Is APX PRIME safe?

Pros

Cons

Is APX Prime A Scam?

Introduction

APX Prime is a forex brokerage that has emerged in recent years, positioning itself as a provider of diverse trading services for both novice and experienced traders. Established in 2021 and registered in Saint Vincent and the Grenadines, APX Prime has attracted attention for its high leverage offerings and a range of trading instruments. However, as with any financial service, especially in the forex market, traders must exercise caution and thoroughly evaluate the credibility of their chosen broker. The forex market is rife with unregulated entities that can pose significant risks to traders, including potential fraud and mismanagement of funds. This article aims to provide an objective analysis of APX Prime, examining its regulatory status, company background, trading conditions, client experiences, and overall safety. The assessment is based on a review of multiple sources, including user feedback, expert analyses, and regulatory databases.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. APX Prime claims to be registered with the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA); however, it is essential to note that this regulatory body does not oversee forex trading, which raises significant concerns about the broker's legitimacy. Below is a summary of APX Prime's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of regulation by a reputable authority, such as the FCA (UK), ASIC (Australia), or SEC (USA), is a major red flag. Such bodies enforce stringent standards to protect investors and ensure fair trading practices. Consequently, trading with an unregulated broker like APX Prime exposes traders to various risks, including the potential for fraud, manipulation of prices, and inadequate recourse in case of disputes. The lack of a robust regulatory framework surrounding APX Prime's operations suggests that traders should approach this broker with caution.

Company Background Investigation

APX Prime was founded in 2021 and is registered in Saint Vincent and the Grenadines. While the registration provides some legitimacy, it does not equate to regulatory oversight. The ownership structure of APX Prime is not clearly disclosed, which is a common concern among unregulated brokers. Transparency regarding ownership and management is vital for building trust with clients.

The management team of APX Prime has not been extensively detailed in available resources, leading to questions about their expertise and experience in the financial services industry. A lack of information about the team can hinder a trader's ability to assess the broker's reliability and operational practices. Furthermore, the transparency of a broker's operations is a crucial factor in evaluating its legitimacy. APX Prime's limited disclosure regarding its management and operational practices raises concerns about its commitment to transparency and accountability.

Trading Conditions Analysis

APX Prime offers various account types, including cents, standard, and ECN accounts, each with different features and minimum deposit requirements. The overall cost structure of trading with APX Prime appears competitive; however, the lack of transparency regarding spreads and commissions is concerning. Below is a comparison of the core trading costs:

| Cost Type | APX Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips (standard account) | 1.0-1.5 pips |

| Commission Model | $8 per lot (ECN account) | Varies by broker |

| Overnight Interest Range | Varies | Varies |

While APX Prime advertises low spreads and high leverage (up to 1:2000), the actual trading costs can significantly impact profitability. The lack of clear information about overnight interest rates and potential hidden fees could lead to unexpected costs for traders. Moreover, traders should be wary of any unusual fee policies, such as withdrawal fees or inactivity fees, which can further erode profits.

Client Fund Safety

The safety of client funds is paramount when assessing a broker's reliability. APX Prime claims to implement measures for fund security, but the lack of regulation raises serious concerns. Key safety measures to evaluate include fund segregation, investor protection schemes, and negative balance protection. Unfortunately, APX Prime does not provide clear information regarding these critical aspects.

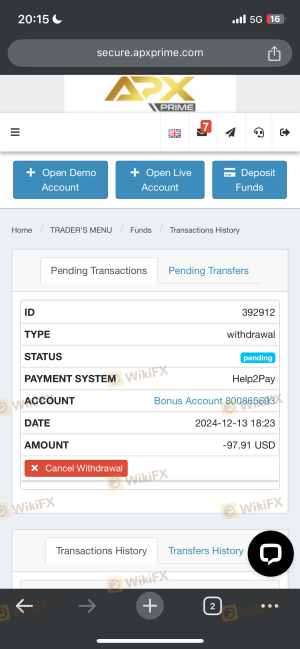

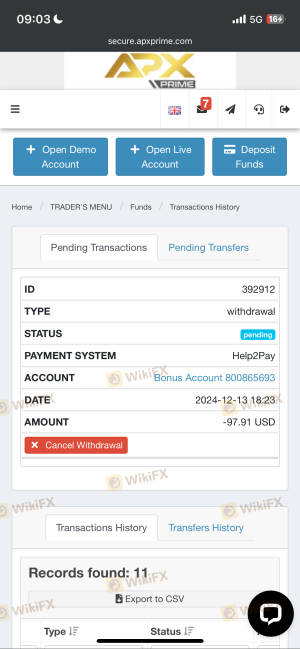

The absence of investor protection mechanisms means that in the event of insolvency or mismanagement, traders may have limited recourse to recover their funds. Additionally, there have been reports of withdrawal issues and delays from users, which further highlights the potential risks involved. Traders should consider these factors seriously when evaluating whether to deposit funds with APX Prime.

Customer Experience and Complaints

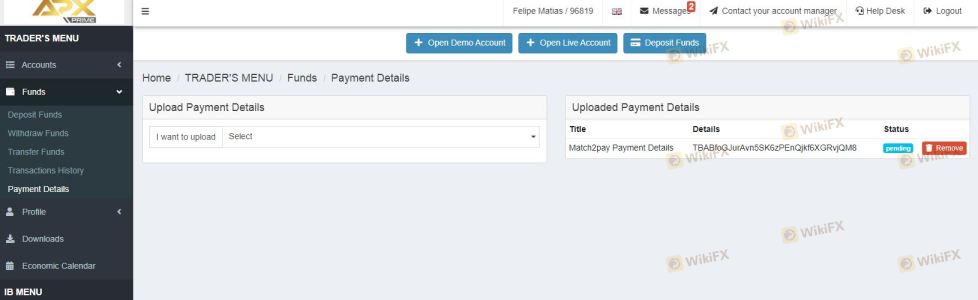

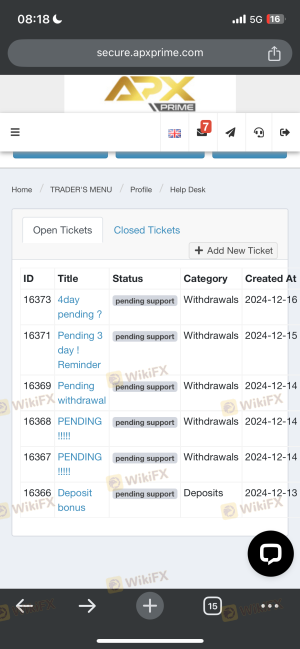

Analyzing customer feedback is essential in understanding a broker's reliability. APX Prime has received mixed reviews from users, with several complaints focusing on withdrawal delays and unresponsive customer service. Common complaint types include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow/no response |

| Lack of Transparency | Medium | Limited information |

| Customer Support Issues | High | Inconsistent support |

For instance, one user reported a pending withdrawal for several weeks despite multiple follow-ups, indicating potential operational issues within the broker. Another user cited unresponsive customer service when attempting to resolve their concerns, which can be particularly frustrating for traders seeking timely assistance. These patterns of complaints suggest that while APX Prime may offer attractive trading conditions, the execution and support may fall short of expectations.

Platform and Execution

The trading platform provided by APX Prime is MetaTrader 4 (MT4), a widely recognized platform known for its user-friendly interface and robust features. However, the performance and reliability of the platform are critical for successful trading. Users have reported varying experiences regarding order execution quality, with some mentioning issues related to slippage and rejections during high volatility periods.

While MT4 is generally considered stable, any signs of platform manipulation or significant downtime can severely impact a trader's ability to execute trades effectively. Traders should be vigilant and monitor their trading experiences closely, particularly during critical market events.

Risk Assessment

Using APX Prime carries several inherent risks, primarily due to its unregulated status and reported customer complaints. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight increases potential for fraud. |

| Withdrawal Risk | High | Numerous complaints about delays and issues. |

| Transparency Risk | Medium | Limited information about fees and management. |

| Platform Reliability Risk | Medium | Reports of execution issues during high volatility. |

To mitigate these risks, traders should consider starting with a small deposit to test the broker's reliability before committing larger amounts. Additionally, keeping thorough records of all transactions and communications can be beneficial in case of disputes.

Conclusion and Recommendations

In summary, APX Prime presents several concerning factors that traders should consider before engaging with this broker. The lack of regulation, mixed customer feedback, and potential withdrawal issues raise red flags about its overall legitimacy. While APX Prime may offer competitive trading conditions, the risks associated with trading with an unregulated broker cannot be overlooked.

For traders seeking a reliable and safe trading environment, it is advisable to consider alternative brokers that are regulated by reputable authorities. Brokers such as IG, OANDA, or Forex.com provide a higher level of investor protection and transparency, making them more suitable options for traders looking to enter the forex market. In conclusion, while APX Prime may attract some traders with its offerings, caution is warranted, and thorough due diligence is essential.

Is APX PRIME a scam, or is it legit?

The latest exposure and evaluation content of APX PRIME brokers.

APX PRIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

APX PRIME latest industry rating score is 2.07, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.07 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.