Is RVE TRADING safe?

Business

License

Is RVE Trading Safe or Scam?

Introduction

RVE Trading is a relatively new player in the forex market, having been established in 2021 and based in the British Virgin Islands. As traders increasingly explore various platforms for trading, the importance of thoroughly assessing the credibility of brokers cannot be overstated. The forex market, while offering lucrative opportunities, is also rife with potential scams and unscrupulous entities. Therefore, it is crucial for traders to conduct due diligence before committing their funds. This article will analyze RVE Trading's safety and legitimacy through a comprehensive evaluation framework, focusing on regulatory status, company background, trading conditions, customer experiences, and risk assessment.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of any forex broker. RVE Trading claims to be regulated by the National Futures Association (NFA), which is a reputable regulatory body in the United States. However, it is essential to verify the authenticity of such claims, especially when the broker is based in a jurisdiction known for less stringent regulations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0525364 | United States | Suspicious Clone |

The above table indicates that RVE Trading's regulatory status is questionable. A score of 1.30 out of 10 on WikiFX suggests significant concerns regarding its legitimacy. The lack of negative regulatory disclosures during the evaluation period does not necessarily imply safety; it may point to a lack of transparency. The absence of robust regulatory oversight raises red flags, as traders often face increased risks when engaging with unregulated brokers. Thus, it is imperative to scrutinize RVE Trading's claims about its regulatory compliance.

Company Background Investigation

RVE Trading was founded in 2021, and its brief history raises questions about its stability and track record. The company's ownership structure is not transparently disclosed, making it challenging to assess the backgrounds of its management team. A lack of information about the founders and key executives can be a red flag for potential investors.

The management team's professional experience is crucial in evaluating the broker's reliability. Unfortunately, RVE Trading does not provide adequate information on its leadership, which may indicate a lack of transparency. Transparency in operations and corporate governance is essential for building trust with clients. Without sufficient disclosure, it becomes difficult to ascertain whether RVE Trading is a legitimate entity or a potential scam.

Trading Conditions Analysis

Understanding the trading conditions offered by RVE Trading is vital for assessing its overall safety. The broker's fee structure and trading costs can significantly impact a trader's profitability. RVE Trading offers various trading instruments, but it is essential to analyze its fee policies critically.

| Fee Type | RVE Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While the specific figures for RVE Trading's fees are not disclosed in the available data, it is crucial to note that any unusual or hidden fees can signal potential issues. Traders should be wary of brokers that impose excessive spreads or commissions, as these can erode profits and indicate a lack of transparency. In the case of RVE Trading, the absence of clear information about trading costs raises concerns about its overall trading conditions and whether they align with industry standards.

Customer Fund Security

The safety of customer funds is paramount when choosing a forex broker. RVE Trading must implement robust measures to ensure the security of client deposits. This includes fund segregation, investor protection mechanisms, and negative balance protection policies.

Unfortunately, there is limited information available regarding RVE Trading's security measures. The lack of transparency surrounding its fund protection policies raises concerns. Traders should be cautious if a broker does not clearly outline how client funds are safeguarded. Additionally, any historical incidents involving fund security issues could further indicate whether RVE Trading is a safe platform or a potential scam.

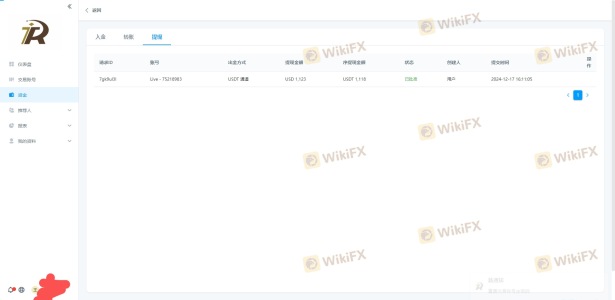

Customer Experience and Complaints

Customer feedback provides valuable insights into the broker's reliability. Analyzing user experiences can help identify common issues and the company's responsiveness to complaints. RVE Trading has received mixed reviews, with some users expressing concerns about the quality of customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service | Medium | Average Support |

Typical complaints revolve around withdrawal difficulties and slow customer service responses. Such issues can significantly impact a trader's experience and raise questions about the broker's reliability. Two notable cases involve users facing delays in fund withdrawals, leading to frustration and dissatisfaction. These complaints highlight the importance of assessing RVE Trading's customer support and responsiveness.

Platform and Execution

The performance and stability of RVE Trading's trading platform are crucial factors in determining its overall reliability. A well-functioning platform should provide a seamless trading experience with minimal downtime and efficient order execution. Traders must also be vigilant about potential signs of platform manipulation, such as excessive slippage or frequent order rejections.

While specific details about RVE Trading's platform performance are scarce, traders should be cautious if they encounter issues that hinder their trading experience. An unreliable platform could indicate underlying problems that may compromise the safety of funds and the integrity of trades.

Risk Assessment

Using RVE Trading involves several risks that traders should be aware of. A comprehensive risk assessment can help individuals make informed decisions about whether to engage with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of strong regulatory oversight raises concerns. |

| Fund Security Risk | Medium | Limited information about fund protection measures. |

| Customer Service Risk | Medium | Complaints about withdrawal issues and slow responses. |

To mitigate these risks, traders should consider the following recommendations:

- Conduct thorough research before opening an account with RVE Trading.

- Start with a minimal deposit to assess the broker's reliability.

- Monitor customer feedback and be cautious of any red flags.

Conclusion and Recommendations

In conclusion, the evidence suggests that RVE Trading raises several concerns regarding its safety and legitimacy. The questionable regulatory status, lack of transparency in company background, and mixed customer feedback indicate potential risks for traders. While there are no definitive signs of fraud, the overall assessment leans towards caution.

For traders seeking reliable alternatives, consider exploring well-established brokers regulated by top-tier authorities. These brokers typically offer more transparency, better customer support, and enhanced fund security. Ultimately, it is essential to prioritize safety and do thorough research before committing to any trading platform.

Is RVE TRADING a scam, or is it legit?

The latest exposure and evaluation content of RVE TRADING brokers.

RVE TRADING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RVE TRADING latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.