Super Ez Forex 2025 Review: Everything You Need to Know

Super Ez Forex has garnered significant attention in the forex trading community, primarily due to its claims of simplifying the trading process through its automated trading system. However, a comprehensive analysis of various sources reveals a mixed bag of opinions and a plethora of concerns regarding its credibility and effectiveness. This review aims to distill the key findings from multiple evaluations, focusing on user experiences, expert opinions, and the overall reliability of the platform.

Note: It's important to recognize that Super Ez Forex operates across various jurisdictions, which may influence its regulatory status and user experiences. This review takes a balanced approach to ensure fairness and accuracy in the information presented.

Ratings Overview

How We Rated the Broker: Ratings are based on a comprehensive review of user feedback, expert insights, and factual data gathered from multiple sources.

Broker Overview

Established in 2018, Super Ez Forex markets itself as an automated trading system designed to help traders maximize their returns with minimal effort. The platform operates exclusively on the MetaTrader 4 (MT4) trading platform, allowing users to engage in trading across various asset classes, including forex, stocks, indices, metals, and cryptocurrencies. However, the lack of transparency regarding its regulatory framework raises significant concerns about its legitimacy and user safety.

Detailed Analysis

Regulatory Environment

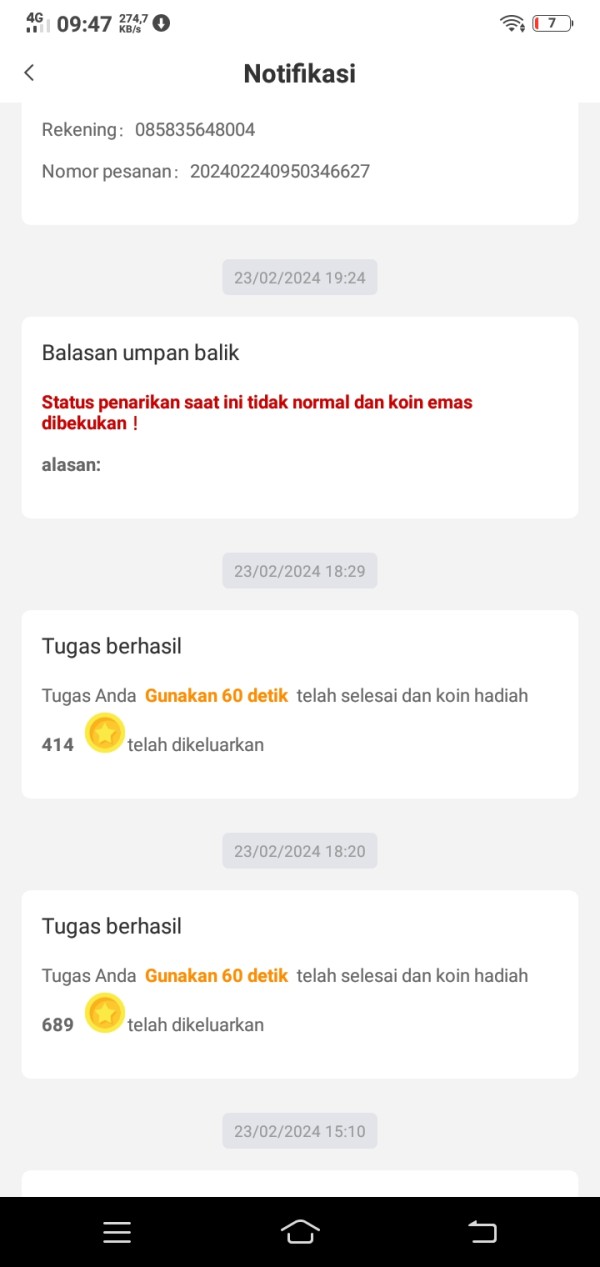

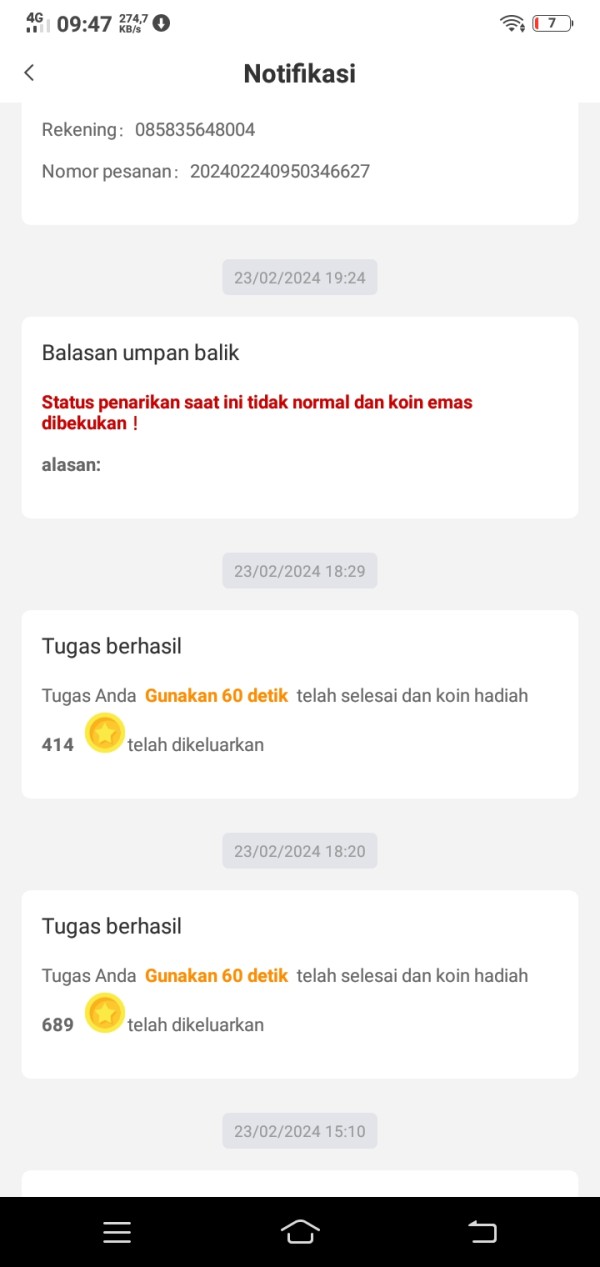

Super Ez Forex operates without clear regulatory oversight, which is a significant red flag for potential users. According to reports, the platform does not provide any verifiable information about its regulatory status or the jurisdictions in which it operates. This absence of oversight could expose traders to substantial risks, including potential fraud or loss of funds.

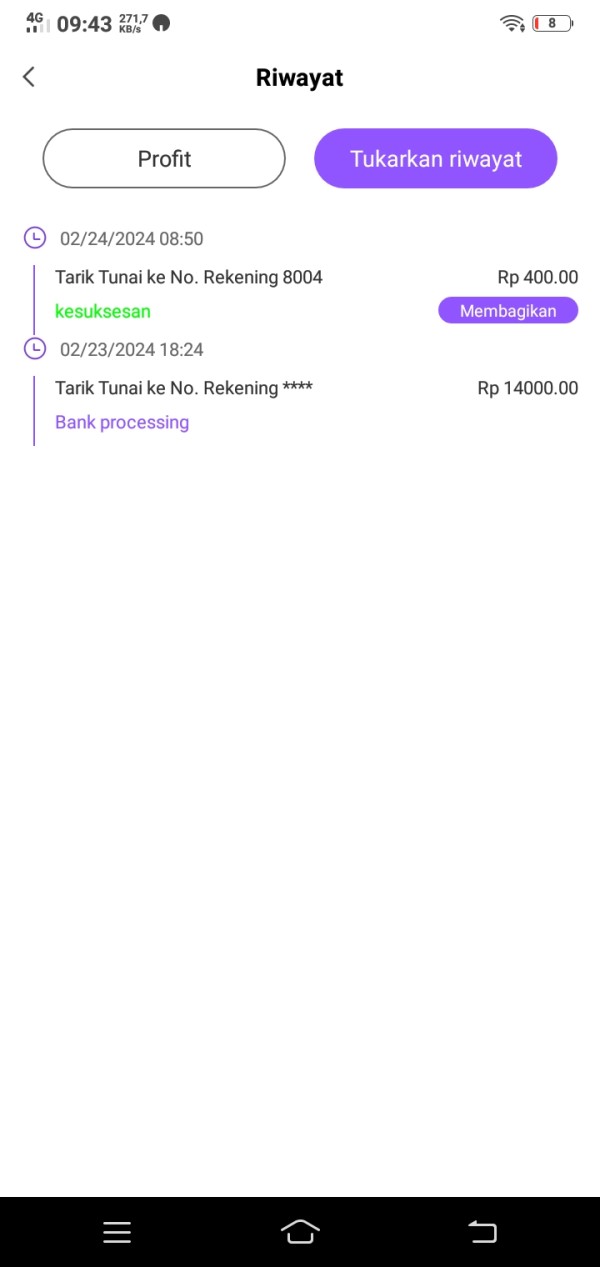

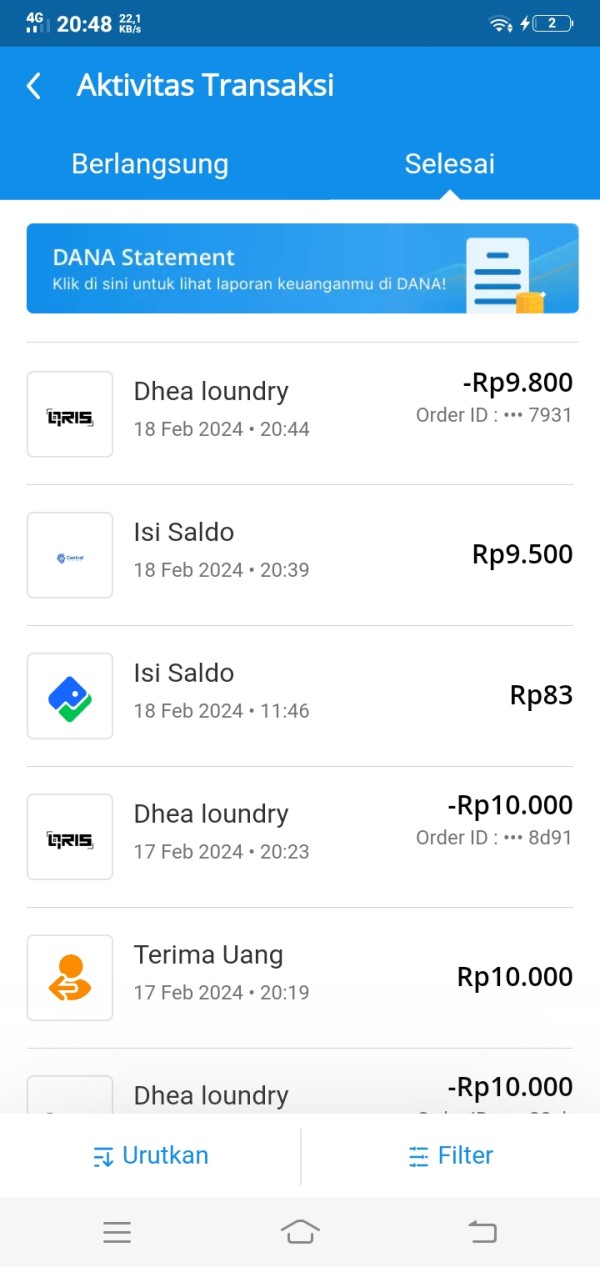

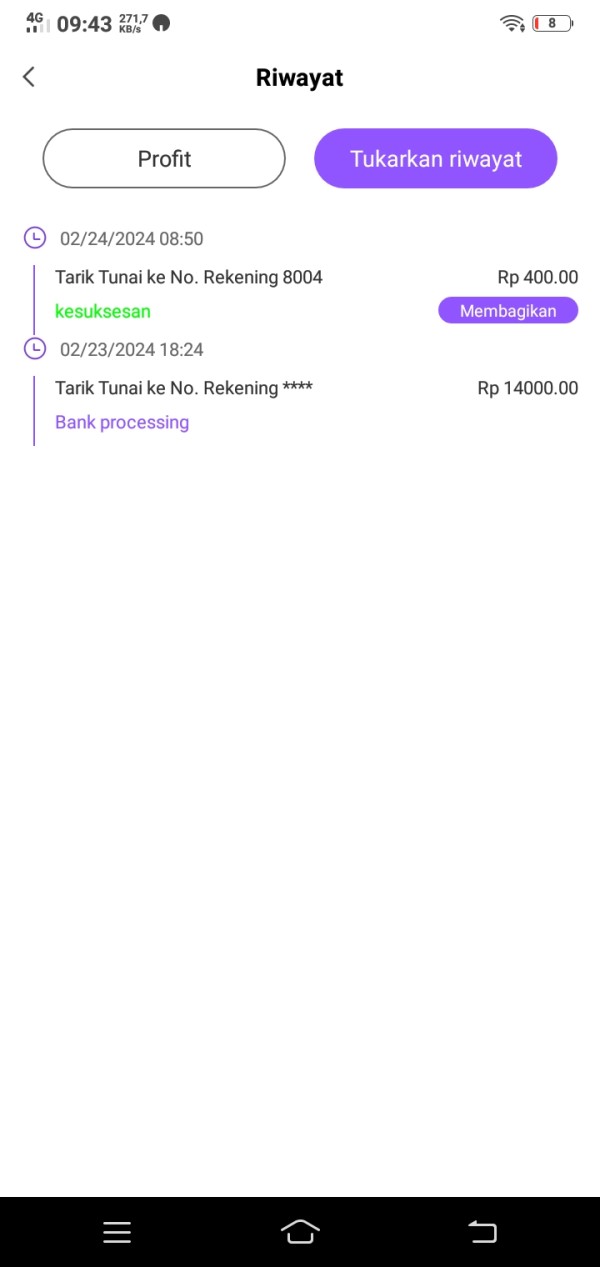

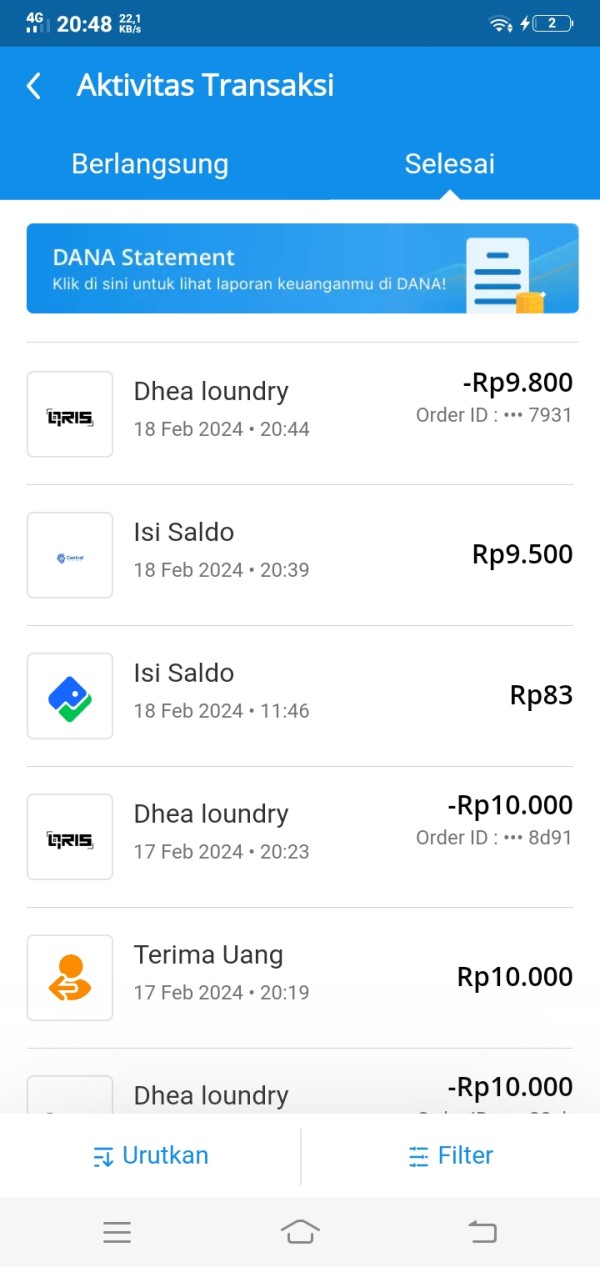

Deposit and Withdrawal

The platform does not specify minimum deposit requirements, which can be a deterrent for new traders looking to enter the forex market. Additionally, users have reported difficulties with withdrawals, raising concerns about the reliability of the platform's financial management.

No promotional offers or bonuses were highlighted in the reviews, which could indicate a lack of incentives for new users to join the platform. This absence might also reflect the platform's focus on its core product rather than customer acquisition strategies.

Tradable Asset Classes

Super Ez Forex claims to support a wide range of trading instruments, including forex pairs, stocks, indices, metals, and cryptocurrencies. However, the lack of detailed information about specific assets or trading conditions raises questions about the platform's actual capabilities.

Costs

The pricing structure for Super Ez Forex is reported to be quite steep, with a one-time fee of $299 plus taxes, totaling approximately $323.67. This pricing is significantly higher than many comparable services in the market, which typically range from $80 to $120 for similar indicators. The absence of a money-back guarantee further exacerbates concerns regarding the value proposition of this service.

Leverage

Details regarding leverage options are not disclosed, which is critical information for traders looking to manage their risk effectively. The lack of clarity on this aspect adds to the uncertainty surrounding the platform's offerings.

Super Ez Forex is exclusively available on the MT4 platform, which limits accessibility for traders who may prefer other platforms like MT5 or proprietary systems. This restriction could deter potential users who are accustomed to different trading interfaces.

Restricted Regions

While specific regions that are restricted from using Super Ez Forex were not mentioned, the lack of regulatory clarity suggests that users from certain jurisdictions may face challenges or legal issues when engaging with the platform.

Customer Support Languages

Customer support appears to be a significant drawback for Super Ez Forex, with many reviews indicating poor service and a lack of responsiveness. The only contact method provided is an email address, which may not be sufficient for users requiring immediate assistance.

Final Ratings Overview

Detailed Breakdown

-

Account Conditions: The lack of clear minimum deposit requirements and withdrawal issues significantly undermine the platform's appeal.

Tools and Resources: While the platform offers some automated trading tools, the absence of backtesting data and verified trading results raises questions about their effectiveness.

Customer Service and Support: Reports of inadequate customer support and slow response times contribute to a negative user experience.

Trading Experience: Users have expressed frustration over the platform's lack of transparency regarding its trading strategies and performance metrics.

Trustworthiness: The absence of regulatory oversight and verified user reviews leads to a low trust rating for Super Ez Forex.

User Experience: Overall user experiences have been mixed, with many expressing concerns over the platform's reliability and effectiveness.

Regulation and Transparency: The lack of regulatory information and transparency about the company's operations is a significant concern for potential investors.

In conclusion, while Super Ez Forex claims to offer a simplified trading experience, the numerous red flags and lack of transparency warrant caution. Potential users should thoroughly research and consider alternative platforms with better regulatory oversight and proven track records before engaging with Super Ez Forex.