Is QX Trading safe?

Pros

Cons

Is QX Trading Safe or a Scam?

Introduction

QX Trading has emerged as a notable player in the forex market, positioning itself as a platform that offers various trading instruments, including currencies, commodities, and cryptocurrencies. As the financial landscape becomes increasingly digital, traders are urged to exercise caution when selecting a broker. The potential for scams is a significant concern in an industry where regulatory oversight can vary widely. This article investigates whether QX Trading is a safe option for traders or if it raises red flags that suggest it may be a scam. We will utilize a comprehensive framework that includes regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, risk assessment, and ultimately provide a conclusion and recommendations.

Regulation and Legitimacy

The regulatory status of a trading platform is paramount in determining its legitimacy. A regulated broker is subject to oversight by financial authorities that enforce strict rules to protect traders. In the case of QX Trading, there is a notable absence of credible regulatory oversight. The broker does not provide any information regarding its regulatory status, which raises concerns about its legitimacy.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The lack of regulation is a significant red flag. Reputable brokers are typically licensed by well-known authorities, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). The absence of such licensing means that QX Trading operates without the protective framework that these regulations provide. This situation can leave traders vulnerable to potential fraud and malpractice.

Company Background Investigation

Understanding the company behind a trading platform is crucial for assessing its credibility. QX Trading, which claims to have been established in recent years, lacks transparency regarding its ownership structure and operational history. The absence of clear information about the company's founders, management team, and operational history raises concerns about its reliability.

The management team's background is particularly important in assessing the broker's credibility. A team with extensive experience in financial markets and a solid track record can instill confidence in traders. Unfortunately, QX Trading does not provide sufficient information about its management, making it challenging to evaluate their expertise and commitment to ethical trading practices.

Moreover, the overall transparency and information disclosure by QX Trading are lacking. Traders should be able to access clear and comprehensive information about the broker's operations, fees, and policies. The absence of such transparency can lead to distrust and hesitation among potential clients.

Trading Conditions Analysis

When evaluating a broker, the overall cost structure and trading conditions are critical factors. QX Trading claims to offer competitive trading fees; however, the lack of clarity regarding these fees is concerning.

Trading Costs Comparison Table

| Fee Type | QX Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific fee information can lead to unexpected costs for traders. If QX Trading employs hidden fees or unusual charges, it could significantly impact the profitability of trades. Furthermore, without a clear commission structure or overnight interest rates, traders may find themselves at a disadvantage, particularly in volatile markets.

Client Fund Safety

The safety of client funds is a primary concern for any trader. QX Trading's website does not provide comprehensive information regarding its fund safety measures. Effective fund protection mechanisms, such as segregated accounts and negative balance protection, are essential for safeguarding traders' investments.

A lack of clarity around these safety measures can be alarming. Traders should expect brokers to maintain strict protocols for fund security, including the segregation of client funds from company operating funds. The absence of such assurances raises questions about the safety of deposits made with QX Trading.

Additionally, any historical issues related to fund safety or disputes should be thoroughly investigated. A broker with a history of unresolved disputes or financial irregularities may pose a higher risk to traders.

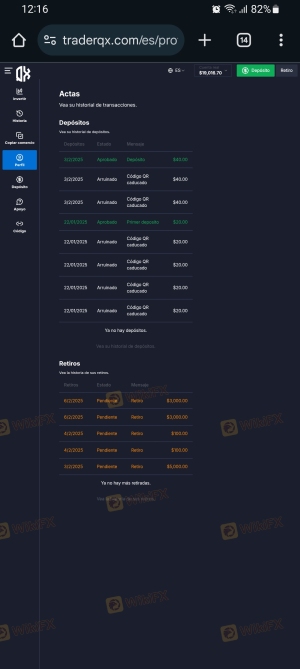

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. QX Trading has received mixed reviews, with several users expressing dissatisfaction regarding their experiences.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | Medium | Average |

| Hidden Fees | High | Poor |

Common complaints include difficulties with withdrawals and unresponsive customer support. Such issues can be detrimental to the trading experience and may indicate a lack of professionalism or operational challenges within the company.

In particular, withdrawal issues are a significant concern. Traders expect to access their funds without undue delay or complications. If a broker consistently fails to address these concerns, it may suggest deeper operational problems.

Platform and Execution

Assessing the trading platform's performance is essential for understanding the overall user experience. QX Trading claims to offer a user-friendly interface; however, details regarding platform stability and execution quality are sparse.

The quality of order execution, including slippage and rejection rates, is also crucial. Traders need assurance that their orders will be executed promptly and at the expected prices. Any signs of manipulation or issues with execution can severely undermine trust in the broker.

Risk Assessment

Engaging with QX Trading involves various risks that traders should be aware of.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of transparency on fund safety measures |

| Customer Support Risk | Medium | Mixed reviews on responsiveness |

Given the high-risk levels associated with QX Trading, traders should exercise caution. It is advisable to conduct thorough research and consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, is QX Trading safe? The evidence suggests that traders should approach this broker with caution. The lack of regulatory oversight, transparency regarding fees, and mixed customer experiences raise significant concerns. While QX Trading may offer some appealing features, the potential risks associated with trading on this platform outweigh the benefits.

For traders seeking safer alternatives, consider brokers that are regulated by reputable authorities and have a proven track record of positive customer experiences. Always prioritize safety and transparency when selecting a trading platform to protect your investments effectively.

Is QX Trading a scam, or is it legit?

The latest exposure and evaluation content of QX Trading brokers.

QX Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

QX Trading latest industry rating score is 1.23, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.23 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.