Is Tradelax safe?

Business

License

Is Tradelax A Scam?

Introduction

Tradelax is an online trading platform that has emerged in the forex market, claiming to offer a range of investment opportunities across various asset classes, including forex, commodities, and indices. However, as with any trading service, it is crucial for traders to exercise caution and thoroughly assess the credibility of the broker before committing their funds. The forex market is rife with unregulated entities and potential scams, making it imperative for traders to conduct due diligence. This article aims to provide an objective analysis of Tradelax, focusing on its regulatory status, company background, trading conditions, customer feedback, and overall risk assessment. The findings are based on a comprehensive review of online resources, regulatory databases, and user testimonials.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy and safety. Tradelax is reported to be unregulated, which raises significant concerns regarding the security of client funds and the broker's adherence to industry standards. The absence of regulation from recognized financial authorities means that traders may have limited recourse in the event of disputes or issues with withdrawals.

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of oversight from top-tier regulators such as the FCA (UK), ASIC (Australia), or the SEC (USA) highlights the risks associated with trading through Tradelax. Regulatory bodies enforce strict guidelines to protect traders from fraud and ensure fair trading practices. Without such oversight, traders are exposed to potential scams and unfair practices. The absence of a regulatory framework also means that Tradelax is not obligated to maintain client funds in segregated accounts, further jeopardizing the safety of investor capital.

Company Background Investigation

Tradelax was established in 2020, but the companys ownership structure and operational history remain largely opaque. There is little to no information available about the individuals behind the brokerage or their professional backgrounds. This lack of transparency is a significant red flag, as reputable brokers typically provide detailed information about their management teams and corporate structure.

The company claims to operate from St. Vincent and the Grenadines, a location often associated with unregulated brokers. The absence of a physical address and the anonymity surrounding the company's operations raise concerns about its legitimacy. Furthermore, the lack of a clear business model and operational history makes it difficult for potential clients to gauge the broker's reliability and trustworthiness.

Trading Conditions Analysis

Tradelax's trading conditions present another layer of concern for potential investors. The broker claims to offer competitive spreads and leverage options; however, the actual terms are often less favorable than advertised. Traders report that the spreads for major currency pairs can reach up to 3 pips, which is significantly higher than the industry average.

| Fee Type | Tradelax | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 0.5 - 1 pip |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of a transparent commission structure and the high spreads could lead to increased trading costs, diminishing potential profits. Additionally, the broker's policy on overnight interest and other fees is not clearly outlined, which could result in unexpected charges for traders. This lack of clarity in trading conditions is a significant concern for those considering whether Tradelax is safe for trading.

Customer Fund Safety

Safety of client funds is paramount when evaluating any brokerage. Tradelax does not provide adequate information regarding its fund protection measures. The absence of segregation of client accounts and a lack of investor compensation schemes means that traders' funds may not be secure in the event of the broker's insolvency.

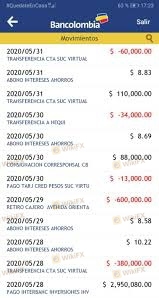

Moreover, there have been reports of withdrawal issues and difficulties faced by clients attempting to access their funds. This raises serious questions about the broker's financial stability and commitment to safeguarding client investments. Historical complaints regarding fund security further reinforce the notion that Tradelax is not safe for trading.

Customer Experience and Complaints

Customer feedback is an essential component in assessing a broker's reliability. Reviews of Tradelax reveal a pattern of complaints regarding withdrawal delays, poor customer service, and overall dissatisfaction with trading conditions. Many users report difficulties in accessing their funds, indicating a serious issue with the broker's operational practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow/No Response |

| Poor Customer Service | Medium | Inconsistent |

| Misleading Information | High | No Acknowledgment |

Several clients have shared their experiences of being unable to withdraw their funds after making deposits, which is a common tactic employed by unregulated brokers to retain client capital. This behavior raises alarms about the integrity of Tradelax and whether it can be classified as a scam.

Platform and Trade Execution

The trading platform offered by Tradelax is reportedly a web-based interface that lacks the advanced features and reliability found in more established platforms such as MetaTrader 4 or 5. Users have expressed concerns about the platform's stability, execution speed, and overall user experience. Reports of slippage and rejected orders have surfaced, indicating potential manipulation or inefficiencies in trade execution.

The quality of trade execution is critical for traders, as delays or errors can significantly impact profitability. The absence of robust trading tools and analytics further diminishes the platform's appeal, making it less suitable for experienced traders who rely on advanced functionalities to make informed decisions.

Risk Assessment

Using Tradelax poses several risks that potential traders should consider. The lack of regulation, transparency, and poor customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Financial Risk | High | Potential for loss of funds |

| Operational Risk | Medium | Reports of withdrawal issues |

| Customer Service Risk | High | Poor response to client complaints |

To mitigate these risks, traders should consider using regulated brokers with a proven track record of reliability and customer satisfaction. Conducting thorough research and seeking alternative trading platforms can help safeguard investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tradelax is not safe for trading. The lack of regulation, transparency, and numerous complaints from users indicate a high likelihood of fraudulent practices. Traders are advised to exercise extreme caution when considering this broker and to avoid investing significant capital without adequate protections in place.

For those looking to engage in forex trading, it is recommended to seek out regulated brokers with established reputations and positive client feedback. Options such as FCA or ASIC regulated brokers can provide a safer trading environment with better oversight and investor protection. Ultimately, the decision to trade with Tradelax should be carefully weighed against the risks and potential for loss.

Is Tradelax a scam, or is it legit?

The latest exposure and evaluation content of Tradelax brokers.

Tradelax Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradelax latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.