Is NvestPro safe?

Business

License

Is NvestPro A Scam?

Introduction

NvestPro is a forex broker that has emerged in the competitive landscape of online trading, claiming to offer a variety of trading instruments, including forex and CFDs. As the forex market continues to grow, traders are increasingly seeking reliable brokers to facilitate their trading activities. However, with the proliferation of unregulated and potentially fraudulent brokers, it is crucial for traders to carefully assess the credibility of any broker before committing their funds. This article aims to provide a comprehensive analysis of NvestPro, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of multiple sources, including regulatory disclosures, user reviews, and expert analyses, to ensure a balanced and thorough evaluation.

Regulation and Legitimacy

When evaluating the safety of a forex broker, regulatory status is of paramount importance. A well-regulated broker is more likely to adhere to strict operational standards, which can protect traders' funds. Unfortunately, NvestPro operates without any significant regulatory oversight. Below is a summary of the broker's regulatory information:

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

NvestPro has not disclosed any valid licenses from reputable regulatory bodies. The absence of regulation poses significant risks for traders, as unregulated brokers can engage in practices that may jeopardize client funds. Furthermore, the broker's previous license from the Vanuatu Financial Services Commission (VFSC) has been revoked, raising additional concerns about its legitimacy. Regulatory bodies are designed to protect investors, and the lack of oversight indicates that traders may not have any recourse in the event of disputes or financial losses. Given these factors, it is crucial for traders to question the safety of NvestPro.

Company Background Investigation

NvestPro's company history and ownership structure provide further insights into its credibility. The broker claims to be based in Saint Vincent and the Grenadines, an offshore jurisdiction known for its lenient regulatory framework. The lack of transparency regarding the company's ownership and management team raises red flags. There is limited information available about the individuals behind NvestPro, and the absence of a clear corporate structure can make it difficult for traders to assess the broker's reliability.

Moreover, the company does not provide comprehensive information about its history, which is a common practice among reputable brokers. A transparent broker typically shares details about its founding, mission, and leadership team, allowing potential clients to make informed decisions. The lack of such information regarding NvestPro suggests a potential attempt to obscure its true operational practices. Therefore, the safety of NvestPro remains questionable, as traders may be dealing with an entity that lacks the necessary oversight and accountability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. NvestPro presents various account types with differing minimum deposit requirements and trading costs. However, the overall fee structure appears to be opaque, making it challenging for traders to determine the true cost of trading. Below is a comparison of NvestPro's key trading costs:

| Fee Type | NvestPro | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 2 pips | From 1.5 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

While NvestPro advertises competitive spreads, the fact that it does not clearly outline its commission structure raises concerns. Many reputable brokers provide transparent information about their fees, including commissions and overnight interest rates, allowing traders to make informed choices. Additionally, the lack of clarity surrounding fees could lead to unexpected costs for traders, further questioning the safety of NvestPro.

Client Funds Security

The security of client funds is a critical aspect of any forex broker's operations. NvestPro has not provided adequate information regarding its fund safety measures. A reputable broker typically employs strict policies for fund segregation, ensuring that client funds are kept separate from the company's operational funds. This practice protects traders in the event of financial difficulties faced by the broker.

Moreover, the absence of investor protection schemes, such as compensation funds, amplifies the risks associated with trading with NvestPro. Without these safeguards, traders may find it challenging to recover their funds in the event of a broker insolvency. The lack of transparency regarding these critical aspects further raises doubts about the safety of NvestPro.

Customer Experience and Complaints

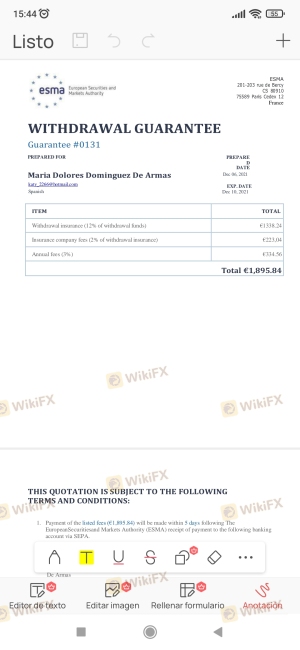

Customer feedback is an essential indicator of a broker's reliability. Reviews of NvestPro reveal a concerning pattern of complaints from users. Many traders have reported issues with withdrawal processes, claiming that their requests were either delayed or denied altogether. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

The frequency and nature of these complaints suggest that NvestPro may not prioritize customer service or transparency. Traders have expressed frustration over the broker's handling of their concerns, indicating a lack of responsiveness. Such patterns are indicative of potential operational issues and may further contribute to the perception that NvestPro is not a trustworthy broker. Therefore, the safety of NvestPro is increasingly called into question.

Platform and Trade Execution

The trading platform's performance is crucial for a positive trading experience. NvestPro claims to offer a user-friendly trading platform; however, user reviews indicate mixed experiences regarding its stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading performance. Additionally, the platform's lack of advanced features and customization options may deter experienced traders from utilizing it effectively.

The potential for platform manipulation is another concern, especially given the broker's unregulated status. A reliable broker should provide a transparent trading environment, free from any practices that could disadvantage traders. Given the mixed feedback regarding NvestPro's platform performance, traders should exercise caution when considering this broker, as the safety of NvestPro is not guaranteed.

Risk Assessment

Engaging with NvestPro carries inherent risks, primarily due to its unregulated status and lack of transparency. Below is a summary of the key risk areas associated with trading with NvestPro:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Safety Risk | High | Lack of fund segregation |

| Customer Service Risk | Medium | Poor response to complaints |

| Platform Risk | Medium | Issues with execution |

To mitigate these risks, traders should consider utilizing only regulated brokers that offer comprehensive client protections. Conducting thorough research and remaining vigilant about potential red flags can help safeguard traders' interests when navigating the forex market.

Conclusion and Recommendations

In conclusion, the evidence gathered indicates that NvestPro operates without proper regulation, lacks transparency, and has a concerning track record of customer complaints. The absence of regulatory oversight raises significant doubts about the safety of NvestPro, making it a potentially risky choice for traders. Given the broker's operational practices, it is advisable for traders to exercise extreme caution and consider alternative options.

For those seeking reliable trading experiences, it is recommended to explore brokers that are well-regulated and have established positive reputations within the industry. These brokers typically offer enhanced security measures, transparent fee structures, and responsive customer support, ensuring a safer trading environment. Ultimately, the choice of a broker should align with individual trading goals and risk tolerance, prioritizing safety and transparency above all else.

Is NvestPro a scam, or is it legit?

The latest exposure and evaluation content of NvestPro brokers.

NvestPro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NvestPro latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.