Regarding the legitimacy of MC Trading forex brokers, it provides CYSEC, FSA and WikiBit, .

Is MC Trading safe?

Business

License

Is MC Trading markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Go Markets Ltd

Effective Date:

2017-04-25Email Address of Licensed Institution:

compliance@gomarkets.euSharing Status:

No SharingWebsite of Licensed Institution:

www.gomarkets.eu, www.gomarkets.com/en-euExpiration Time:

--Address of Licensed Institution:

Σπύρου Κυπριανού 38, Κτήριο CCS, 2ος όροφος, Γραφείο 201, Κάτω Πολεμίδια, 4154 Λεμεσός, ΚύπροςPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Go Markets International Ltd

Effective Date:

--Email Address of Licensed Institution:

compliance@gomarket.scSharing Status:

No SharingWebsite of Licensed Institution:

https://www.int.gomarkets.com/Expiration Time:

--Address of Licensed Institution:

IMAD Complex, Office 12, 3rd Floor, Ile du Port, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4671903Licensed Institution Certified Documents:

Is Mc Trading Safe or a Scam?

Introduction

Mc Trading has emerged in the forex trading landscape, positioning itself as a platform for traders seeking to engage in foreign exchange markets. Given the rapid growth of online trading, it is crucial for traders to conduct thorough investigations into the legitimacy of brokers before committing their funds. The forex market is rife with potential pitfalls, including scams and unregulated brokers. Thus, assessing the safety and reliability of a broker like Mc Trading is essential for protecting ones investments. This article utilizes a comprehensive evaluation framework, incorporating regulatory status, company background, trading conditions, client experiences, and risk assessments, to determine whether Mc Trading is safe or a scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards of conduct and financial responsibility. Mc Trading claims to operate under various regulatory frameworks; however, investigations reveal a concerning lack of credible regulation.

| Regulatory Body | License Number | Regulating Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

Mc Trading is not regulated by any level 1, 2, or 3 regulatory bodies, which raises significant red flags. The absence of a governing authority means that there are no legal protections in place for traders, making it exceedingly risky to entrust funds to this broker. The company appears to be registered offshore, which often correlates with a lack of transparency and accountability. Furthermore, the claims of regulation made by Mc Trading have been scrutinized and found to be misleading, further supporting the assertion that Mc Trading is not safe.

Company Background Investigation

Understanding the companys history and ownership structure is vital for assessing its credibility. Mc Trading was established in 2023, which raises questions about its operational experience and stability. The management team behind Mc Trading lacks publicly available information, making it difficult to evaluate their qualifications and expertise in the financial sector.

Transparency is a key element in building trust with clients, and Mc Trading‘s failure to disclose critical information about its management and operations is concerning. Without a detailed understanding of the company’s leadership and their professional backgrounds, potential clients are left in the dark regarding the brokers reliability. This lack of transparency further cements the notion that Mc Trading is unsafe for traders looking for a trustworthy broker.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. Mc Trading claims to provide competitive trading fees, yet an analysis of its fee structure reveals potential issues.

| Fee Type | Mc Trading | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Mc Trading are higher than the industry average, which could erode profit margins for traders. Additionally, the lack of a clear commission structure raises concerns about hidden fees that may not be disclosed upfront. Such practices are often indicative of unscrupulous brokers, leading to the conclusion that Mc Trading may not be safe for trading.

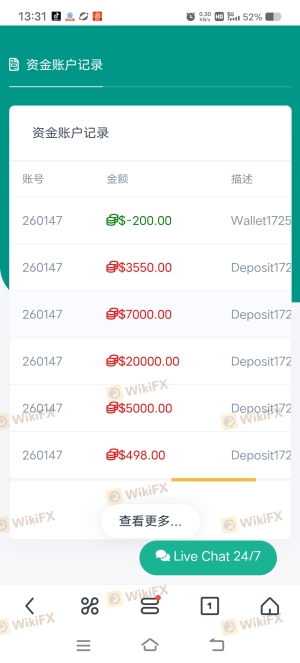

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. Mc Trading has not provided sufficient information regarding its measures for securing client deposits. There are no indications of segregated accounts or investor protection schemes, which are standard practices among reputable brokers.

The absence of these safety measures means that client funds could be at risk, especially in the event of the brokers insolvency or fraudulent activities. Furthermore, there have been reports of clients facing difficulties in withdrawing their funds, which is a common issue with unregulated brokers. Such incidents highlight the potential dangers of trading with Mc Trading, reinforcing the idea that Mc Trading is not safe for investors.

Customer Experience and Complaints

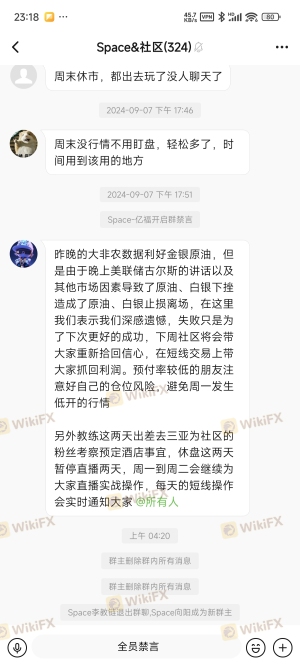

Customer feedback plays a crucial role in assessing a brokers reputation. Reviews of Mc Trading indicate a pattern of negative experiences, with many clients reporting difficulties in withdrawal processes and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

Typical complaints include delayed withdrawals, lack of communication from support staff, and misleading information regarding trading conditions. The poor response from the company to these complaints is alarming and suggests a lack of accountability. These issues further substantiate the claim that Mc Trading could be a scam.

Platform and Trade Execution

The performance and stability of a trading platform are crucial for a seamless trading experience. Mc Trading offers a web-based platform, but user reviews indicate that it suffers from stability issues and poor execution quality.

Traders have reported instances of slippage and rejected orders, which can significantly affect trading outcomes. Such execution problems are often indicative of a brokers inability to manage trades effectively, raising suspicions of potential manipulation. Given these concerns, it is reasonable to conclude that Mc Trading is not a safe option for traders who prioritize execution quality.

Risk Assessment

Engaging with Mc Trading presents several risks that potential clients should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | Potential loss of funds due to fraud |

| Operational Risk | Medium | Issues with platform stability |

The lack of regulation poses a significant risk, as traders have limited recourse in the event of disputes or fraud. Additionally, the operational risks associated with platform reliability and execution quality further compound the dangers of trading with Mc Trading. To mitigate these risks, traders are advised to conduct thorough research and consider alternative, regulated brokers.

Conclusion and Recommendations

In conclusion, the evidence gathered strongly suggests that Mc Trading is not safe for potential investors. The lack of regulation, transparency issues, unfavorable trading conditions, and numerous customer complaints indicate that this broker may not be trustworthy. Traders should exercise caution and consider seeking alternatives that offer regulatory oversight and a proven track record of reliability.

For those looking for secure trading options, it is advisable to explore well-regulated brokers that provide robust investor protections and transparent trading conditions. By doing so, traders can safeguard their investments and engage in forex trading with greater confidence.

Is MC Trading a scam, or is it legit?

The latest exposure and evaluation content of MC Trading brokers.

MC Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MC Trading latest industry rating score is 1.29, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.29 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.