Is Oclsvg safe?

Business

License

Is OCLSVG Safe or Scam?

Introduction

OCLSVG is a forex broker that has gained attention in the trading community, particularly among those seeking to explore the vast opportunities within the foreign exchange market. As the forex market continues to grow, so does the number of brokers claiming to offer competitive trading conditions and exceptional services. However, it is crucial for traders to exercise caution and thoroughly evaluate any broker before committing their funds. This article aims to provide an in-depth analysis of OCLSVG, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation will be based on data gathered from various reputable sources, including regulatory bodies and user reviews, to ensure a comprehensive assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. OCLSVG is reportedly not regulated by any major financial authority, which raises concerns regarding its operational legitimacy. A lack of regulation can expose traders to higher risks, as unregulated brokers may not adhere to strict financial standards or provide adequate investor protection.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

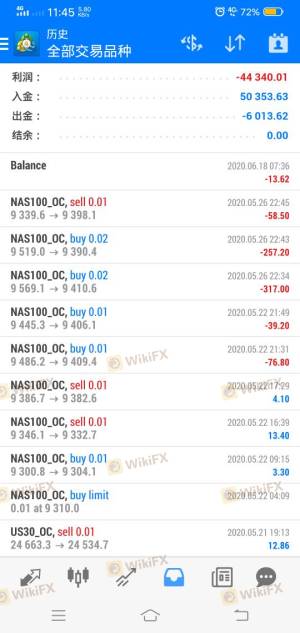

The absence of a regulatory framework means that OCLSVG does not have to comply with industry standards that protect traders, such as segregated accounts and financial transparency. This situation is concerning, as it can lead to potential fraud or mismanagement of funds. Moreover, the broker's suspicious regulatory license and high potential risk score, as noted by sources such as WikiFX, further underscore the need for caution. Traders should be wary of engaging with OCLSVG, given its lack of oversight and the potential for unethical practices.

Company Background Investigation

OCLSVG, operating under the name Orient Capital Limited, has a limited history in the forex market. The broker appears to be relatively new, which can be a red flag for potential investors. A lack of a robust track record can indicate a higher risk of operational issues or even fraud. Furthermore, the ownership structure of OCLSVG is not transparent, making it difficult for traders to assess the integrity of its management team.

The management teams background is crucial in understanding a broker's reliability. Unfortunately, OCLSVG does not provide sufficient information regarding its executives or their professional experience in the financial industry. This lack of transparency can lead to concerns about the broker's accountability and the quality of its services. It is essential for traders to consider brokers with experienced management teams that have a history of ethical practices and sound financial management.

Trading Conditions Analysis

When assessing whether OCLSVG is safe, it is essential to examine its trading conditions, including fees, spreads, and commissions. The broker's fee structure is not well-documented, leading to uncertainty about the costs traders may incur.

| Fee Type | OCLSVG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies (0 - $10) |

| Overnight Interest Range | N/A | 2% - 5% |

The lack of clear information regarding spreads and commissions can be concerning for traders, as hidden fees can significantly impact profitability. Moreover, the absence of competitive rates compared to industry averages raises questions about the broker's pricing policy. Traders should be cautious of any broker that does not provide transparent information about its trading conditions, as this can be indicative of potential issues down the line.

Client Funds Safety

The safety of client funds is paramount when evaluating a forex broker. OCLSVG's approach to fund security is unclear, with no information provided on whether client funds are kept in segregated accounts or if there are any investor protection mechanisms in place.

Traders should be particularly concerned about the lack of details regarding negative balance protection and the measures taken to ensure the safety of their investments. In the event of the broker's insolvency or mismanagement of funds, traders could face significant losses without any recourse. Historical issues or controversies related to fund safety are also absent in OCLSVG's documentation, which could indicate a lack of accountability.

Customer Experience and Complaints

Customer feedback is a valuable tool in assessing the reliability of a broker. Reports from users indicate mixed experiences with OCLSVG, with several complaints highlighting issues related to withdrawal delays and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Customer Support Issues | Medium | Unresponsive |

These complaints suggest that OCLSVG may struggle with maintaining a satisfactory level of customer service, which can be detrimental to traders seeking timely assistance. The severity of the complaints raises concerns about the broker's operational efficiency and dedication to client satisfaction. Traders should be cautious when dealing with a broker that has a history of unresolved complaints and poor customer service.

Platform and Execution

The performance and reliability of a trading platform are critical for a positive trading experience. OCLSVG offers a trading platform that is not well-reviewed, with users reporting issues related to stability and execution quality.

Concerns about order execution, slippage, and rejection rates have been noted, which can significantly affect trading outcomes. If a broker's platform is prone to technical issues or manipulation, it can lead to substantial losses for traders. Therefore, it is essential to consider the platform's performance when determining whether OCLSVG is safe to trade with.

Risk Assessment

Engaging with OCLSVG presents several risks that traders should be aware of. The absence of regulation, unclear trading conditions, and negative customer feedback contribute to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight by major financial authorities |

| Financial Risk | High | Lack of transparency in fees and conditions |

| Operational Risk | Medium | Issues with platform stability and execution |

To mitigate these risks, traders should consider utilizing a regulated broker with a proven track record of reliability and customer satisfaction. Additionally, conducting thorough research and maintaining a cautious approach to trading can help protect investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that OCLSVG may not be a safe option for forex trading. The lack of regulation, unclear trading conditions, and negative customer experiences raise significant concerns about the broker's legitimacy. Traders should exercise caution and consider alternative, more reputable brokers that offer robust regulatory oversight and transparent trading conditions. For those seeking reliable options, brokers regulated by top-tier authorities such as the FCA or ASIC are recommended, as they provide a higher level of investor protection and accountability.

In summary, is OCLSVG safe? The answer appears to lean towards a cautious "no," and traders should be wary of engaging with this broker without further due diligence.

Is Oclsvg a scam, or is it legit?

The latest exposure and evaluation content of Oclsvg brokers.

Oclsvg Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Oclsvg latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.