Sunger 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Sunger review examines a US-registered, unregulated brokerage company that has received significant negative attention from traders worldwide. Based on available information and user feedback, Sunger presents itself as a forex and CFD broker but operates without proper regulatory oversight. This raises substantial concerns about trader safety and fund security.

The company offers the MT5 trading platform. It also provides access to over 50 forex currency pairs, positioning itself as a solution for traders seeking diversified foreign exchange trading opportunities. However, user reviews paint a troubling picture. The broker receives extremely poor ratings across review platforms.

On PissedConsumer, Sunger has earned a dismal 1-star rating based on 57 user reviews. This indicates widespread dissatisfaction among its client base. This Sunger review reveals that while the broker may offer some standard trading tools, the lack of regulatory protection combined with overwhelmingly negative user experiences suggests that potential traders should exercise extreme caution.

The company's unregulated status means that traders have limited recourse in case of disputes or issues with fund withdrawals. This makes it a high-risk choice for forex trading activities.

Important Notice

Due to Sunger's unregulated status, investors must exercise particular caution when considering this broker. This is especially important given the varying legal frameworks and consumer protections across different jurisdictions. The lack of regulatory oversight means that standard investor protection schemes may not apply.

This leaves traders vulnerable to potential losses beyond their trading capital. This review is based on publicly available information, user feedback, and basic company details provided through various online sources. Given the limited transparency from the company itself, prospective traders should conduct additional due diligence before making any investment decisions.

Rating Framework

Broker Overview

Sunger Trade was established in 2003. It positions itself as a forex and contracts for difference broker in the competitive online trading market. The company has operated for over two decades, though its longevity has not translated into positive user experiences or regulatory recognition.

Despite its years in operation, Sunger remains an unregulated entity. This significantly impacts its credibility within the professional trading community. The broker's primary business model focuses on providing forex and CFD trading services to retail traders.

However, unlike established and regulated competitors, Sunger operates without the oversight of major financial regulatory bodies. This creates substantial risks for potential clients. This Sunger review emphasizes that the company's business approach appears to prioritize market access over regulatory compliance and user protection.

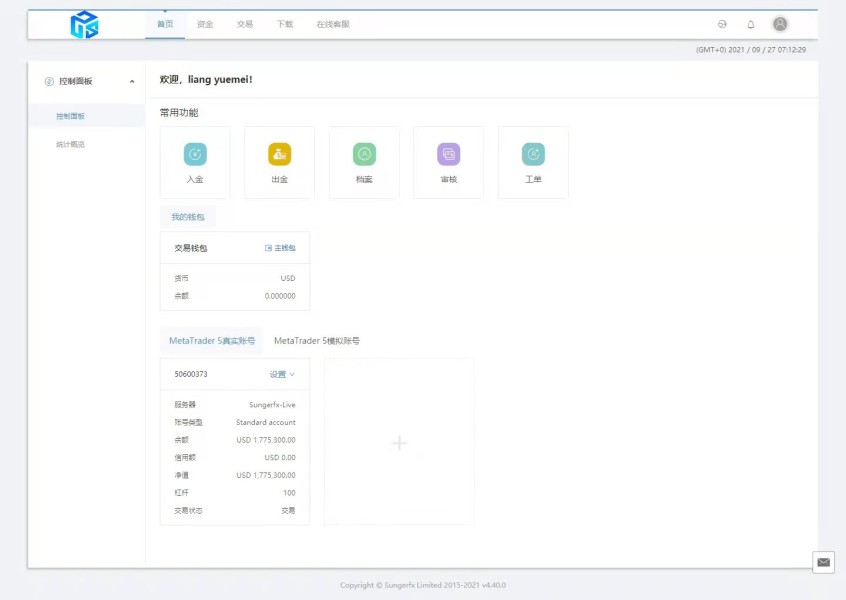

Sunger FX utilizes the MetaTrader 5 platform as its primary trading interface. It offers both desktop and mobile versions to accommodate different trading preferences. The broker specializes in forex trading, providing access to major, minor, and exotic currency pairs.

While the company offers CFD trading capabilities, the specific range of instruments beyond forex pairs remains unclear from available information. The absence of regulatory oversight means that standard trading protections and compensation schemes that regulated brokers typically provide are not available to Sunger clients.

Regulatory Status: Sunger operates as an unregulated broker registered in the United States. This status means the company does not fall under the supervision of major financial regulators such as the SEC, CFTC, or other international regulatory bodies. This creates significant risks for trader fund safety.

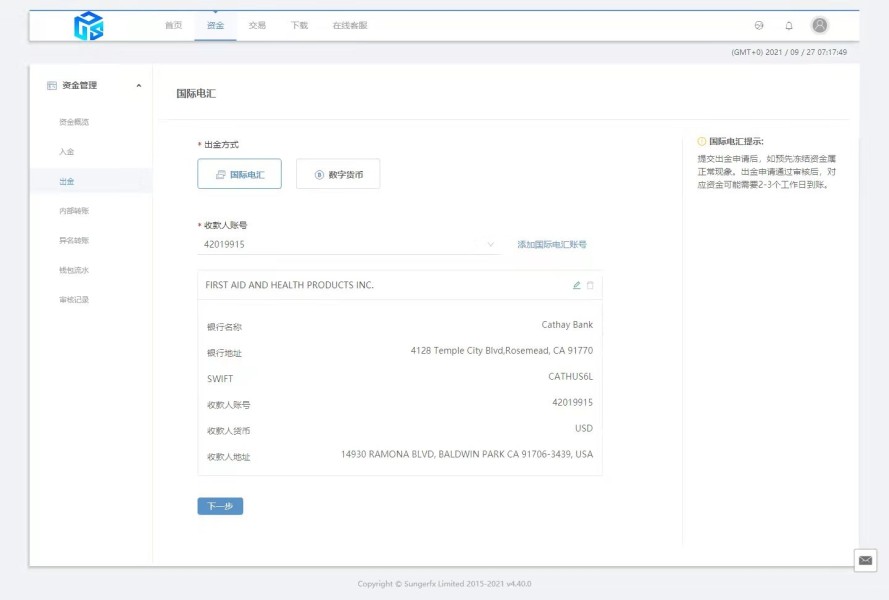

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available resources. This itself raises concerns about transparency and operational clarity.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit requirements in publicly available information. This makes it difficult for potential traders to assess accessibility.

Bonuses and Promotions: No information about promotional offers or bonus programs is available in current resources. This suggests either the absence of such programs or poor transparency in marketing communications.

Tradable Assets: Sunger provides access to over 50 forex currency pairs. These cover major pairs like EUR/USD, GBP/USD, and USD/JPY, along with minor and exotic pairs for diversified trading opportunities.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in current resources. This creates uncertainty about the true cost of trading with this broker. This lack of transparency is particularly concerning for cost-conscious traders.

Leverage Ratios: Specific leverage offerings are not mentioned in available information. However, this is typically a crucial factor for forex traders in position sizing and risk management.

Platform Options: The broker offers MetaTrader 5 in both desktop and mobile versions. It provides standard charting tools and trading capabilities associated with this popular platform.

Geographic Restrictions: Information about geographic restrictions or availability is not specified in current resources.

Customer Support Languages: Available customer service languages are not detailed in accessible information. This potentially limits support accessibility for international clients.

This Sunger review highlights significant information gaps that prospective traders should consider as red flags when evaluating broker transparency and professionalism.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Sunger remain largely opaque. No publicly available information details the types of accounts, their specific features, or associated benefits. This lack of transparency represents a significant concern for potential traders who need clear information about account structures to make informed decisions.

Professional traders typically expect detailed information about account tiers, minimum balance requirements, and special features such as VIP accounts or institutional offerings. The absence of information about minimum deposit requirements further complicates the evaluation process. Most reputable brokers clearly communicate their account opening requirements, allowing traders to assess whether the broker's services align with their capital availability.

Without this fundamental information, traders cannot properly plan their engagement with Sunger or compare it effectively with other market options. Account opening procedures and verification processes are not documented in available resources. This raises questions about the broker's onboarding standards and compliance practices.

Additionally, there is no mention of specialized account types such as Islamic accounts for traders requiring Sharia-compliant trading conditions. Many regulated brokers routinely offer these services. This Sunger review finds that the complete absence of account condition details significantly hampers any meaningful evaluation of the broker's offerings and suggests a concerning lack of transparency in basic business operations.

Sunger's trading tools and resources center around the MetaTrader 5 platform. This provides access to standard charting capabilities, technical indicators, and automated trading features that MT5 users expect. The platform supports trading across more than 50 forex currency pairs, offering reasonable diversity for currency trading strategies.

However, the broker's tool offerings appear limited compared to comprehensive trading environments provided by regulated competitors. Research and analysis resources are not detailed in available information. This suggests that traders may need to rely on third-party sources for market analysis, economic calendars, and trading signals.

Professional traders often depend on integrated research tools, daily market commentary, and economic analysis to inform their trading decisions. The apparent absence of these resources represents a significant limitation. Educational resources, which are crucial for developing traders, are not mentioned in current information about Sunger.

Most reputable brokers invest heavily in trader education through webinars, tutorials, trading guides, and market analysis content. The lack of educational support suggests that Sunger may not prioritize client development and success. Automated trading support through Expert Advisors is presumably available given the MT5 platform, but specific information about EA implementation, testing environments, or algorithmic trading support is not provided.

This gap in information makes it difficult for algorithmic traders to assess the platform's suitability for their strategies.

Customer Service and Support Analysis

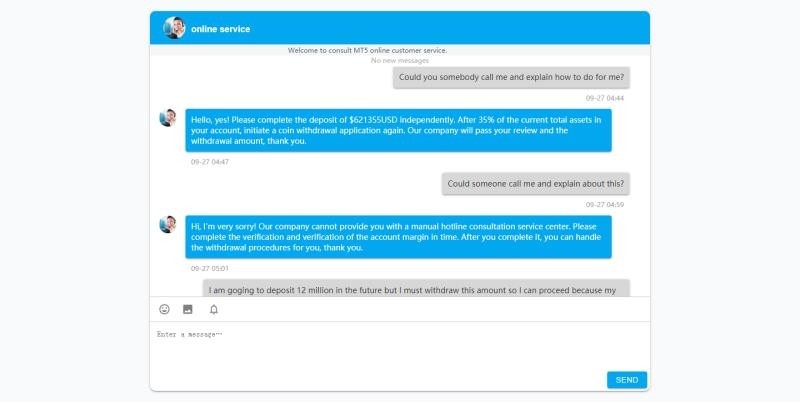

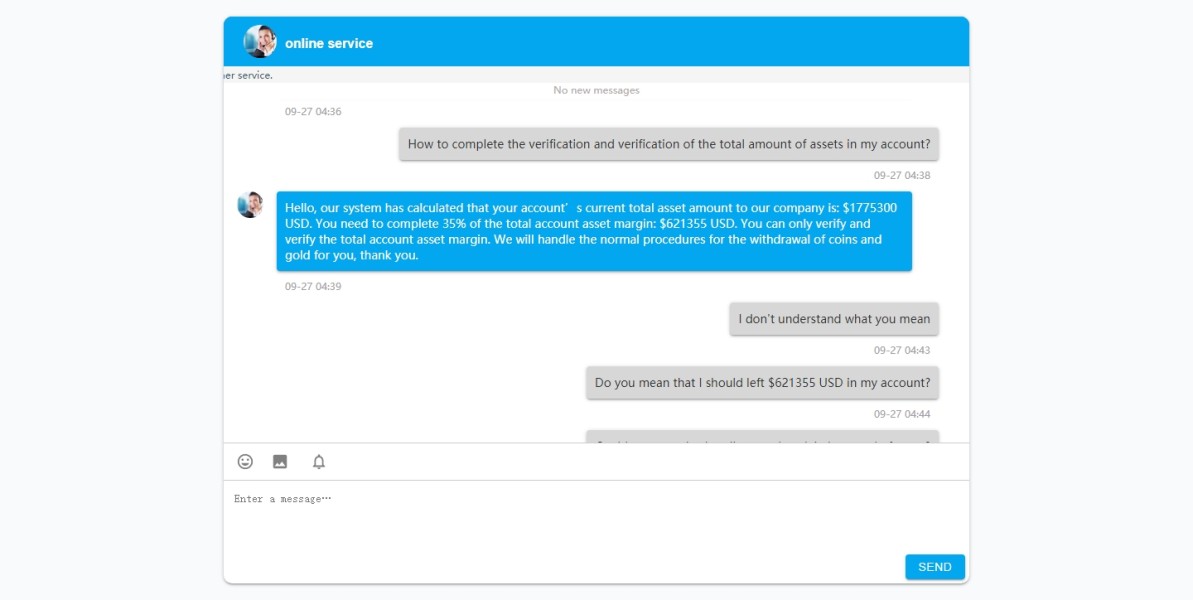

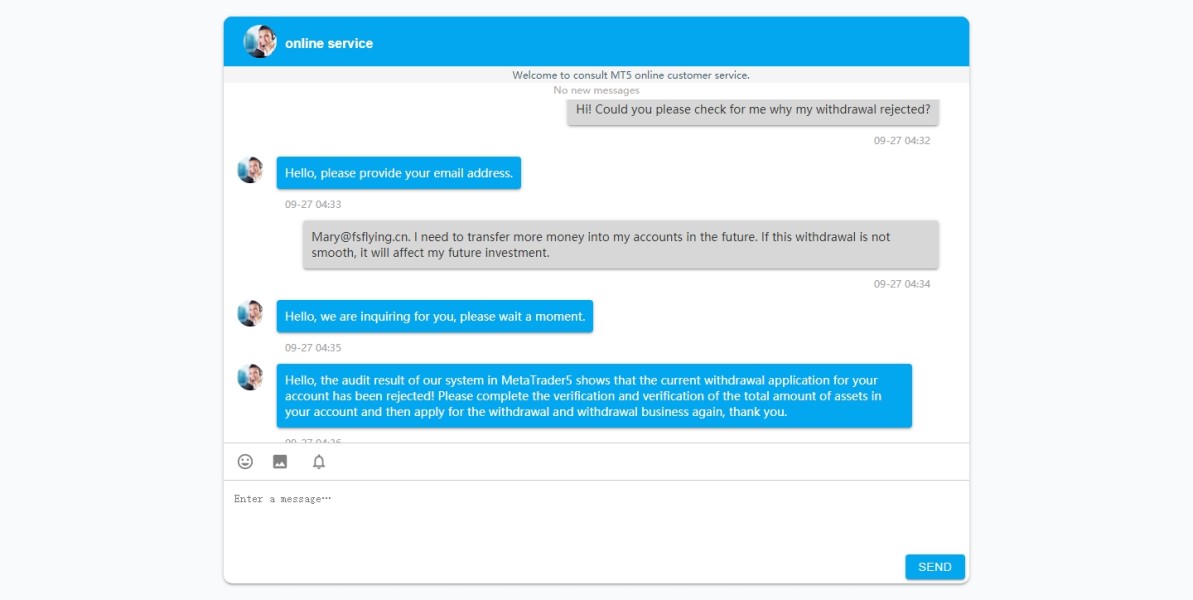

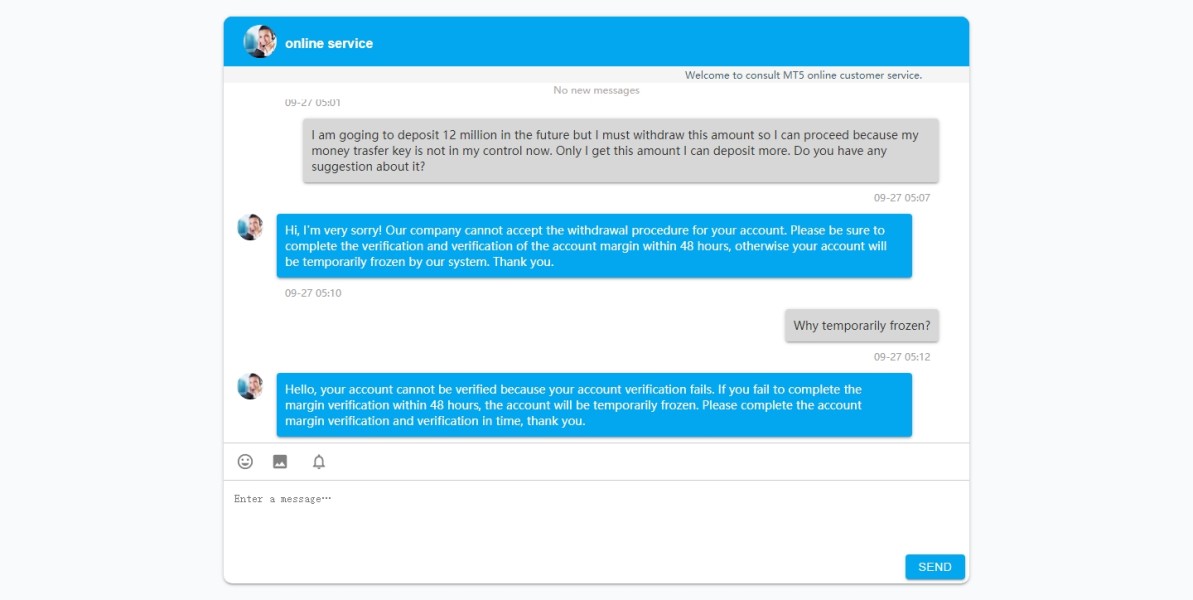

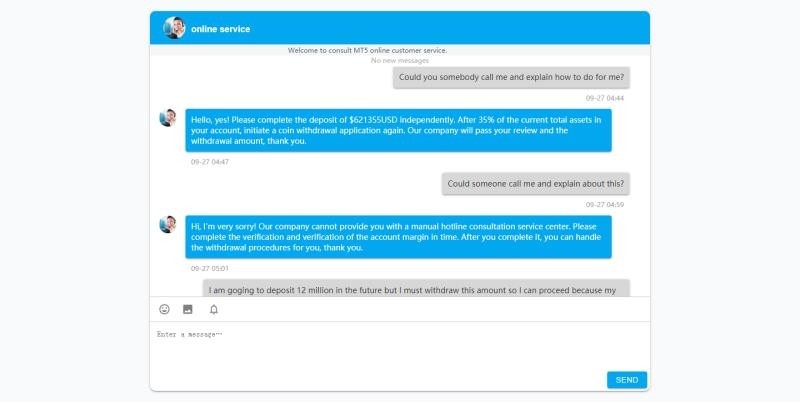

Customer service quality appears to be a significant weakness for Sunger. This is based on the overwhelmingly negative user feedback across review platforms. The 1-star rating on PissedConsumer, derived from 57 user reviews, suggests systemic issues with customer support responsiveness, effectiveness, and professionalism.

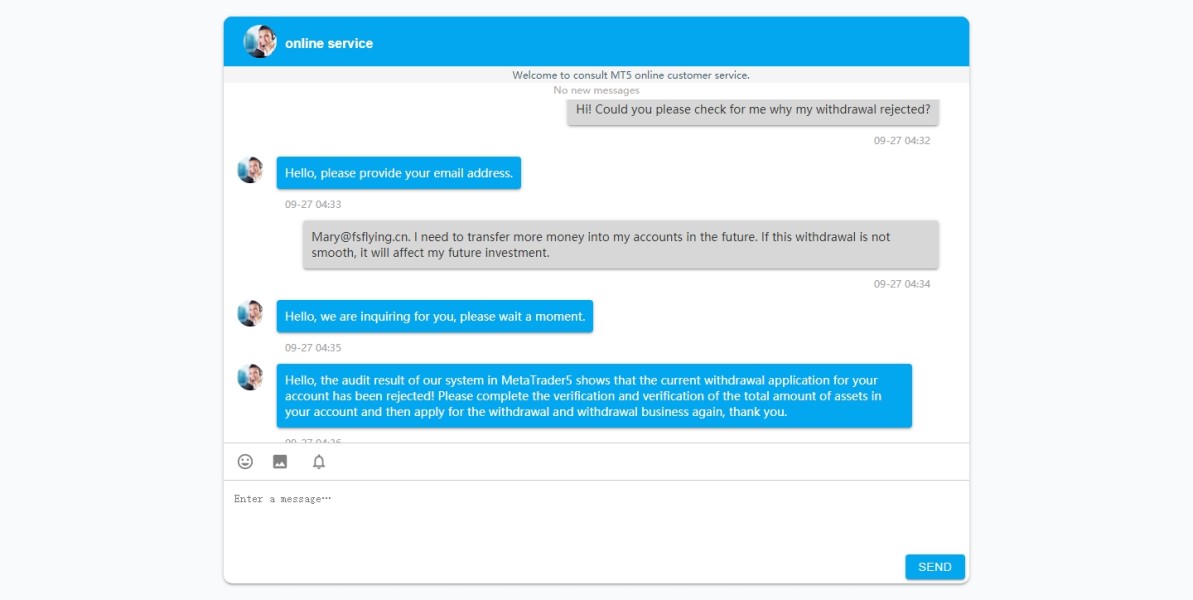

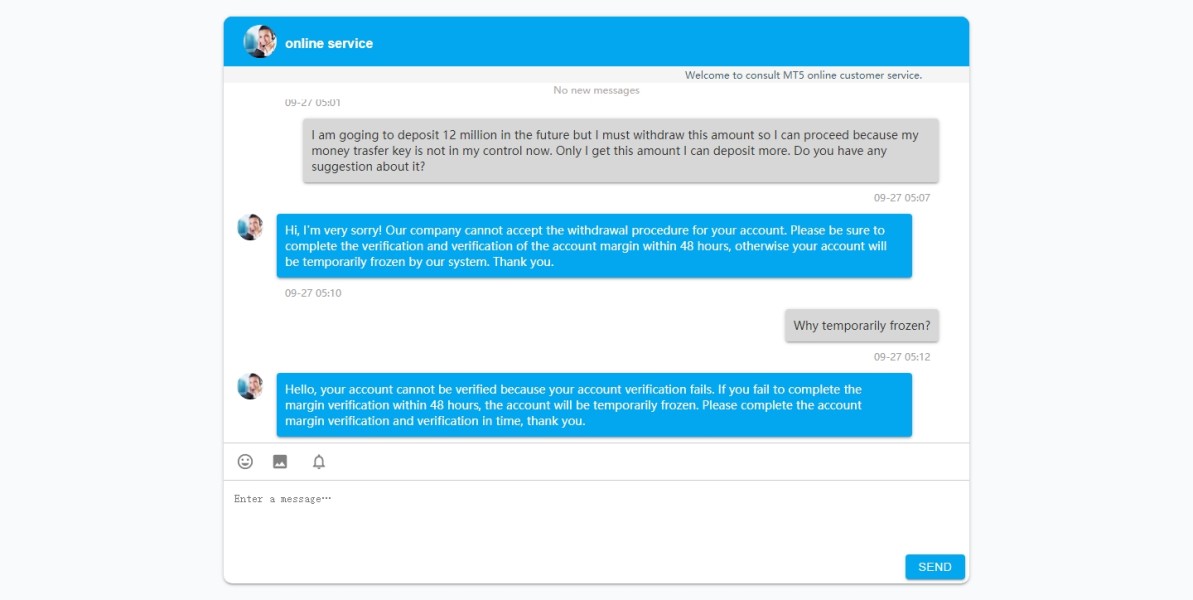

This pattern indicates that traders may struggle to receive adequate assistance when facing account issues, technical problems, or withdrawal difficulties. Specific information about customer service channels, including phone support, email assistance, or live chat availability, is not provided in accessible resources. This lack of transparency about support options creates uncertainty about how traders can reach the company when assistance is needed.

Professional trading environments typically offer multiple contact methods with clearly defined response times and escalation procedures. Response times for customer inquiries are not documented, but user feedback suggests significant delays or inadequate responses to client concerns. In the fast-paced forex trading environment, delayed customer support can result in missed trading opportunities or prolonged resolution of critical account issues.

The absence of multilingual support information is particularly concerning for an international broker. Effective communication is essential for resolving complex trading or account-related issues. Quality customer service often distinguishes reputable brokers from problematic operators, and the negative user feedback in this area represents a major red flag for potential Sunger clients.

Trading Experience Analysis

The trading experience with Sunger centers around the MetaTrader 5 platform. This generally offers reliable performance and comprehensive trading functionality. However, user reviews do not provide specific positive feedback about platform stability, execution speed, or overall trading conditions.

This suggests that the technical trading experience may not meet professional standards despite using a reputable platform. Order execution quality, including slippage rates, rejection frequencies, and fill speeds, is not documented in available information. These factors are crucial for active traders, particularly those employing scalping or high-frequency trading strategies.

The absence of execution statistics or transparency about trading conditions makes it difficult to assess whether Sunger can provide competitive execution quality. Platform functionality completeness through MT5 should theoretically provide comprehensive charting, analysis tools, and order management capabilities. However, without specific information about customization options, additional plugins, or enhanced features, traders cannot fully evaluate the platform's suitability for their specific trading approaches.

Mobile trading experience details are not provided, though MT5 mobile applications are generally functional. Professional traders increasingly rely on mobile platforms for position monitoring and trade management, making mobile platform quality an important consideration. The overall trading environment, including spreads, market depth, and liquidity provision, lacks transparency in available information.

This Sunger review emphasizes that the absence of detailed trading condition information, combined with negative user feedback, suggests that the trading experience may not meet professional standards expected by serious forex traders.

Trustworthiness Analysis

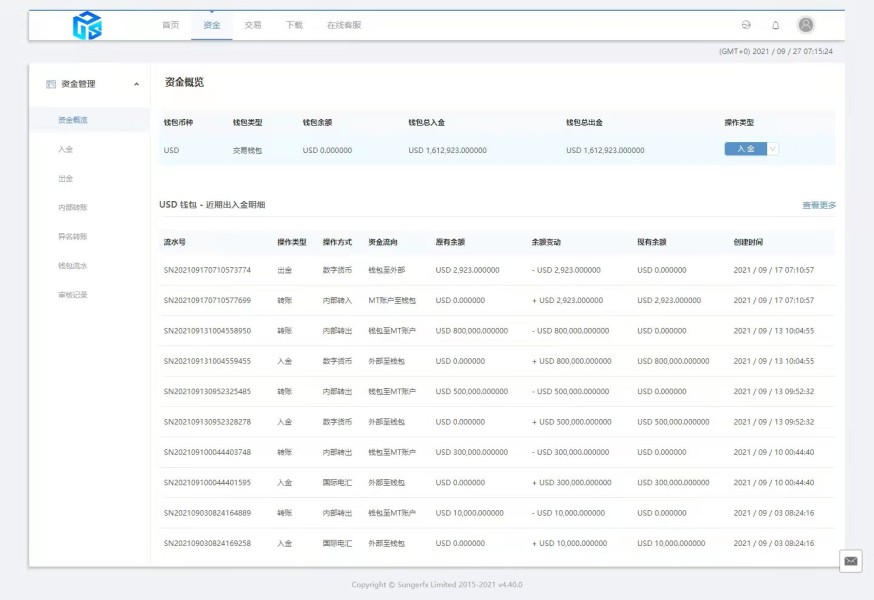

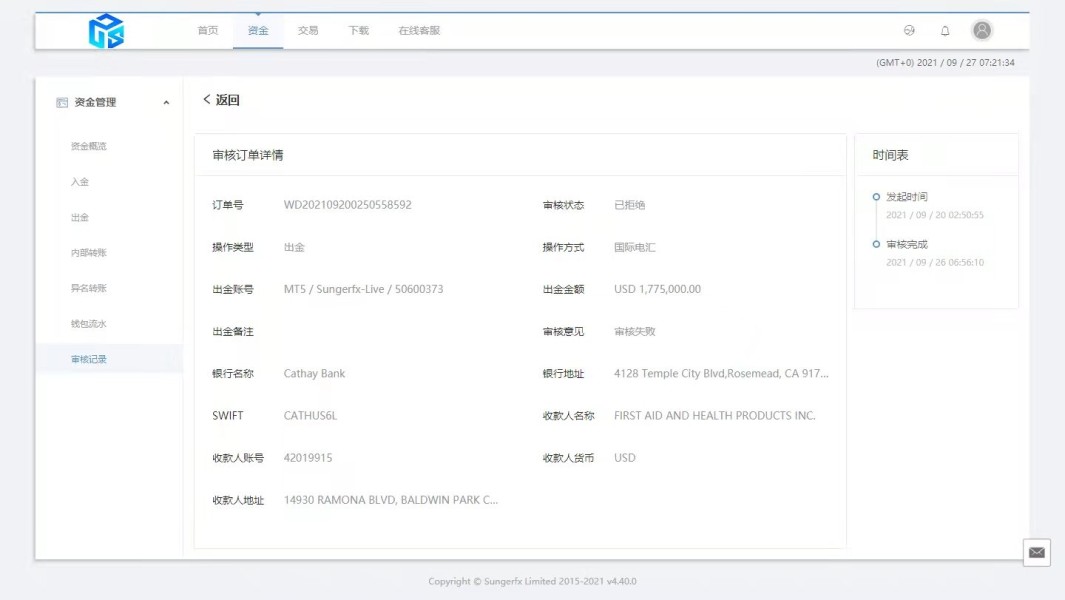

Sunger's trustworthiness faces severe challenges due to its unregulated status and consistently negative user feedback. Operating without regulatory oversight means the broker is not subject to capital adequacy requirements, client fund segregation mandates, or operational standards that regulated entities must maintain. This regulatory gap creates substantial risks for trader funds and limits recourse options when disputes arise.

The absence of regulatory licensing from recognized authorities such as the FCA, CySEC, ASIC, or other major regulators means that Sunger does not benefit from the credibility and oversight that regulatory compliance provides. Regulated brokers must adhere to strict operational standards, maintain adequate capital reserves, and participate in compensation schemes that protect client funds in case of broker insolvency. Fund safety measures, including client money segregation and insurance coverage, are not detailed in available information.

Reputable brokers typically maintain client funds in segregated accounts with tier-one banks and carry professional indemnity insurance to protect against operational risks. The absence of such information raises serious concerns about fund security. Company transparency is notably lacking, with limited disclosure about corporate structure, ownership, financial statements, or operational procedures.

Professional traders typically expect comprehensive information about their broker's financial stability and business practices. The overwhelmingly negative user reviews, particularly the 1-star rating based on 57 reviews, indicate systematic issues with the broker's operations and client treatment. This pattern of negative feedback suggests that trustworthiness concerns are well-founded and supported by actual user experiences.

User Experience Analysis

Overall user satisfaction with Sunger appears extremely poor. This is evidenced by the 1-star rating on review platforms and the absence of positive user testimonials in available information. This level of dissatisfaction suggests fundamental problems with the broker's service delivery, platform performance, or business practices that consistently fail to meet client expectations.

Interface design and usability information is limited to the MT5 platform, which generally provides a professional trading interface. However, the broader user experience encompasses account management, customer service interactions, and operational efficiency, areas where Sunger appears to underperform significantly based on user feedback. Registration and verification processes are not detailed in available resources, but user complaints may indicate problematic onboarding procedures, excessive documentation requirements, or verification delays that frustrate new clients attempting to begin trading activities.

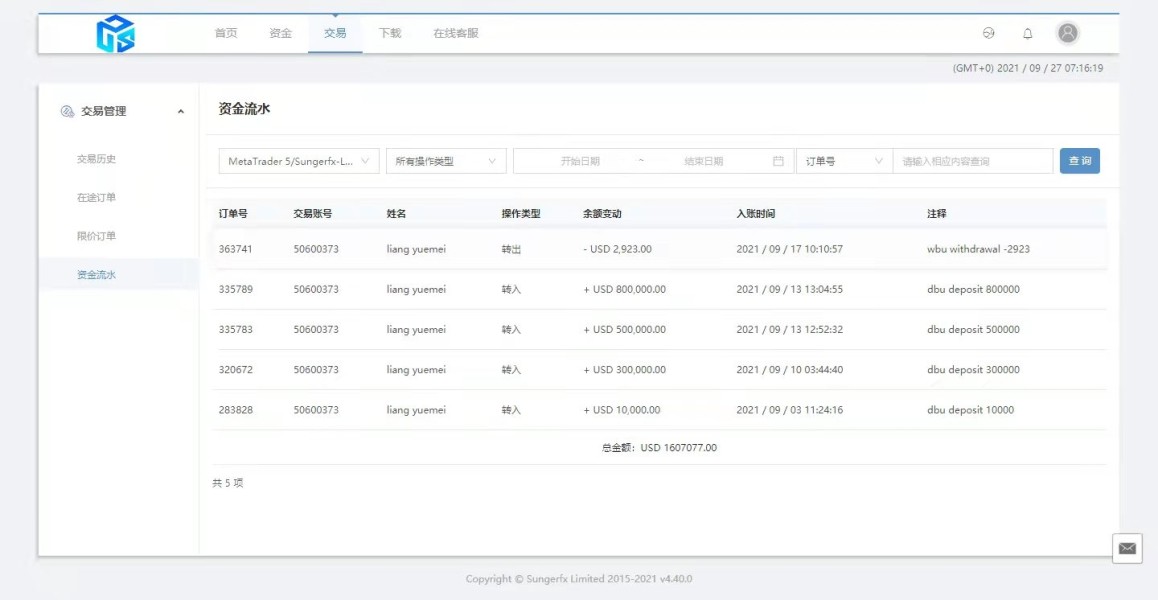

Fund operation experiences, particularly withdrawal processes, appear to be a source of significant user dissatisfaction based on the pattern of negative reviews. Withdrawal difficulties are among the most serious concerns traders can face, as they directly impact access to trading profits and capital. Common user complaints center around customer service inadequacy, potential withdrawal issues, and general operational problems, though specific details are not provided in current information.

The consistency of negative feedback suggests systematic rather than isolated problems. Traders seeking diversified forex trading tools should approach Sunger with extreme caution, considering the unregulated status and poor user feedback as significant risk factors that outweigh any potential benefits from the broker's currency pair offerings.

Conclusion

This comprehensive Sunger review reveals a broker that presents significant risks to potential traders. This is despite offering access to the MT5 platform and over 50 forex currency pairs. The company's unregulated status, combined with overwhelmingly negative user feedback, creates a risk profile that most professional traders would find unacceptable.

While Sunger may appeal to traders seeking diverse forex trading opportunities, the lack of regulatory protection and poor user satisfaction ratings suggest that these benefits are overshadowed by fundamental operational and trustworthiness concerns. The absence of transparent information about costs, account conditions, and business practices further compounds the risks associated with this broker. The main advantages include access to the popular MT5 platform and a reasonable selection of currency pairs for forex trading.

However, these limited benefits are significantly outweighed by major disadvantages including unregulated status, poor customer service, lack of transparency, and consistently negative user experiences that indicate systematic operational problems.