Regarding the legitimacy of Spring FX Markets forex brokers, it provides VFSC and WikiBit, .

Is Spring FX Markets safe?

Business

License

Is Spring FX Markets markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Triumph Int. Limited

Effective Date:

2017-04-26Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Spring FX Markets Safe or Scam?

Introduction

Spring FX Markets positions itself as a player in the forex trading arena, offering a variety of trading instruments and enticing features. However, the increasing prevalence of scams in the online trading space necessitates a cautious approach. Traders need to conduct thorough due diligence before committing their funds to any broker. In this article, we will investigate whether Spring FX Markets is safe or if it raises red flags that suggest otherwise. Our evaluation will be based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer safety, user experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial for assessing its legitimacy and safety. A regulated broker is subject to oversight by financial authorities, which helps protect traders' interests and funds. In the case of Spring FX Markets, it appears that the broker operates without a valid license, raising significant concerns about its credibility.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Regulated | N/A | N/A | Unverified |

The absence of regulation means that Spring FX Markets does not adhere to the standards and protections established by recognized financial authorities. This lack of oversight is a major red flag, as it indicates that the broker may engage in practices that are not in the best interest of its clients. Moreover, the Financial Conduct Authority (FCA) has issued warnings against Spring FX Markets, clearly stating that the broker is not authorized to operate within their jurisdiction. Such warnings should be taken seriously, as they often stem from complaints about fraudulent activities.

Company Background Investigation

Understanding the background of a trading firm is essential for assessing its reliability. Spring FX Markets claims to offer a range of financial services, but its company history and ownership structure are murky at best. Reports indicate that the broker has been operational for a relatively short period, which raises questions about its stability and long-term viability.

The management teams credentials are equally important. However, the available information on the team behind Spring FX Markets is sparse, leading to concerns about their expertise and experience in the financial industry. Transparency in this area is lacking, as the broker does not provide sufficient details regarding its corporate structure or the qualifications of its management team. This opacity can be a significant warning sign for potential investors.

Trading Conditions Analysis

The trading conditions offered by a broker often reflect its commitment to providing a fair and transparent trading environment. In the case of Spring FX Markets, the details surrounding its fee structure and trading costs are concerning. Many users have reported hidden fees and unclear commission structures, which can significantly impact a trader's profitability.

| Fee Type | Spring FX Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding spreads and commissions is a common tactic employed by less reputable brokers to mislead traders. Moreover, the absence of a demo account further complicates the situation, as it prevents potential clients from evaluating the trading conditions risk-free. This lack of transparency raises significant concerns about whether Spring FX Markets is safe for trading.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. Spring FX Markets has not provided sufficient information regarding its fund security measures. The absence of segregated accounts, which are essential for protecting clients' funds from operational risks, is particularly alarming. Additionally, there is no indication that the broker offers negative balance protection, which can leave traders vulnerable to losing more than their initial investment.

Historically, there have been reports of traders facing difficulties in withdrawing their funds, a common issue with unregulated brokers. Such experiences further underscore the risks associated with trading through Spring FX Markets, raising doubts about whether the broker prioritizes the safety of its clients' investments.

Customer Experience and Complaints

Customer feedback is a crucial element in assessing a broker's reliability. Numerous reviews from users of Spring FX Markets indicate a pattern of dissatisfaction, particularly concerning withdrawal issues and unresponsive customer support. Many clients have reported being unable to retrieve their funds, leading to significant financial losses.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Poor |

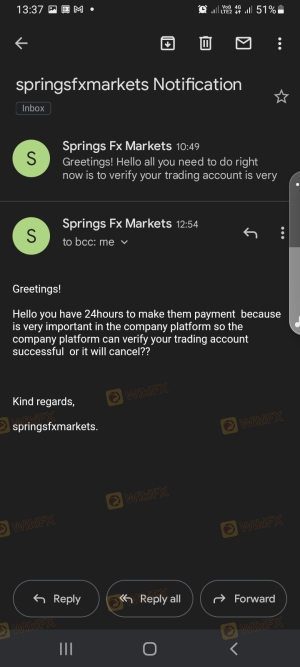

Typical cases involve clients who, after depositing funds, found themselves unable to withdraw due to arbitrary "verification fees" or other excuses. These complaints highlight a troubling trend that suggests Spring FX Markets may not be a reliable broker. The overall customer experience points to a lack of accountability and transparency, further questioning whether Spring FX Markets is safe for traders.

Platform and Execution

The trading platform is another critical aspect of a broker's service. A reliable and efficient platform is essential for executing trades effectively. However, feedback regarding Spring FX Markets indicates concerns about platform performance, stability, and execution quality. Users have reported experiencing slippage and rejected orders, which can severely impact trading outcomes.

Moreover, any signs of platform manipulation should be taken seriously. If traders suspect that their trades are being manipulated or that the platform is not functioning as advertised, it raises significant concerns about the integrity of the broker. This adds another layer of doubt about whether Spring FX Markets is safe for trading.

Risk Assessment

Using Spring FX Markets carries inherent risks that potential traders should be aware of. The lack of regulation, combined with negative user experiences and opaque trading conditions, creates a high-risk environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk exposure. |

| Financial Risk | High | Complaints about fund withdrawals indicate potential financial instability. |

| Operational Risk | Medium | Platform issues may lead to execution problems. |

To mitigate these risks, potential traders should consider thoroughly researching the broker and exploring alternatives that offer better regulatory oversight and customer protection.

Conclusion and Recommendations

In conclusion, Spring FX Markets raises several red flags that suggest it may not be a safe trading environment. The lack of regulation, coupled with numerous complaints regarding fund withdrawals and poor customer service, casts doubt on the broker's legitimacy. Additionally, the opaque trading conditions and platform performance issues further exacerbate these concerns.

For traders seeking a reliable forex broker, it is advisable to explore alternatives that are well-regulated and have a proven track record of positive customer experiences. Brokers such as OctaFX and XM offer robust regulatory frameworks and transparent trading conditions, making them safer options for traders.

In summary, potential investors should approach Spring FX Markets with caution and consider the risks involved before making any financial commitments.

Is Spring FX Markets a scam, or is it legit?

The latest exposure and evaluation content of Spring FX Markets brokers.

Spring FX Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Spring FX Markets latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.