Is NEW KNIGHT GROUP LIMITED safe?

Business

License

Is New Knight Group Limited A Scam?

Introduction

New Knight Group Limited positions itself as an online trading broker within the forex market, claiming to provide a range of trading instruments including foreign currencies, commodities, and indices. As the allure of forex trading continues to attract both novice and experienced traders alike, it becomes increasingly crucial for individuals to carefully assess the credibility and safety of their chosen brokers. In an industry rife with scams and fraudulent practices, understanding the regulatory landscape and company practices is vital to safeguarding one's investments.

This article investigates the legitimacy of New Knight Group Limited through a comprehensive evaluation framework that encompasses regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. By synthesizing data from multiple reputable sources, we aim to provide a balanced view on whether New Knight Group Limited is safe or if it operates as a potential scam.

Regulatory and Legality

The regulatory status of a trading broker is a fundamental aspect that dictates its legitimacy and operational security. New Knight Group Limited claims to be based in Australia, asserting compliance with local financial regulations. However, a deeper investigation reveals a lack of credible regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Australian Securities and Investments Commission (ASIC) | N/A | Australia | Not Registered |

New Knight Group Limited does not appear in ASIC's registry, raising significant concerns about its operational legitimacy. The absence of regulation implies that the broker is not subject to the stringent oversight that protects traders from malpractice. Additionally, claims of having branches in the United States, Vanuatu, and Hong Kong further complicate its regulatory standing, as no valid licenses can be traced in these jurisdictions either.

The quality of regulation is paramount; without it, brokers can mismanage client funds, engage in fraudulent practices, or disappear without notice. The lack of a regulatory framework around New Knight Group Limited suggests that it is not safe for traders to engage with this broker.

Company Background Investigation

New Knight Group Limited presents a somewhat vague corporate history, claiming to have been established in 2007. However, the details surrounding its ownership structure and management team remain obscure. The absence of publicly available information about the company's founders or executives raises red flags regarding its transparency.

A reputable broker typically provides detailed information about its management team, including their qualifications and industry experience. In the case of New Knight Group Limited, the lack of such information can be interpreted as a tactic to obscure the truth about its operations. Transparency is critical in the financial services industry, as it fosters trust and accountability.

Given that New Knight Group Limited has not demonstrated a commitment to transparency, it raises the question of whether New Knight Group Limited is safe for potential investors. Without a clear understanding of the individuals behind the broker, traders may be exposing themselves to unnecessary risks.

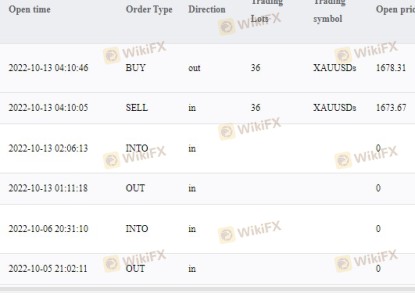

Trading Conditions Analysis

A thorough evaluation of trading conditions is essential to understanding the overall cost of trading with a broker. New Knight Group Limited requires a minimum deposit of $1,000, which is significantly higher than the industry average of $100 to $250. Such a high entry barrier can deter novice traders and indicates that the broker may be prioritizing profit over accessibility.

| Fee Type | New Knight Group Limited | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread of 3 pips on major currency pairs is also notably wider than what is typically offered by reputable brokers, which usually hover around 1 to 2 pips. This disparity suggests that trading costs may be inflated, which is a common characteristic of less reputable brokers.

Furthermore, the absence of a clear commission structure and the lack of transparency regarding overnight interest rates further complicate the cost analysis for traders. This leads to the conclusion that New Knight Group Limited is not safe for traders seeking fair and transparent trading conditions.

Client Fund Security

The safety of client funds is a critical concern when evaluating a broker. New Knight Group Limited claims to implement various measures to protect client funds; however, these assertions lack substantiation. A legitimate broker typically segregates client funds in separate bank accounts to ensure that they are not misused.

Without such measures in place, traders are at risk of losing their investments if the broker faces financial difficulties. Additionally, the absence of investor protection schemes, which are common in regulated environments, means that clients have little recourse in the event of a dispute or financial loss.

Given the lack of clear information regarding fund security, it is reasonable to assert that New Knight Group Limited is not safe for traders who prioritize the protection of their investments.

Customer Experience and Complaints

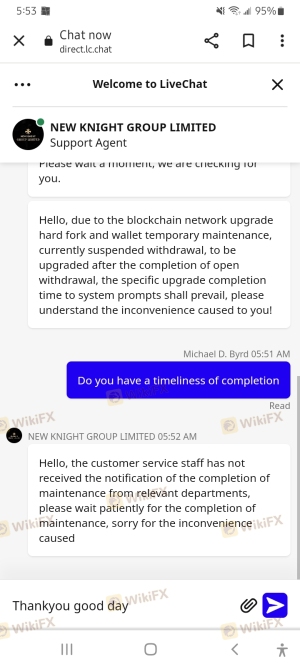

Customer feedback is a vital indicator of a broker's reliability and service quality. Many reviews and testimonials regarding New Knight Group Limited highlight significant dissatisfaction among users, particularly concerning withdrawal issues and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | High | Poor |

| Lack of Communication | Medium | Poor |

Common complaints include difficulties in withdrawing funds, with many users reporting that their accounts were blocked or that they were required to pay excessive fees to access their money. The company's response to these complaints has been largely inadequate, leading to an erosion of trust among clients.

Several case studies reveal a pattern of users being lured into investing more money under the guise of profitable trading opportunities, only to find themselves unable to retrieve their funds once they attempt to withdraw. This pattern strongly indicates that New Knight Group Limited is unsafe and potentially operates as a scam.

Platform and Trade Execution

The trading platform offered by New Knight Group Limited is touted as being user-friendly and equipped with advanced features. However, the actual performance of the platform raises concerns. Users have reported issues with trade execution, including slippage and order rejections, which can severely impact trading outcomes.

Moreover, any signs of platform manipulation, such as artificially inflating prices or restricting access to trading tools, would further indicate that the broker is not operating in good faith. A reliable trading environment is essential for traders to feel confident in their strategies and investments.

Given these concerns, it is reasonable to question whether New Knight Group Limited is safe for conducting trades in the forex market.

Risk Assessment

Engaging with New Knight Group Limited presents several risks that potential traders should consider. The lack of regulation, high trading costs, and negative customer experiences culminate in a concerning risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Security | High | Lack of fund segregation and investor protection. |

| Customer Service | Medium | Poor response to complaints and withdrawal issues. |

To mitigate these risks, it is advisable for traders to conduct thorough due diligence before engaging with any broker. Seeking out regulated alternatives and ensuring a clear understanding of fee structures can help protect against potential losses.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that New Knight Group Limited is not safe for traders. The absence of regulation, high trading costs, poor customer experiences, and a lack of transparency all point to significant risks associated with this broker.

For traders seeking a reliable and trustworthy trading environment, it is recommended to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some reputable options include brokers regulated by the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

Ultimately, exercising caution and conducting thorough research are paramount in the quest for a secure trading experience in the forex market.

Is NEW KNIGHT GROUP LIMITED a scam, or is it legit?

The latest exposure and evaluation content of NEW KNIGHT GROUP LIMITED brokers.

NEW KNIGHT GROUP LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NEW KNIGHT GROUP LIMITED latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.