Regarding the legitimacy of Forwin forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is Forwin safe?

Pros

Cons

Is Forwin markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Forwin Futures Group Limited

Effective Date:

2016-06-22Email Address of Licensed Institution:

fwfg.info@forwin-holding.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.forwin-holding.com/Expiration Time:

--Address of Licensed Institution:

香港灣仔港灣道1號會展廣場辦公大樓22樓2201室*Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Forwin Safe or Scam?

Introduction

Forwin Holding Limited, commonly referred to as Forwin, is a brokerage firm that operates in the foreign exchange (forex) and contract for difference (CFD) markets. Established in Hong Kong, Forwin aims to provide a range of trading services to clients globally. However, potential traders must exercise caution when evaluating the credibility of forex brokers, as the market is rife with both legitimate and fraudulent entities. This article aims to assess whether Forwin is a safe broker or a potential scam. To achieve this, we will analyze various aspects of the broker, including its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

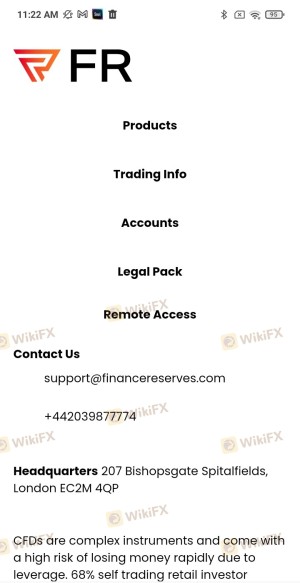

The regulatory status of a broker is a critical factor in determining its safety. Forwin claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is a reputable regulatory body. However, there are conflicting reports regarding its actual regulatory standing. Below is a summary of the regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | Not disclosed | Hong Kong | Unverified |

While the SFC is known for enforcing strict regulations, the lack of a specific license number and the unverified status raise concerns about Forwin's compliance with regulatory standards. Furthermore, the absence of clear information about the company's regulatory history and any past compliance issues adds to the uncertainty surrounding its legitimacy. Without robust regulatory oversight, traders may be exposed to higher risks, making it essential to question whether Forwin is safe for investment.

Company Background Investigation

Forwin has a relatively obscure corporate history, which adds to the skepticism surrounding its operations. The company is based in Hong Kong, but detailed information about its ownership structure and management team is limited. This lack of transparency can be a red flag for potential investors. A reputable broker typically provides comprehensive details about its founders and key personnel, along with their qualifications and experience in the financial industry.

The management team at Forwin appears to lack visibility, with little publicly available information about their backgrounds. This absence of transparency raises concerns about the company's accountability and commitment to ethical business practices. Moreover, the overall opacity in the company's operations makes it difficult for traders to gauge the level of trust they can place in Forwin. Thus, when considering whether Forwin is safe, the company's dubious background cannot be overlooked.

Trading Conditions Analysis

When assessing a broker's trading conditions, it's vital to evaluate its fee structure and trading costs. Forwin offers competitive pricing on certain trading instruments, but there are indications of potentially hidden fees that could affect traders' profitability. The following table summarizes the core trading costs associated with Forwin:

| Fee Type | Forwin | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Variable | 1.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | High | Medium |

While Forwin does not charge commissions on trades, the variable spreads and high overnight interest rates may significantly impact trading outcomes. Traders should be cautious of any unusual fee policies that may not be immediately apparent. The overall cost structure raises questions about the broker's transparency and fairness, making it essential to further investigate whether Forwin is safe for trading.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading environment. Forwin claims to implement several measures to protect client funds, including segregated accounts. However, the lack of detailed information on these safety measures raises concerns. Traders should look for clear policies regarding fund segregation, investor protection schemes, and negative balance protection.

To date, there have been no widely reported incidents of fund mismanagement or security breaches associated with Forwin. Still, the absence of comprehensive details regarding their fund safety protocols makes it difficult to ascertain the level of risk involved. As such, potential investors need to critically assess whether Forwin is safe in terms of protecting their investments.

Customer Experience and Complaints

User feedback is a vital component in evaluating a broker's reliability. Reviews of Forwin reveal a mixed bag of experiences, with some users praising the platform's usability while others express frustration over withdrawal issues and poor customer service. Common complaints include delays in processing withdrawals and a lack of responsiveness from customer support. The following table summarizes the primary types of complaints received:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Inconsistent |

| Account Management Problems | High | Slow |

One notable case involved a trader who reported significant delays in withdrawing funds after achieving substantial profits. The trader claimed that despite repeated inquiries, Forwins customer support was unhelpful, leading to frustration and dissatisfaction. Such complaints raise serious questions about the broker's operational integrity and responsiveness, further complicating the assessment of whether Forwin is safe for traders.

Platform and Trade Execution

The trading platform offered by Forwin is another critical factor in determining its reliability. Users have reported mixed experiences with the platform's performance, citing occasional instability and execution delays. The quality of order execution is particularly concerning, as traders have noted instances of slippage and rejections, which can adversely affect trading outcomes.

In assessing the platform's performance, it is crucial to consider the frequency of these issues and whether they indicate potential manipulation or operational inadequacies. Without a robust and reliable trading platform, the overall trading experience may be compromised, leading traders to question whether Forwin is safe for their trading activities.

Risk Assessment

When evaluating the overall risk associated with trading through Forwin, several factors come into play. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unverified regulatory status |

| Fund Safety Risk | Medium | Lack of transparency in protocols |

| Customer Service Risk | High | Poor response to complaints |

| Platform Performance Risk | Medium | Reports of execution issues |

Given these risks, potential traders should exercise caution. It is advisable to conduct thorough research and consider starting with a small investment to gauge the broker's reliability before committing larger sums. By doing so, traders can better assess whether Forwin is safe for their trading needs.

Conclusion and Recommendations

In conclusion, the analysis of Forwin indicates that while the broker may offer some appealing features, several red flags warrant caution. The lack of verified regulatory oversight, combined with a history of customer complaints and concerns about fund safety, suggests that potential investors should approach Forwin with a critical eye.

For traders looking for a reliable alternative, it is advisable to consider brokers that are regulated by top-tier authorities, offer transparent fee structures, and maintain a strong reputation for customer service. Overall, while Forwin may present opportunities, the associated risks raise significant concerns about its safety and reliability in the forex market. Therefore, it is essential to ask whether Forwin is safe and to weigh the potential risks against the benefits before proceeding with any investments.

Is Forwin a scam, or is it legit?

The latest exposure and evaluation content of Forwin brokers.

Forwin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Forwin latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.