Starek 2025 Review: Everything You Need to Know

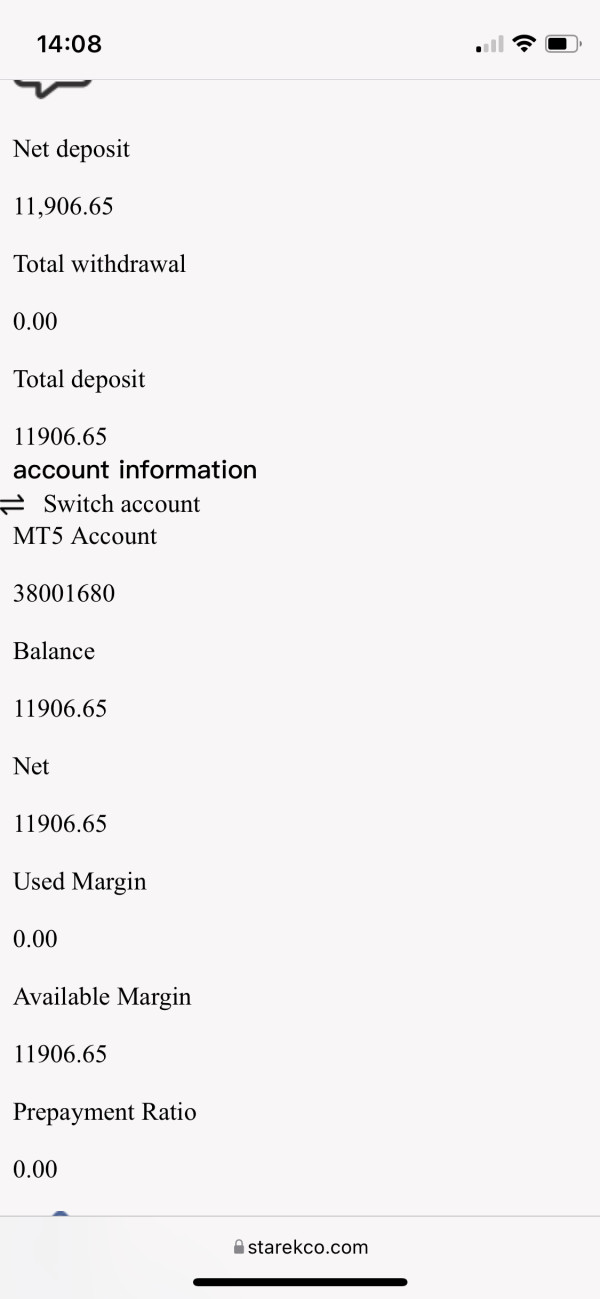

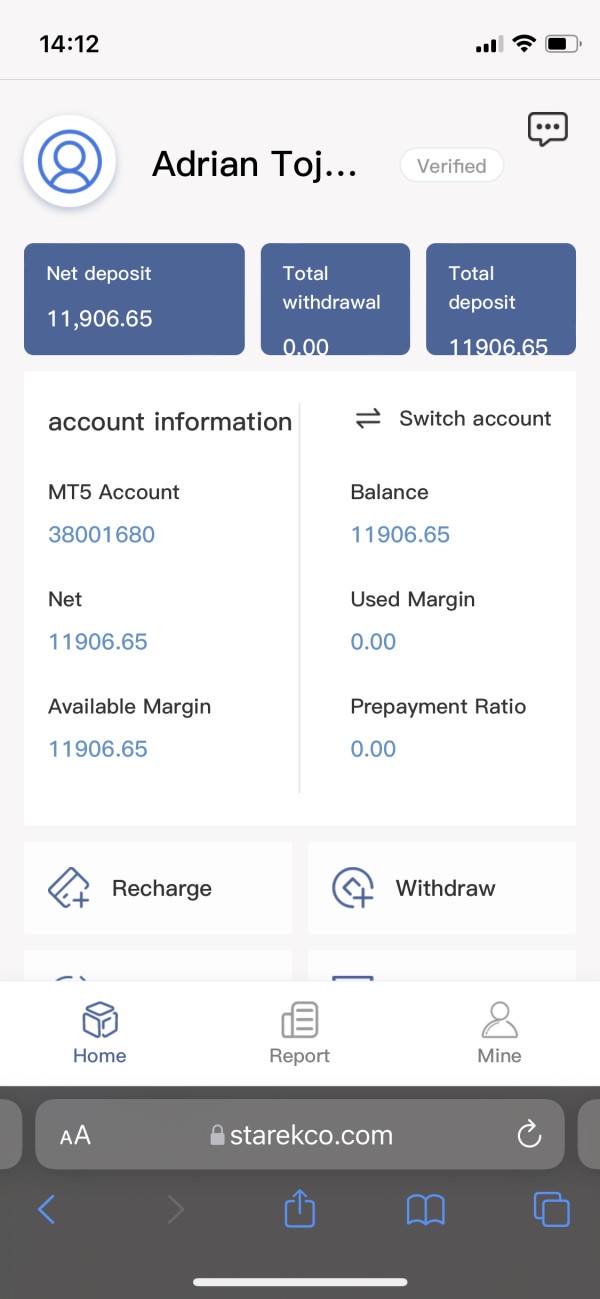

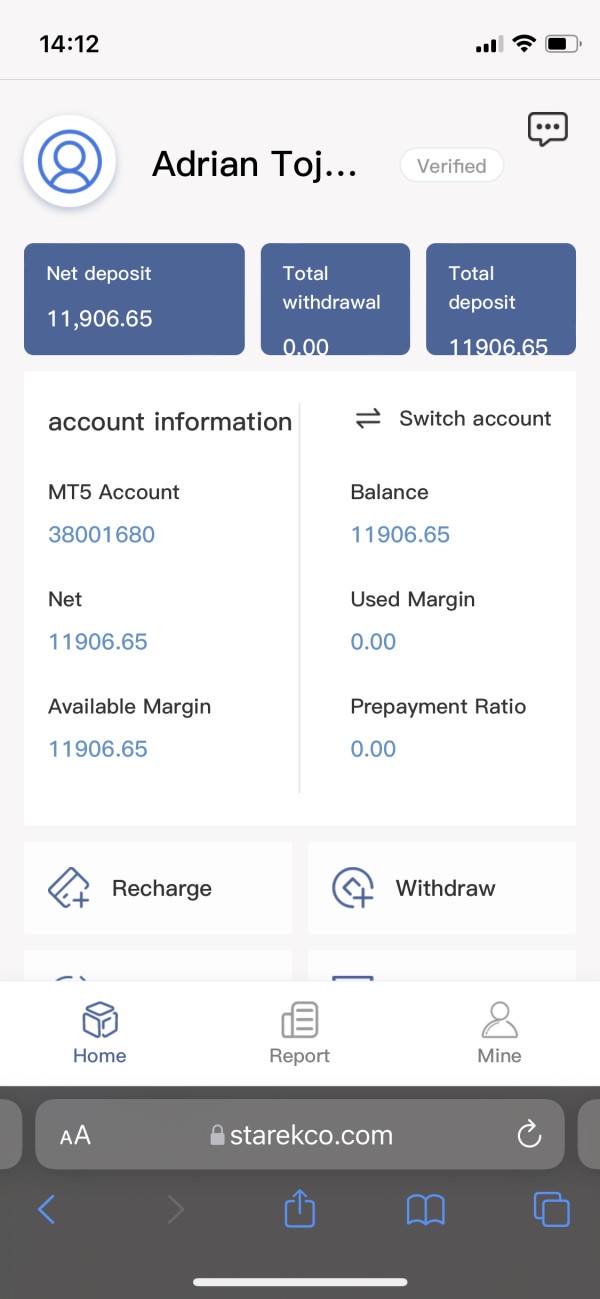

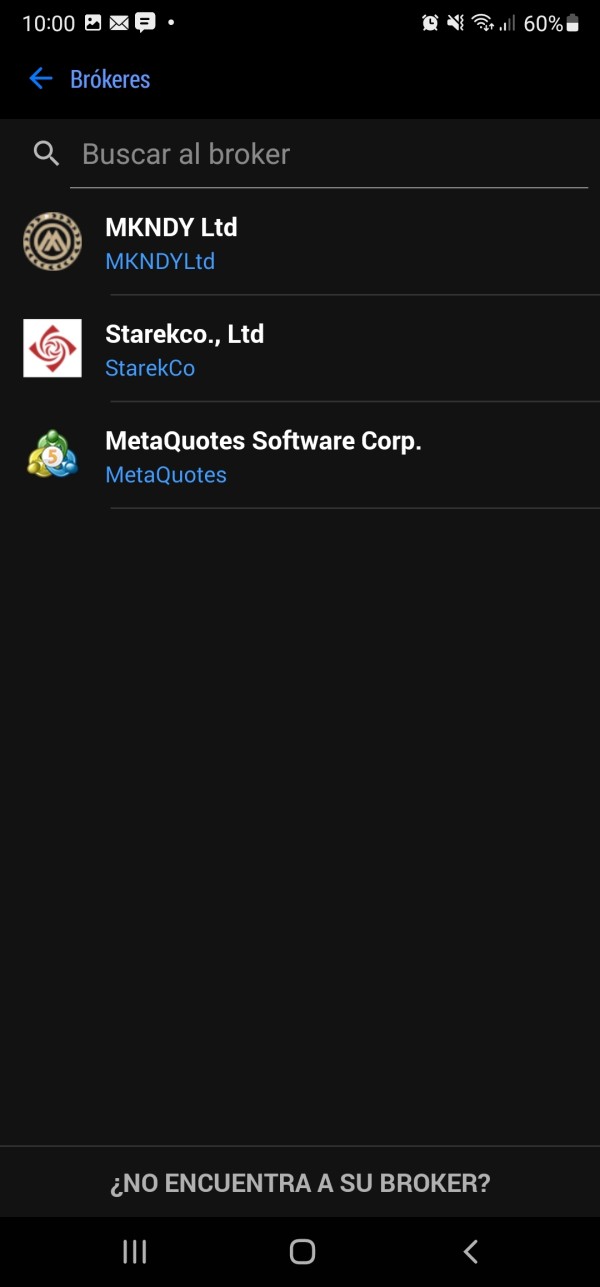

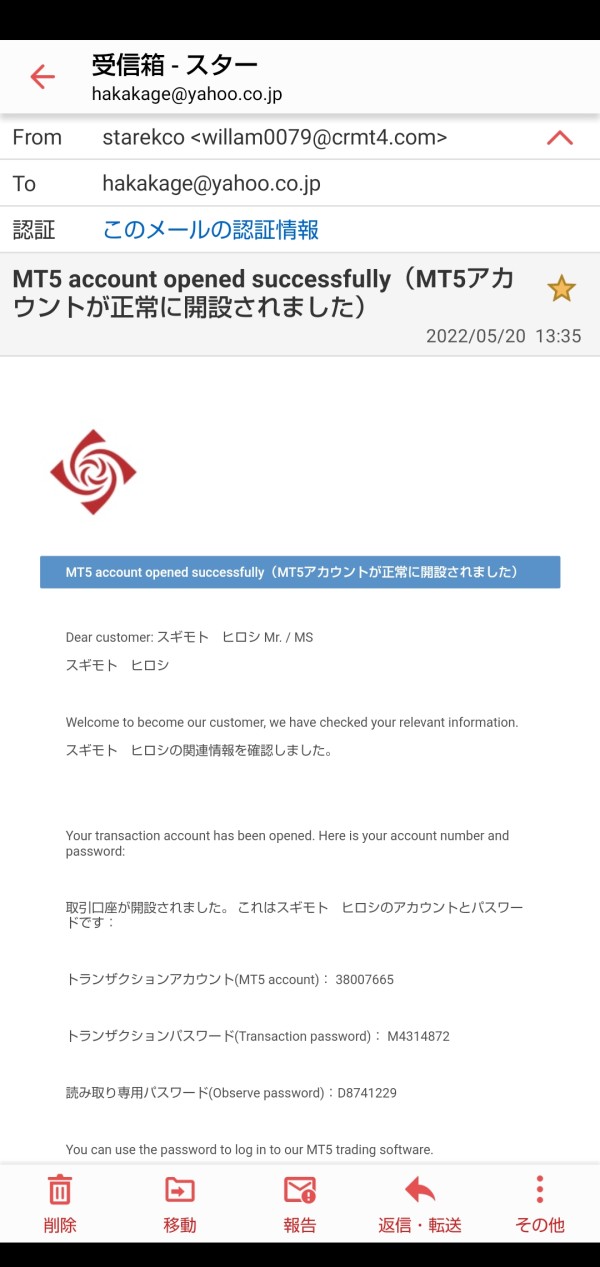

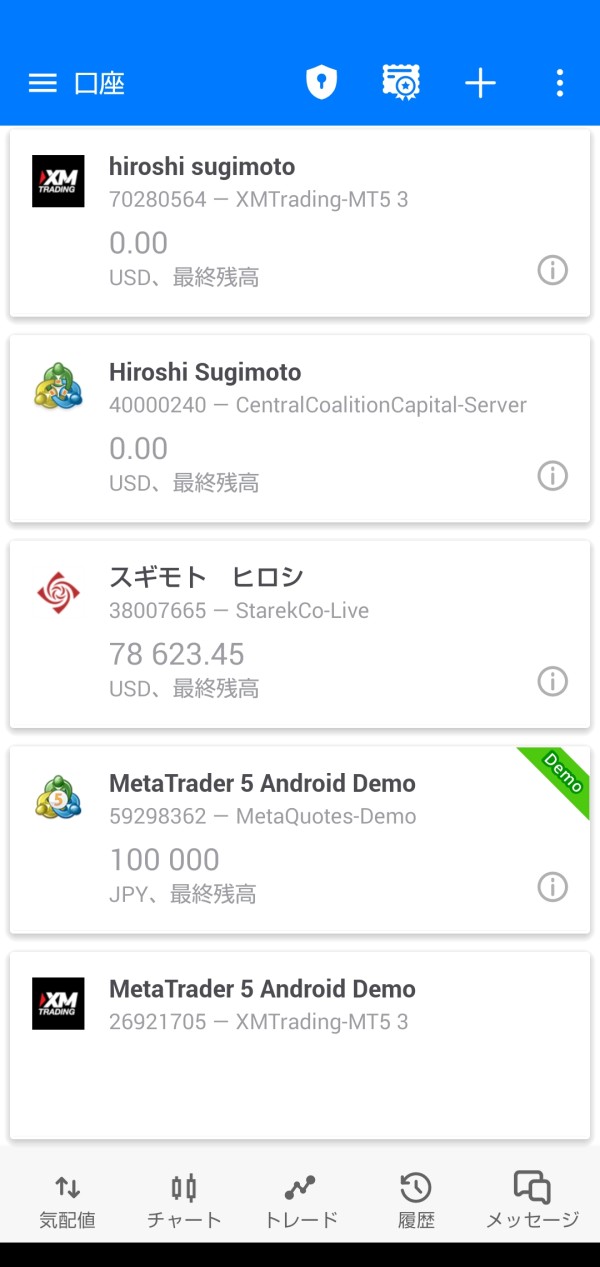

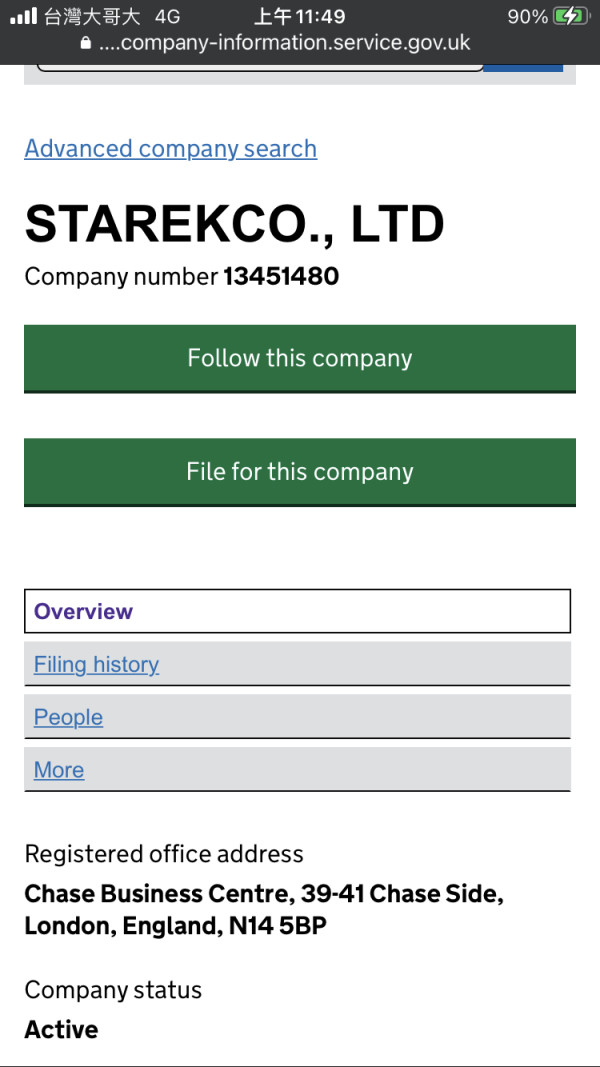

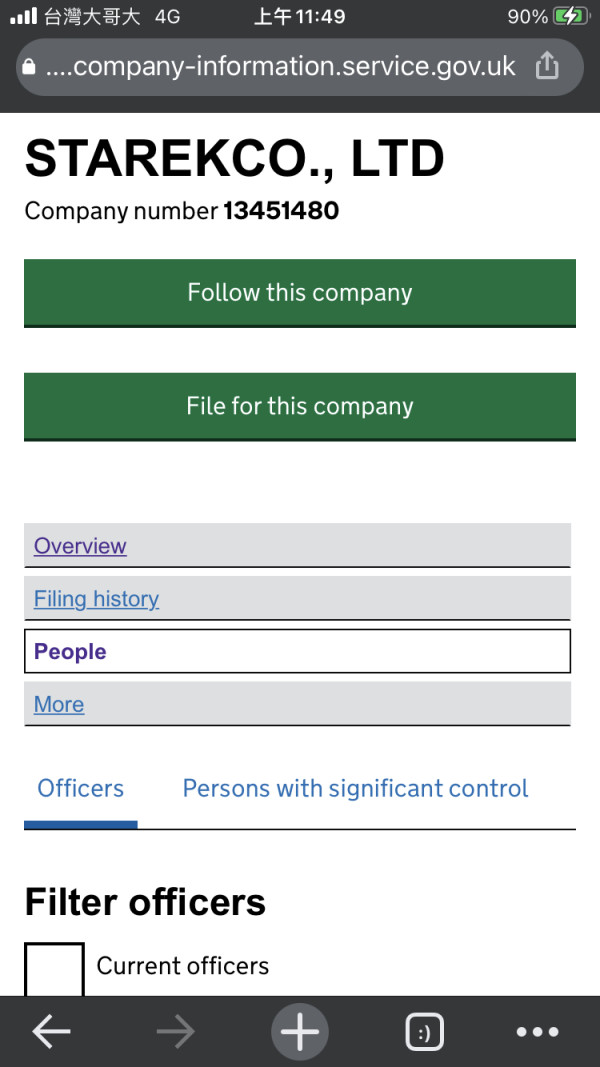

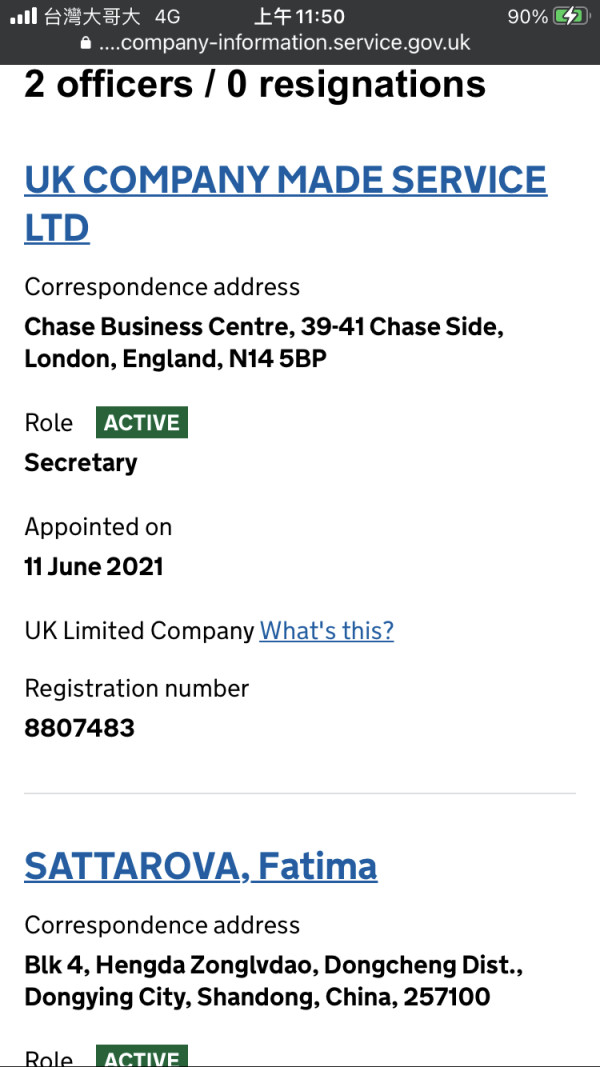

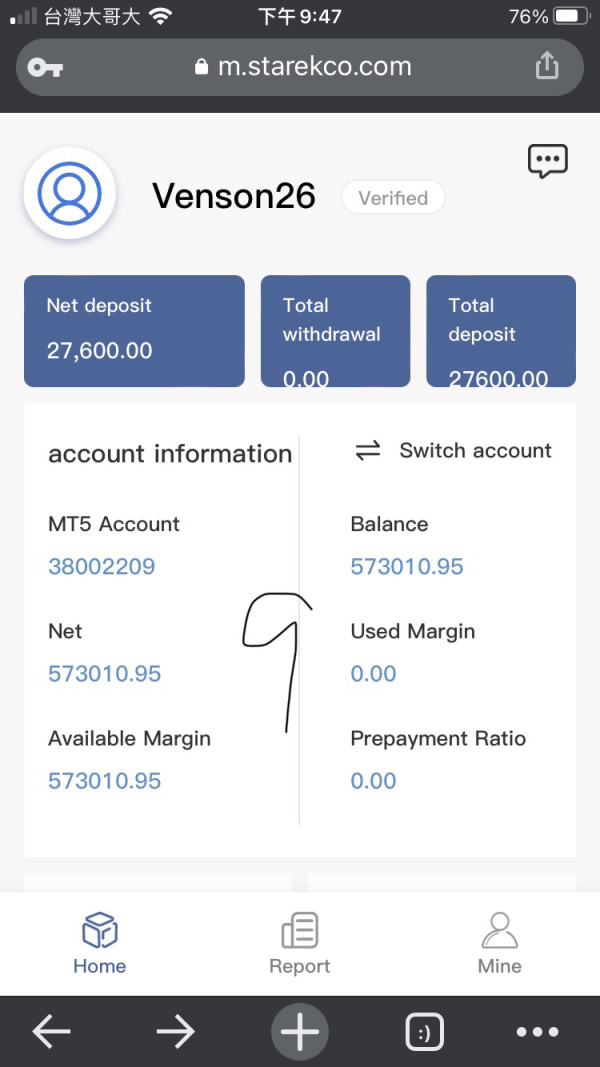

Starek, a forex broker that claims to operate from the UK, has garnered significant attention for its questionable practices and lack of regulatory oversight. The reviews indicate a predominantly negative sentiment, highlighting serious concerns regarding user safety, withdrawal issues, and the broker's legitimacy. Notably, Starek offers the widely-used MetaTrader 5 platform, but this does little to alleviate the concerns surrounding its operations.

Note: It is crucial for potential investors to be aware that Starek operates under various entities across different jurisdictions, which complicates the regulatory landscape. This review is based on a comprehensive analysis of multiple sources to ensure fairness and accuracy.

Ratings Overview

We rate brokers based on user feedback, regulatory status, and the overall trading experience they provide.

Broker Overview

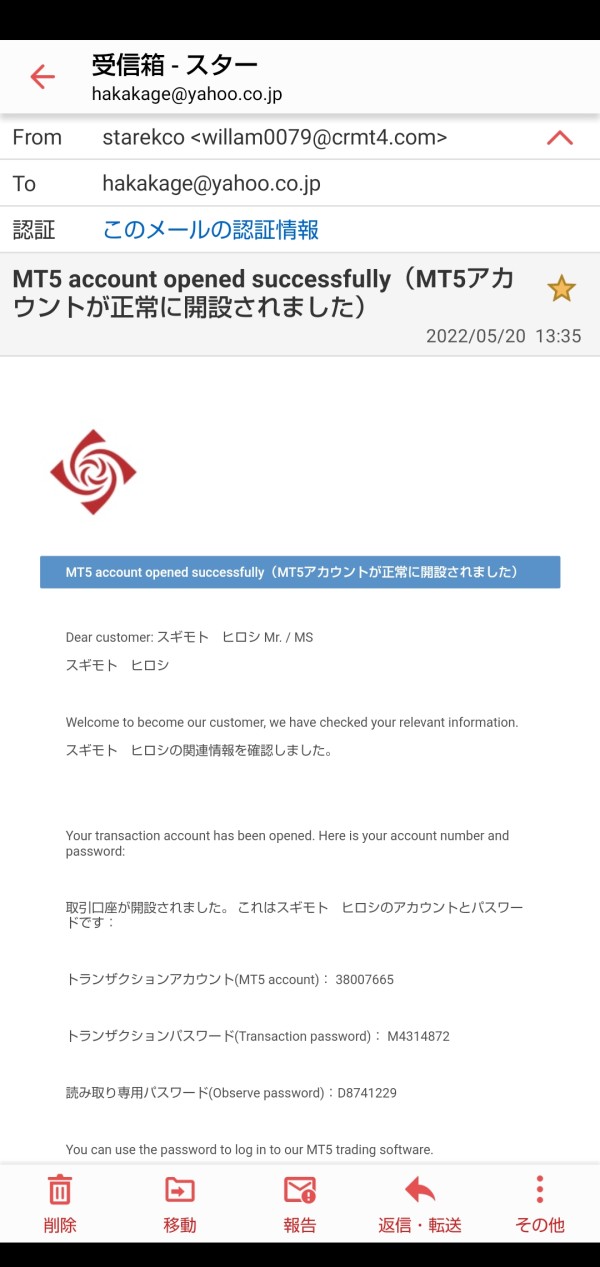

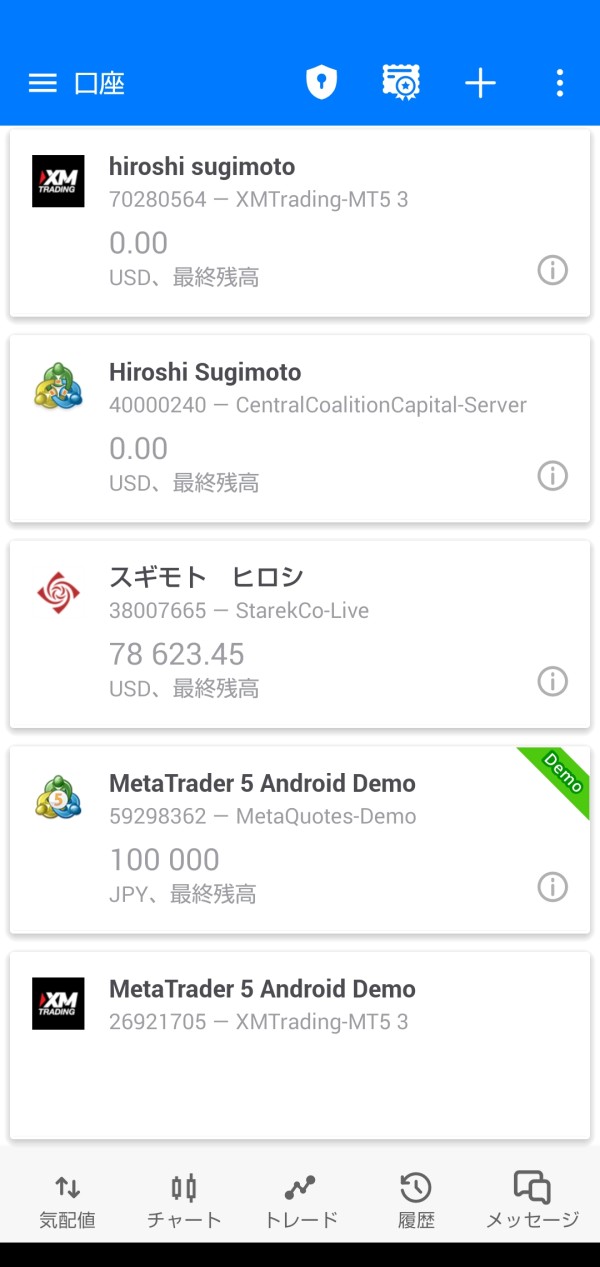

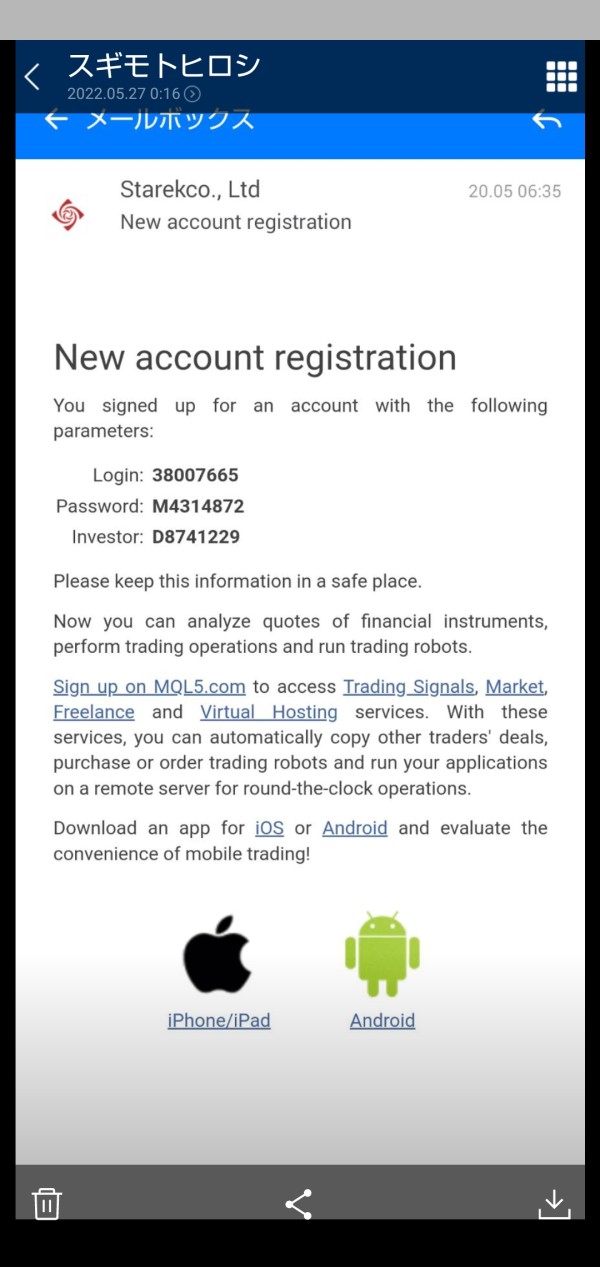

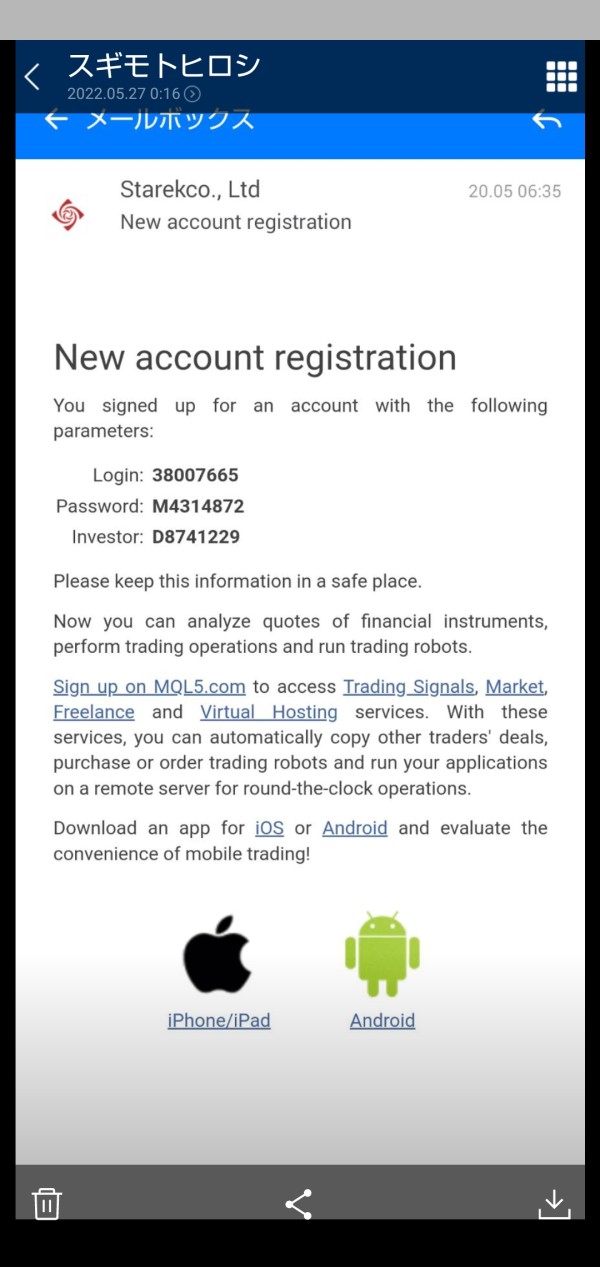

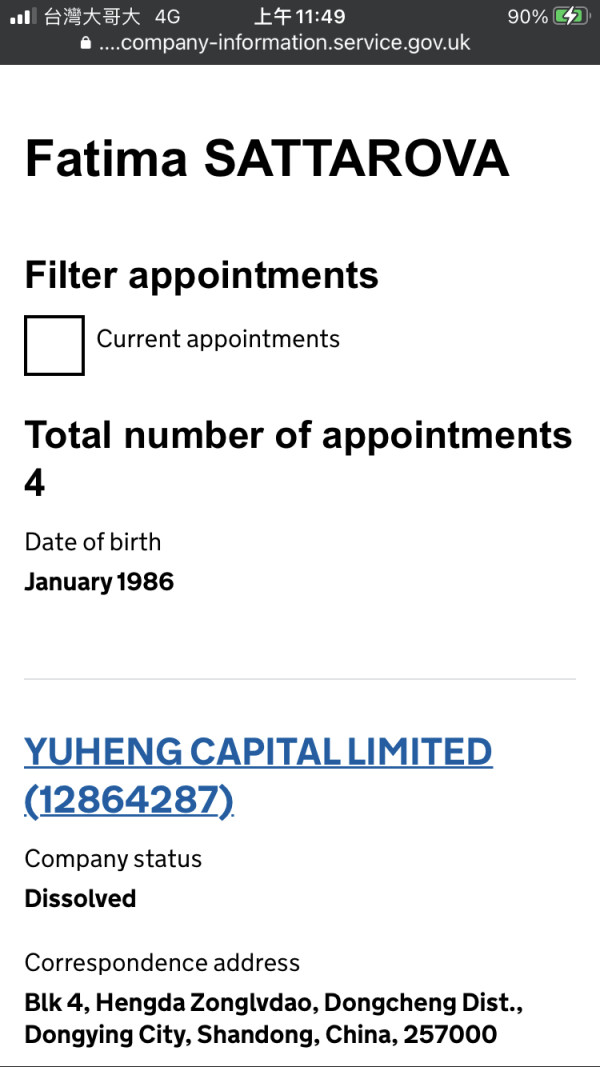

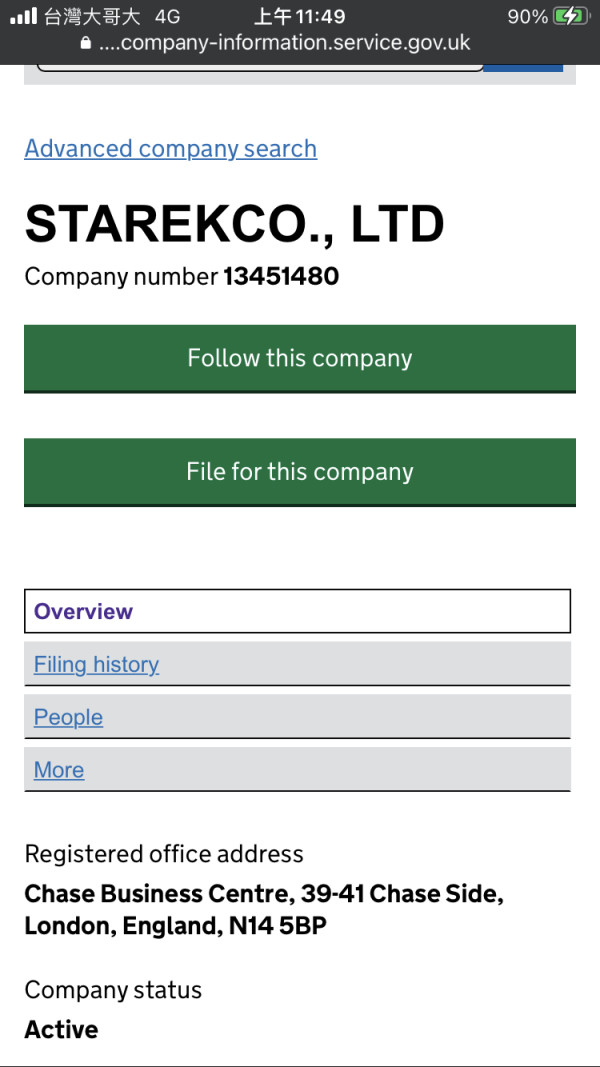

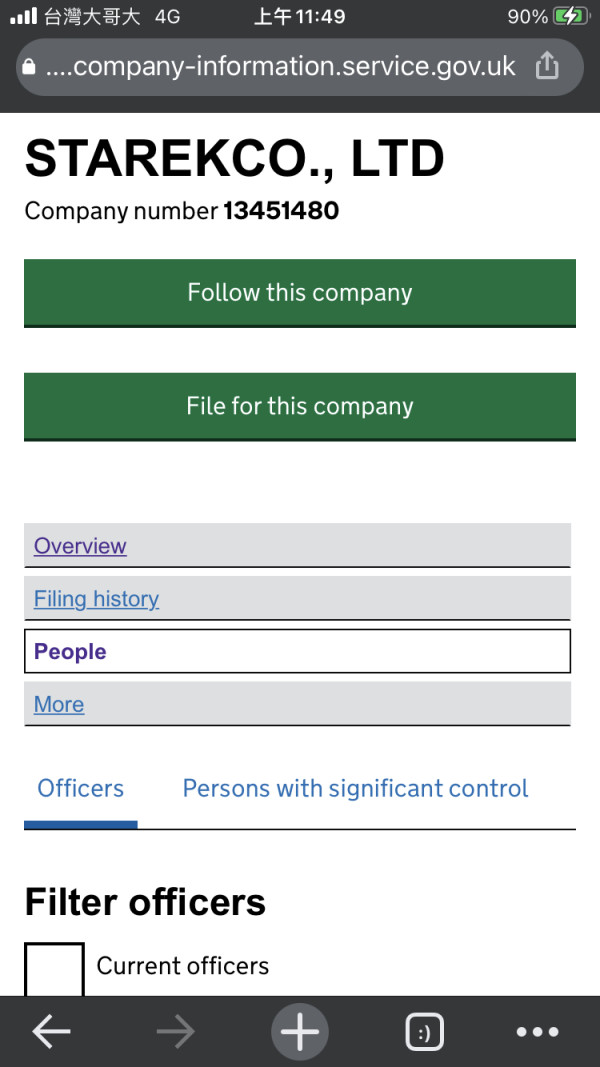

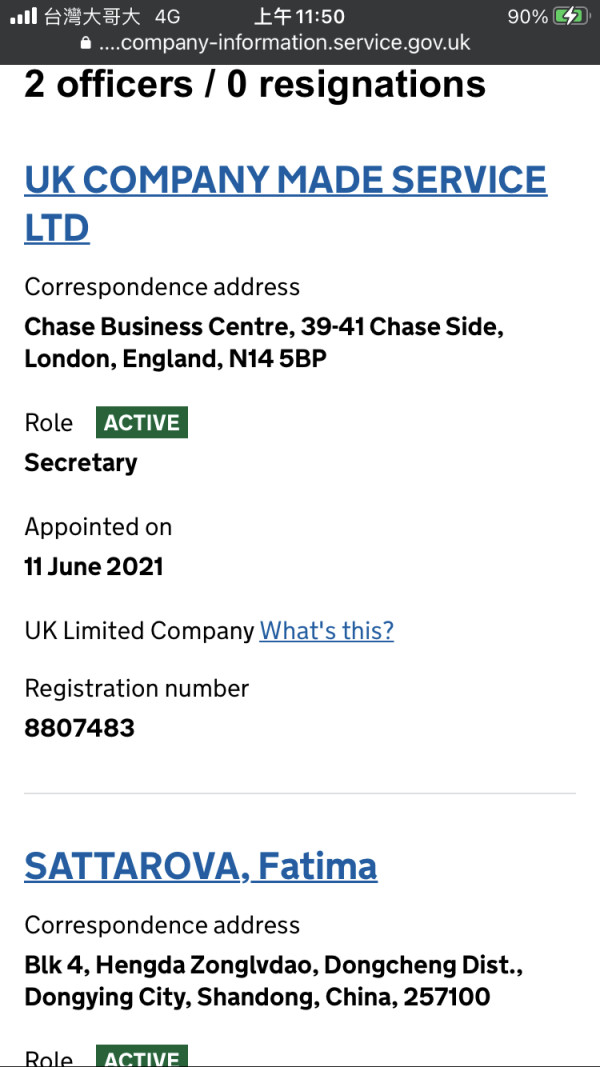

Founded in 2021, Starek presents itself as a multi-asset trading platform offering a variety of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies. Although it claims to operate from the UK, Starek lacks a valid license from the Financial Conduct Authority (FCA) and operates under a dubious regulatory status. The platform supports the MetaTrader 5 trading software, which is favored for its advanced features and user-friendly interface.

Detailed Analysis

Regulatory Regions:

Starek is marketed as a UK-based broker; however, there is no evidence of it being regulated by any recognized financial authority. A check with the FCA reveals no registration for Starek, indicating that it operates without the necessary oversight, which is a major red flag for potential users.

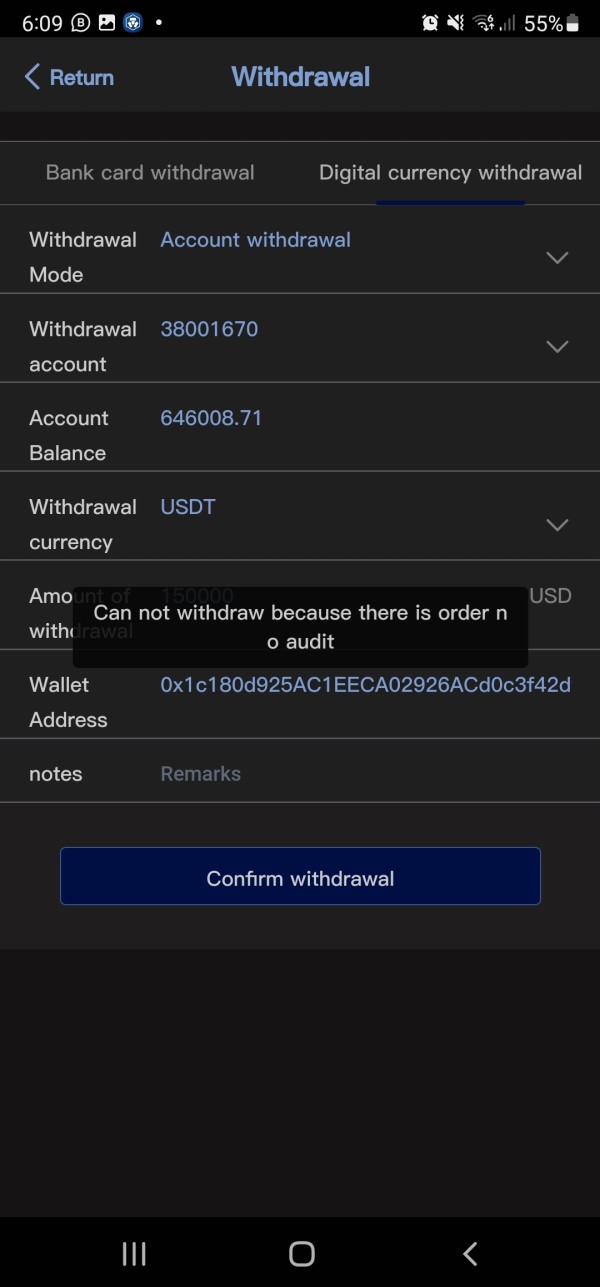

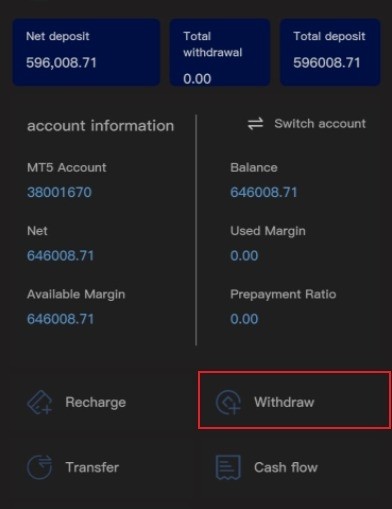

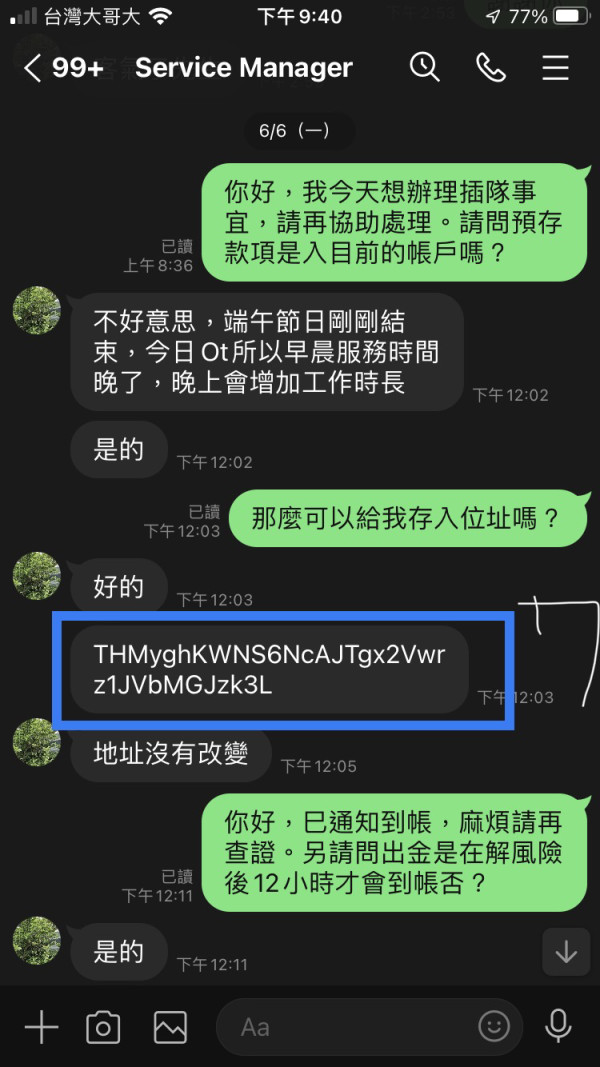

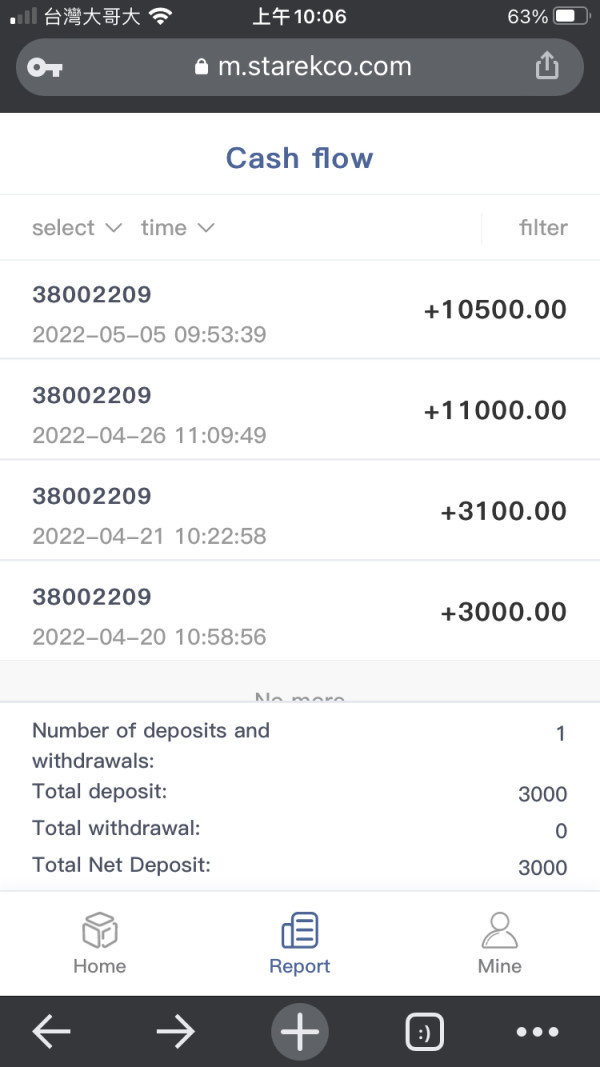

Deposit/Withdrawal Methods:

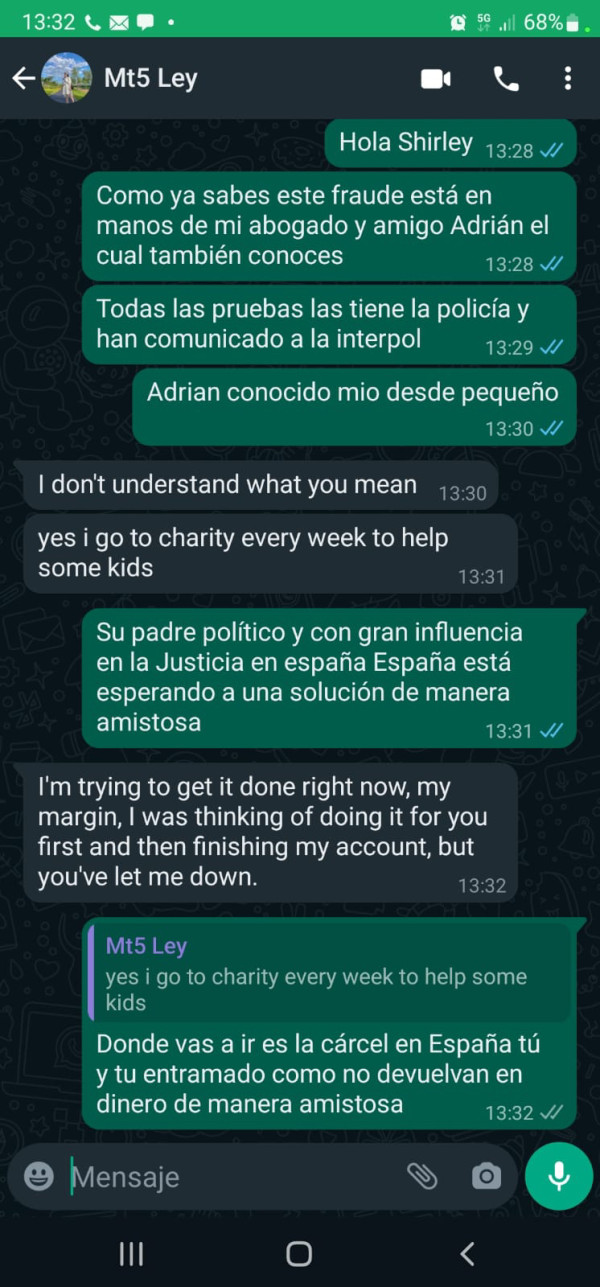

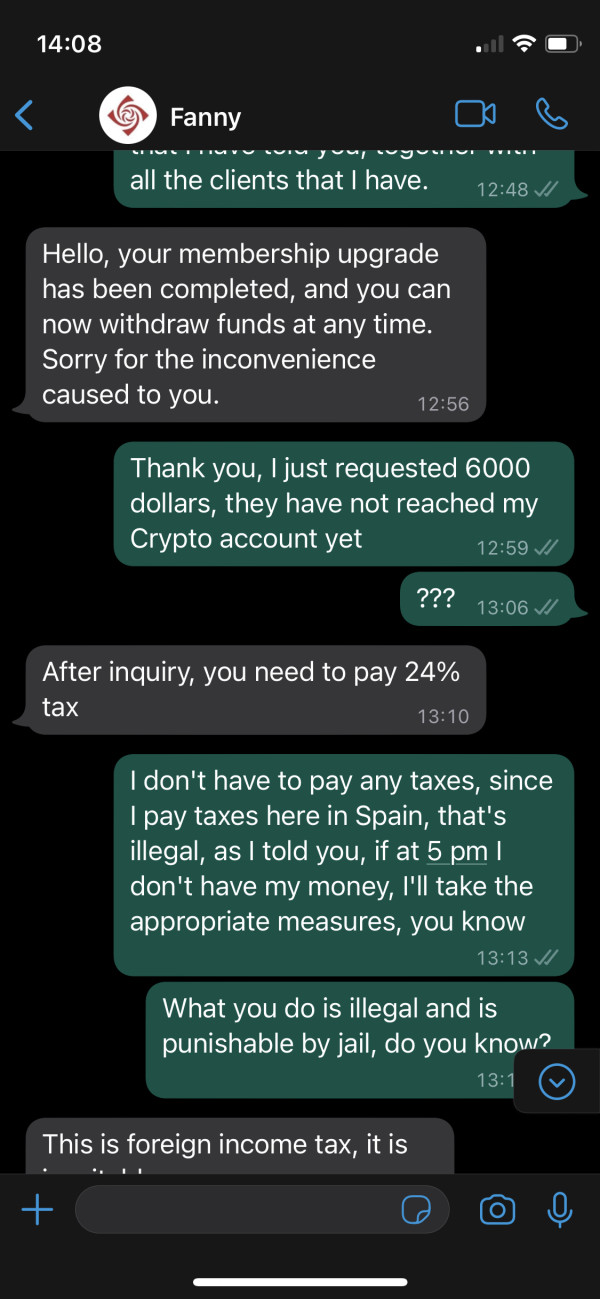

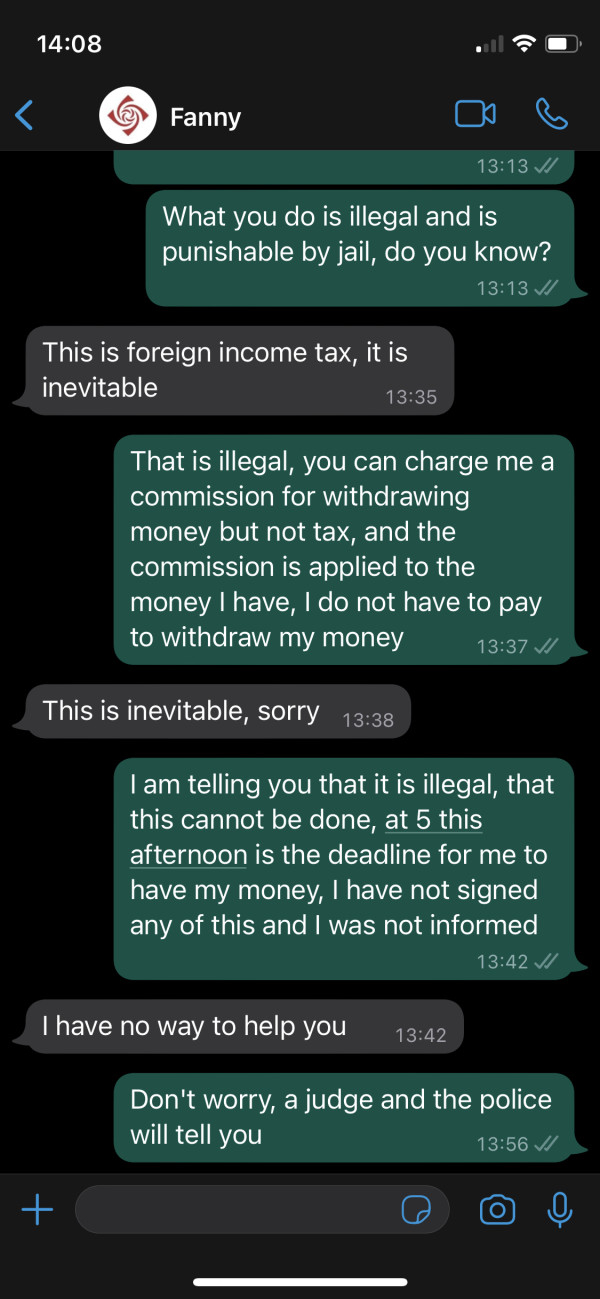

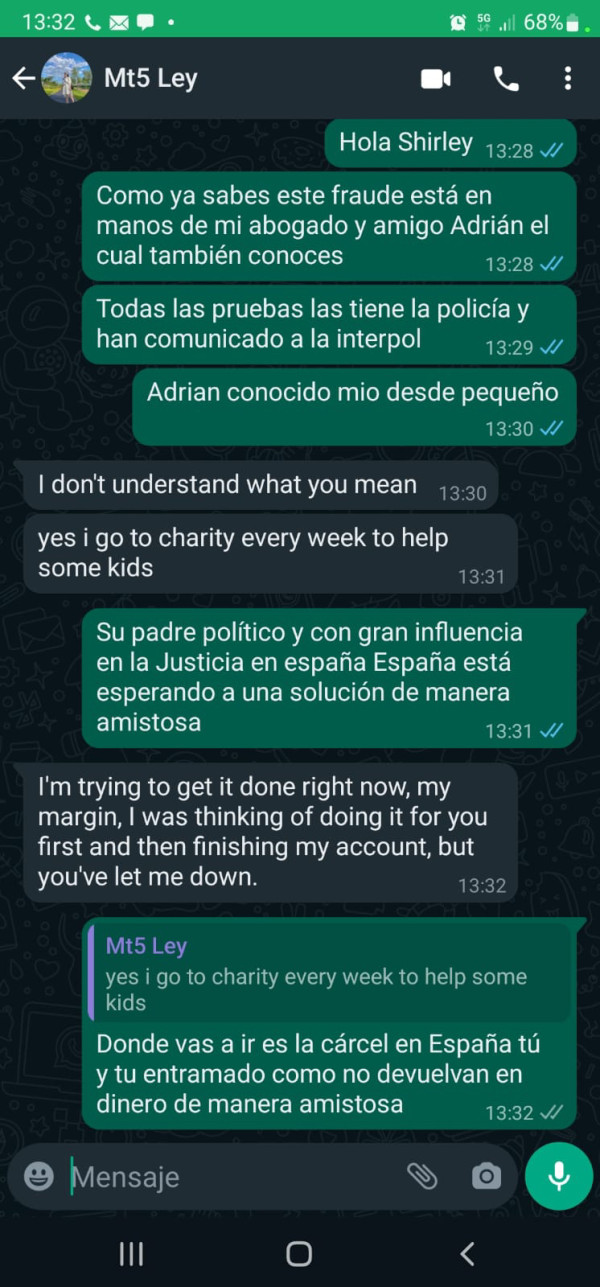

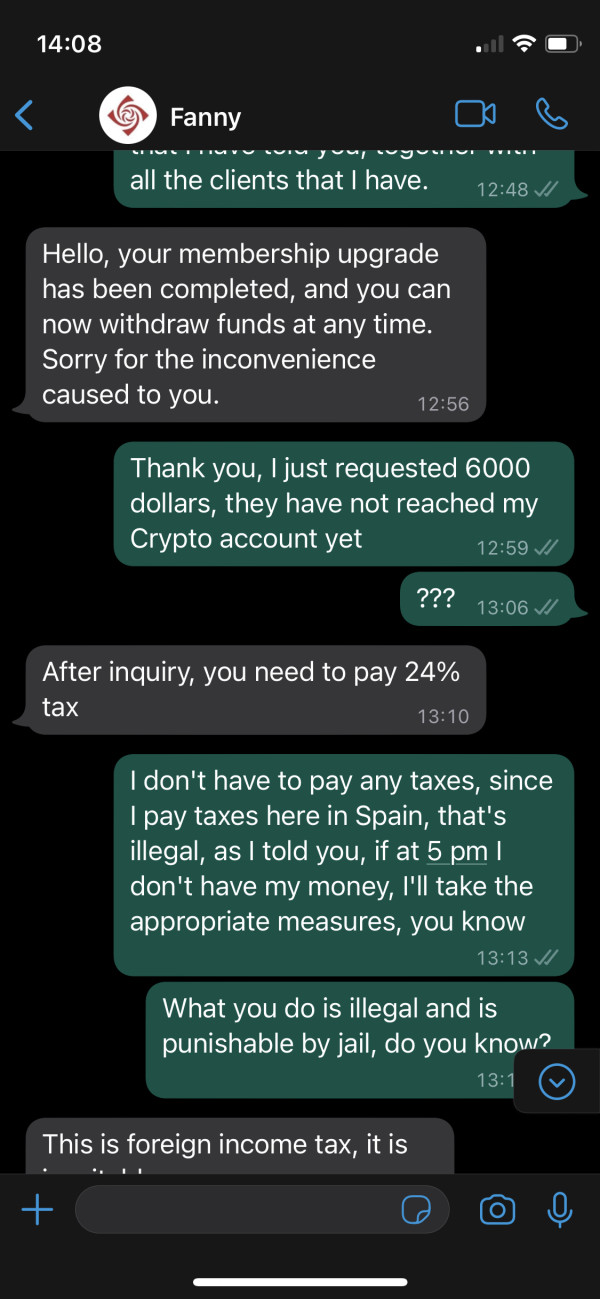

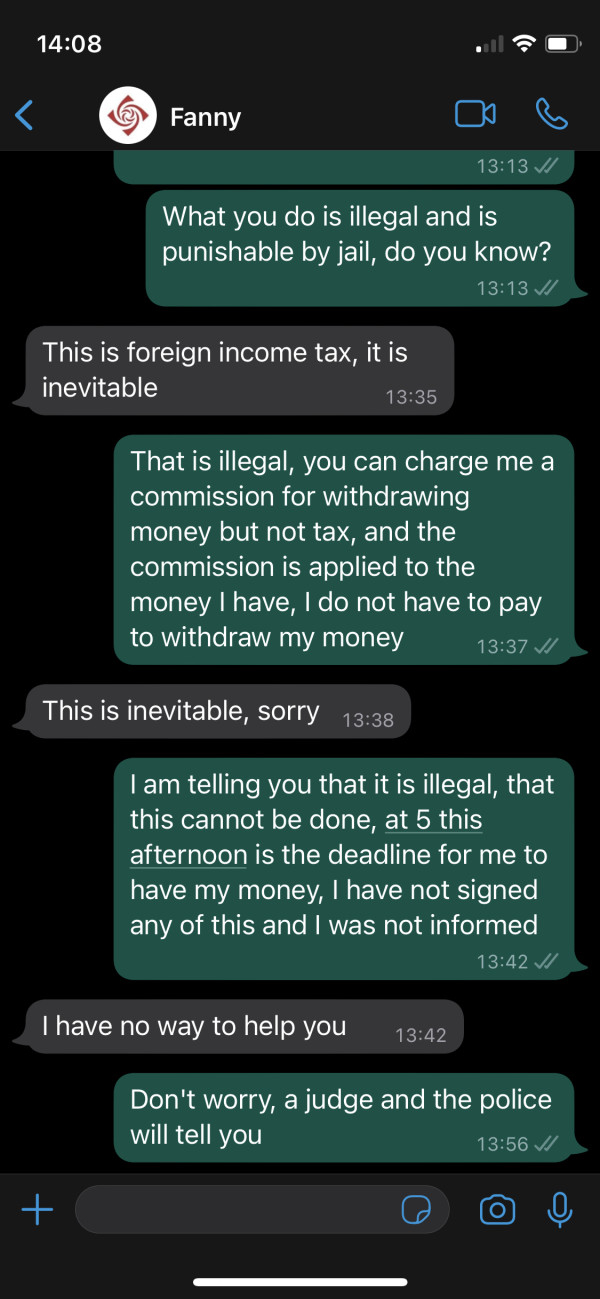

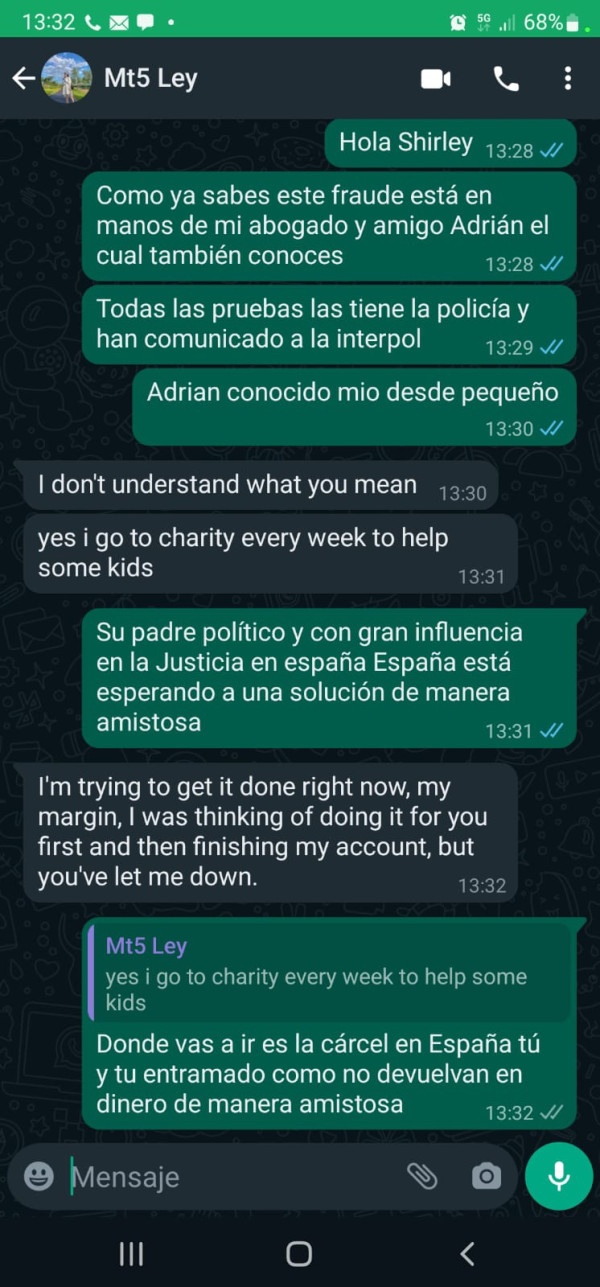

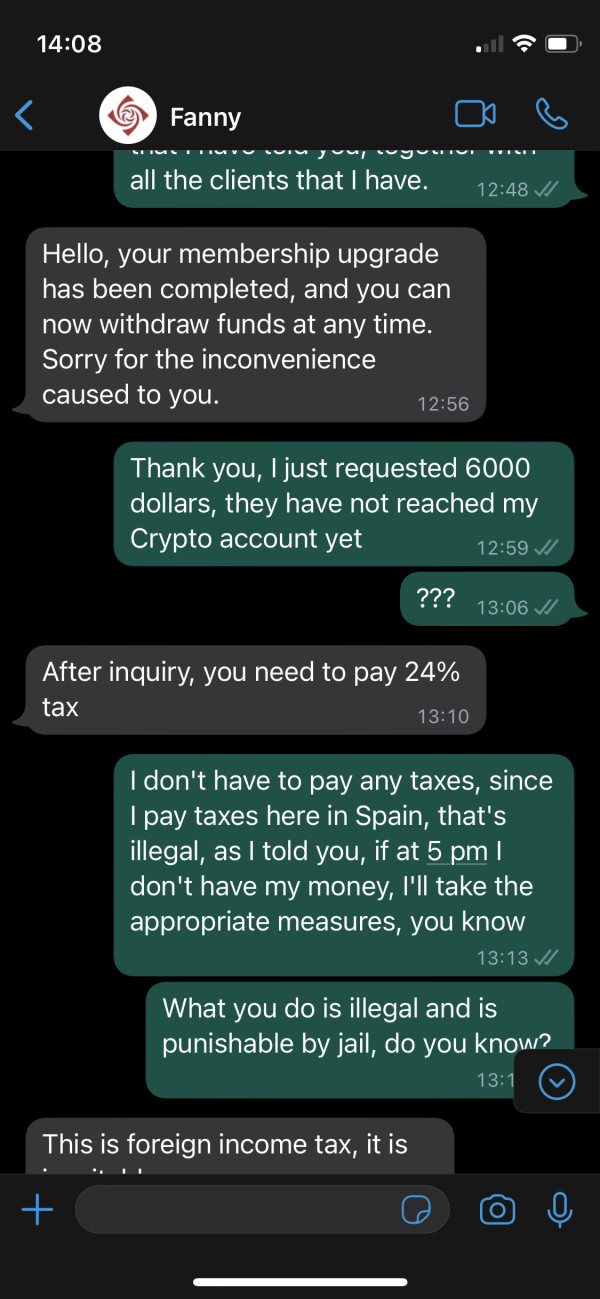

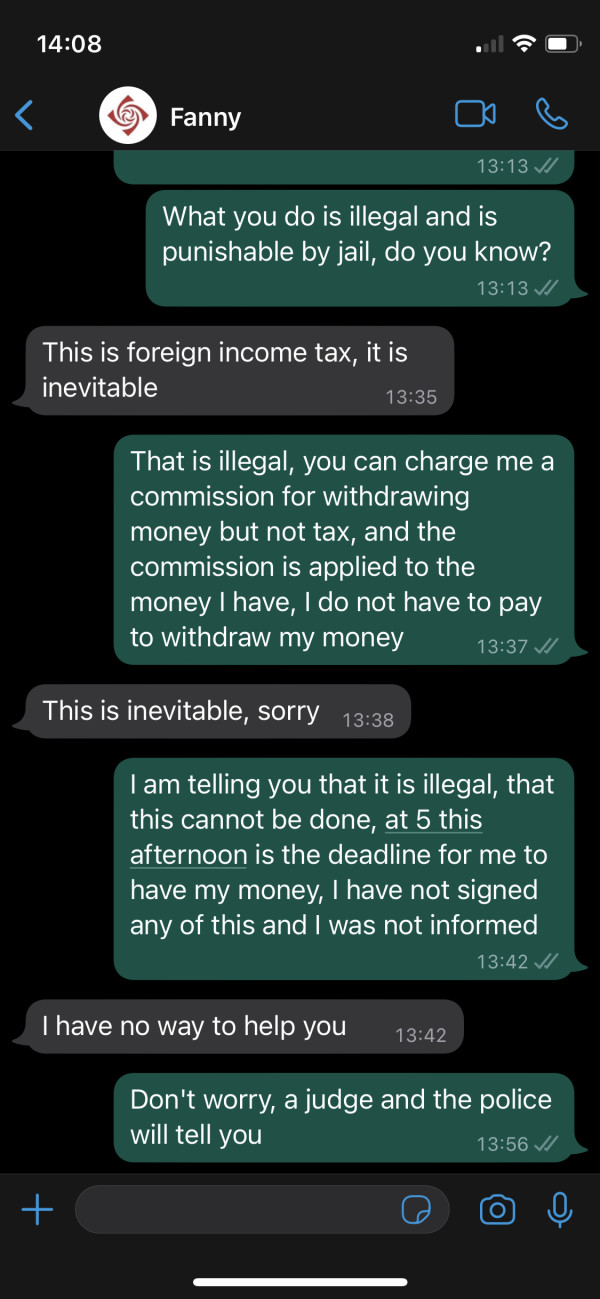

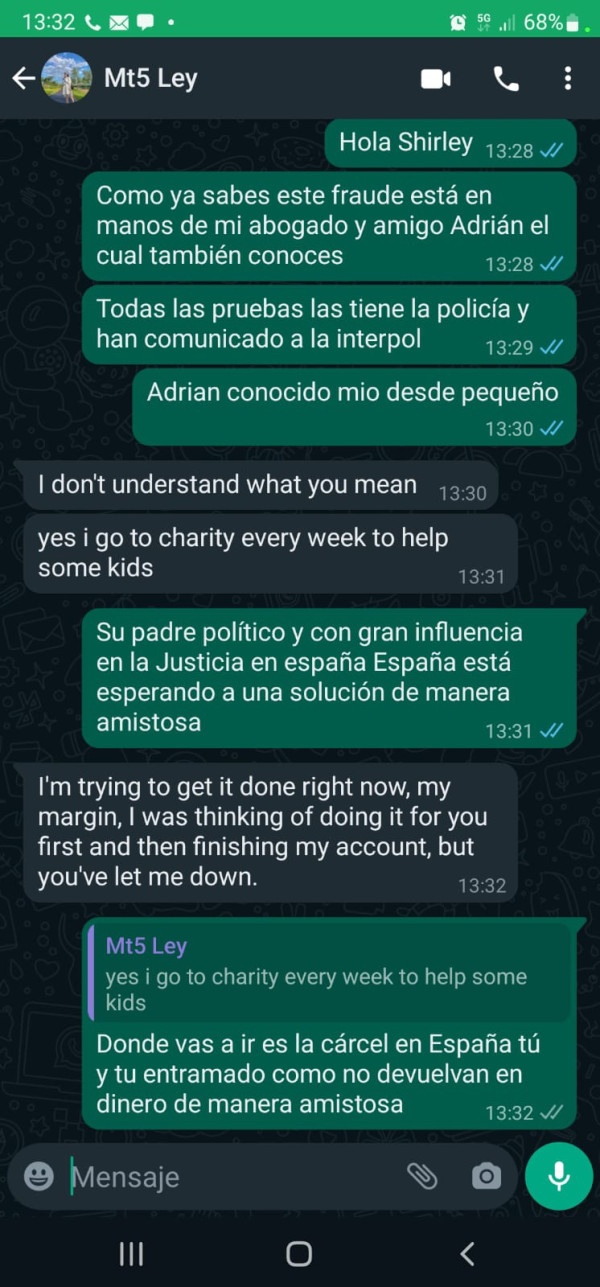

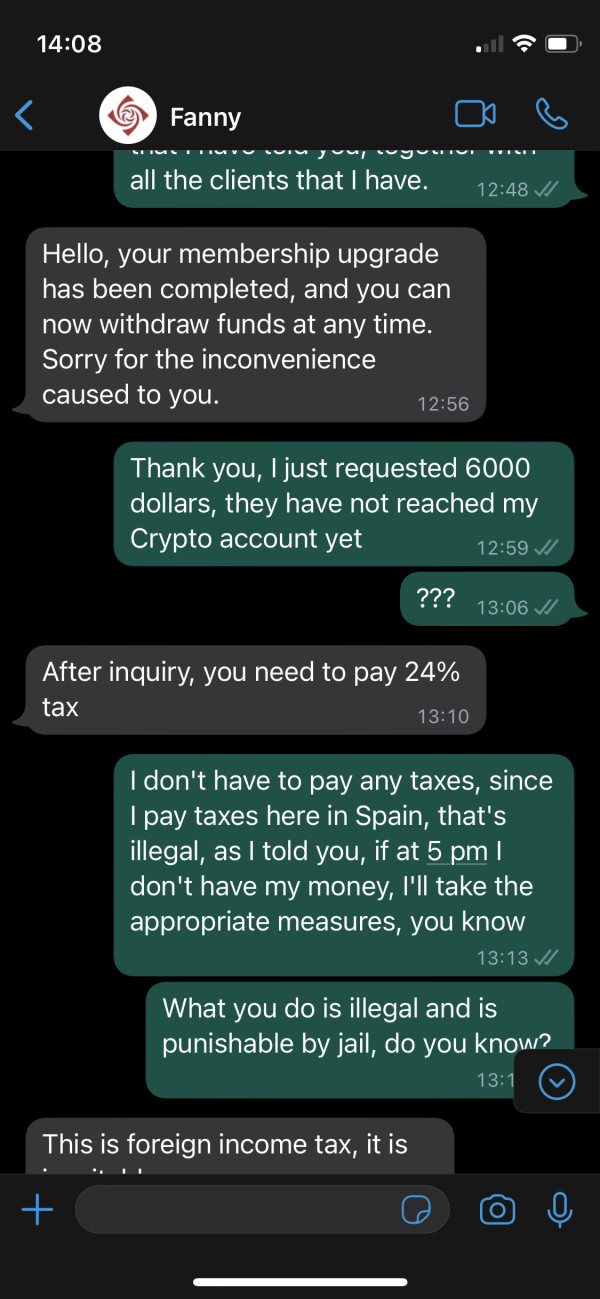

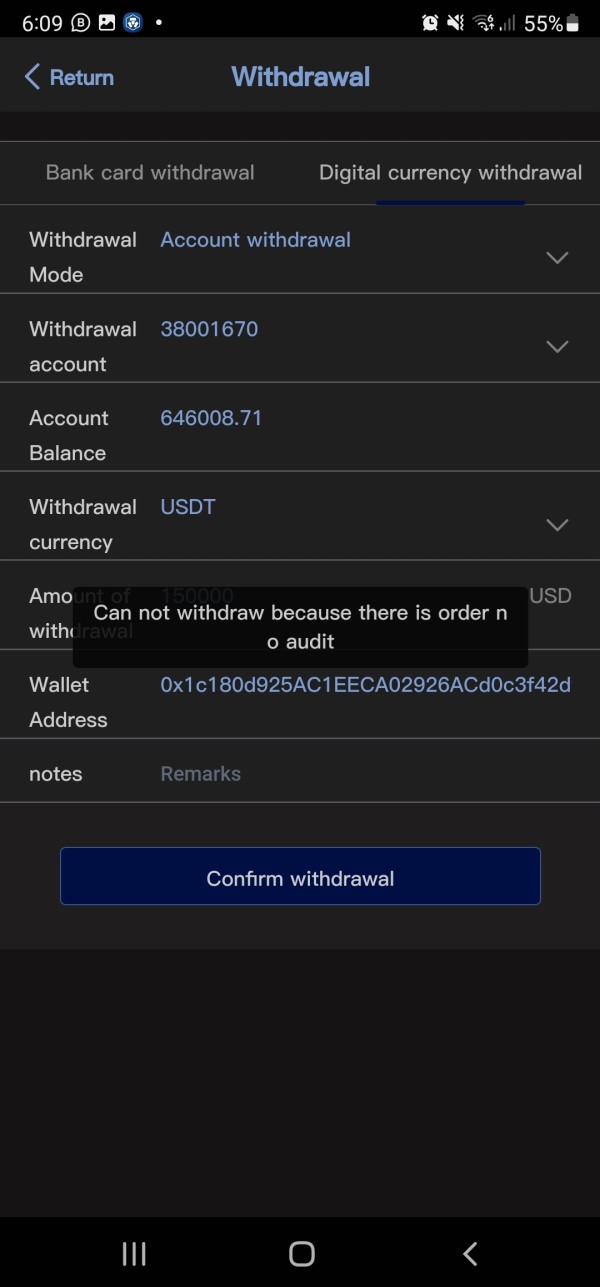

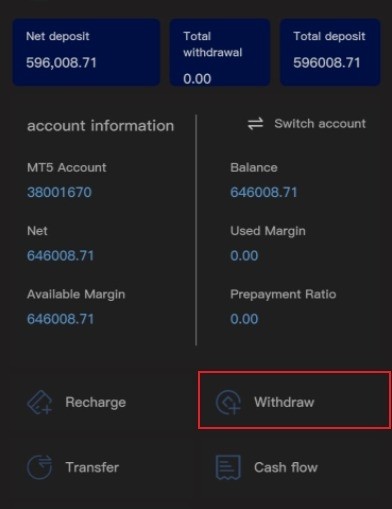

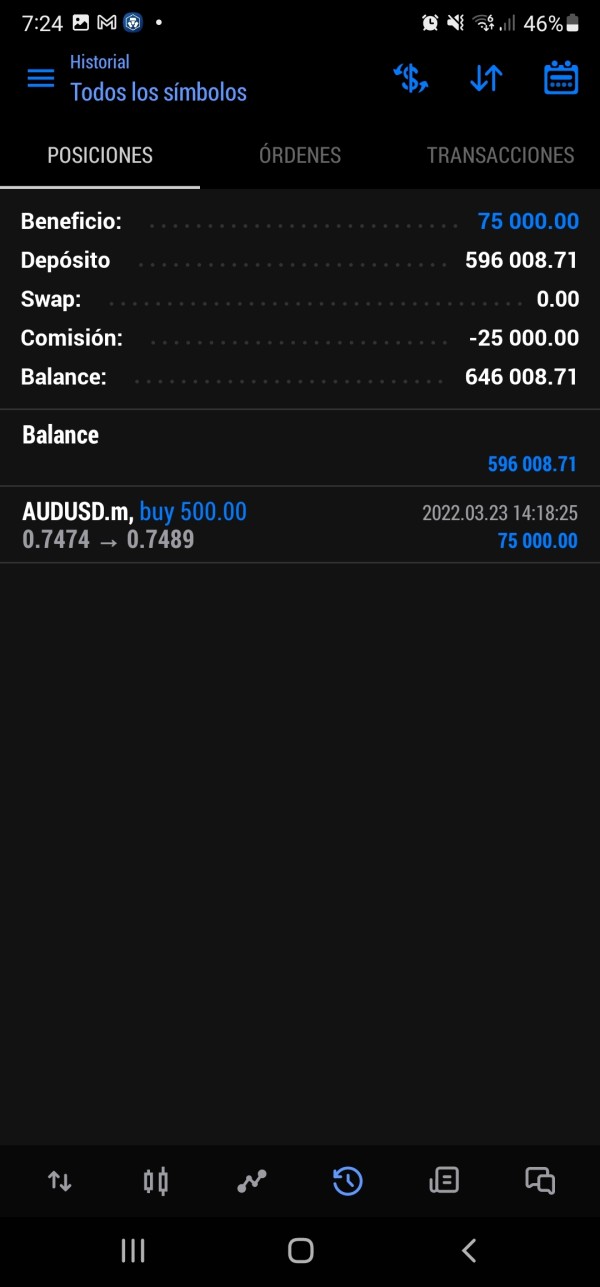

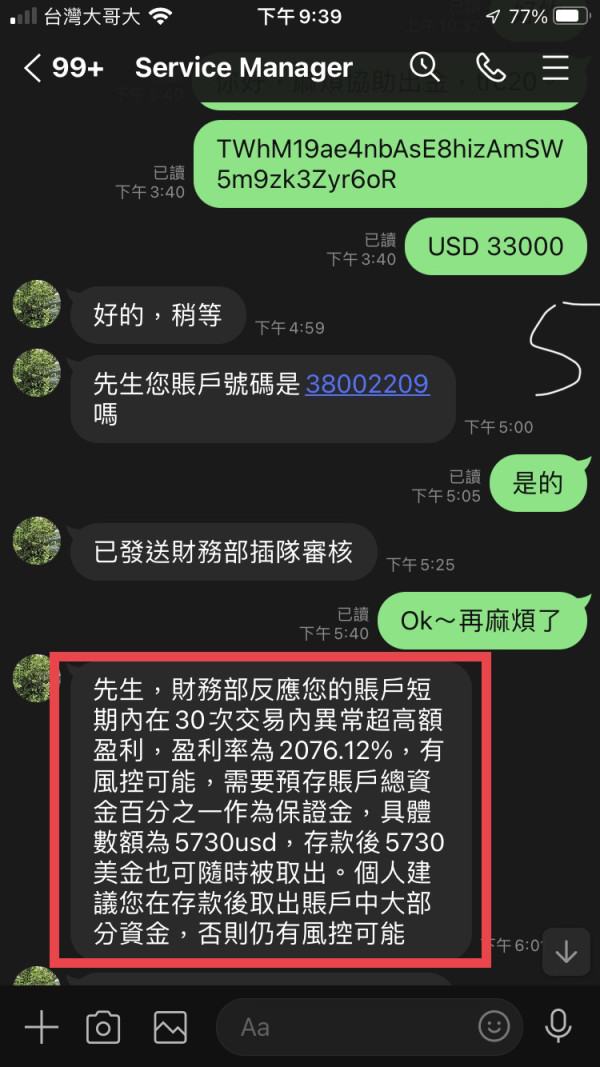

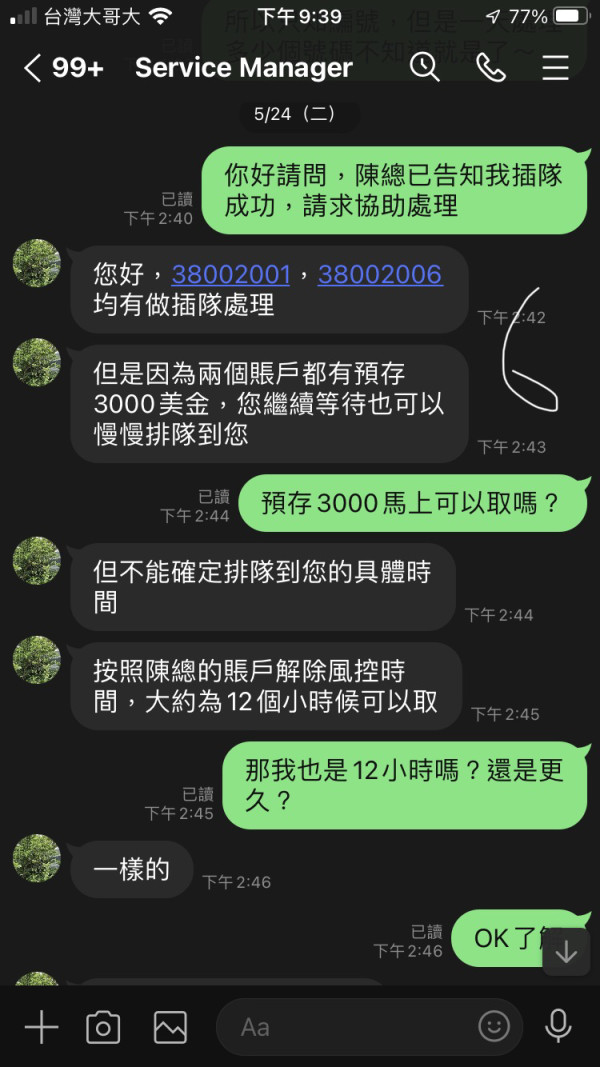

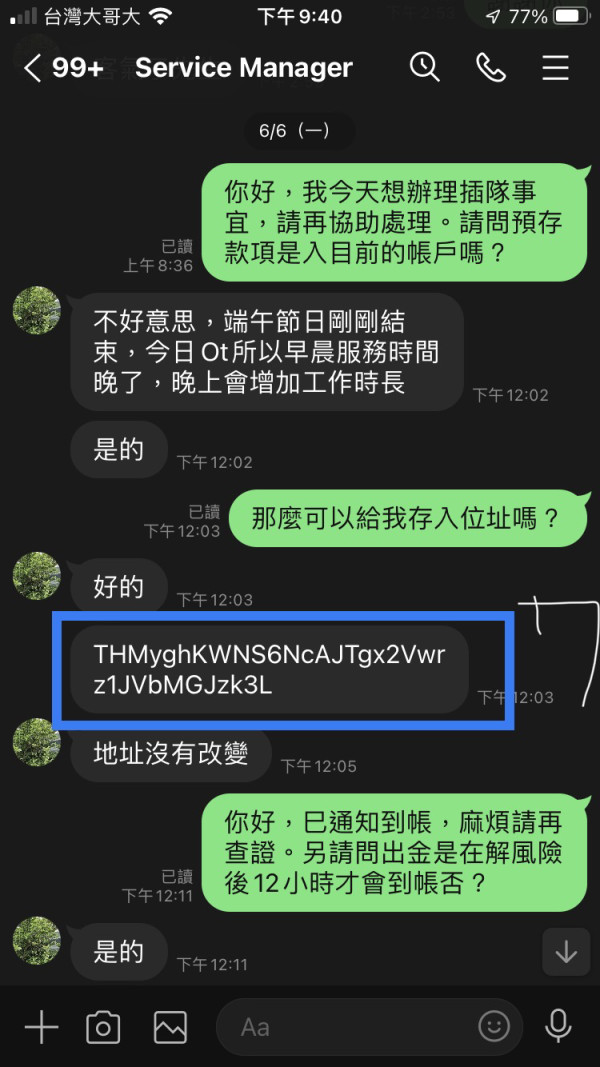

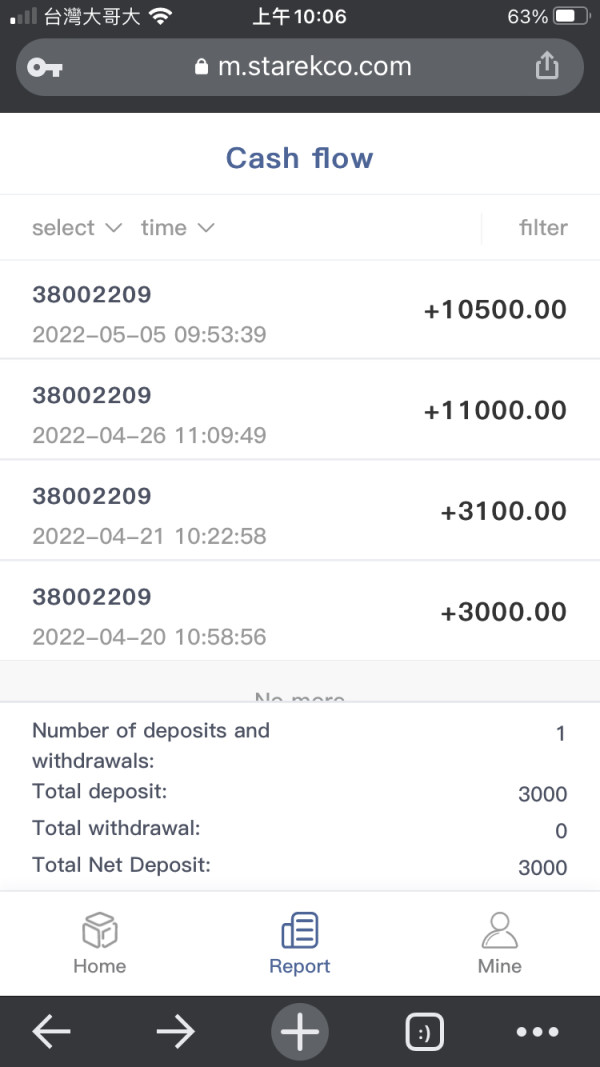

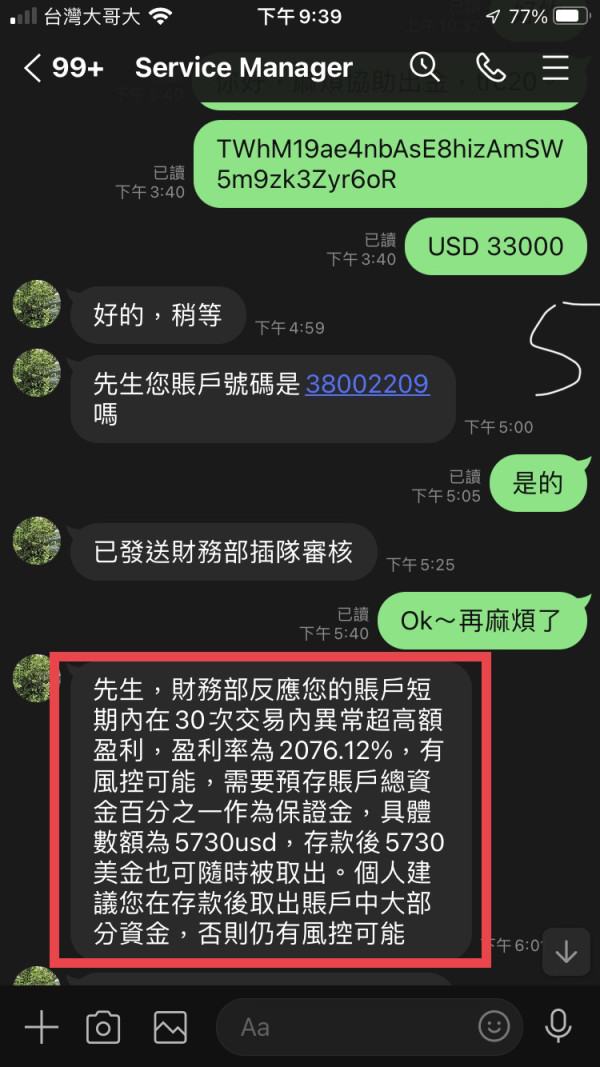

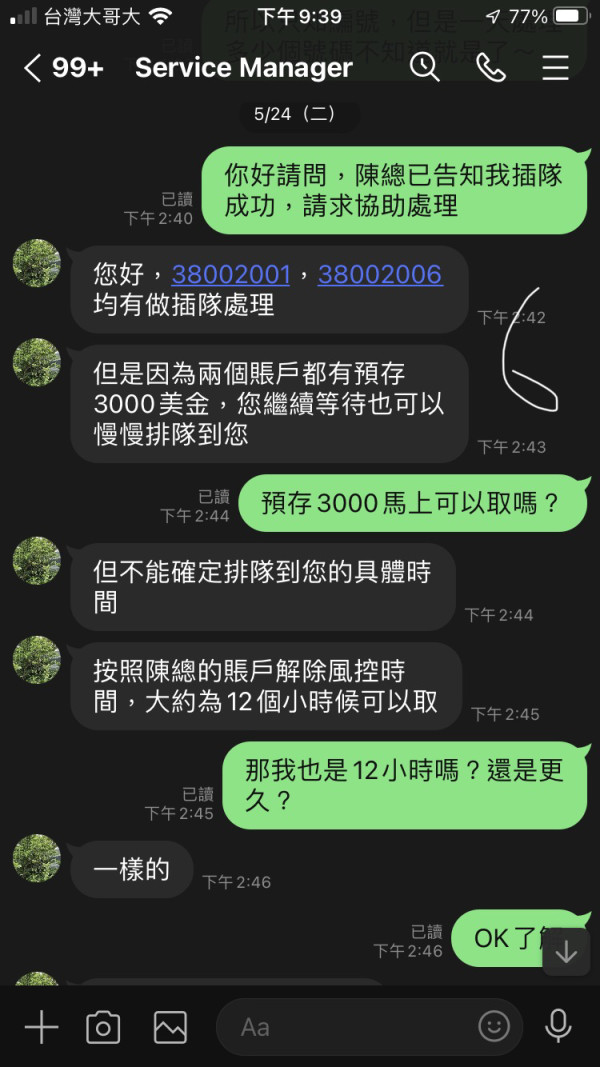

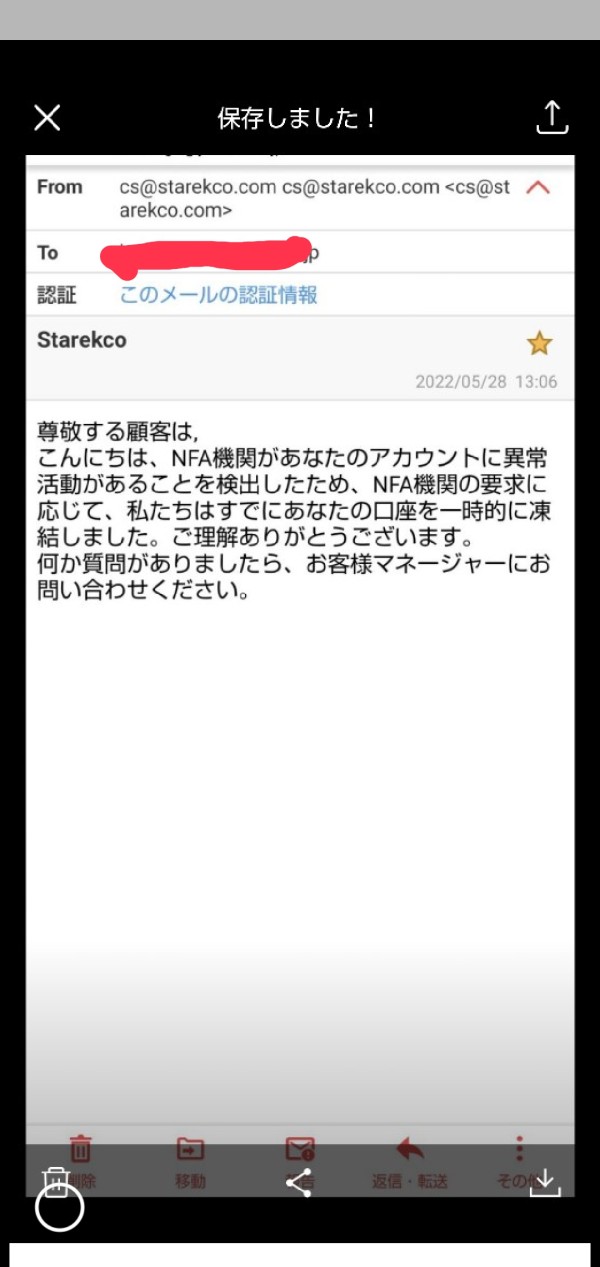

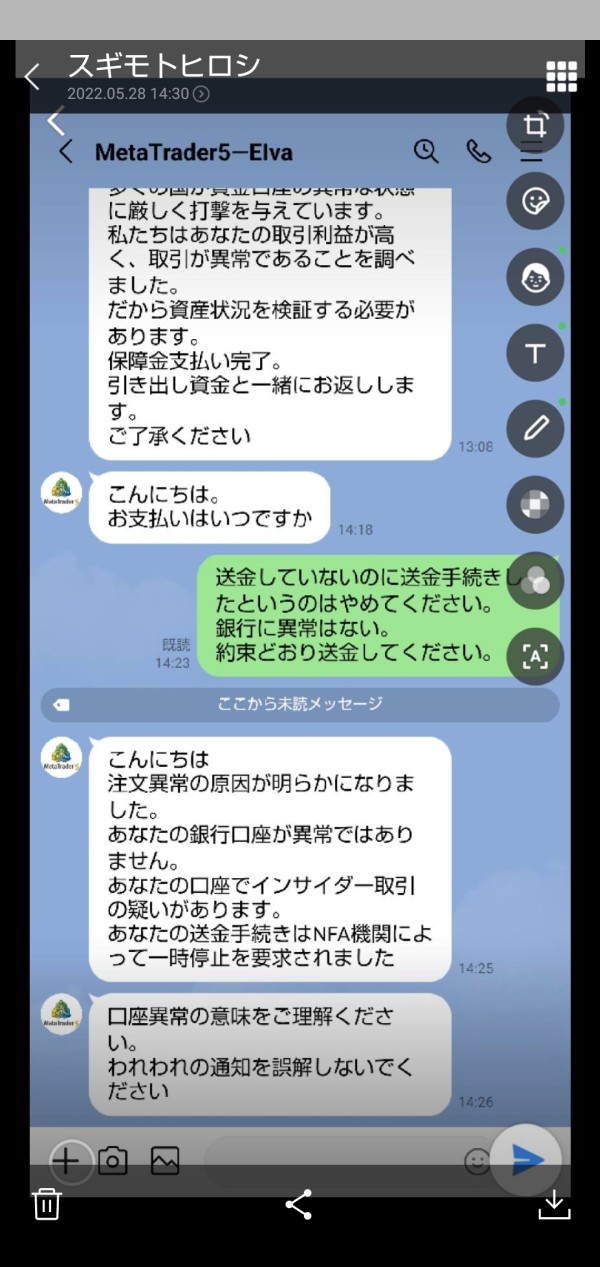

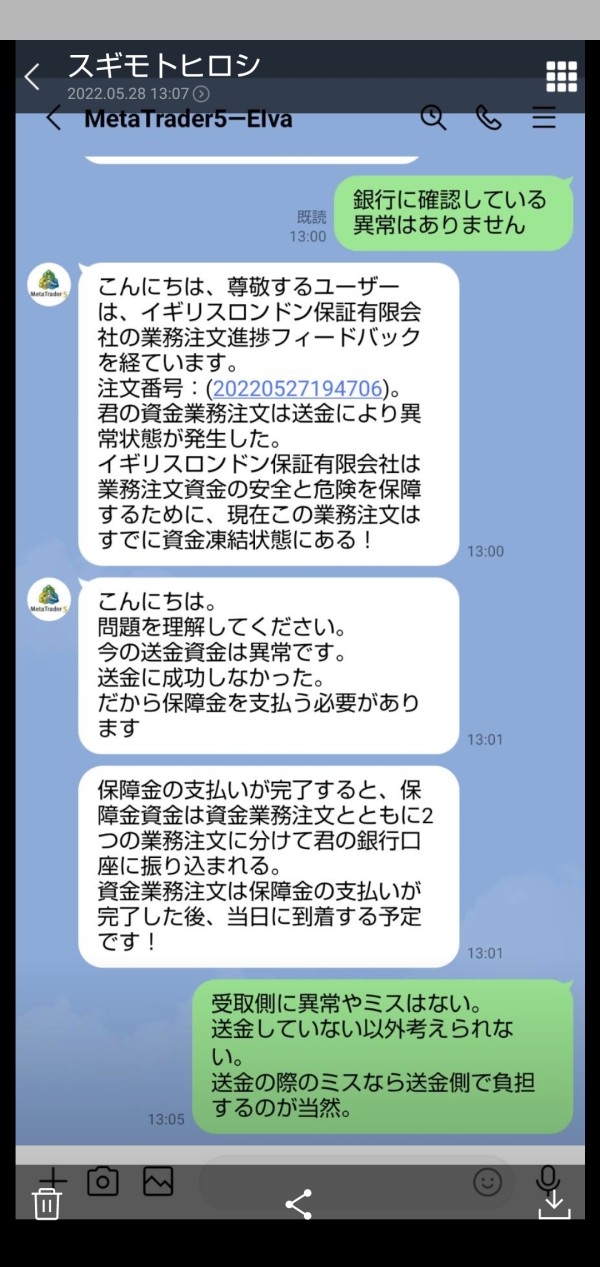

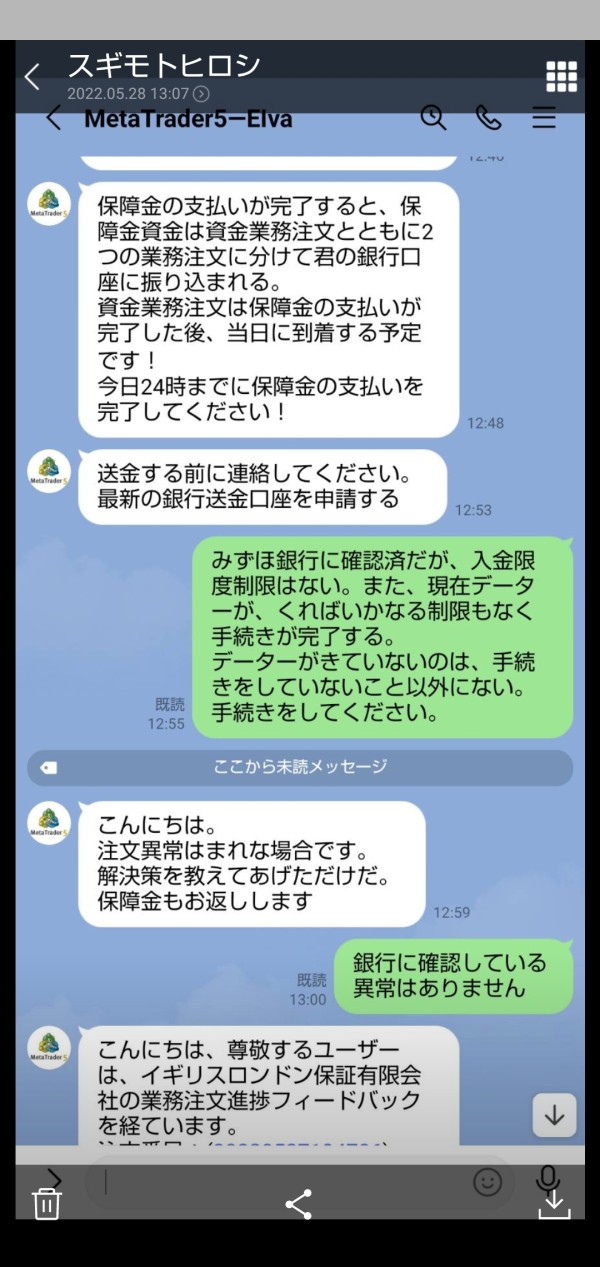

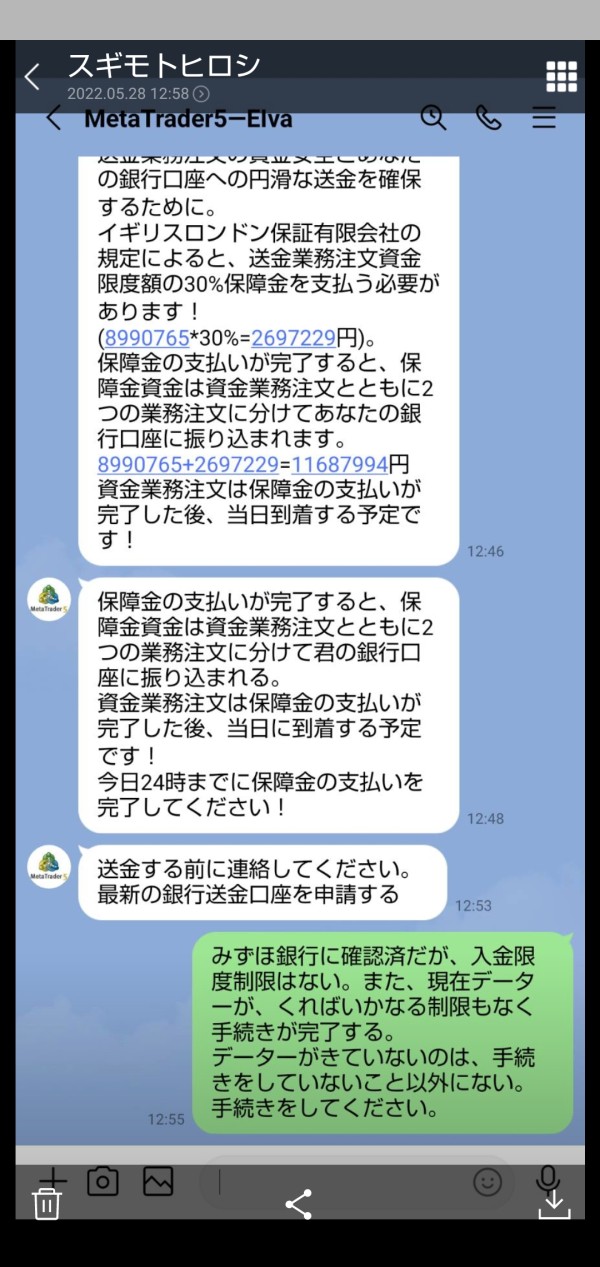

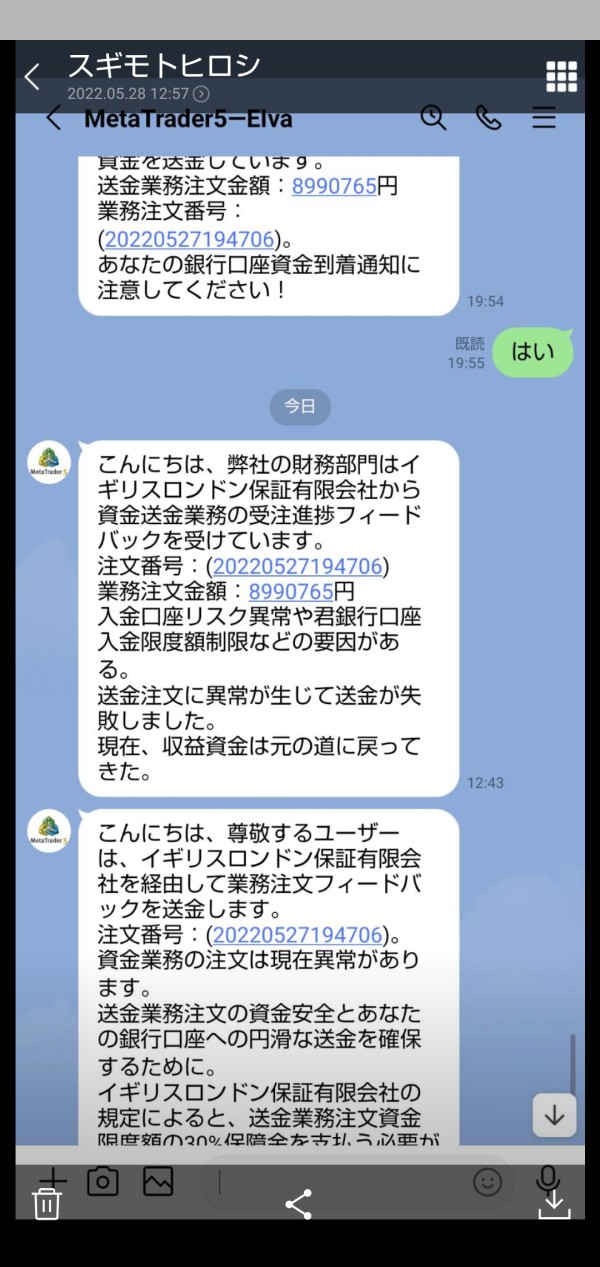

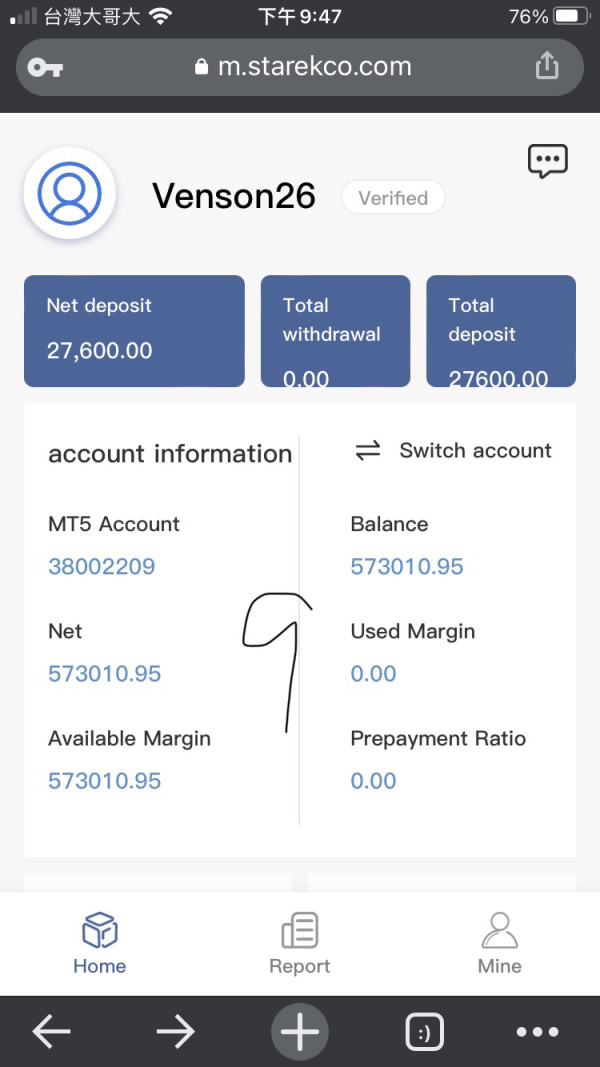

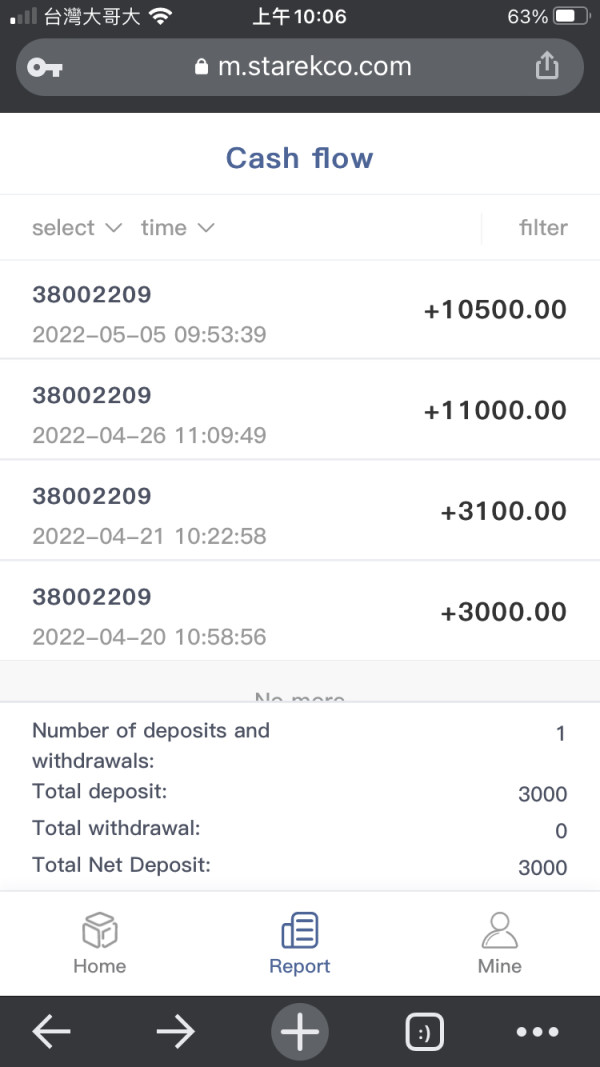

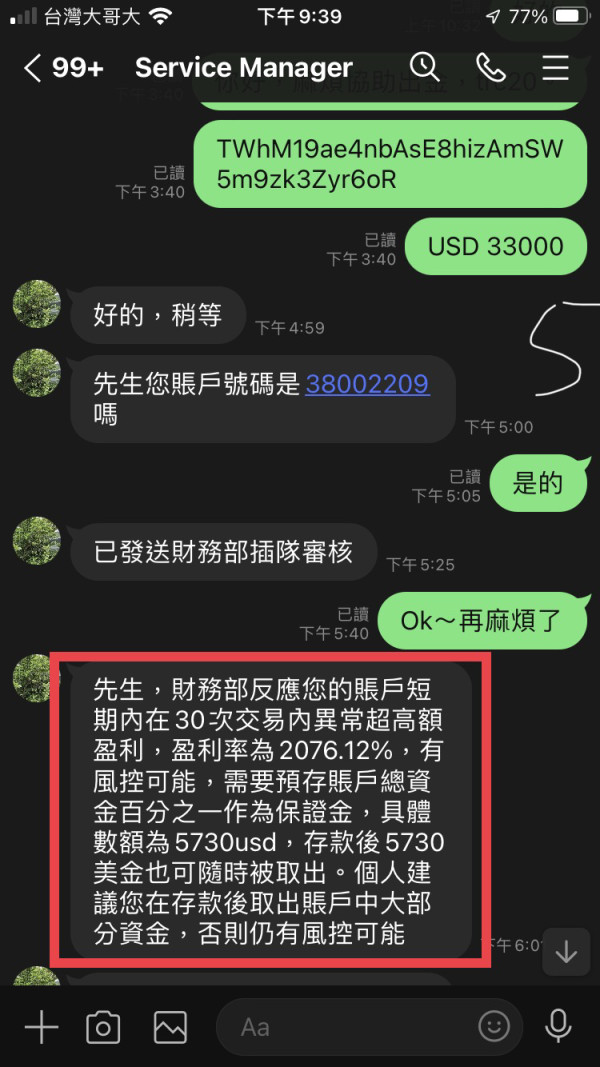

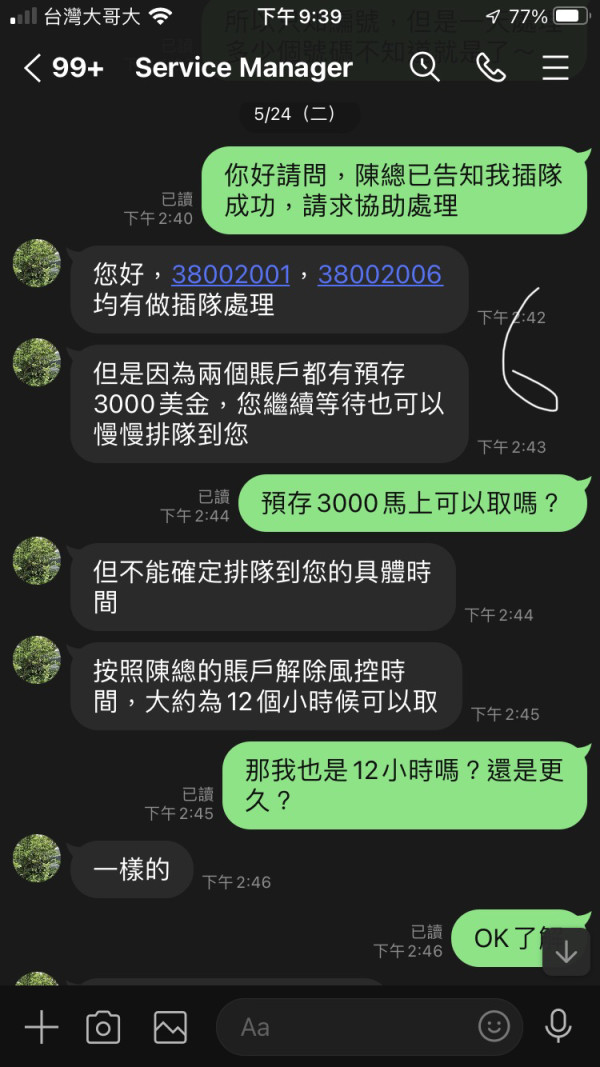

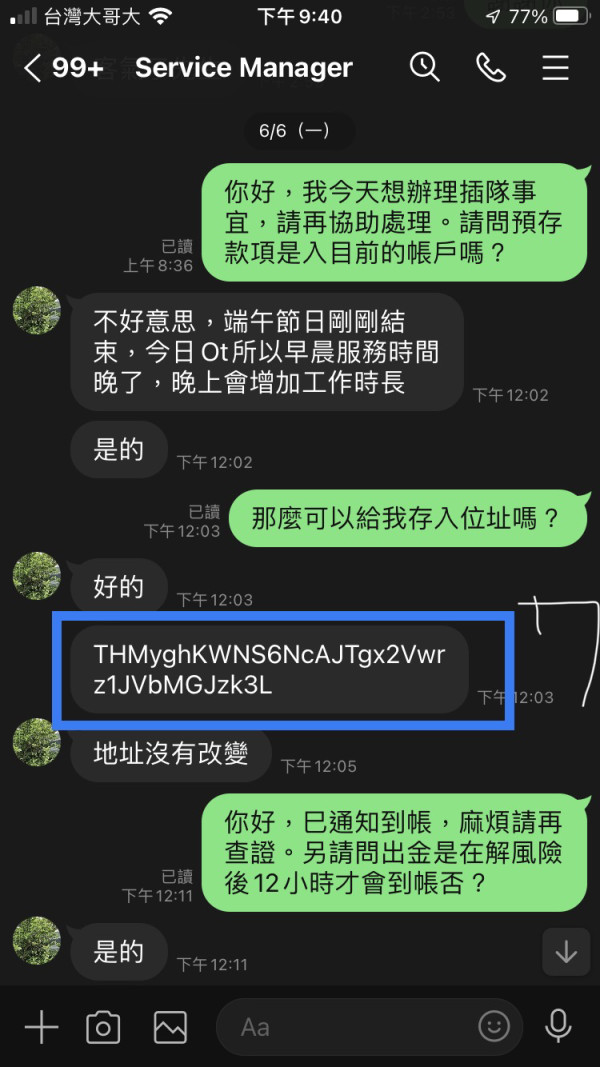

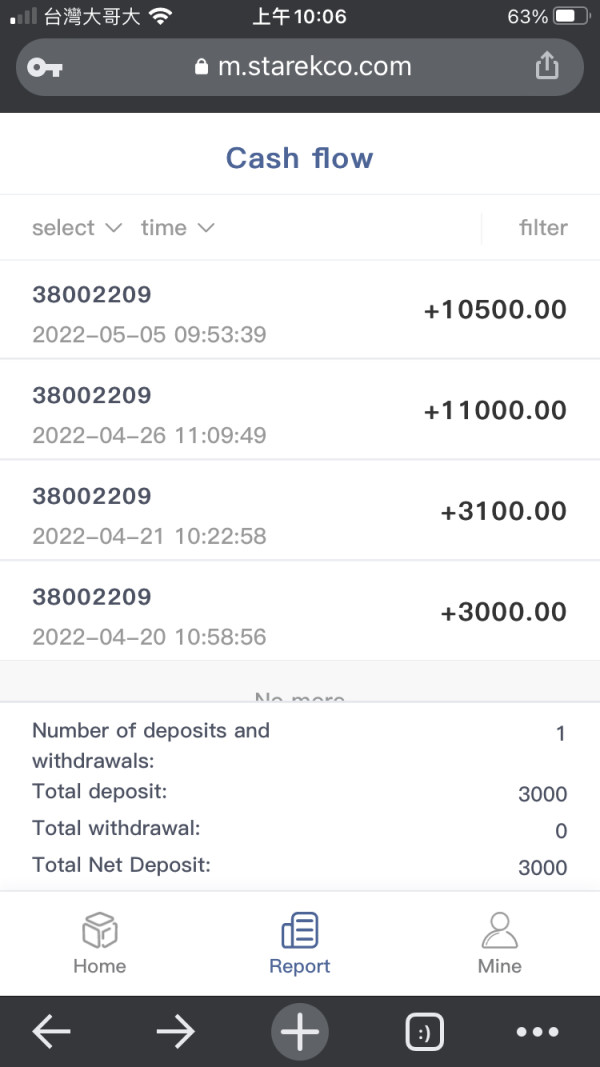

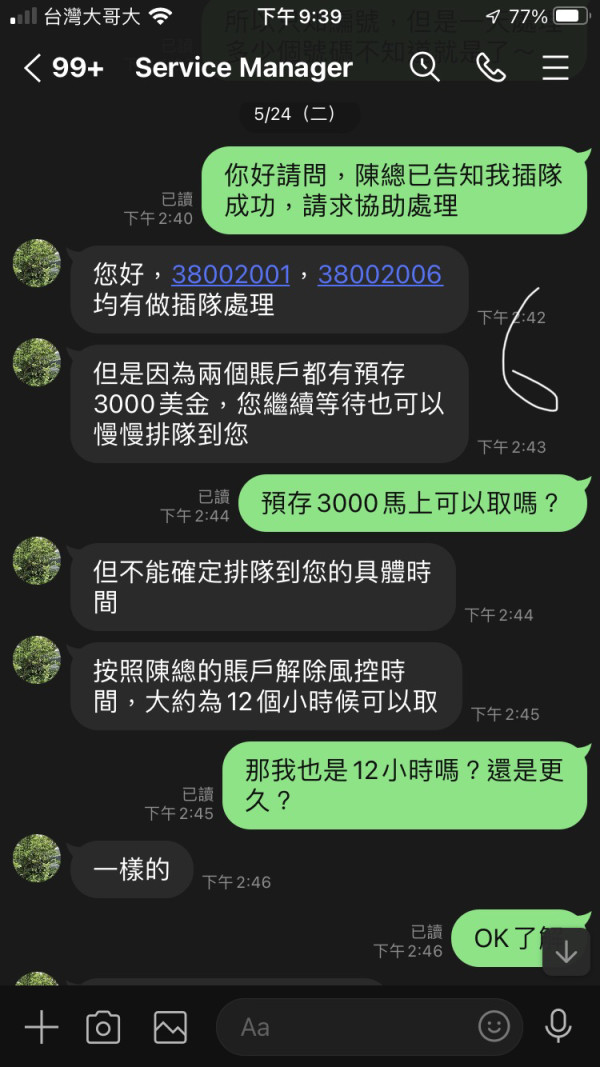

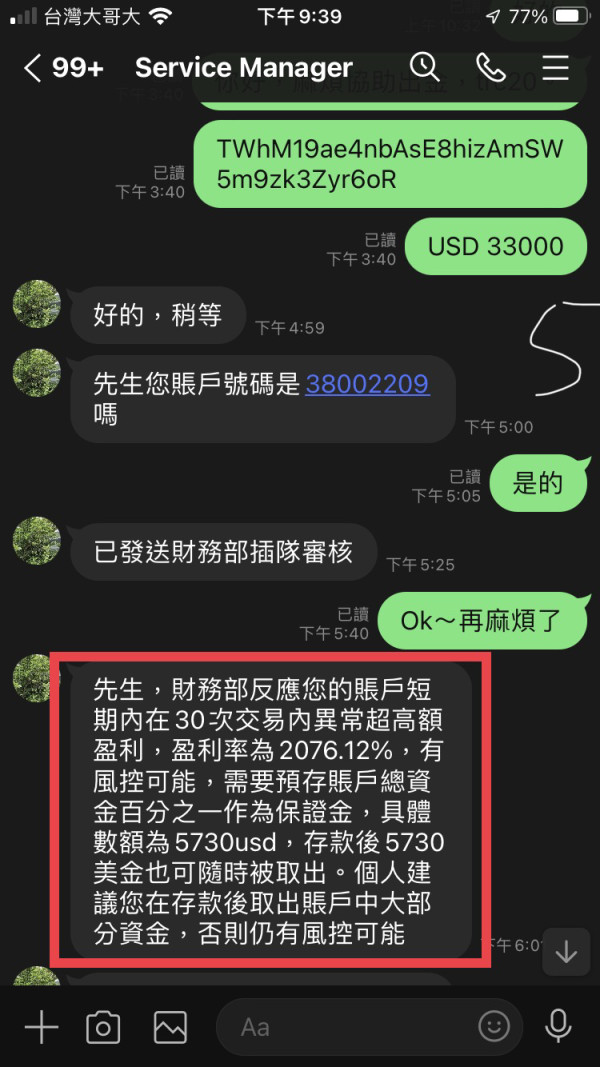

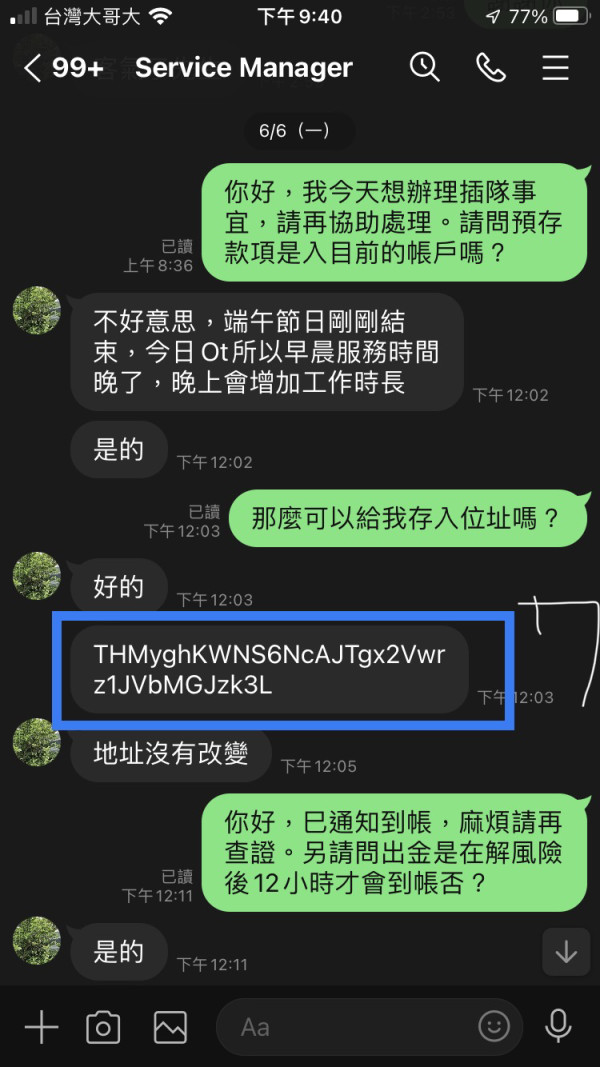

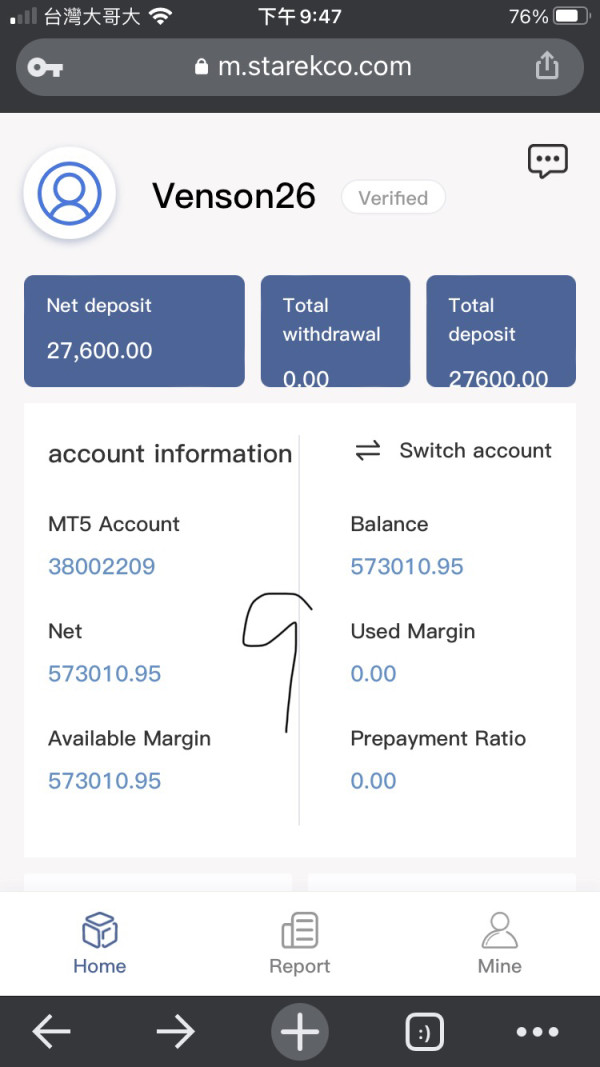

The information regarding deposit and withdrawal methods is limited, with no clear disclosure of accepted currencies or cryptocurrencies. Users have reported difficulties in withdrawing funds, often citing excuses from the broker, which points to a potentially fraudulent operation.

Minimum Deposit:

The minimum deposit requirement is not specified on Starek's website, which is unusual for brokers. This lack of transparency raises concerns about the broker's intentions and financial practices.

Bonuses/Promotions:

Starek has been noted to offer bonuses; however, these often come with stringent conditions that make it difficult for users to withdraw their funds. Such practices are common among unregulated brokers, as they use bonuses to lock clients into their platforms.

Asset Classes:

Starek claims to offer a diverse range of trading instruments, including forex pairs, commodities like gold and oil, indices, and cryptocurrencies. However, the lack of regulatory oversight casts doubt on the legitimacy of these offerings.

Costs (Spreads, Fees, Commissions):

The average spread on the EUR/USD pair is reported to be around 1 pip, which is competitive. However, the absence of detailed information on commissions and other fees makes it difficult to assess the overall cost structure of trading with Starek.

Leverage:

Starek offers leverage up to 1:500, a figure that is significantly higher than what is permitted by regulators in the UK and EU. Such high leverage can lead to substantial losses, especially for inexperienced traders.

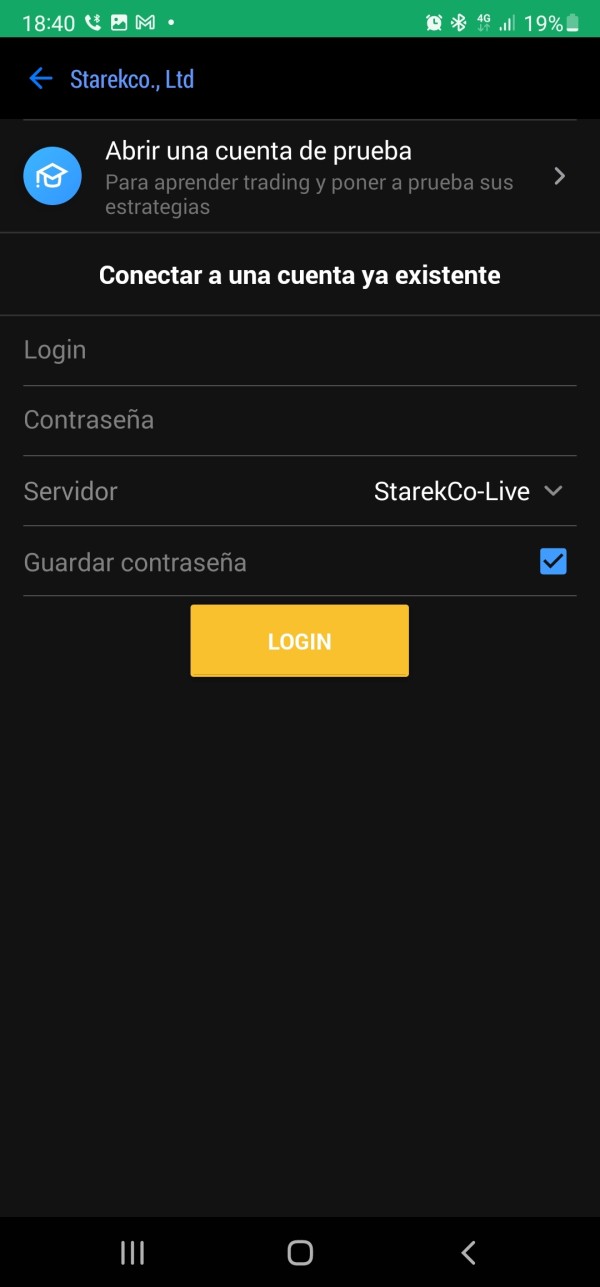

Trading Platforms Allowed:

Starek supports the MetaTrader 5 platform, which is well-regarded in the trading community for its comprehensive tools and functionalities. However, the platform's availability does not compensate for the broker's lack of regulation.

Restricted Regions:

There is no clear information regarding restricted regions for Starek, but the lack of regulatory oversight suggests that it may not be a safe option for traders in many jurisdictions.

Available Customer Service Languages:

Starek appears to offer customer support primarily through email, which can lead to delays in response times. The absence of live chat or phone support is a notable drawback for users seeking immediate assistance.

Final Ratings Overview

Detailed Breakdown

-

Account Conditions:

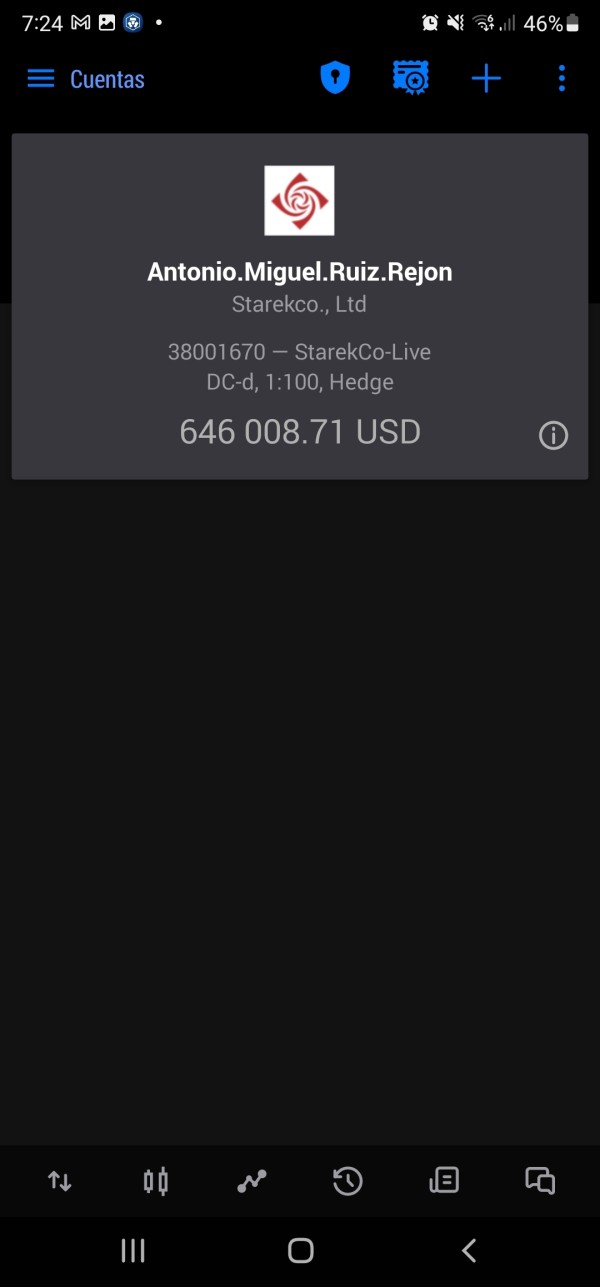

Starek's account conditions are not transparent, with no clear minimum deposit or withdrawal policies. The lack of clarity raises concerns about the broker's intentions.

Tools and Resources:

While Starek provides access to the MT5 platform, the overall tools and resources available are limited, especially considering the lack of educational materials or research tools.

Customer Service and Support:

Customer service is primarily via email, leading to frustrations among users who have reported slow response times and inadequate support.

Trading Setup:

Starek's trading setup offers competitive spreads, but the absence of regulatory oversight makes it a risky choice for traders.

Trustworthiness:

The most significant concern is Starek's lack of regulation, which leads to a low trust rating. Many users have reported withdrawal issues, indicating a high likelihood of scams.

User Experience:

User experiences have been overwhelmingly negative, with multiple reports of funds being withheld and accounts being frozen without justification.

In conclusion, the evidence strongly suggests that Starek is a risky choice for traders, given its lack of regulation and numerous user complaints. If you are considering trading with Starek, it is advisable to conduct thorough due diligence and consider more reputable alternatives.