. TradeWorldFX established its online presence in March 2024. The platform has quickly garnered negative attention from multiple regulatory and review sources. The company claims to offer forex investment services and trading opportunities. It positions itself as a broker for retail traders seeking access to foreign exchange markets.

However, our analysis reveals troubling indicators that potential clients must understand. According to Scam Detector, TradeWorldFX receives an extremely low trust score of just 11 out of 100. Scamdoc assigns it a trust rating of only 25%. Most concerning is the official warning issued by the Abu Dhabi Global Market Financial Services Regulatory Authority. This authority has specifically alerted the public about "false and misleading claims" made by Trade World FX operating under the website tradeworldfx.com.

The broker appears to target investors looking for forex trading opportunities. However, the lack of transparent information about company registration, contact details, and regulatory compliance raises serious red flags. With no verified address, telephone number, or support email publicly available, TradeWorldFX fails to meet basic transparency standards. These standards are expected from legitimate financial service providers in today's market.

Important Disclaimers

This review is based on publicly available information from regulatory warnings, third-party review platforms, and official announcements as of early 2025. Our evaluation methodology incorporates data from multiple sources including regulatory body warnings, trust verification platforms, and available public records. Traders should note that the information regarding TradeWorldFX is limited. Many standard broker details are not publicly disclosed or verified. The evaluation considers the significant regulatory concerns and warning notices that have been issued regarding this entity's operations and claims.

Overall Rating Framework

Broker Overview

TradeWorldFX emerged in the forex trading landscape in 2024. Domain registration records indicate the website was created on March 29, 2024. The relatively recent establishment of their online presence coincides with a concerning lack of fundamental business information. This information is typically expected from legitimate financial service providers. The company presents itself as offering forex investment services. However, specific details about their business model, operational structure, and corporate governance remain notably absent from public records.

The broker's business approach appears to focus on forex trading services. They may expand into CFD products, though concrete information about their service offerings is not clearly documented in available materials. What stands out immediately in any tradeworldfx review is the absence of basic contact information. No verified business address, customer service telephone numbers, or official support email addresses are publicly available. This represents a significant departure from industry standards for transparency and accessibility.

From a regulatory perspective, TradeWorldFX faces serious challenges. The Abu Dhabi Global Market Financial Services Regulatory Authority has issued explicit warnings about the entity. They specifically caution the financial services community and public about "false and misleading claims" made by Trade World FX. This regulatory action suggests that the platform may be operating without proper authorization. It may also be making claims about services or regulatory status that cannot be substantiated through official channels.

Regulatory Status: The regulatory situation for TradeWorldFX presents major concerns for potential clients. The ADGM has specifically identified this entity in official warnings. This indicates that the platform may be making unauthorized claims about regulatory compliance or operational legitimacy. No verified regulatory licenses or authorizations have been identified in available public records.

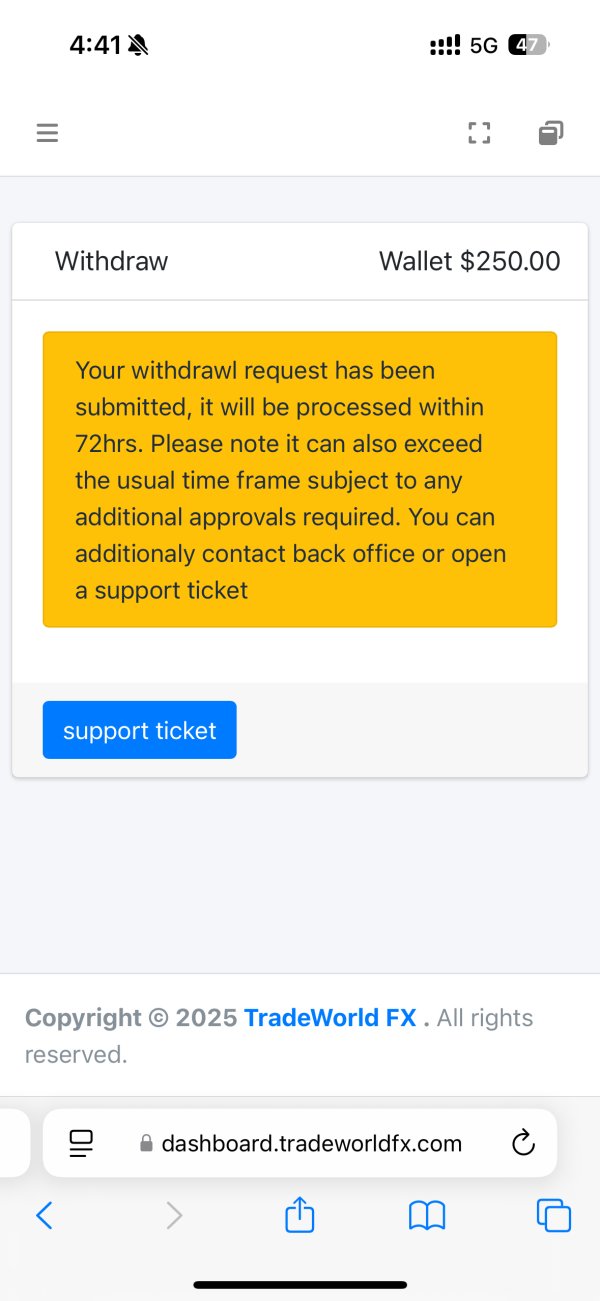

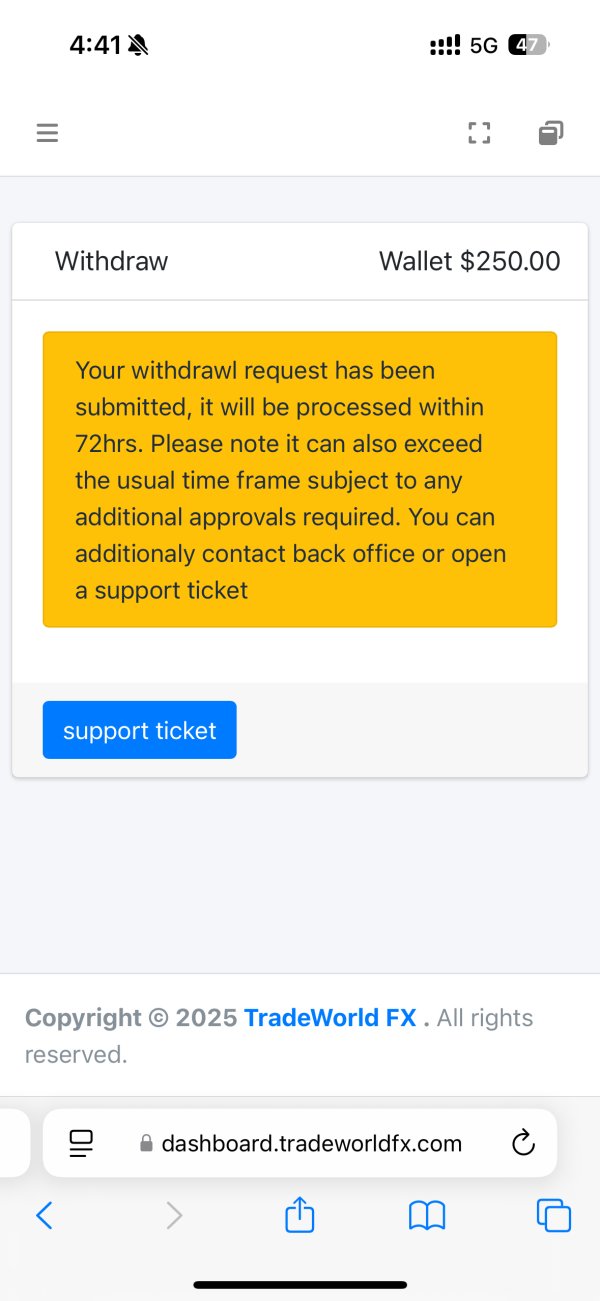

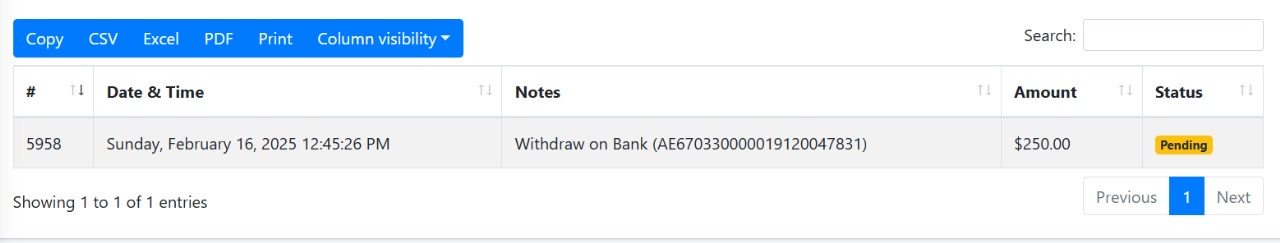

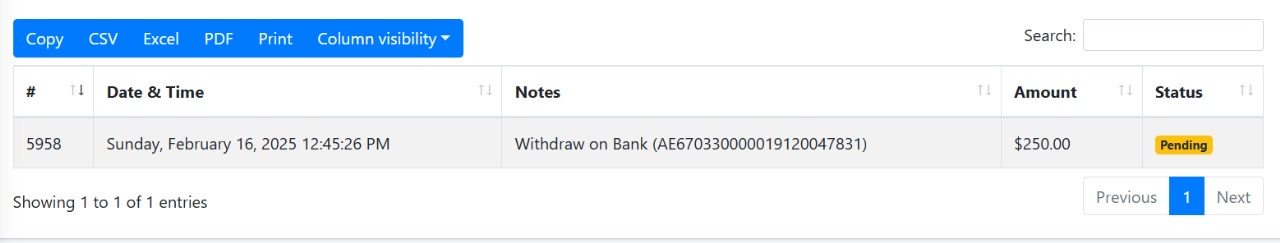

Deposit and Withdrawal Methods: Specific information about funding methods, accepted payment systems, or withdrawal procedures is not detailed in available materials. This lack of transparency regarding financial transactions represents a significant gap in essential service information. Traders typically require this information before selecting a broker.

Minimum Deposit Requirements: Concrete minimum deposit amounts or account funding requirements are not specified in publicly available information. This makes it difficult for potential clients to understand the financial commitment required to begin trading.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not mentioned in available materials. However, traders should exercise extreme caution regarding any promotional offers from platforms with regulatory warnings.

Available Trading Assets: The platform appears to focus on forex trading services. However, specific currency pairs, asset classes, or trading instruments available through the platform are not clearly documented. References suggest potential CFD offerings. Comprehensive asset listings are not publicly available.

Cost Structure: Critical pricing information including spreads, commission structures, overnight fees, and other trading costs are not detailed in available materials. This lack of pricing transparency makes it impossible for traders to assess the true cost of trading through this platform.

Leverage Options: Information about maximum leverage ratios, margin requirements, or risk management parameters is not specified in publicly available documentation.

Trading Platforms: The specific trading platform software, technology infrastructure, or trading interface details are not mentioned in available materials. This leaves potential clients without crucial information about the trading environment.

This comprehensive tradeworldfx review highlights the concerning lack of detailed service information. Such information would typically be readily available from legitimate forex brokers.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by TradeWorldFX receive the lowest possible rating. This is due to a complete absence of transparent information about account structures, requirements, and features. Legitimate forex brokers typically provide detailed information about different account tiers, minimum deposit requirements, account opening procedures, and special features such as Islamic accounts for Muslim traders. However, in the case of TradeWorldFX, none of this fundamental information is readily available to potential clients.

The lack of clear account opening procedures raises serious concerns about the platform's operational legitimacy. Standard industry practice requires brokers to outline their Know Your Customer procedures, documentation requirements, and verification processes. Without these details, potential clients cannot understand what would be required to establish an account. They also cannot understand how their personal information would be handled during the registration process.

Furthermore, the absence of information about account types, features, and conditions makes it impossible for traders to determine whether the platform could meet their specific trading needs. Professional traders, beginners, and institutional clients all have different requirements. Legitimate brokers typically structure their account offerings to accommodate these diverse needs. The failure to provide such basic information suggests either inadequate service development or deliberate opacity that contradicts industry best practices.

This tradeworldfx review must emphasize that the complete lack of account condition transparency, combined with regulatory warnings, creates an unsuitable environment for any type of trading activity.

The trading tools and resources category reveals another area of significant concern. No publicly available information exists about the analytical tools, research resources, or educational materials that would typically be provided by a legitimate forex broker. Modern forex trading requires access to sophisticated charting tools, technical analysis indicators, economic calendars, and market research to make informed trading decisions.

Professional forex brokers typically offer comprehensive trading platforms with advanced charting capabilities, real-time market data, news feeds, and analytical tools. Educational resources such as webinars, trading guides, market analysis, and tutorial materials are standard offerings. These help traders develop their skills and stay informed about market conditions. The complete absence of information about such tools and resources suggests that TradeWorldFX may not have developed the infrastructure necessary to support serious trading activities.

Additionally, modern brokers often provide automated trading support, API access for algorithmic trading, and integration with third-party tools and services. The lack of any information about these capabilities further reinforces concerns about the platform's legitimacy and operational capacity. Without proper tools and resources, traders would be severely handicapped in their ability to analyze markets, execute strategies, and manage risk effectively.

The absence of educational resources is particularly concerning. Legitimate brokers typically invest significantly in client education to promote responsible trading practices and long-term client success.

Customer Service and Support Analysis

Customer service and support capabilities represent perhaps the most glaring deficiency in TradeWorldFX's service offering. The complete absence of publicly available contact information, including telephone numbers, email addresses, or physical business addresses, makes it virtually impossible for clients to seek assistance. It also makes it impossible to resolve issues that may arise during trading activities.

Legitimate forex brokers typically maintain multiple customer service channels including telephone support, email assistance, live chat functionality, and comprehensive FAQ sections. Many also provide multilingual support to serve international clientele. They maintain extended service hours to accommodate traders across different time zones. The forex market operates 24 hours a day during weekdays. Traders often require immediate assistance with technical issues, account problems, or urgent trading matters.

The lack of any identifiable customer service infrastructure raises serious questions about how client issues would be addressed. It raises questions about how disputes would be resolved and whether clients would have any recourse if problems arise with their accounts or trading activities. This absence of support channels is particularly concerning given the regulatory warnings that have been issued about the platform.

Professional forex brokers also typically provide dedicated support for different client types. This includes specialized assistance for institutional clients, premium support for high-volume traders, and educational support for beginning traders. The complete absence of any customer service information suggests that TradeWorldFX has not developed the operational infrastructure necessary to provide legitimate financial services.

Trading Experience Analysis

The trading experience evaluation for TradeWorldFX must be based on the concerning lack of information about platform stability, execution quality, and overall trading environment. This tradeworldfx review cannot identify any specific details about the trading platform technology, order execution methods, or system reliability. These would be essential for evaluating the actual trading experience.

Modern forex trading requires robust platform technology that can handle rapid order execution, provide real-time pricing, and maintain stability during periods of high market volatility. Traders need access to various order types, risk management tools, and reliable execution to implement their trading strategies effectively. The absence of any technical specifications or platform details makes it impossible to assess whether TradeWorldFX could provide a satisfactory trading environment.

Mobile trading capabilities have become essential in today's forex market. Traders need the ability to monitor positions and execute trades while away from their desktop computers. The lack of information about mobile applications, platform compatibility, or trading accessibility across different devices represents another significant gap in the service offering.

Additionally, the quality of trade execution, including factors such as slippage, requotes, and order processing speed, are critical components of the trading experience. Without transparent information about execution policies, pricing models, or system performance, potential clients cannot evaluate whether the platform would meet their trading requirements. They also cannot determine if it would provide competitive execution quality.

Trust and Safety Analysis

Trust and safety considerations represent the most critical concerns in this evaluation of TradeWorldFX. The official warning issued by the Abu Dhabi Global Market Financial Services Regulatory Authority specifically identifies this entity as making "false and misleading claims." This represents a severe regulatory red flag that cannot be overlooked.

The extremely low trust scores from independent verification platforms provide additional confirmation of these concerns. Scam Detector's rating of just 11 out of 100 and Scamdoc's trust score of only 25% indicate that multiple evaluation systems have identified significant risk factors associated with this platform. These ratings typically consider factors such as website security, business transparency, regulatory compliance, and user feedback patterns.

From a regulatory perspective, legitimate forex brokers typically maintain licenses from recognized financial regulatory authorities. They provide clear information about their regulatory status, client fund protection measures, and compliance procedures. The absence of verifiable regulatory authorization, combined with official warnings from regulatory bodies, creates an environment of extreme risk for potential clients.

Fund security measures, which are fundamental to legitimate forex operations, are not described or verified for TradeWorldFX. Reputable brokers typically maintain segregated client accounts, provide deposit insurance or compensation schemes, and undergo regular regulatory audits to ensure client fund protection. The lack of information about such safeguards, combined with regulatory warnings, suggests that client funds could be at significant risk.

User Experience Analysis

The user experience evaluation for TradeWorldFX is severely hampered by the absence of verified user feedback, transparent operational procedures, and accessible service information. A comprehensive user experience assessment typically considers factors such as account registration ease, platform navigation, customer onboarding processes, and overall service accessibility.

The lack of clear registration procedures, verification requirements, and account setup processes makes it impossible for potential users to understand what their experience would be like when attempting to establish an account. Legitimate brokers typically provide step-by-step guidance for new clients, clear documentation requirements, and reasonable timeframes for account activation.

Website usability and platform design are important components of user experience. However, the regulatory warnings and trust concerns overshadow any evaluation of interface design or navigational elements. Even if the platform appeared user-friendly from a design perspective, the underlying legitimacy concerns would make any positive user experience elements irrelevant.

The absence of user testimonials, case studies, or verified client feedback represents another significant gap in understanding the actual user experience. Legitimate brokers typically showcase client success stories, provide references from satisfied customers, and maintain transparent review systems. These allow potential clients to learn from existing user experiences.

Most importantly, the regulatory warnings and low trust scores suggest that users who attempt to engage with this platform may face significant difficulties in account management, fund recovery, or dispute resolution. This would result in an extremely poor overall user experience regardless of other platform features.

Conclusion

This comprehensive tradeworldfx review reveals multiple serious concerns that make this platform unsuitable for forex trading activities. The combination of regulatory warnings from the ADGM, extremely low trust scores from independent verification platforms, and the complete absence of transparent business information creates an environment of unacceptable risk for potential clients.

The lack of basic transparency regarding company registration, contact information, service details, and operational procedures represents a fundamental departure from industry standards for legitimate financial service providers. When combined with official regulatory warnings about "false and misleading claims," these factors indicate that TradeWorldFX does not meet the basic requirements for safe and legitimate forex trading services.

Based on our analysis, we cannot recommend TradeWorldFX to any category of trader, whether beginner or experienced. The regulatory concerns, lack of transparency, and absence of verifiable business information create risks that far outweigh any potential benefits. Traders seeking reliable forex services should consider only properly regulated brokers with transparent operations, verified contact information, and positive regulatory standing.