Is Hmarl safe?

Pros

Cons

Is Hmarl A Scam?

Introduction

Hmarl is a forex broker that positions itself within the competitive landscape of online trading, offering a variety of financial instruments including foreign exchange, investment funds, and loans. As the forex market continues to expand, it becomes increasingly crucial for traders to carefully assess the credibility and reliability of brokers like Hmarl. This article aims to provide a comprehensive analysis of Hmarl, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation is based on a thorough review of available data, including user feedback and expert evaluations, to determine whether Hmarl is a safe option for traders or a potential scam.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the legitimacy of any forex broker. Hmarl claims to operate under the oversight of the Financial Conduct Authority (FCA) in the UK; however, there are significant concerns regarding the authenticity of this regulation. The following table summarizes the key regulatory information associated with Hmarl:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 469112 | United Kingdom | Suspicious Clone |

| ASIC | 129887538 | Australia | No Valid Regulation |

The FCA is known for its stringent regulatory standards, which are designed to protect traders and maintain market integrity. However, reports indicate that Hmarl may be operating as a "clone" of a legitimate FCA-regulated entity. This raises red flags about the broker's true operational legitimacy. Additionally, Hmarl's Australian counterpart, HMA Investments Pty Ltd, has been identified as lacking valid regulation, further complicating its credibility. The absence of robust regulatory oversight can expose traders to significant risks, making it essential to question whether Hmarl is indeed a safe broker.

Company Background Investigation

Hmarl (UK) Global Holdings Limited was incorporated on November 28, 2017, and has since been operating in the financial services sector. The company's registered office is located in London, UK. However, it is noteworthy that the company was dissolved on July 25, 2023, which raises concerns about its operational continuity and reliability. The management team behind Hmarl has not been extensively documented, leading to questions about their qualifications and experience in the trading industry. Transparency is vital for any financial institution, and the lack of accessible information regarding Hmarl's ownership and management structure contributes to the uncertainty surrounding its operations.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is paramount. Hmarl's fee structure appears to be complex, with various charges that may not be immediately clear to potential clients. Below is a comparison of Hmarl's core trading costs against industry averages:

| Fee Type | Hmarl | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not Specified | 1-2 pips |

| Commission Model | Not Specified | $5 per lot |

| Overnight Interest Range | Not Specified | Varies |

The absence of specific information regarding spreads, commissions, and overnight interest rates could indicate a lack of transparency, which is a common characteristic of unreliable brokers. Traders should be wary of hidden fees that could erode their profits and affect their trading experience. It is crucial to thoroughly read the terms and conditions before engaging with Hmarl.

Customer Funds Safety

The safety of customer funds is a crucial aspect of any trading platform. Hmarl claims to implement various security measures to protect client deposits. However, the effectiveness of these measures remains questionable given the broker's regulatory status. A detailed analysis of Hmarl's fund safety protocols reveals potential gaps in their approach:

- Segregation of Funds: It is unclear whether Hmarl segregates client funds from its operational funds, a practice that is vital for ensuring that client money is protected in the event of company insolvency.

- Investor Protection: There is no clear indication that Hmarl offers any investor protection schemes, which are typically mandated by reputable regulatory authorities.

- Negative Balance Protection: The absence of a negative balance protection policy could leave traders vulnerable to losing more than their initial investment during volatile market conditions.

These factors collectively raise concerns about whether Hmarl is genuinely committed to safeguarding customer funds, making it essential for traders to exercise caution.

Customer Experience and Complaints

Customer feedback plays a significant role in understanding the overall experience provided by a broker. Reviews of Hmarl indicate a pattern of complaints that suggest potential issues with their service. The following table summarizes the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Fraudulent Practices | High | Ignored |

| Poor Customer Support | Medium | Slow |

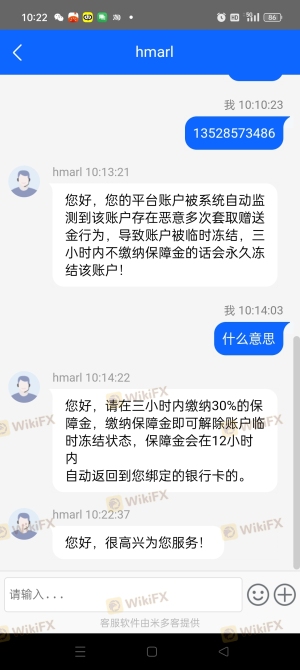

Many users have reported difficulties in withdrawing their funds, often citing requests for additional payments or taxes before they could access their money. Such practices are alarming and suggest that Hmarl may not be operating ethically. Additionally, the lack of responsiveness from customer support further exacerbates the situation, leaving traders feeling frustrated and unsupported.

Platform and Execution

The trading platform provided by Hmarl is another critical factor for traders to consider. While the broker claims to offer a user-friendly interface and access to various trading tools, the actual performance of the platform has been questioned. Issues such as order execution quality, slippage, and potential manipulation have been reported by users. Traders have expressed concerns about experiencing significant slippage during volatile market conditions, which could lead to unexpected losses.

Risk Assessment

Engaging with Hmarl carries certain risks that potential traders should be aware of. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspicions of being a clone broker |

| Fund Safety | High | Lack of clear fund protection measures |

| Customer Support | Medium | Poor responsiveness to client inquiries |

| Trading Conditions | Medium | Lack of transparency in fees and spreads |

To mitigate these risks, traders should conduct thorough research and consider starting with a small deposit if they choose to engage with Hmarl.

Conclusion and Recommendations

In conclusion, the evidence suggests that Hmarl may not be a safe broker for traders. The concerns regarding its regulatory status, customer complaints, and transparency issues raise significant red flags. While Hmarl offers a variety of financial services, the potential risks associated with trading on this platform cannot be overlooked.

Traders should exercise caution and consider alternative options that are well-regulated and have a proven track record of reliability. Reliable brokers such as eToro, IG, and Forex.com are recommended as safer alternatives for traders seeking a trustworthy trading environment. Ultimately, it is essential for traders to prioritize their safety and conduct due diligence before committing their funds to any trading platform.

Thus, when asking the question, "Is Hmarl safe?" the answer leans towards caution and skepticism.

Is Hmarl a scam, or is it legit?

The latest exposure and evaluation content of Hmarl brokers.

Hmarl Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hmarl latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.