Is TingJu safe?

Business

License

Is Tingju Safe or Scam?

Introduction

Tingju, a forex broker operating primarily in the Chinese market, has attracted attention for its trading services. As the forex market continues to grow, traders are increasingly cautious about selecting a broker that aligns with their investment goals and offers a secure trading environment. The importance of assessing a broker's legitimacy cannot be overstated, as the potential for scams and fraudulent activities looms large in this unregulated space. This article investigates whether Tingju is a safe trading option or a potential scam. Our analysis is based on a comprehensive review of available data, regulatory status, customer feedback, and overall trading conditions.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices. Unfortunately, Tingju lacks regulation from a recognized financial authority, which raises significant concerns about its legitimacy. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | China | Unverified |

The absence of regulation means that Tingju does not operate under the oversight of any financial authority, which is critical for protecting traders' interests. A regulated broker is typically required to maintain a certain level of capital, segregate client funds, and provide transparency in its operations. Without these safeguards, traders are left vulnerable to potential misconduct.

Moreover, the lack of historical compliance records further complicates the assessment of Tingju's safety. The absence of oversight means that there are no guarantees regarding the broker's trading practices, which could potentially lead to exploitation of clients.

Company Background Investigation

Tingju Investment Co., Limited, established in China, has a relatively short operational history of 2 to 5 years. This limited track record raises questions about the company's stability and long-term viability in the forex market. The management teams background is also crucial in evaluating the broker's trustworthiness. Unfortunately, there is limited publicly available information regarding the qualifications and experience of Tingju's leadership. A transparent company typically provides detailed information about its management team, including their professional backgrounds and previous experience in the financial industry.

Transparency is a vital aspect of a broker's reputation. If a broker fails to disclose essential information about its operations or management, it can lead to mistrust among potential clients. Given that Tingju operates in a largely unregulated environment, the lack of transparency is particularly concerning. Investors should be wary of companies that do not provide sufficient information about their ownership structure, as this can indicate potential issues related to accountability and governance.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. Tingju presents a mixed picture in terms of its trading fees and conditions. While the broker claims to offer competitive spreads and commissions, the absence of regulatory oversight raises questions about the reliability of these claims. Below is a comparison of core trading costs:

| Fee Type | Tingju | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

Without specific figures available, it is challenging to evaluate whether Tingju's trading conditions are genuinely competitive or if they are hiding unfavorable terms. Traders should be cautious of brokers that do not provide clear information on their fee structures, as this can lead to unexpected costs that may erode profits.

Additionally, any unusual or problematic fee policies should be scrutinized. For instance, hidden fees for withdrawals or inactivity can significantly affect traders returns. Therefore, it is crucial to conduct thorough research before committing funds to any broker, especially one like Tingju that lacks regulatory oversight.

Customer Fund Safety

When it comes to trading, the safety of customer funds is paramount. Traders need to ensure that their investments are protected and that the broker has robust security measures in place. Tingju's approach to fund safety is unclear due to the lack of regulation and transparency. It is essential to assess the broker's policies regarding fund segregation, investor protection, and negative balance protection.

Segregation of client funds is a critical practice that ensures traders' money is kept separate from the broker's operating funds. This is particularly important in the event of a broker's insolvency. Additionally, negative balance protection prevents traders from losing more money than they have deposited, providing an extra layer of security.

Unfortunately, without clear information on Tingjus policies regarding these safety measures, potential clients may find themselves at risk. Any historical issues related to fund safety or disputes should also be considered when evaluating the broker's reliability.

Customer Experience and Complaints

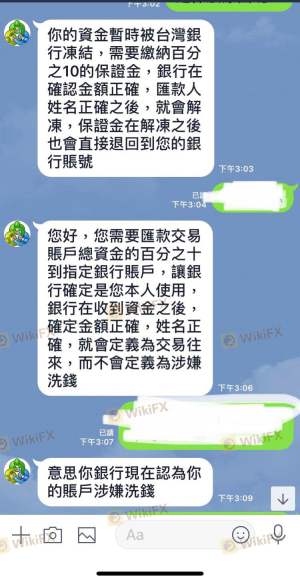

Customer feedback plays a vital role in assessing a broker's overall reputation. Evaluating real user experiences can provide insights into the quality of service and potential issues that may arise. A review of customer experiences with Tingju reveals a range of feedback, with several users expressing concerns about withdrawal difficulties and unresponsive customer service.

Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

| Transparency Concerns | High | Lacking |

Typical case studies indicate that some users have faced obstacles when attempting to withdraw their funds, which is a significant red flag in assessing whether Tingju is safe. A broker that does not facilitate smooth withdrawals may be engaging in questionable practices, leading to potential allegations of fraud.

Platform and Trade Execution

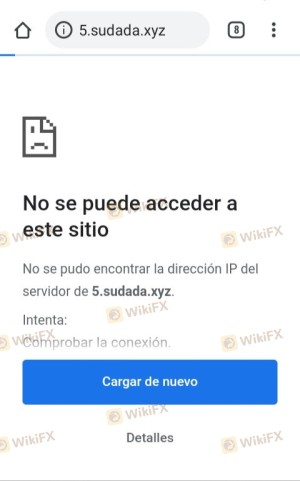

Tingju's trading platform is another critical aspect of the trading experience. A reliable trading platform should offer stability, user-friendliness, and efficient order execution. However, there are concerns regarding the performance of Tingju's platform, including reports of slippage and order rejections, which can significantly impact trading outcomes.

The quality of order execution is vital for traders, especially in a volatile market. Any signs of platform manipulation or irregularities should be closely monitored. Traders should be wary of brokers that do not provide clear information on execution policies or those that exhibit signs of poor performance during critical trading periods.

Risk Assessment

Using Tingju for forex trading entails various risks, primarily due to its unregulated status and lack of transparency. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation increases potential for fraud. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders should consider using a regulated broker with a proven track record. It is also advisable to start with a small investment to test the waters before committing larger sums.

Conclusion and Recommendations

In conclusion, the investigation into Tingju raises significant concerns about its safety and legitimacy. The absence of regulatory oversight, combined with customer complaints and a lack of transparency, suggests that traders should approach this broker with caution. Is Tingju safe? The evidence points towards potential risks that cannot be overlooked.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated and have a proven track record of positive customer experiences. Some reputable options include established brokers with strong regulatory frameworks and transparent operations. Ultimately, conducting thorough research and due diligence is essential for ensuring a secure trading experience in the forex market.

Is TingJu a scam, or is it legit?

The latest exposure and evaluation content of TingJu brokers.

TingJu Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TingJu latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.