Is TRADE7fx safe?

Business

License

Is Trade7FX A Scam?

Introduction

Trade7FX is an online forex broker that positions itself within the competitive landscape of foreign exchange trading. As with any broker, it is crucial for traders to thoroughly evaluate its credibility, as the forex market is rife with potential scams and unregulated entities. The need for due diligence is underscored by the fact that many traders have lost significant amounts of money due to unreliable brokers. In this article, we will explore the safety and legitimacy of Trade7FX by examining its regulatory status, company background, trading conditions, and customer experiences. Our investigation is based on a comprehensive review of various online sources, including regulatory warnings and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety. Regulated brokers are required to adhere to strict guidelines that protect investors and ensure fair trading practices. Unfortunately, Trade7FX does not appear to be regulated by any recognized financial authority. This lack of regulation raises significant concerns about the safety of clients' funds and the broker's operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory framework means that Trade7FX is not subject to the same oversight as regulated brokers, which often leads to a higher risk of fraud and mismanagement. Moreover, reports indicate that Trade7FX has been operating without authorization in various jurisdictions, further solidifying the notion that it may not be a trustworthy broker. The lack of a regulatory license is a significant red flag, making it imperative for potential clients to exercise extreme caution when considering this broker.

Company Background Investigation

Trade7FX's company history and ownership structure are also vital in assessing its reliability. Unfortunately, detailed information about the company's origins and ownership is scarce. This lack of transparency can be alarming for potential clients, as reputable brokers typically provide clear information about their management teams and corporate structures.

Furthermore, the absence of a verified physical address or contact information can lead to skepticism regarding the broker's legitimacy. A transparent company should have easily accessible information about its founders, management team, and operational history. In the case of Trade7FX, this critical information is either missing or difficult to verify, which raises further concerns about the broker's trustworthiness.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is essential. Trade7FX has set its minimum deposit at $500, which is relatively high compared to many regulated brokers that offer accounts for as little as $10. This significant barrier to entry may deter potential clients, especially those who are new to trading.

| Fee Type | Trade7FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Moreover, reports suggest that Trade7FX does not provide clear information on its fee structures or spreads, which can lead to unexpected costs for traders. The lack of transparency regarding trading conditions is concerning and may indicate that the broker is not operating in good faith.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. Regulated brokers are typically required to keep clients' funds in segregated accounts and provide investor protection schemes. However, Trade7FX does not appear to offer any such safeguards. The absence of segregated accounts means that client funds could be at risk in the event of the broker's insolvency.

Additionally, there are no indications that Trade7FX provides negative balance protection, which is a critical feature for safeguarding traders against losing more than their initial investment. The lack of these essential security measures raises concerns about the safety of funds held with Trade7FX and reinforces the notion that it may not be a safe choice for traders.

Customer Experience and Complaints

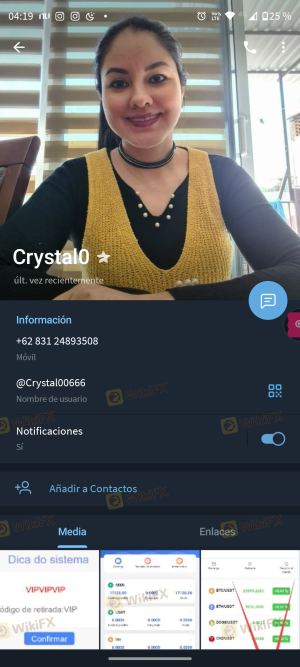

Customer feedback is an invaluable resource when assessing a broker's reliability. Unfortunately, reviews of Trade7FX have highlighted numerous complaints from users, indicating a pattern of negative experiences. Common complaints include difficulties in withdrawing funds, unresponsive customer service, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Account Management Problems | High | Poor |

For instance, several users have reported being unable to withdraw their funds after making deposits, which is a significant concern. Such issues can be indicative of a scam, as they suggest that the broker may be engaging in practices designed to prevent clients from accessing their money. The overall negative sentiment surrounding Trade7FX further supports the notion that it is not a safe or trustworthy broker.

Platform and Trade Execution

The performance of a trading platform can significantly impact a trader's experience. Trade7FX's platform has been criticized for its instability, with users reporting frequent outages and slow execution times. These issues can lead to missed trading opportunities and increased risk, particularly in a fast-moving market.

Moreover, concerns have been raised about potential manipulation of trades, with reports of slippage and rejected orders. Such practices can severely undermine a trader's confidence in the broker and raise questions about the integrity of the trading environment.

Risk Assessment

Using Trade7FX presents several risks that potential clients should be aware of. The lack of regulation, transparency, and security measures creates an environment where traders' funds may be at significant risk.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Fund Safety Risk | High | No segregation or investor protection |

| Customer Service Risk | Medium | Poor responsiveness to complaints |

To mitigate these risks, it is advisable for traders to conduct thorough research before engaging with Trade7FX. Seeking out regulated brokers with a proven track record may provide a safer trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that Trade7FX exhibits several characteristics commonly associated with scam brokers. The lack of regulation, transparency, and poor customer feedback raises significant red flags regarding its legitimacy. Therefore, it is crucial for traders to remain cautious and consider alternative options.

For those seeking safe trading environments, it is advisable to explore regulated brokers that have demonstrated compliance with industry standards and possess a solid reputation. Brokers such as [insert reputable brokers here] are recommended as safer alternatives for traders looking to navigate the forex market without the risks associated with Trade7FX.

In summary, is Trade7FX safe? The overwhelming evidence points to the conclusion that it is not a safe option for traders, and potential clients should be wary of engaging with this broker.

Is TRADE7fx a scam, or is it legit?

The latest exposure and evaluation content of TRADE7fx brokers.

TRADE7fx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADE7fx latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.