Is REMAXIMA safe?

Business

License

Is Remaxima A Scam?

Introduction

Remaxima is an online forex trading broker that has recently emerged in the financial markets, claiming to offer a range of trading services for various asset classes, including currency pairs and CFDs. As with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The foreign exchange market is rife with opportunities, but it also harbors risks, particularly when it comes to unregulated or questionable brokers. This article aims to objectively assess whether Remaxima is safe or a scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile.

To conduct this analysis, we reviewed multiple sources, including customer reviews, regulatory warnings, and expert opinions. This comprehensive approach allows us to provide a balanced view of Remaxima's credibility in the forex market.

Regulation and Legitimacy

The regulatory status of a trading broker is one of the most critical factors in determining its legitimacy. Regulated brokers are subject to stringent oversight, ensuring that they adhere to industry standards and protect their clients' funds. In contrast, unregulated brokers may operate with little to no accountability, increasing the risk for traders.

Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Remaxima operates without any regulatory oversight, which is a significant red flag for potential investors. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the Central Bank of Ireland have issued warnings against Remaxima, indicating that the broker is not authorized to operate in their jurisdictions. The absence of a regulatory license means that clients have little to no recourse in the event of disputes or issues related to fund withdrawals.

The lack of regulation raises serious concerns about the broker's legitimacy and operational transparency. A regulated broker is required to maintain client funds in segregated accounts, provide clear information about fees, and undergo regular audits. Remaxima's unregulated status suggests that it may not adhere to these essential practices, putting clients' investments at risk.

Company Background Investigation

Understanding a company's history and ownership structure is vital for assessing its credibility. Remaxima claims to be based in Budapest, Hungary, but there are inconsistencies regarding its operational details. The company's website lacks transparency about its ownership and management team, which is another warning sign for potential clients.

The management teams background and experience can significantly impact a broker's operations. Unfortunately, detailed information about Remaxima's management is scarce, making it difficult for potential clients to gauge the expertise and reliability of those running the company. Transparency is crucial in the financial industry, and the lack of information raises concerns about the broker's commitment to ethical practices.

Furthermore, the absence of a clear history or established reputation in the market further diminishes confidence in Remaxima. Traders should be cautious when dealing with brokers that do not provide adequate information about their business operations and management.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence a trader's experience and profitability. Remaxima claims to provide competitive trading conditions; however, the lack of transparency regarding fees and spreads raises questions about the overall trading environment.

Core Trading Costs Comparison

| Cost Type | Remaxima | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-2% |

While the specific trading costs associated with Remaxima are not clearly outlined, the brokers unregulated status may imply hidden fees or unfavorable conditions that could affect traders negatively. A common practice among unregulated brokers is to impose excessive fees or unfavorable trading conditions, which can lead to significant losses for traders.

Additionally, traders should be wary of any unusual fee structures that may be presented as incentives but ultimately serve to trap clients into unfavorable trading conditions. Without clear information on spreads, commissions, and overnight interest, it is difficult for traders to make informed decisions about their trading strategies.

Client Fund Security

The safety of client funds is paramount when choosing a broker. Regulated brokers typically segregate client funds from their operational funds, ensuring that clients' money is protected even in the event of the broker's insolvency. Remaxima's unregulated status raises concerns about its fund security measures.

The broker does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies. This lack of transparency is concerning, as it suggests that clients' funds may not be adequately protected. In addition, historical reports indicate that clients have faced difficulties in withdrawing their funds, which is a common issue with unregulated brokers.

Traders should always prioritize brokers that offer robust fund security measures and clear information regarding how their money is handled. The absence of such information from Remaxima is a significant warning sign.

Customer Experience and Complaints

Customer feedback is a valuable source of information when evaluating a broker's reliability. Numerous reviews and complaints have surfaced regarding Remaxima, indicating a troubling pattern of negative experiences among clients.

Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Aggressive Marketing | Medium | Inconsistent |

| Account Blocking | High | Poor |

Common complaints include difficulties in withdrawing funds, aggressive marketing tactics, and account blocking without clear justification. Many users have reported that their withdrawal requests were met with delays or outright denials, which is a significant red flag for any trading broker.

In several instances, clients have described their experiences with retention agents who pressure them to deposit additional funds under the guise of securing better trading opportunities. This tactic is often employed by fraudulent brokers to extract as much money as possible from unsuspecting clients.

Platform and Execution

The trading platform's performance and execution quality are critical factors for traders. Remaxima claims to offer a user-friendly trading environment; however, there are concerns regarding the platform's stability and execution quality.

Traders have reported issues such as slippage, delayed order execution, and even rejected orders during volatile market conditions. Such problems can significantly impact a trader's profitability and overall experience. Moreover, there are allegations of potential platform manipulation, which further erodes trust in the broker.

Risk Assessment

Engaging with Remaxima presents several risks that potential traders should consider before proceeding.

Risk Assessment Summary

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases vulnerability. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

To mitigate these risks, traders should conduct thorough research, consider starting with a small investment, and be prepared to withdraw funds promptly if they encounter issues. Additionally, seeking advice from financial professionals can provide valuable insights.

Conclusion and Recommendations

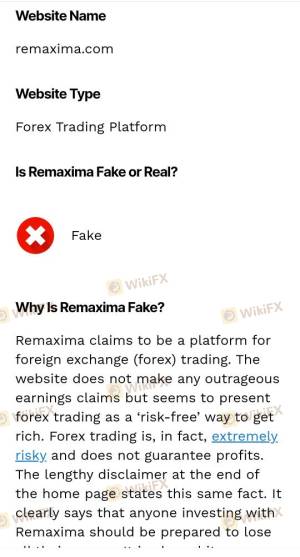

In conclusion, the evidence strongly suggests that Remaxima is a high-risk broker with significant red flags indicating potential fraudulent behavior. The lack of regulation, transparency, and consistent negative customer feedback raises serious concerns about the broker's legitimacy.

Traders are advised to exercise extreme caution when considering engaging with Remaxima. It is crucial to prioritize brokers that are regulated and have a proven track record of reliability and customer satisfaction. If you are looking for trustworthy alternatives, consider brokers with strong regulatory oversight and positive user reviews.

In summary, is Remaxima safe? Based on the analysis, it is prudent to conclude that Remaxima exhibits several characteristics of a scam, warranting significant caution from potential investors.

Is REMAXIMA a scam, or is it legit?

The latest exposure and evaluation content of REMAXIMA brokers.

REMAXIMA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

REMAXIMA latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.