Is TERRAIN CAPITAL safe?

Business

License

Is Terrain Capital Safe or Scam?

Introduction

Terrain Capital is a forex broker that has attracted attention in the trading community for its claims of offering access to various financial markets, including forex, precious metals, and commodities. However, the legitimacy and safety of this broker have come under scrutiny, prompting traders to carefully evaluate its credibility. In the volatile world of forex trading, it is essential for traders to conduct thorough due diligence on brokers to avoid potential scams that can lead to significant financial losses. This article aims to provide an objective analysis of Terrain Capital by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The findings are based on an extensive review of multiple sources, including user reviews, regulatory databases, and financial analysis platforms.

Regulation and Legitimacy

One of the most critical factors in determining whether a broker is safe or a scam is its regulatory status. Regulatory bodies are responsible for overseeing brokers to ensure they adhere to established financial standards and protect investors. Unfortunately, Terrain Capital operates as an unregulated broker, which raises significant concerns regarding its legitimacy and the safety of client funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Terrain Capital does not have to comply with the stringent requirements imposed by reputable financial authorities, such as the UK's Financial Conduct Authority (FCA) or the U.S. Commodity Futures Trading Commission (CFTC). This lack of oversight increases the risk of non-compliance and fraud, making it imperative for traders to approach this broker with caution. Additionally, reports indicate that Terrain Capital has a history of operational issues, including an inaccessible website, which further diminishes its credibility.

Company Background Investigation

Terrain Capital's operational history is relatively obscure, and there is limited information regarding its ownership structure and management team. The broker claims to be based in the United Kingdom, but many reviews suggest that this information may be misleading. The lack of transparency regarding the company's true location and ownership raises red flags about its legitimacy.

The management teams qualifications and experience are also unclear, as there is no publicly available information detailing their backgrounds. A reputable broker typically discloses information about its executive team, demonstrating transparency and accountability. The absence of such information for Terrain Capital contributes to the perception that it may not be a trustworthy broker. Overall, the lack of transparency and verifiable information about the company further complicates the assessment of whether Terrain Capital is safe or a scam.

Trading Conditions Analysis

When evaluating a broker's safety, understanding its trading conditions is essential. Terrain Capital claims to offer competitive trading conditions; however, specific details about its fee structure and trading costs are not readily available. This lack of transparency can be a significant concern for potential traders.

| Fee Type | Terrain Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | N/A |

| Commission Structure | N/A | N/A |

| Overnight Interest Range | N/A | N/A |

The absence of clear information regarding spreads, commissions, and overnight fees can lead to unexpected costs for traders. Furthermore, the lack of detailed disclosures about trading conditions can be indicative of a broker that may not prioritize client interests. Traders should be particularly wary of brokers that do not provide transparent fee structures, as this can lead to hidden charges that significantly affect overall profitability.

Client Funds Security

The safety of client funds is a paramount concern when assessing a broker's reliability. Terrain Capital has been criticized for its inadequate security measures regarding client funds. As an unregulated entity, it is not obligated to implement stringent safety protocols, such as segregating client funds from operational capital or providing negative balance protection.

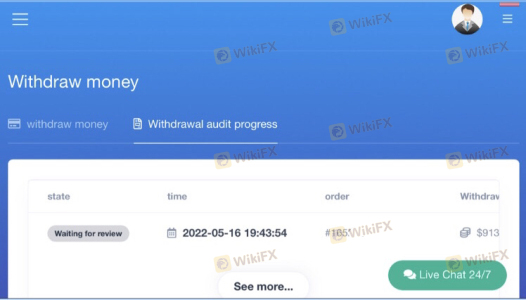

The lack of investor protection measures is a significant risk factor, as it leaves clients vulnerable to potential losses without any recourse. Historical complaints from users indicate that many have experienced difficulties in withdrawing their funds, further emphasizing the need for caution when dealing with Terrain Capital. The absence of a solid framework for fund security raises serious questions about whether Terrain Capital is safe or a scam.

Customer Experience and Complaints

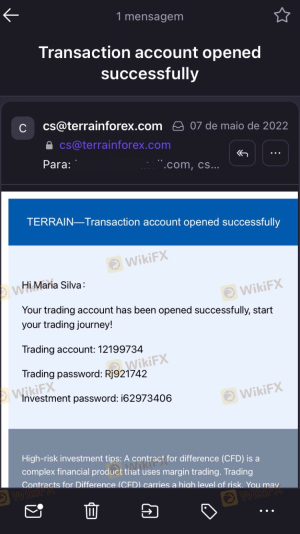

Customer feedback is a valuable indicator of a broker's reliability and service quality. Terrain Capital has received numerous negative reviews, with many users reporting issues related to fund withdrawals and customer service responsiveness. Common complaints include delays in processing withdrawal requests and accusations of unauthorized trading activities.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Poor |

For instance, multiple users have reported being unable to withdraw their funds, leading to frustration and financial losses. These complaints highlight a pattern of operational inefficiencies and a lack of accountability on the part of Terrain Capital. Such issues not only diminish trust but also raise concerns about the broker's overall integrity and whether it can be considered safe for traders.

Platform and Execution

The trading platform offered by Terrain Capital is another critical aspect to consider. A reliable broker should provide a stable and user-friendly platform with efficient order execution. However, many reviews indicate that Terrain Capital's platform may not meet these standards, with reports of slippage and order rejections.

Traders have expressed concerns about the overall performance and reliability of the trading platform, which can significantly impact trading outcomes. If a broker fails to provide a seamless trading experience and allows for manipulative practices, it raises further questions about whether Terrain Capital is safe or a scam.

Risk Assessment

Using Terrain Capital comes with various risks that potential traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of investor protection measures. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

Given these significant risks, traders should approach Terrain Capital with extreme caution. It is advisable to consider alternative brokers that are regulated and have a proven track record of reliability and customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence suggests that Terrain Capital raises several red flags that warrant serious consideration. The broker's unregulated status, lack of transparency, and numerous customer complaints indicate that it may not be a safe option for traders. The potential for financial loss, coupled with inadequate customer support and questionable trading conditions, leads to the conclusion that Terrain Capital may be more aligned with scam-like behavior than legitimate brokerage practices.

For traders seeking a safe and reliable trading environment, it is highly recommended to explore regulated alternatives that prioritize client protection and transparency. Brokers such as [insert recommended brokers here] offer a more secure trading experience, backed by regulatory oversight and positive customer feedback. Always conduct thorough research and due diligence before choosing a broker to ensure your trading experience is both safe and successful.

Is TERRAIN CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of TERRAIN CAPITAL brokers.

TERRAIN CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TERRAIN CAPITAL latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.