Is Avatrade safe?

Pros

Cons

Is AvaTrade Safe or a Scam?

Introduction

AvaTrade, founded in 2006 and headquartered in Dublin, Ireland, has established itself as a prominent player in the online forex and CFD trading market. As a broker that offers a wide range of trading instruments, including forex, commodities, stocks, and cryptocurrencies, AvaTrade appeals to both novice and experienced traders. However, with the increasing number of online trading platforms, it is crucial for traders to carefully evaluate the reliability and safety of their chosen broker. This article aims to investigate whether AvaTrade is a scam or a safe trading platform, utilizing various sources and reviews to form a comprehensive assessment.

Regulation and Legitimacy

AvaTrade operates under the supervision of several regulatory authorities, which is a critical factor in determining its legitimacy. Regulatory oversight ensures that brokers adhere to strict standards of conduct, protecting traders' interests. Below is a summary of AvaTrade's regulatory status:

| Regulatory Body | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Central Bank of Ireland | C53877 | EU | Verified |

| Australian Securities and Investments Commission (ASIC) | 406684 | Australia | Verified |

| Financial Services Authority (FSA) | 1662 | Japan | Verified |

| Financial Sector Conduct Authority (FSCA) | 45984 | South Africa | Verified |

| British Virgin Islands Financial Services Commission | N/A | BVI | Verified |

AvaTrade is regulated in multiple jurisdictions, including the EU, Australia, Japan, and South Africa. This multi-regulatory framework is a strong indicator of its commitment to compliance and transparency. The broker has maintained a relatively clean compliance history, with no significant regulatory sanctions reported. This regulatory structure enhances the safety of trading with AvaTrade, making it a trustworthy option for traders.

Company Background Investigation

AvaTrade was established with the goal of providing a user-friendly trading experience for retail traders. Over the years, it has expanded its services to accommodate a diverse clientele, including institutional investors. The ownership structure of AvaTrade includes a team of experienced financial professionals, which contributes to its credibility in the industry.

The management team at AvaTrade has extensive backgrounds in finance and trading, which bolsters the company's reputation for reliability. AvaTrade's commitment to transparency is evident in its comprehensive disclosure of trading conditions, fees, and regulatory compliance. The broker provides detailed information about its operations, ensuring that potential clients have access to all necessary information before making a decision.

Trading Conditions Analysis

AvaTrade's trading conditions are competitive, offering various instruments with reasonable costs. The overall fee structure includes spreads, commissions, and overnight financing fees. Below is a comparison of AvaTrade's core trading costs:

| Fee Type | AvaTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.9 pips | 1.2 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | Variable | Variable |

AvaTrade does not charge commissions on trades, which is advantageous for traders looking to minimize costs. However, it does impose an inactivity fee of $50 after three months of non-use, which could be viewed as a disadvantage for infrequent traders. Overall, AvaTrade's trading conditions are favorable compared to the industry average, making it an attractive option for many traders.

Client Fund Security

Client fund security is paramount when assessing whether AvaTrade is safe. The broker employs several measures to ensure the safety of traders' funds. AvaTrade segregates client funds into separate accounts, ensuring that they are not used for operational expenses. Additionally, the broker offers negative balance protection, which means that clients cannot lose more than their deposited amount, providing an extra layer of security during volatile market conditions.

AvaTrade's commitment to financial security is further reinforced by its compliance with anti-money laundering (AML) regulations. The broker has not faced any significant security breaches or controversies regarding fund safety, which enhances its reputation as a reliable trading platform.

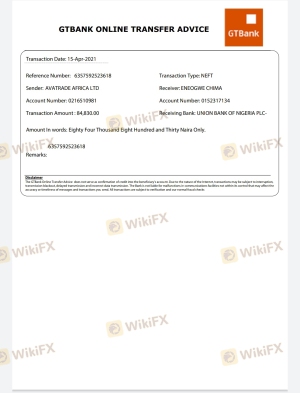

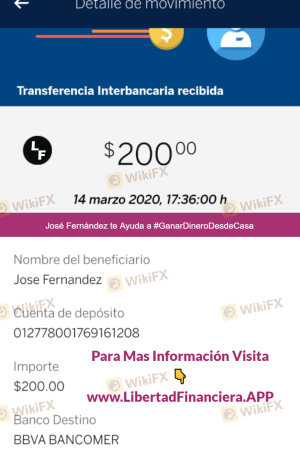

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating AvaTrade's reliability. While many users report positive experiences, there are also common complaints regarding withdrawal times and customer service responsiveness. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Mixed responses |

| Customer Support | High | Often slow |

| Inactivity Fees | Low | Clearly communicated |

Typical case studies reveal that while some clients have experienced delays in processing withdrawals, the majority of users have received their funds within the expected timeframe. However, the quality of customer service has been a recurring issue, with some users reporting slow response times and inadequate support. These concerns should be taken into account when considering whether AvaTrade is safe.

Platform and Trade Execution

The performance of AvaTrade's trading platforms is crucial for user experience. AvaTrade offers several platforms, including MetaTrader 4 and 5, as well as its proprietary AvaTrade Go app. Users generally report that the platforms are stable and user-friendly, allowing for efficient trade execution.

The execution quality is generally high, with low slippage rates reported during normal market conditions. However, some traders have noted instances of order rejections during high volatility, which could impact trading outcomes. Overall, AvaTrade's platform performance aligns with industry standards, contributing positively to the trading experience.

Risk Assessment

When evaluating whether AvaTrade is safe, it is essential to consider the risks involved in trading with the broker. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated in multiple jurisdictions |

| Operational Risk | Medium | Occasional complaints about service quality |

| Market Risk | High | Trading involves significant risks, especially with leverage |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts to practice strategies, and only trade with funds they can afford to lose.

Conclusion and Recommendations

In conclusion, AvaTrade appears to be a legitimate and regulated broker, with no significant evidence suggesting it is a scam. Its multi-regulatory framework, competitive trading conditions, and commitment to client fund security contribute to its reputation as a reliable trading platform. However, potential users should remain cautious, particularly regarding customer service and withdrawal experiences.

For traders seeking a trustworthy broker, AvaTrade is a solid option, but it may not be the best fit for everyone. Beginners may find the educational resources helpful, while experienced traders can benefit from the advanced trading tools available. For those who prioritize customer service and faster withdrawal processes, alternative brokers such as IG or eToro may be worth considering.

Overall, if you are asking, "Is AvaTrade safe?" the evidence suggests that it is a reputable broker, but as with any trading platform, due diligence is essential.

Is Avatrade a scam, or is it legit?

The latest exposure and evaluation content of Avatrade brokers.

Avatrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Avatrade latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.