Is Metrictradingfx safe?

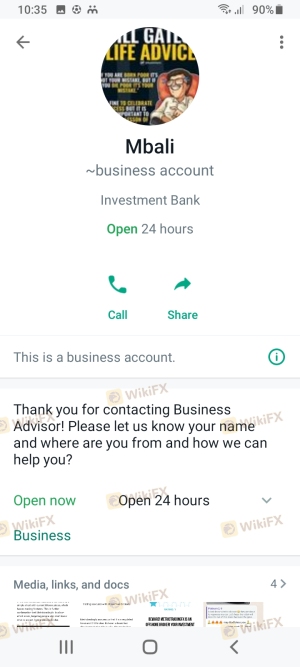

Business

License

Is MetrictradingFX A Scam?

Introduction

MetrictradingFX positions itself as an online forex and CFD brokerage, aiming to attract traders with promises of competitive trading conditions and a diverse range of financial instruments. However, the forex market is notorious for its high risks and the presence of unregulated brokers that can jeopardize traders' funds. As a result, it is crucial for traders to conduct thorough evaluations of any brokerage before committing their capital. This article investigates the legitimacy of MetrictradingFX, examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The findings are based on a review of multiple credible sources, including regulatory bodies, user reviews, and expert analyses.

Regulation and Legitimacy

A broker's regulatory status is a vital indicator of its legitimacy and reliability. Regulatory bodies enforce stringent standards that protect traders, ensuring that brokers operate fairly and transparently. In the case of MetrictradingFX, the broker claims to be regulated by the fictitious "US Financial Services Authority" and the Malta Financial Services Authority (MFSA). However, a thorough investigation reveals that there is no such authority in the United States, and MetrictradingFX is not listed in the MFSA registry.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| US Financial Services Authority | N/A | United States | Not Applicable |

| MFSA | N/A | Malta | Not Listed |

The absence of a valid regulatory framework raises significant concerns regarding the safety of funds deposited with MetrictradingFX. Traders should be aware that without proper oversight, the broker is not obligated to adhere to any consumer protection laws, which could lead to potential fraud or mismanagement of funds.

Company Background Investigation

MetrictradingFX is operated by a company named P240 Ltd, which claims to have been founded in 2021. However, the lack of transparency regarding its ownership structure and management team is alarming. The website does not provide sufficient information about the individuals behind the broker, which is a common red flag in the industry. Brokers that operate under anonymity often lack accountability, making it challenging for traders to seek recourse in case of disputes.

The company's brief history and the absence of any notable achievements or regulatory compliance records further emphasize the potential risks associated with trading with MetrictradingFX. Transparency is a key factor in building trust, and the lack thereof raises questions about the broker's intentions and operational integrity.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for traders looking to optimize their trading strategies. MetrictradingFX has set a minimum deposit requirement of $500, which is relatively high compared to industry standards. This could deter new traders who wish to start with smaller amounts. Additionally, the broker claims to offer various account types with different features, but there is little clarity on the actual costs associated with trading.

| Fee Type | MetrictradingFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.9 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding spreads, commissions, and overnight interest rates is concerning. Traders may encounter unexpected costs that could significantly impact their profitability. Moreover, the absence of clear information on trading conditions could indicate that the broker is trying to obfuscate potentially unfavorable terms.

Client Fund Safety

The safety of client funds is paramount in forex trading. Regulated brokers are typically required to maintain segregated accounts, ensuring that traders' funds are kept separate from the broker's operating funds. Unfortunately, MetrictradingFX does not provide any information regarding its fund safety measures, such as the segregation of client accounts or negative balance protection.

Without these crucial protections, traders risk losing more than their initial investment. Moreover, the lack of historical data on fund security raises concerns about potential past incidents of fraud or mismanagement. Traders must exercise caution and consider the implications of investing with a broker that does not prioritize client fund safety.

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing a broker's reliability. Unfortunately, reviews for MetrictradingFX have been predominantly negative. Users have reported issues related to withdrawal requests being ignored or delayed, which is a common complaint among unregulated brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Access Problems | Medium | Poor |

One notable case involved a trader who reported being unable to withdraw their funds after multiple attempts. The broker's customer support was unresponsive, leaving the trader feeling frustrated and helpless. Such experiences highlight the potential risks associated with using MetrictradingFX, raising the question: Is MetrictradingFX safe for traders?

Platform and Trade Execution

The performance of the trading platform is another critical aspect to consider. MetrictradingFX claims to offer the popular MetaTrader 5 (MT5) platform; however, users have reported difficulties in accessing the platform, with many experiencing connectivity issues.

Additionally, there are concerns regarding order execution quality, including high slippage rates and instances of rejected orders. These factors can significantly impact trading outcomes, especially for those who rely on timely execution for their strategies.

Risk Assessment

Trading with MetrictradingFX presents several risks that traders should be aware of. The lack of regulation, transparency, and poor customer feedback all contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight. |

| Fund Safety Risk | High | No information on fund segregation or protection. |

| Operational Risk | Medium | Poor platform performance and customer support. |

To mitigate these risks, traders should consider conducting thorough research and possibly seek alternative, regulated brokers with a proven track record in the industry.

Conclusion and Recommendations

In conclusion, the evidence gathered regarding MetrictradingFX strongly suggests that it poses significant risks to traders. The absence of valid regulation, poor customer feedback, and lack of transparency raise serious concerns about the broker's legitimacy. Therefore, it is prudent for traders to exercise caution when considering this broker.

For those looking to engage in forex trading, it is advisable to seek out well-regulated brokers with transparent practices and positive customer reviews. Some reliable alternatives include brokers like OctaFX and FP Markets, which have established reputations in the industry.

Ultimately, it is essential to prioritize safety and reliability in forex trading. So, is MetrictradingFX safe? The overwhelming consensus is that it is not, and traders should remain vigilant when navigating the forex market.

Is Metrictradingfx a scam, or is it legit?

The latest exposure and evaluation content of Metrictradingfx brokers.

Metrictradingfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Metrictradingfx latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.