Is Tradefm safe?

Business

License

Is TradeFM Safe or Scam?

Introduction

TradeFM is an online forex broker that positions itself within the competitive landscape of the foreign exchange market. With an array of trading instruments, including forex, CFDs, and cryptocurrencies, TradeFM aims to attract both novice and experienced traders. However, in an industry rife with scams and unregulated entities, it is essential for traders to exercise caution and thoroughly evaluate any broker before committing their funds. This article aims to investigate the legitimacy of TradeFM by examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. Our investigation is based on a comprehensive analysis of available information, including user reviews and regulatory data, to provide a balanced view of whether TradeFM is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a trading broker is one of the most critical factors in determining its legitimacy. A regulated broker is subject to oversight from financial authorities, which can provide a level of security for traders. Unfortunately, TradeFM is registered in the Marshall Islands and operates without any regulatory oversight. This lack of regulation raises significant red flags for potential investors, as it indicates that there are no legal protections in place should issues arise.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Marshall Islands | Unregulated |

The absence of a regulatory framework not only questions the broker's credibility but also its operational practices. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) are known for their stringent requirements. TradeFM does not appear in any reputable regulatory register, further emphasizing the need for caution. The lack of oversight means that traders have limited recourse in the event of disputes or fraudulent activities, making it crucial to consider whether TradeFM is safe for trading.

Company Background Investigation

TradeFM is owned by Evergo Ltd., a company that has been flagged by multiple regulatory bodies, including the Italian Commissione Nazionale per le Società e la Borsa (CONSOB). The company operates from an offshore location, which is often associated with higher risks. The anonymity surrounding the management team and ownership structure raises further concerns.

The lack of transparency regarding the company's operations and ownership can be alarming for potential investors. A reputable broker typically provides detailed information about its management team and their qualifications, which helps build trust. In the case of TradeFM, the absence of such information suggests a lack of accountability. This opacity can be indicative of a broker that may not have the best interests of its clients at heart, prompting further investigation into whether TradeFM is safe for trading.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for assessing its overall reliability. TradeFM claims to offer competitive spreads and various account types, but the absence of a demo account is a significant drawback. Traders are often encouraged to test platforms before committing real funds, but TradeFM does not provide this option.

| Fee Type | TradeFM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The reported minimum deposit of $1,000 is notably higher than many regulated brokers, which typically allow for smaller initial investments. This high entry threshold may deter novice traders and raises questions about the broker's accessibility. Furthermore, the absence of clear information about commissions and spreads can lead to unexpected costs, making it essential for traders to consider whether TradeFM is safe to use.

Client Fund Safety

The safety of client funds is paramount in any trading environment. TradeFM does not provide clear information about its fund security measures, which raises concerns. A reputable broker typically segregates client funds from its operational funds and offers investor protection schemes. However, TradeFM's lack of regulation means that there are no guarantees in place to protect client deposits.

In the event of a dispute or if the broker were to become insolvent, traders could find themselves with little to no recourse. Historical issues related to fund safety, particularly with unregulated brokers, emphasize the risks involved. It is essential for potential clients to assess whether TradeFM is safe by considering the potential risks associated with their investment.

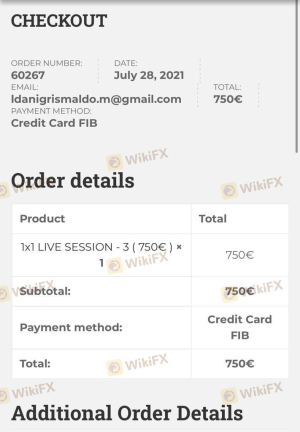

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's reliability. TradeFM has received mixed reviews, with several users reporting difficulties in withdrawing funds and poor customer service. Common complaints include delayed withdrawals and unresponsive support teams, which are significant red flags for any trading platform.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

For instance, one user reported that after requesting a withdrawal, their account was suspended without explanation, leading to frustration and financial loss. Such experiences highlight the importance of considering whether TradeFM is safe for trading, as they indicate potential operational issues that could affect traders' ability to access their funds.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. TradeFM offers a web-based trading platform, but there are concerns regarding its stability and execution quality. Users have reported instances of slippage and order rejections, which can be detrimental to trading outcomes.

The absence of a well-known trading platform like MetaTrader 4 or 5 further raises questions about the broker's commitment to providing a reliable trading environment. If the platform exhibits signs of manipulation or instability, it could severely impact traders' experiences and profitability.

Risk Assessment

Using TradeFM presents several risks that potential traders should be aware of. The lack of regulation, coupled with reported customer complaints, creates a high-risk environment for investors.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No oversight from regulatory bodies |

| Fund Security | High | No segregation or protection measures |

| Withdrawal Issues | Medium | Complaints about delayed withdrawals |

To mitigate these risks, potential traders should conduct thorough research, consider using regulated brokers, and only invest what they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that TradeFM is not a safe broker for trading. The lack of regulation, coupled with numerous complaints regarding fund withdrawals and customer service, raises significant concerns about the broker's legitimacy. For traders seeking a reliable trading experience, it is advisable to consider regulated alternatives that offer better security and customer support.

If you are considering trading in the forex market, it is paramount to prioritize safety and choose brokers with a proven track record. Recommended alternatives include well-regulated brokers that provide transparent trading conditions and robust customer support. Ultimately, the risks associated with TradeFM indicate that caution is warranted, and potential investors should think twice before engaging with this broker.

Is Tradefm a scam, or is it legit?

The latest exposure and evaluation content of Tradefm brokers.

Tradefm Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradefm latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.