Is Starek safe?

Pros

Cons

Is Starek Safe or Scam?

Introduction

Starek is a relatively new player in the forex market, having been established in 2021. It positions itself as a broker offering a range of trading instruments, including forex, commodities, and CFDs. However, the rapid growth of online trading has also led to an increase in fraudulent activities, making it imperative for traders to conduct thorough evaluations of their brokers. This article aims to investigate whether Starek is a safe trading platform or a potential scam. Our assessment is based on a comprehensive analysis of various factors, including regulatory status, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices designed to protect investors. Starek claims to be based in the United Kingdom and asserts that it is regulated by the National Futures Association (NFA). However, a deeper investigation reveals that Starek operates without any valid regulatory oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0546623 | United States | Unauthorized |

The lack of legitimate regulation raises significant concerns regarding the safety of funds and the overall credibility of the broker. Without proper oversight, traders are left vulnerable to potential scams and unethical practices. The absence of a valid license from reputable regulatory bodies such as the Financial Conduct Authority (FCA) in the UK further compounds these concerns. Given that Starek does not meet the necessary regulatory requirements, it is crucial for traders to be cautious and consider the risks associated with trading on this platform.

Company Background Investigation

Starek claims to have a rich history and a strong presence in the forex market, yet its actual background is murky at best. The company was founded in 2021, and information regarding its ownership structure is scarce. The lack of transparency surrounding the company's management team and their professional qualifications raises red flags. A reputable broker typically provides detailed information about its team, including their experience and qualifications in the financial industry.

Moreover, the company's website appears to lack essential information that would typically be available for a legitimate broker, such as physical office locations and a comprehensive corporate history. This opacity can be indicative of a broker that is not operating in good faith. If a broker is unwilling to disclose pertinent information about its operations and management, it is a warning sign that traders should heed. Therefore, the question remains: Is Starek safe for trading? The evidence suggests otherwise.

Trading Conditions Analysis

When evaluating a broker, it is essential to scrutinize the trading conditions it offers. Starek presents itself as providing attractive trading conditions, including high leverage and low spreads. However, the overall fee structure is unclear, which is concerning. A broker that does not transparently disclose its fees may have hidden charges that can significantly impact a trader's profitability.

| Fee Type | Starek | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 0.5 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The potential for hidden fees is a common tactic used by fraudulent brokers to extract more money from traders. Additionally, reports have surfaced regarding Starek's practices of imposing unreasonable fees for withdrawals and account management, which could further indicate that it operates more like a scam than a legitimate broker. As such, traders should approach Starek with caution and consider whether the trading conditions align with their expectations.

Customer Funds Security

Another vital aspect of any broker's credibility is the security of customer funds. Starek's lack of regulation raises serious questions about its measures for safeguarding client deposits. A reputable broker typically employs stringent security protocols, including segregated accounts and negative balance protection, to ensure that client funds are secure.

Unfortunately, Starek does not appear to offer these protections. The absence of segregated accounts means that client funds may not be kept separate from the broker's operational funds, increasing the risk of loss in the event of financial difficulties. Furthermore, the lack of negative balance protection could leave traders exposed to significant losses beyond their initial investment. Given these factors, it is reasonable to question Is Starek safe for trading? The evidence suggests that it is not.

Customer Experience and Complaints

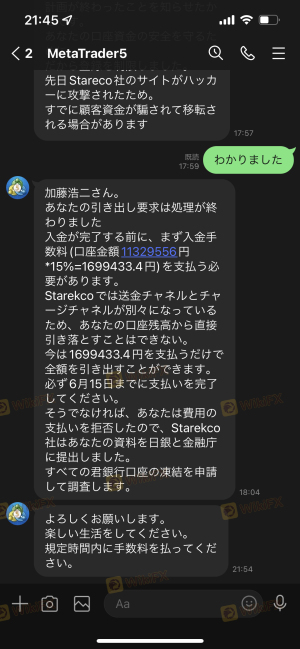

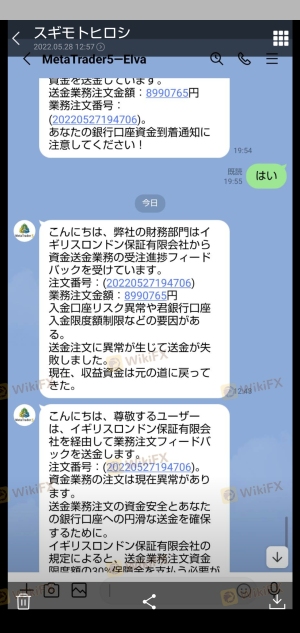

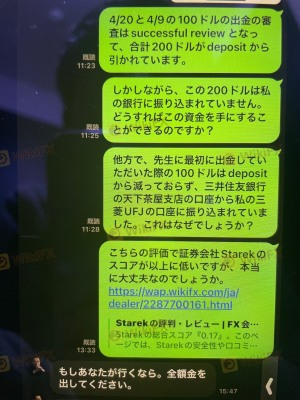

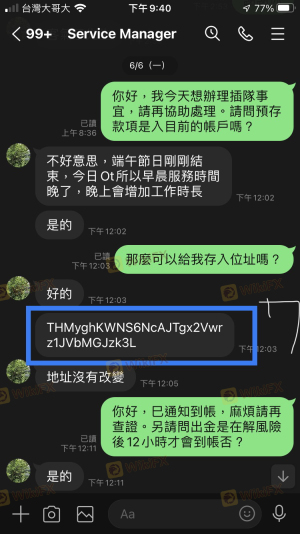

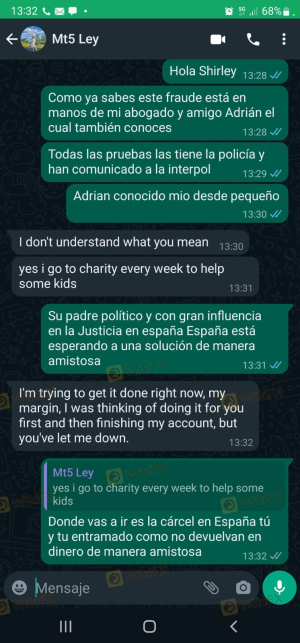

Customer feedback is a crucial indicator of a broker's reliability. Starek has received numerous complaints from users, primarily focusing on withdrawal issues and poor customer service. Many traders have reported being unable to withdraw their funds, which is often a hallmark of a scam broker.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Freezing | High | Poor |

One notable case involved a trader who reported that their account was frozen without justification, and they were subsequently asked to pay additional fees to access their funds. Such complaints are alarming and indicate that Starek may not be operating with the best interests of its clients in mind. The recurring nature of these complaints raises significant concerns about the broker's practices and whether it can be trusted.

Platform and Execution

The trading platform offered by Starek is MetaTrader 5 (MT5), a widely recognized platform in the industry. While MT5 is known for its robust features and capabilities, the overall user experience can be compromised by the broker's execution quality. Reports of slippage and order rejections have surfaced, suggesting that Starek may not provide a fair trading environment.

Traders should be cautious about platforms that exhibit signs of manipulation or poor execution, as these can severely impact trading outcomes. Given the concerns surrounding Starek's operational practices, it is essential to consider whether trading on this platform is worth the risk.

Risk Assessment

Engaging with Starek comes with inherent risks that potential traders should carefully evaluate. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation, increasing vulnerability to scams. |

| Financial Security Risk | High | Lack of segregated accounts and negative balance protection. |

| Customer Service Risk | High | Numerous complaints regarding withdrawal issues and poor response times. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with any broker, particularly those with dubious backgrounds like Starek. Utilizing well-regulated brokers with transparent practices is essential for safeguarding investments.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that Starek is not a safe trading platform. The lack of regulation, poor customer feedback, and questionable trading practices raise significant concerns about its legitimacy. For traders seeking a reliable forex broker, it is crucial to prioritize safety and transparency.

If you are considering trading in the forex market, it is advisable to opt for well-regulated brokers that offer robust investor protections and transparent trading conditions. Some alternatives to consider include established brokers that are regulated by reputable authorities, ensuring that your investments are safeguarded. Ultimately, the question of Is Starek safe? can be answered with a resounding no; therefore, it is prudent to avoid this broker altogether.

Is Starek a scam, or is it legit?

The latest exposure and evaluation content of Starek brokers.

Starek Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Starek latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.