Is Sunger safe?

Pros

Cons

Is Sunger A Scam?

Introduction

Sunger, also known as SungerFX, positions itself as a forex and CFD broker in the competitive online trading market. The broker claims to offer a wide range of trading instruments, including currency pairs, indices, and commodities, while utilizing the popular MetaTrader 5 platform. However, as with any financial service, traders must be cautious and conduct thorough evaluations of forex brokers before investing their hard-earned money. The potential for scams in the trading world necessitates a careful assessment of a brokers legitimacy, regulatory compliance, and overall reputation. This article aims to investigate whether Sunger is a trustworthy trading platform or if it raises red flags that indicate it may be a scam. Our analysis is based on various credible sources, user reviews, and regulatory information.

Regulation and Legitimacy

When assessing the safety of a forex broker, regulatory oversight is paramount. A regulated broker is subject to strict guidelines that protect traders, including the segregation of client funds and adherence to financial standards. In the case of Sunger, there is a significant lack of transparency regarding its regulatory status. The broker claims to be regulated by the Financial Conduct Authority (FCA) in the UK; however, a search of the FCA's official database reveals that Sunger is not authorized to provide financial services in the UK.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Verified |

| CONSOB | N/A | Italy | Not Verified |

This lack of regulation is a critical concern, as it indicates that Sunger operates without the oversight necessary to ensure the safety of client funds. Additionally, the absence of any verifiable regulatory history raises questions about the broker's legitimacy. Notably, both the FCA and Italy's CONSOB have issued warnings against Sunger for engaging in unauthorized financial activities. Such warnings are significant indicators that traders should exercise extreme caution when considering any transactions with Sunger.

Company Background Investigation

Sunger's company history is shrouded in ambiguity. There is little publicly available information regarding its establishment, ownership structure, or management team. The absence of clear details about the company's background is concerning, as reputable brokers typically provide comprehensive information about their operations, including their legal entity, corporate history, and executive team credentials. A thorough investigation reveals that Sunger has not disclosed its physical address, which is another red flag commonly associated with fraudulent brokers.

The lack of transparency in Sunger's operations raises serious doubts about its credibility. A reliable broker should be able to provide potential clients with information about its regulatory status, ownership, and management team. The absence of such information implies that Sunger may not be operating with the transparency and accountability expected in the financial services industry.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for assessing its overall value proposition. Sunger claims to provide competitive trading costs; however, the lack of detailed information on its website makes it challenging to evaluate these claims fully. Traders often encounter hidden fees or unfavorable trading conditions that can significantly impact their trading performance.

| Fee Type | Sunger | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Most reputable brokers offer a clear outline of their fee structures, including spreads, commissions, and overnight interest rates. In contrast, Sunger does not provide sufficient information regarding its trading costs, which raises concerns about potential hidden fees that could erode traders' profits. The minimum deposit requirement of $1,000 is also significantly higher than the industry average, which typically ranges from $100 to $500. This high barrier to entry may deter potential traders, further questioning Sunger's accessibility and fairness.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. In the case of Sunger, there are several alarming indicators regarding its fund security measures. The broker does not offer any information on how client funds are protected, such as segregated accounts or investor compensation schemes. These are essential features that reputable brokers implement to safeguard client funds in the event of insolvency or operational issues.

Moreover, Sunger's lack of negative balance protection is another significant risk factor. This protection ensures that clients cannot lose more than their initial investment, offering a safety net against unpredictable market fluctuations. The absence of such measures raises serious concerns about the potential risks associated with trading through Sunger. Historical complaints from users suggest that clients have experienced difficulties withdrawing their funds, further emphasizing the need for caution when dealing with this broker.

Customer Experience and Complaints

Analyzing customer feedback is crucial for gauging a broker's reliability and service quality. In the case of Sunger, numerous complaints have been reported regarding fund withdrawals, customer support responsiveness, and overall trading experience. Many users have expressed frustration over the inability to withdraw their funds, which is a significant red flag that often indicates potential fraudulent activity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Lack of Transparency | High | None |

Typical complaints include prolonged withdrawal processes, lack of communication from customer support, and insufficient information regarding account management. In some cases, users have reported being unable to access their accounts entirely. These issues are indicative of a broker that may not prioritize customer service or transparency, further solidifying concerns about Sunger's legitimacy.

Platform and Trade Execution

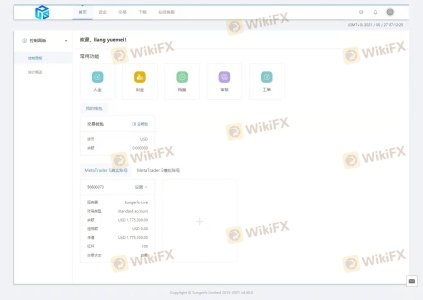

The trading platform is a critical component of a trader's experience. Sunger claims to offer the MetaTrader 5 (MT5) platform, known for its advanced features and user-friendly interface. However, the overall performance and reliability of the platform are equally important. User reviews indicate that there have been instances of slippage, order rejections, and other execution issues that can severely impact trading outcomes.

Traders have reported experiencing delays in trade execution, which can lead to missed opportunities and financial losses. Additionally, any signs of platform manipulation, such as sudden price changes or unauthorized trades, are serious concerns that should not be overlooked. The combination of these factors raises significant doubts about Sunger's operational integrity and the reliability of its trading environment.

Risk Assessment

Engaging with any broker carries inherent risks, but the risks associated with Sunger appear to be particularly high. The lack of regulation, transparency, and poor customer feedback contribute to a concerning risk profile for potential traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of client fund protection measures. |

| Execution Risk | Medium | Reports of slippage and order issues. |

| Withdrawal Risk | High | Difficulty in accessing funds. |

To mitigate these risks, traders should consider avoiding Sunger altogether and instead look for brokers with established regulatory frameworks, transparent operations, and positive user reviews. Conducting thorough research and selecting a reputable broker can significantly reduce the likelihood of encountering issues.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is evident that Sunger raises numerous red flags that suggest it may not be a safe broker. The lack of regulation, transparency issues, and consistent negative feedback from users indicate that potential traders should exercise extreme caution when considering this platform.

For traders looking for reliable alternatives, it is advisable to consider well-regulated brokers that prioritize client safety and offer transparent trading conditions. Some reputable options include brokers regulated by the FCA, ASIC, or CySEC, as these entities enforce strict compliance measures to protect traders.

In conclusion, the evidence strongly suggests that Sunger is not a safe choice for trading. Traders should prioritize their safety and opt for brokers that demonstrate a commitment to regulatory compliance and customer service.

Is Sunger a scam, or is it legit?

The latest exposure and evaluation content of Sunger brokers.

Sunger Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sunger latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.