Is JetSwap safe?

Pros

Cons

Is Jetswap Safe or Scam?

Introduction

Jetswap is a relatively new player in the forex market, positioning itself as a decentralized automated market maker (AMM) operating on the Binance Smart Chain, Polygon, and Fantom networks. It offers users the ability to trade from their wallets without the need for a centralized exchange, which can be appealing for those seeking greater control over their assets. However, as with any trading platform, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with the service. The forex market is rife with potential pitfalls, including scams and unregulated brokers, making it imperative for traders to assess the legitimacy and safety of their chosen platform.

This article investigates whether Jetswap is a safe trading option or a potential scam by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risks. The assessment is based on a review of various sources, including user reviews, regulatory information, and expert analyses. By synthesizing this information, we aim to provide a comprehensive overview of Jetswap's safety.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the trading industry. A broker's regulatory status can significantly influence its credibility and the safety of customer funds. Unfortunately, Jetswap does not appear to be regulated by any recognized financial authority, which raises concerns about its legitimacy. Below is a summary of the regulatory information available:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Jetswap operates without the safeguards typically provided by licensed brokers, such as investor protection and adherence to strict operational standards. This lack of regulation is a significant red flag for potential users, as it increases the risk of fraud and malpractice. Furthermore, the platform's claims of decentralization may complicate accountability, making it challenging for users to seek recourse in case of disputes or issues.

Company Background Investigation

Jetswap is operated by Jet Swap Capital Ltd., a company that was incorporated in November 2021. The company's registered office is located in London, UK. However, information about the ownership structure and management team is limited, which raises questions about transparency. The founder, Andrey V. Dementyev, is noted as the primary contact for the company, but there are no further details about his background or expertise in the financial industry.

The lack of transparency surrounding the company's history and ownership structure can be concerning for potential users. A well-established broker typically provides detailed information about its management team and corporate structure, which helps build trust among users. In this case, the limited information may indicate a lack of accountability and could be a warning sign for traders considering using Jetswap.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its overall value. Jetswap claims to provide competitive trading conditions, including low spreads and various trading instruments. However, the absence of detailed information regarding fees and commissions is a concern. Below is a comparison of the core trading costs:

| Fee Type | Jetswap | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding trading costs may indicate potential hidden fees or unfavorable trading conditions. Traders should be cautious and conduct their own research to ensure they are not subjected to unexpected charges. Additionally, without a clear understanding of the fee structure, it becomes challenging to assess the overall cost-effectiveness of trading with Jetswap.

Customer Fund Security

The safety of customer funds is a paramount concern for any trading platform. Jetswap claims to implement various security measures; however, the specifics of these measures are not well-documented. It is crucial for traders to know how their funds are protected. An assessment of the platform's fund security reveals the following:

- Segregation of Funds: There is no clear indication that Jetswap maintains segregated accounts for client funds, which is a standard practice among regulated brokers.

- Investor Protection: The platform does not provide any information regarding investor protection policies or compensation schemes.

- Negative Balance Protection: There is no mention of negative balance protection, which can leave traders vulnerable in volatile market conditions.

The absence of clear information regarding these security measures raises significant concerns about the safety of funds held on Jetswap. Traders should be wary of platforms that lack transparency regarding fund protection, as this can lead to substantial financial losses.

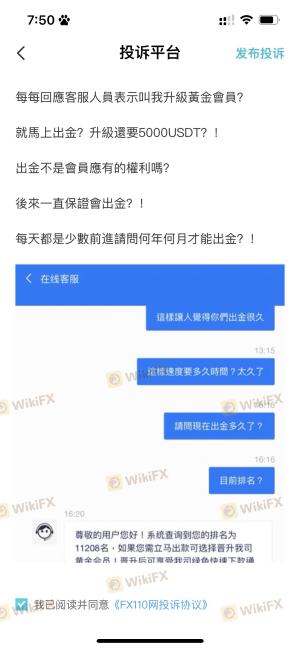

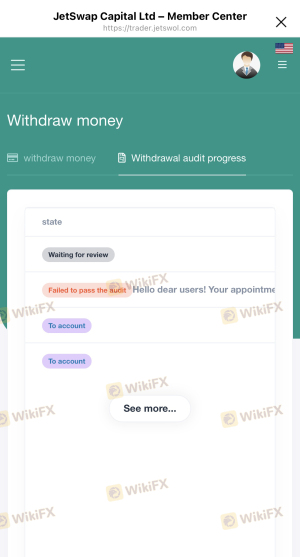

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a trading platform. Unfortunately, reviews regarding Jetswap are mixed, with a significant number of negative experiences reported. Common complaints include issues with fund withdrawals, poor customer support, and unclear trading conditions. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Unresolved |

| Unclear Fees | Medium | Limited Clarity |

For instance, several users have reported difficulties in withdrawing their funds after making deposits, with claims of delayed responses from customer support. Such issues can lead to frustration and financial strain for traders, further indicating potential risks associated with using Jetswap.

Platform and Trade Execution

The performance of a trading platform is critical for user experience. Jetswap operates as a decentralized exchange, allowing users to trade directly from their wallets. While this can offer advantages in terms of control, it also raises questions about the platform's execution quality. Users have reported varying experiences regarding order execution speed and slippage, with some noting instances of significant slippage during trades.

Additionally, the lack of a centralized order book may result in less reliable trade execution compared to traditional exchanges. Traders should be cautious of platforms that do not offer transparency regarding execution quality, as this can impact overall trading performance.

Risk Assessment

Using Jetswap comes with inherent risks, particularly due to its lack of regulation and transparency. Below is a summary of the key risk areas associated with the platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of clear fund protection policies |

| Execution Risk | Medium | Potential slippage and execution issues |

To mitigate these risks, traders are advised to conduct thorough research, consider using smaller amounts for initial trades, and remain vigilant about the platform's operations.

Conclusion and Recommendations

In conclusion, the evidence suggests that Jetswap raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, transparency about company operations, and mixed customer feedback point towards potential risks for traders. While the decentralized nature of the platform may appeal to some users, the associated risks cannot be overlooked.

Traders should approach Jetswap with caution and consider alternative trading platforms that offer better regulatory protection and customer support. Reliable options include well-established brokers that are regulated by recognized authorities and provide clear information about trading conditions and fund security. Always prioritize safety and due diligence when selecting a trading platform to ensure a secure trading experience.

In summary, Is Jetswap safe? The answer remains uncertain, and potential users should weigh the risks carefully before proceeding.

Is JetSwap a scam, or is it legit?

The latest exposure and evaluation content of JetSwap brokers.

JetSwap Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JetSwap latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.