Neuko 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Neuko review reveals concerning findings about this forex broker's operations and reliability. With an overall rating of 1.00 out of 10, Neuko shows very poor performance in all areas we checked. The broker lacks essential regulatory oversight, with a licensing index of 0. This means no financial authorities have given them permission to operate. User feedback consistently shows negative experiences. This highlights major problems with the broker's service delivery and operational standards.

The primary characteristics of Neuko include a complete absence of regulatory information and extremely poor user experience ratings. The broker fails to provide clear information about its licensing, operational procedures, or safety measures. This raises serious red flags for potential traders. Based on available information, this broker may only appeal to traders who place minimal emphasis on regulatory compliance and safety measures. Even such traders should exercise extreme caution when considering this platform.

Important Disclaimer

Regional Entity Differences: Trading conditions and legal frameworks may vary significantly across different jurisdictions. Users should be aware that regulatory environments, available services, and legal protections differ substantially between regions. What applies in one location may not be relevant in another.

Review Methodology: This evaluation is based on publicly available information, user feedback, and industry data. The assessment has not involved direct testing or on-site verification of the broker's services. Traders should conduct their own due diligence before making any trading decisions.

Rating Framework

Broker Overview

Neuko operates as a forex broker in an increasingly competitive market. Specific details about its establishment date and corporate background remain notably absent from available documentation. The lack of clear company information immediately raises concerns about the broker's legitimacy and operational standards. Without clear founding details or corporate history, potential clients cannot properly assess the broker's experience level or track record in the financial services industry.

The company's business model and operational structure are not clearly defined in available materials. This represents a significant transparency deficit. Professional forex brokers typically provide comprehensive information about their corporate structure, management team, and business approach. This Neuko review finds that such fundamental information is missing. This makes it impossible to evaluate the broker's strategic direction or operational competency.

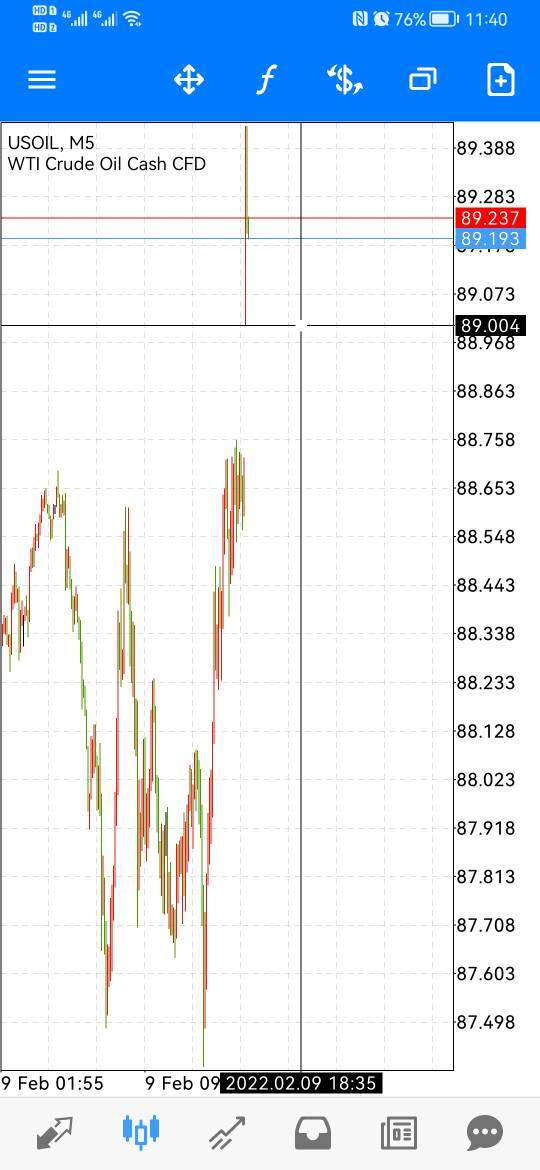

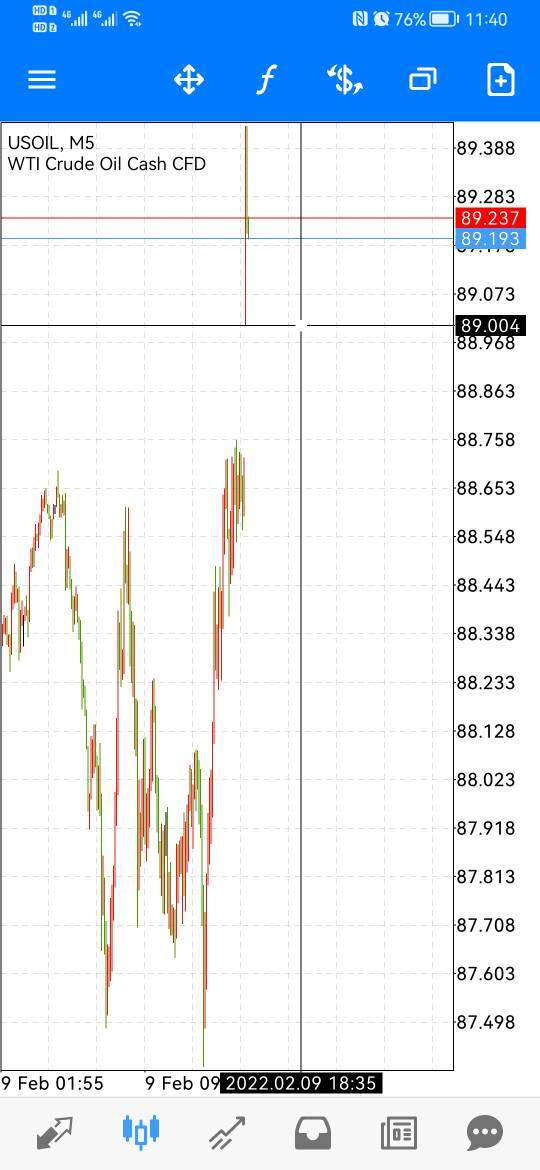

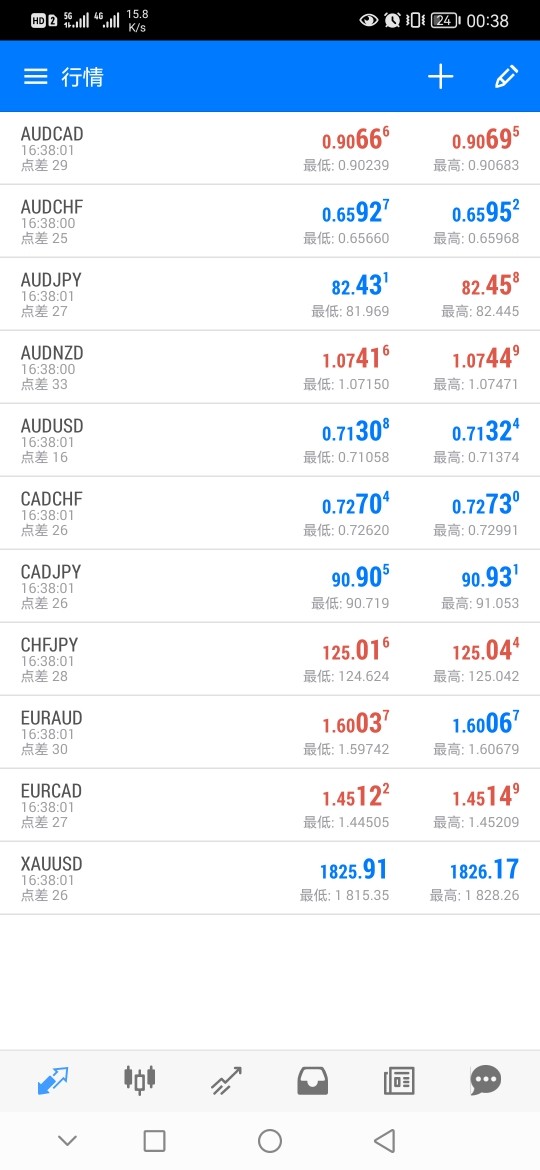

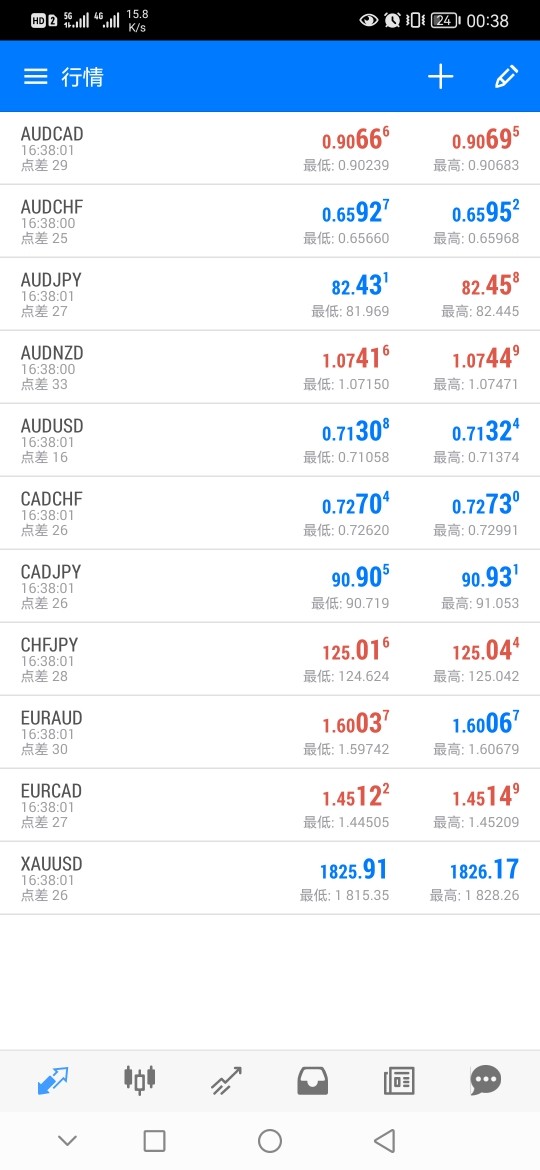

Regarding trading infrastructure, available information does not specify which trading platforms Neuko supports or what asset classes are available for trading. The absence of clear platform specifications suggests either poor service offerings or poor communication of available services. Similarly, no information is available about the broker's regulatory status or oversight by recognized financial authorities. This represents a critical gap in essential safety information that professional traders require.

Regulatory Status: No specific regulatory jurisdictions or licensing information is available in current documentation. The licensing index of 0 indicates a complete absence of verifiable regulatory oversight. This is extremely concerning for any financial services provider.

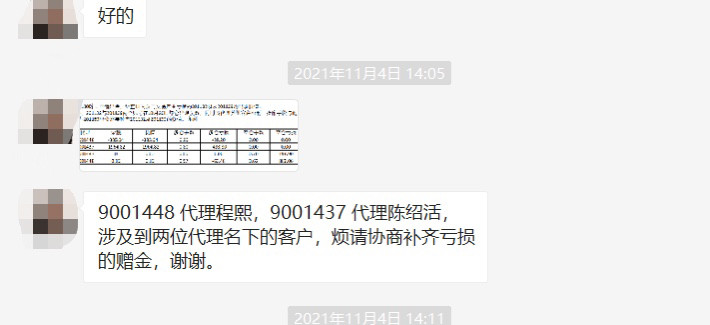

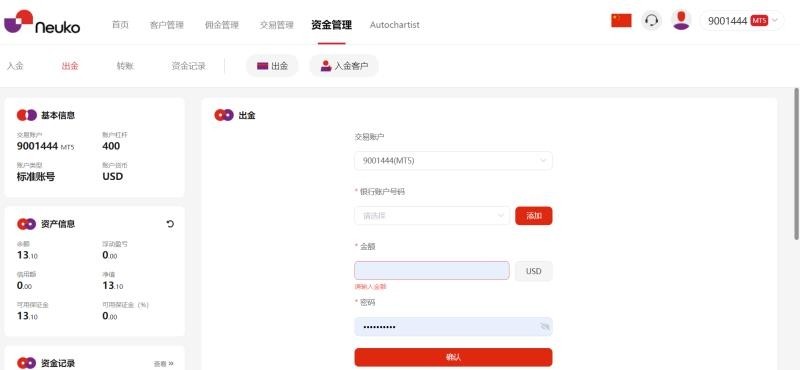

Deposit and Withdrawal Methods: Available materials do not specify accepted payment methods, processing times, or associated fees for deposits and withdrawals. This represents a significant information gap.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available documentation. This prevents potential clients from understanding entry-level requirements.

Promotional Offers: No information about bonuses, promotional campaigns, or special offers is available. This suggests either no promotional activities or poor marketing communication.

Tradeable Assets: The range of available trading instruments, including forex pairs, commodities, indices, or other assets, is not specified in current materials.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is notably absent from available documentation. This lack of pricing transparency makes it impossible for traders to assess the true cost of trading with this broker.

Leverage Options: Maximum leverage ratios and margin requirements are not specified. This prevents traders from understanding their potential exposure levels.

Platform Selection: No information is available about supported trading platforms, mobile applications, or web-based trading interfaces.

Geographic Restrictions: Specific country restrictions or regional limitations are not clearly outlined in available materials.

Customer Support Languages: The range of supported languages for customer service is not specified in current documentation.

This Neuko review highlights the concerning lack of essential information that professional traders require to make informed decisions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by Neuko receive the lowest possible rating due to a complete lack of available information about account types, features, and requirements. Professional forex brokers typically offer multiple account tiers designed to accommodate different trader profiles, from beginners to institutional clients. However, available documentation provides no details about Neuko's account structure. This makes it impossible to assess whether the broker offers appropriate options for different trading styles and experience levels.

Minimum deposit requirements, which are fundamental to account accessibility, are not disclosed in any available materials. This information gap prevents potential clients from understanding the financial commitment required to begin trading. Additionally, the account opening process, verification requirements, and timeline for account activation are not documented. This suggests either poor operational procedures or poor communication of essential service details.

Special account features that professional traders often require, such as Islamic accounts for Shariah-compliant trading, VIP accounts with enhanced services, or demo accounts for strategy testing, are not mentioned in available materials. The absence of such offerings, or at least information about them, indicates either limited service diversity or poor marketing communication.

This Neuko review finds that the complete lack of account condition transparency makes it impossible for potential clients to make informed decisions about account selection. This represents a fundamental failure in basic service communication standards expected from professional financial services providers.

The trading tools and educational resources category receives the minimum rating due to the complete absence of information about available analytical tools, educational materials, or trading support resources. Professional forex brokers typically provide comprehensive trading tools including technical analysis indicators, economic calendars, market news feeds, and advanced charting capabilities. However, no such offerings are documented for Neuko.

Research and analysis resources, which are essential for informed trading decisions, appear to be either non-existent or poorly communicated. Professional traders rely on market analysis, expert commentary, and research reports to guide their trading strategies. The absence of such resources significantly limits the broker's value proposition for serious traders who require comprehensive market intelligence.

Educational resources, particularly important for newer traders, are not mentioned in available documentation. Quality brokers typically offer webinars, trading guides, video tutorials, and other educational content to support client development. The lack of such resources suggests either minimal commitment to client education or poor communication of available learning opportunities.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, is not addressed in available materials. This represents a significant limitation for traders who rely on automated strategies or systematic trading approaches.

Customer Service and Support Analysis (Score: 1/10)

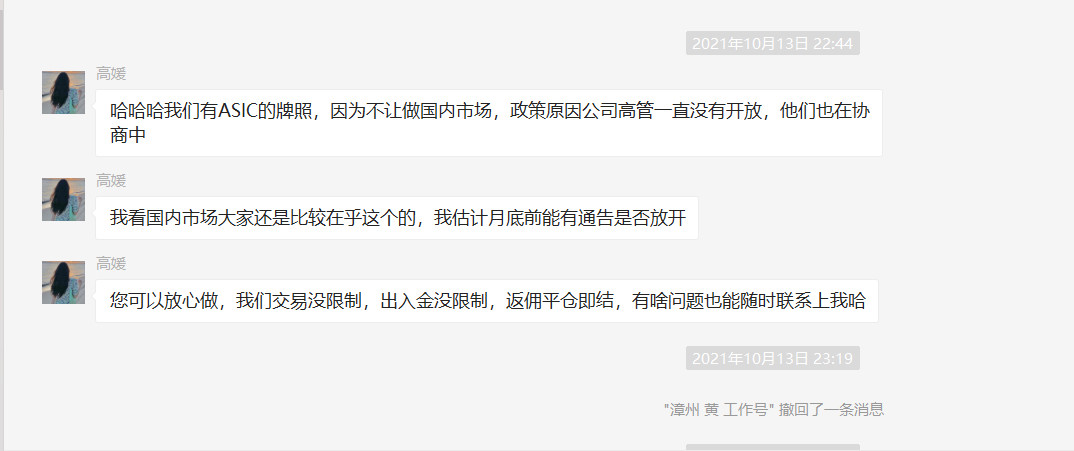

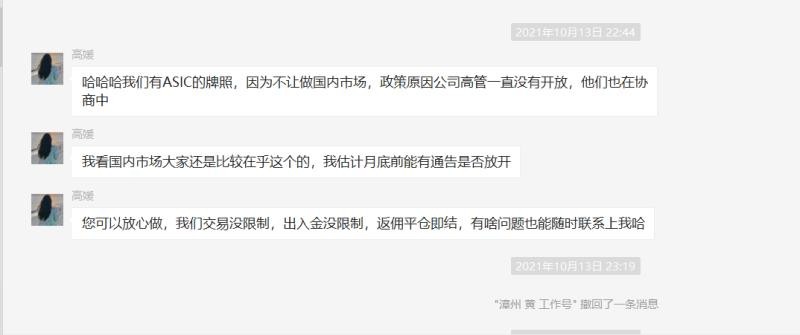

Customer service capabilities receive the lowest possible rating due to the complete absence of information about support channels, availability, and service quality standards. Professional forex brokers typically maintain multiple communication channels including live chat, phone support, email assistance, and often social media engagement. However, no specific contact methods or support channels are documented for Neuko.

Response time commitments, which are crucial for time-sensitive trading issues, are not specified in available materials. Professional traders often require immediate assistance for account issues, technical problems, or trading disputes. The absence of clear response time standards suggests either poor service level commitments or poor communication of support capabilities.

Service quality metrics, such as customer satisfaction ratings, support team qualifications, or problem resolution procedures, are not available in current documentation. This lack of transparency about service standards makes it impossible for potential clients to assess the likely quality of support they might receive.

Multi-language support capabilities, essential for serving international clients, are not specified in available materials. Additionally, customer service hours and timezone coverage are not documented. This prevents clients from understanding when support assistance might be available.

Trading Experience Analysis (Score: 1/10)

The trading experience evaluation receives the minimum rating due to insufficient information about platform stability, execution quality, and overall trading environment. Professional forex trading requires reliable platform performance, fast order execution, and minimal technical disruptions. However, no performance metrics or stability information is available for Neuko's trading infrastructure.

Order execution quality, including execution speeds, slippage rates, and fill quality, is not documented in available materials. These factors are crucial for trading profitability, particularly for scalping strategies or high-frequency trading approaches. The absence of execution quality data prevents traders from assessing whether the broker can meet their performance requirements.

Platform functionality and feature completeness are not described in current documentation. Professional traders require advanced charting tools, multiple order types, risk management features, and comprehensive market data. Without clear information about platform capabilities, it's impossible to determine whether Neuko can support sophisticated trading strategies.

Mobile trading capabilities, increasingly important for active traders, are not addressed in available materials. The absence of mobile platform information suggests either limited mobile offerings or poor communication of available mobile solutions.

This Neuko review finds that the lack of trading experience information represents a fundamental transparency failure that prevents meaningful evaluation of the broker's trading environment quality.

Trust and Safety Analysis (Score: 1/10)

Trust and safety receive the lowest possible rating primarily due to the licensing index of 0, indicating no verifiable regulatory oversight from recognized financial authorities. Regulatory compliance is the foundation of broker trustworthiness, providing legal frameworks for client protection, dispute resolution, and operational standards. The absence of regulatory authorization represents the most serious concern identified in this evaluation.

Fund safety measures, such as client fund segregation, deposit insurance, or compensation schemes, are not documented in available materials. Professional brokers typically maintain client funds in segregated accounts at tier-1 banks and participate in investor compensation programs. The lack of such safety information raises serious concerns about client fund protection.

Corporate transparency, including management team disclosure, financial reporting, and operational transparency, is notably absent from available documentation. Legitimate financial services providers typically maintain high transparency standards to build client confidence and meet regulatory requirements.

Industry reputation and third-party validation are not evident in available materials. Professional brokers often receive industry recognition, regulatory commendations, or independent certifications that validate their operational quality and compliance standards.

User Experience Analysis (Score: 1/10)

User experience receives the minimum rating based on the overall evaluation score of 1.00, indicating widespread user dissatisfaction with the broker's services. This extremely low rating suggests fundamental problems with service delivery, platform functionality, or customer support that significantly impact user satisfaction.

Interface design and usability information is not available in current documentation, preventing assessment of platform user-friendliness or navigation efficiency. Professional trading platforms should offer intuitive interfaces that support efficient trading workflows and minimize user confusion.

Registration and verification processes are not documented, making it impossible to assess the ease of account setup or the efficiency of client onboarding procedures. Streamlined onboarding processes are essential for positive initial user experiences.

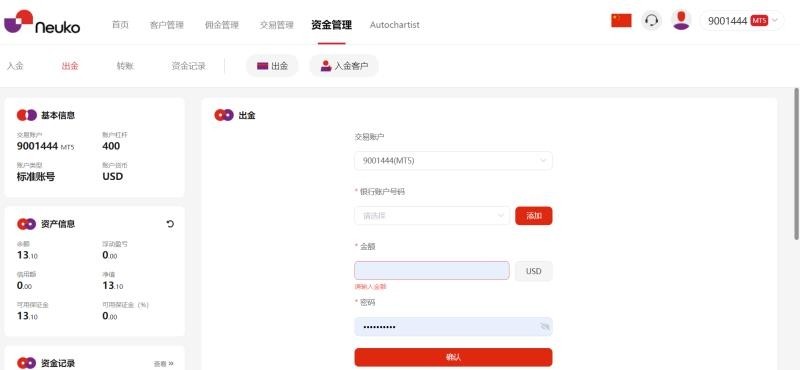

Fund operation experiences, including deposit and withdrawal efficiency, are not addressed in available materials. Smooth fund operations are crucial for user satisfaction and confidence in broker reliability.

Common user complaints or satisfaction metrics are not available in current documentation, preventing identification of specific problem areas or user satisfaction trends that might inform potential clients about likely experience quality.

Conclusion

This comprehensive Neuko review reveals significant concerns about the broker's operations, transparency, and regulatory compliance. With an overall rating of 1.00 out of 10, Neuko demonstrates fundamental deficiencies across all evaluated criteria. This makes it unsuitable for most traders seeking reliable forex trading services.

The broker is particularly inappropriate for novice traders who require educational support, regulatory protection, and reliable customer service. Experienced traders seeking professional-grade services, advanced tools, and regulatory security should also avoid this broker due to the numerous transparency and compliance issues identified.

The primary disadvantages include complete lack of regulatory oversight, absence of essential service information, poor user satisfaction ratings, and fundamental transparency deficits. No significant advantages were identified during this evaluation. This reinforces the recommendation to seek alternative brokers with proper regulatory authorization and transparent operational standards.