Mc Trading 2025 Review: Everything You Need to Know

Executive Summary

MC Trading presents itself as a forex broker offering access to over 500 investment instruments across multiple asset classes. However, this Mc Trading review reveals significant concerns about the broker's regulatory status and overall credibility. While the platform claims to be regulated by relevant authorities, there is a notable lack of concrete evidence supporting these regulatory claims.

The broker targets traders seeking high leverage opportunities and diversified trading instruments, including commodities, indices, cryptocurrencies, and stocks. MC Trading offers a free demo account with a virtual balance of $10,000, allowing potential clients to test their services before committing real funds. Despite some positive user ratings on certain platforms, the absence of proper regulatory oversight and conflicting user feedback regarding potential scam activities raise serious red flags for prospective traders.

Important Notice

Regional Entity Differences: MC Trading operates as an unregulated broker, and users should exercise extreme caution when considering this platform. Different jurisdictions have varying legal frameworks governing forex trading, and the lack of regulatory compliance may significantly impact trading experiences and fund security across different regions.

Review Methodology: This evaluation is based on comprehensive analysis of publicly available information, user feedback from multiple review platforms, and industry standards for broker assessment. Given the limited verified information available about MC Trading, this review emphasizes transparency about information gaps and potential risks.

Rating Framework

Broker Overview

MC Trading positions itself as a relatively new participant in the forex market. The company attempts to attract traders with promises of high leverage and extensive instrument variety. The broker's business model centers around providing online forex trading services with access to multiple asset classes including commodities, indices, cryptocurrencies, and stocks.

However, the company's background information remains notably sparse, with limited transparency regarding its founding date, management structure, or corporate history. The broker's approach focuses on offering what it claims to be competitive trading conditions, though specific details about spreads, commissions, and execution models are not readily available in public materials. This Mc Trading review finds that the platform's lack of detailed operational information raises questions about its commitment to transparency and professional standards expected in the forex industry.

Regulatory Status: MC Trading claims to be regulated by relevant authorities but fails to provide concrete evidence of any legitimate regulatory oversight. The absence of verifiable regulatory credentials from recognized financial authorities represents a significant concern for potential clients.

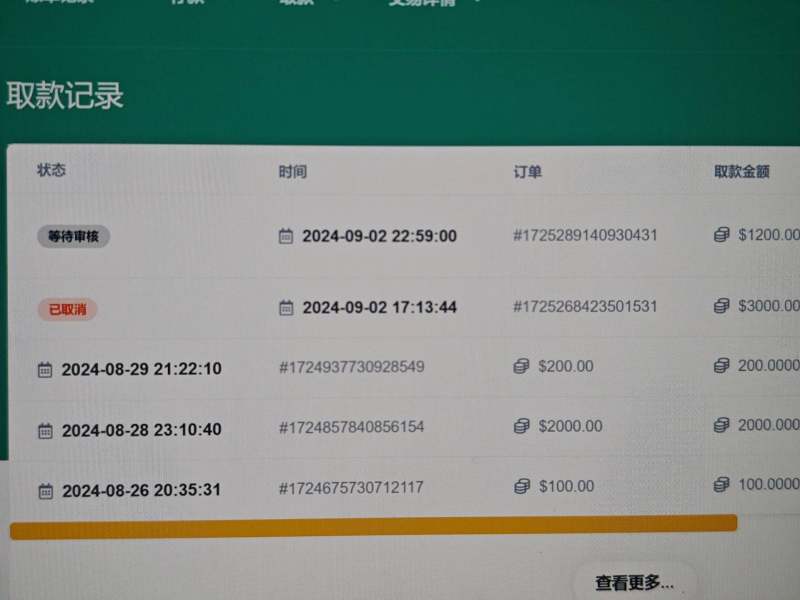

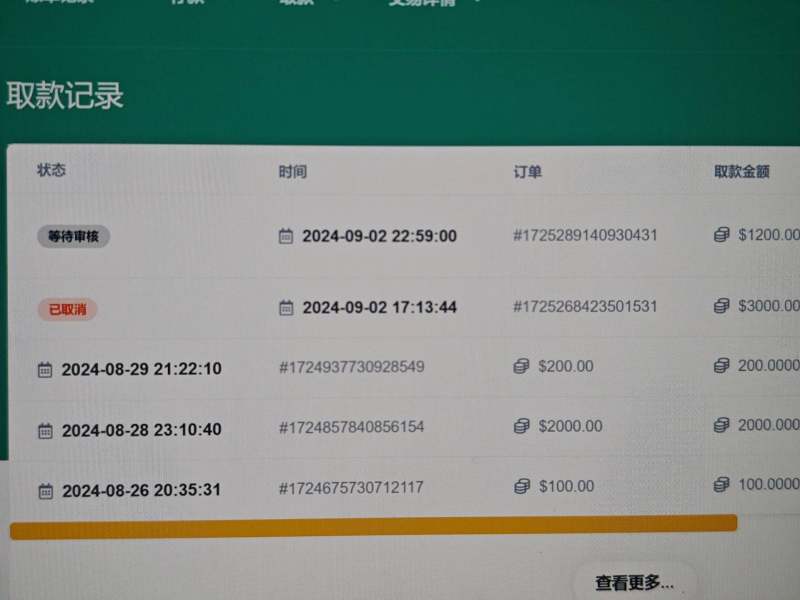

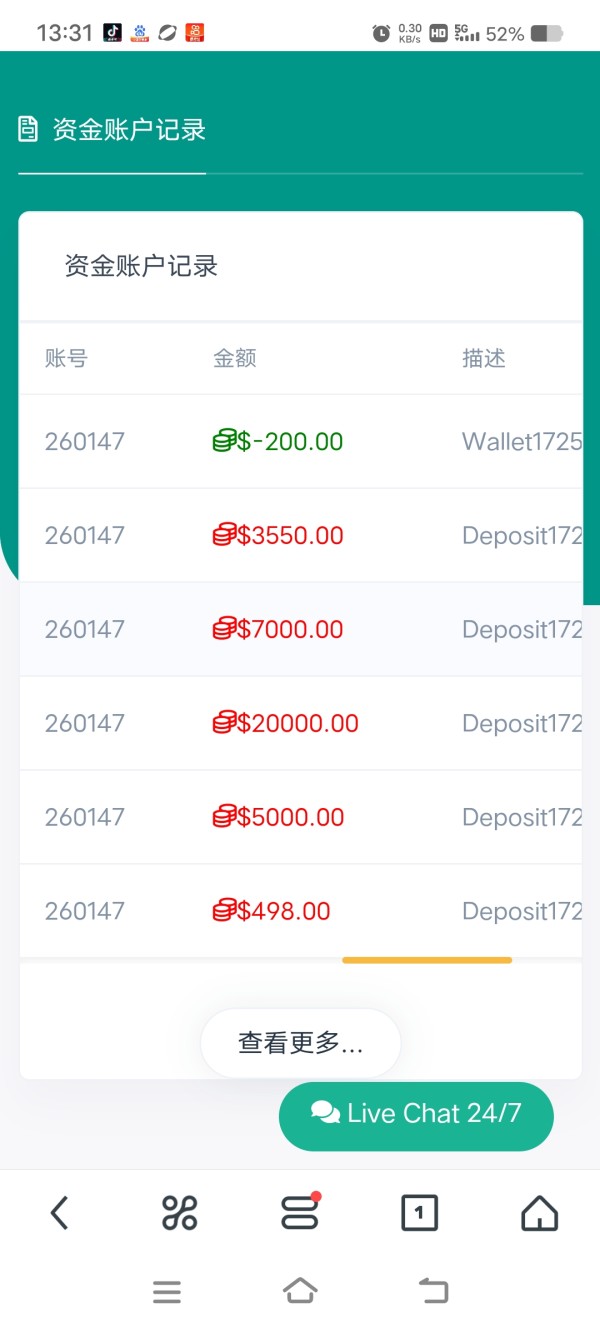

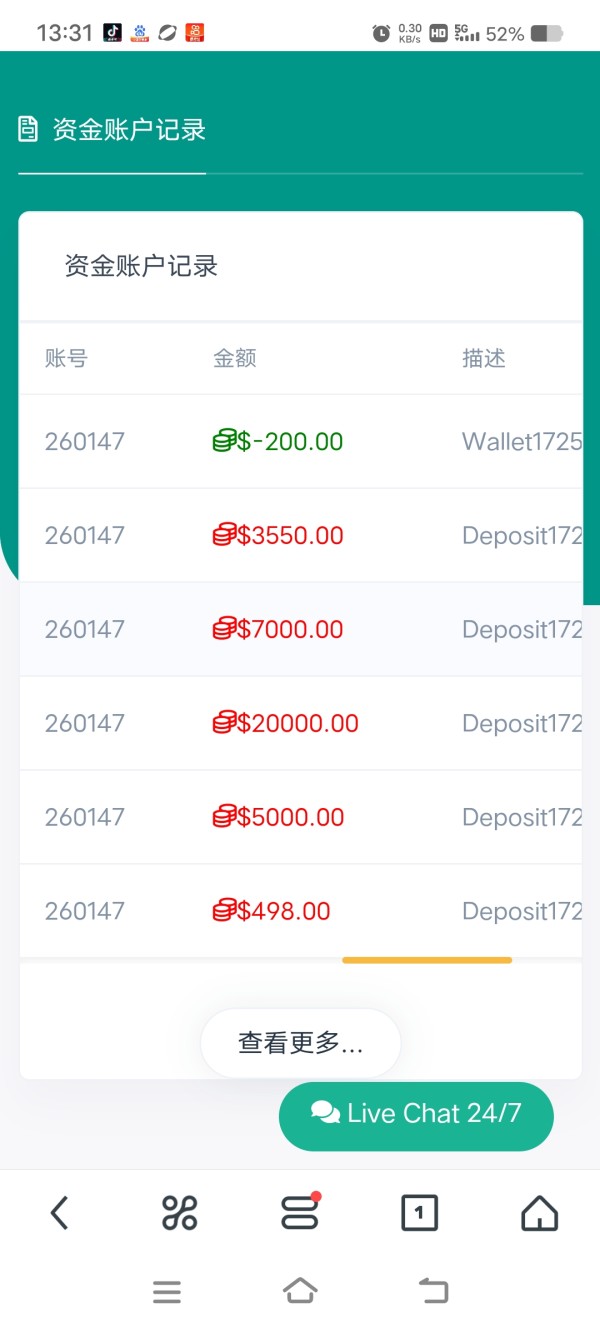

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available materials. This creates uncertainty about fund transfer processes and associated fees.

Minimum Deposit Requirements: The broker has not clearly specified minimum deposit requirements across different account types, making it difficult for potential traders to assess accessibility.

Bonus and Promotions: Available information does not include details about any promotional offers, welcome bonuses, or incentive programs that might be available to new or existing clients.

Tradeable Assets: MC Trading advertises access to over 500 investment instruments spanning commodities, stock indices, cryptocurrencies, and individual stocks. This suggests a comprehensive asset selection for diversified trading strategies.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not readily available. This prevents accurate cost comparison with other brokers.

Leverage Ratios: The platform mentions offering high leverage options, though exact ratios and their application across different asset classes remain unspecified.

Platform Options: Details about specific trading platforms, whether proprietary or third-party solutions like MetaTrader, are not clearly outlined in available materials.

Geographic Restrictions: Information regarding regional restrictions or prohibited countries for account opening is not explicitly stated.

Customer Support Languages: The range of languages supported by customer service representatives is not specified in available documentation.

This Mc Trading review highlights the significant information gaps that potential clients should consider when evaluating this broker.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by MC Trading remain largely opaque. This contributes to the low rating in this category. Available information does not specify the different types of accounts available, their respective features, or the minimum deposit requirements for each tier.

This lack of transparency makes it impossible for potential traders to make informed decisions about which account type might suit their trading style and capital allocation. The broker mentions providing a free demo account with a $10,000 virtual balance, which represents a positive feature for traders wanting to test the platform before committing real funds. However, the absence of detailed information about live account opening procedures, verification requirements, and account maintenance fees creates uncertainty about the actual trading conditions clients can expect.

Furthermore, there is no mention of special account types such as Islamic accounts for traders requiring Sharia-compliant trading conditions. The lack of detailed fee structures, including potential inactivity fees or account closure procedures, adds to the overall concern about transparency. This Mc Trading review cannot provide a comprehensive assessment of account conditions due to insufficient publicly available information.

MC Trading's strongest feature appears to be its claimed offering of over 500 investment instruments across multiple asset classes. The platform reportedly provides access to commodities, stock indices, cryptocurrencies, and individual stocks, suggesting a comprehensive selection for traders seeking portfolio diversification.

This variety could appeal to both novice and experienced traders looking to explore different markets from a single platform. However, the quality and depth of trading tools beyond basic market access remain unclear. Available information does not detail whether the platform provides advanced charting capabilities, technical analysis tools, or market research resources.

The absence of information about educational materials, market analysis, or trading signals raises questions about the broker's commitment to supporting trader development and decision-making. Additionally, there is no mention of automated trading support, expert advisors, or copy trading features that many modern traders consider essential. The lack of detailed information about mobile trading capabilities or platform customization options further limits the assessment of the broker's technological offerings.

User feedback on Justdial shows some positive ratings, though the limited number of reviews makes it difficult to assess the actual quality and reliability of the tools provided.

Customer Service and Support Analysis

Customer service information for MC Trading is notably limited. This makes it challenging to assess the quality and accessibility of support services. Available materials do not specify the channels through which customers can reach support representatives, whether through live chat, email, phone, or other communication methods.

This lack of clarity about contact options could prove problematic for traders requiring immediate assistance. Response times, service quality metrics, and availability hours are not documented in accessible sources, preventing potential clients from understanding what level of support they can expect. The absence of information about multi-language support capabilities may also pose challenges for international traders who prefer assistance in their native languages.

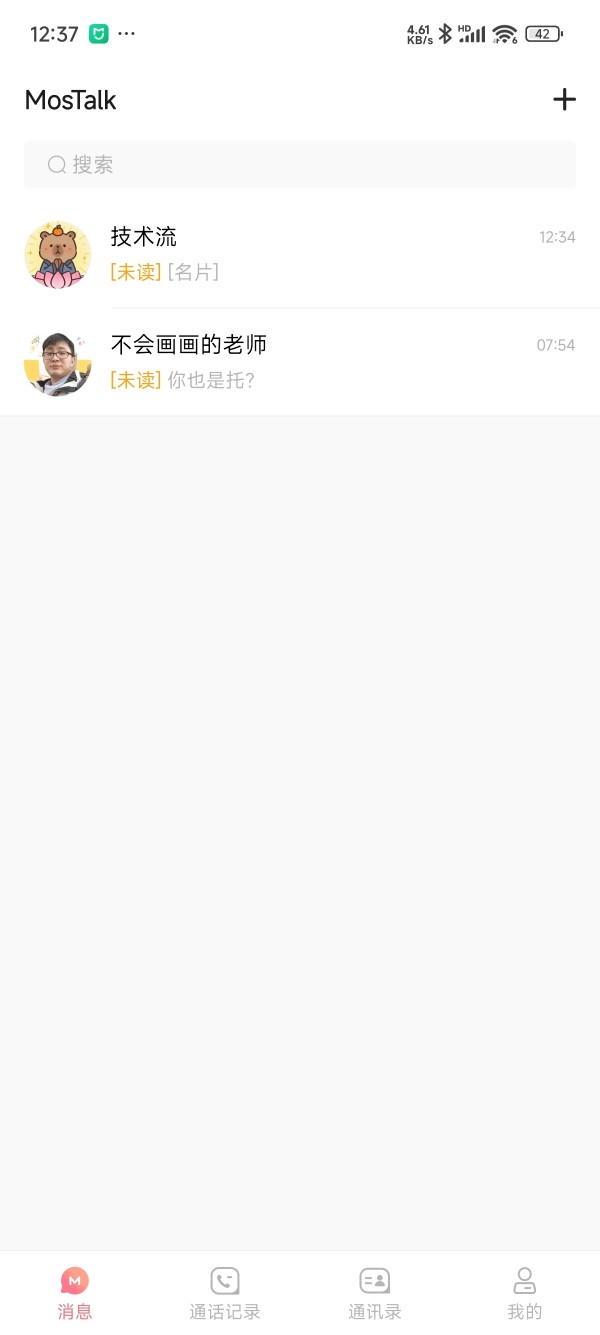

User feedback regarding customer service experiences is scarce and mixed, with limited detailed testimonials about problem resolution effectiveness or support representative knowledge levels. The lack of comprehensive customer service information, combined with the broker's unregulated status, raises concerns about recourse options for clients experiencing issues with their accounts or trading activities. Without established regulatory oversight, dispute resolution mechanisms may be limited or non-existent.

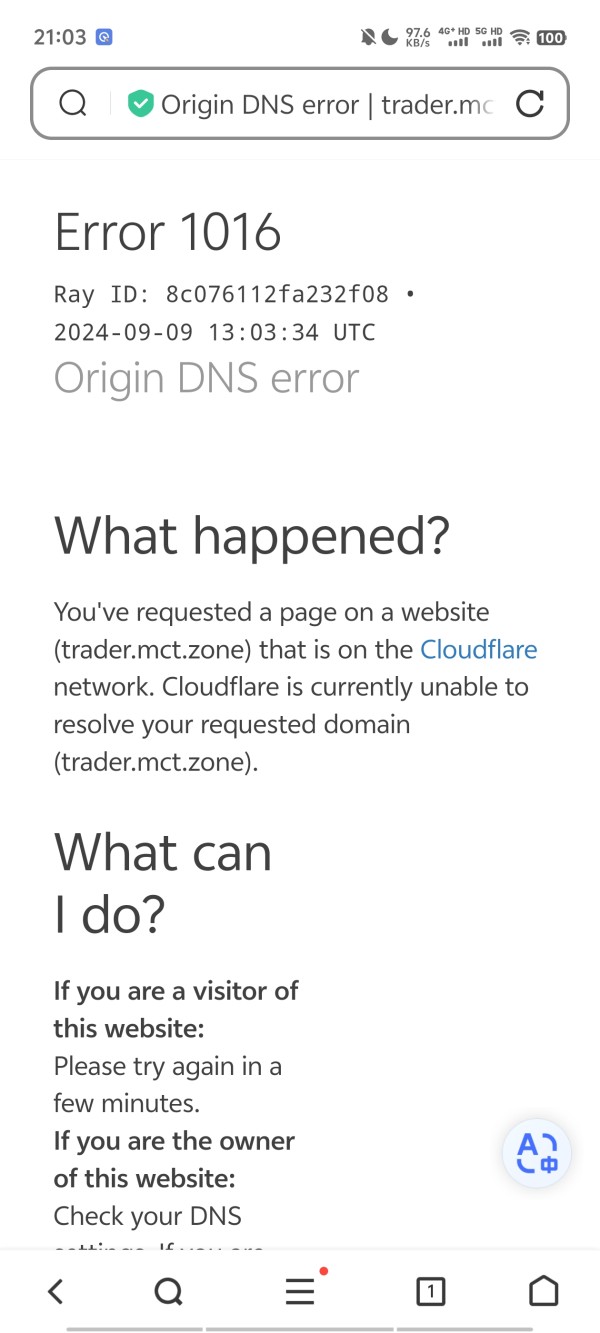

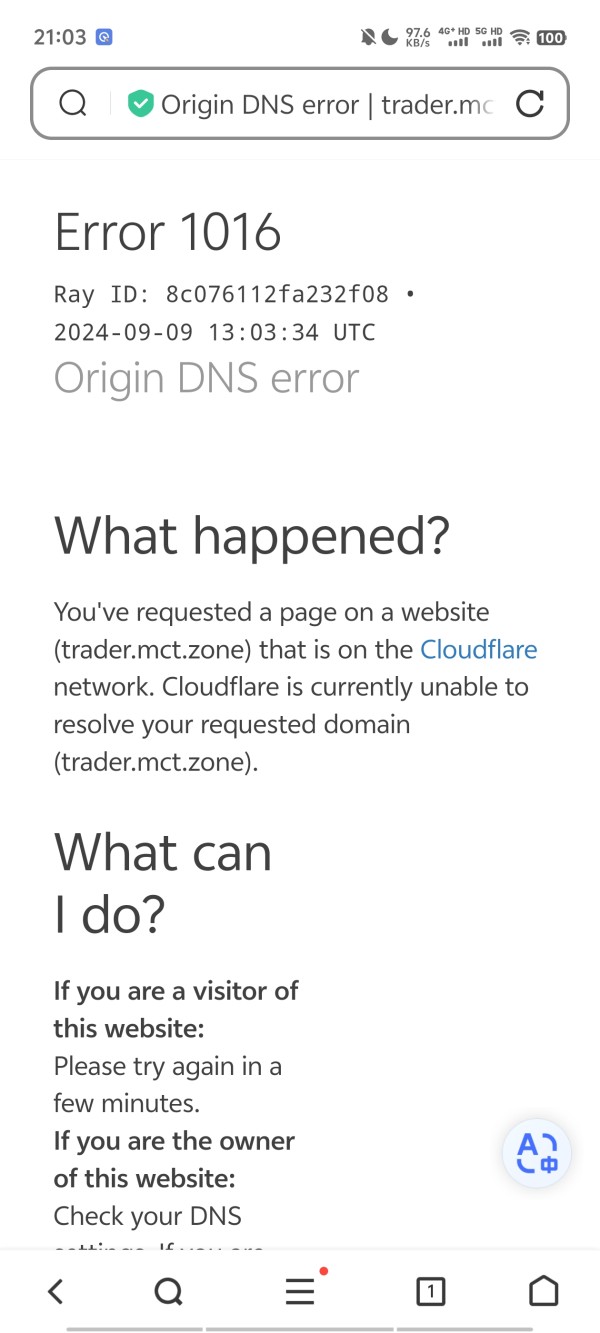

Trading Experience Analysis

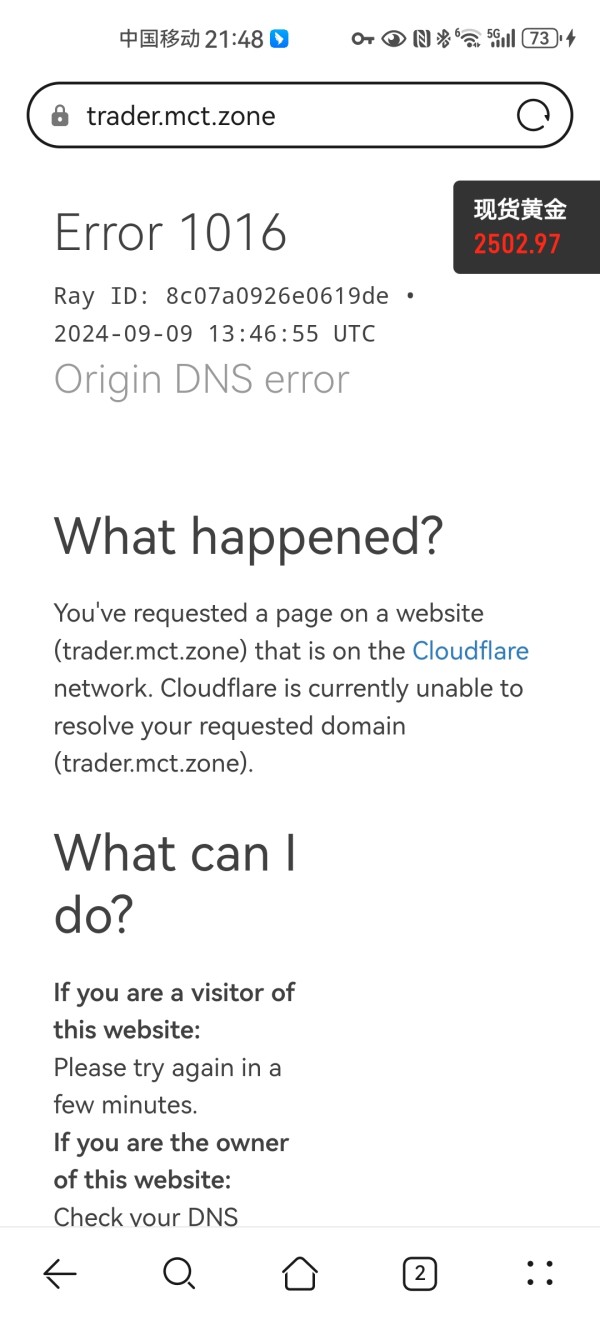

The trading experience evaluation for MC Trading is hampered by insufficient information about platform stability, execution speed, and overall user interface quality. Available sources do not provide specific details about the trading platforms offered, whether they utilize popular solutions like MetaTrader 4/5 or proprietary systems, making it difficult to assess functionality and reliability.

Order execution quality, including information about slippage rates, requotes, or execution speeds during high volatility periods, is not documented in available materials. This lack of performance data prevents traders from understanding what execution quality they might expect, particularly during important market events or news releases. Platform functionality details, such as available chart types, technical indicators, or advanced order types, are not specified.

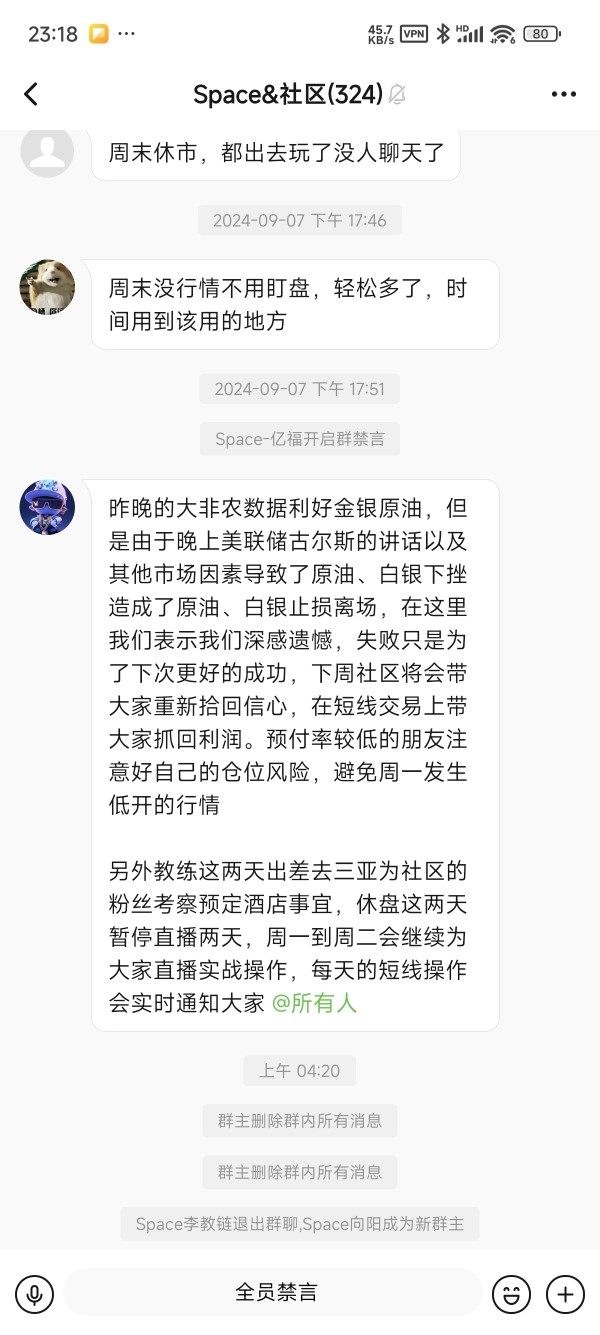

The absence of information about mobile trading capabilities or cross-device synchronization features also limits the assessment of trading convenience and flexibility. User reviews across different platforms show mixed opinions, with some positive ratings on Justdial contrasted by concerning reports on other review sites, making it difficult to establish a clear picture of the actual trading experience quality.

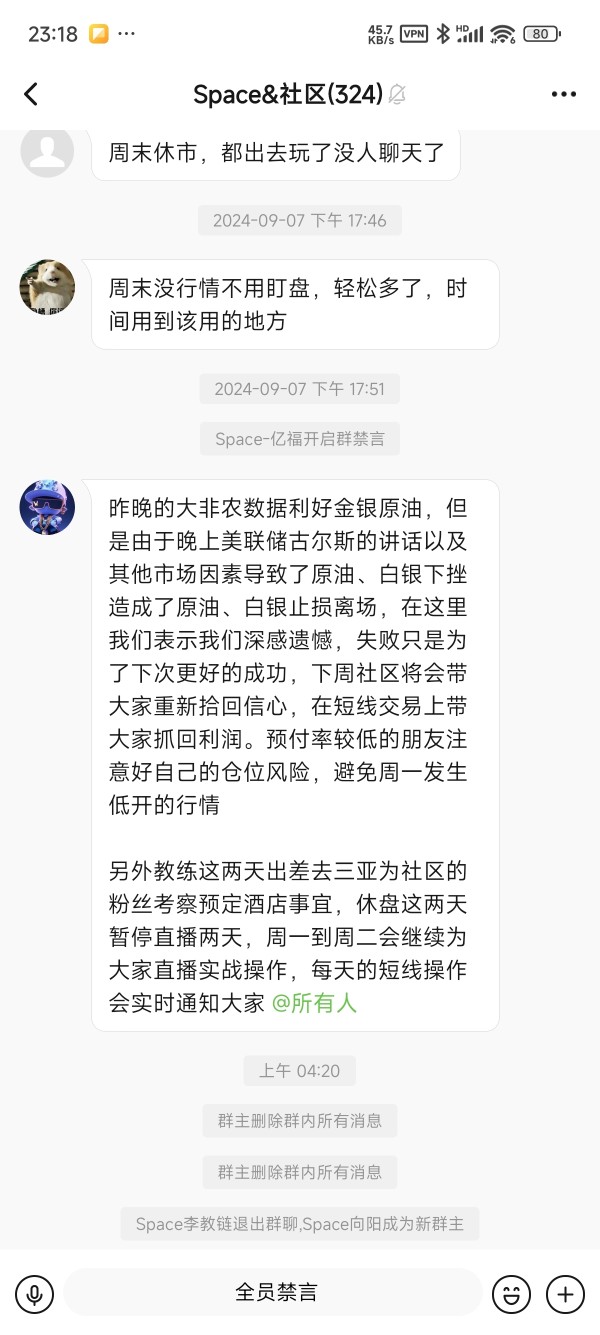

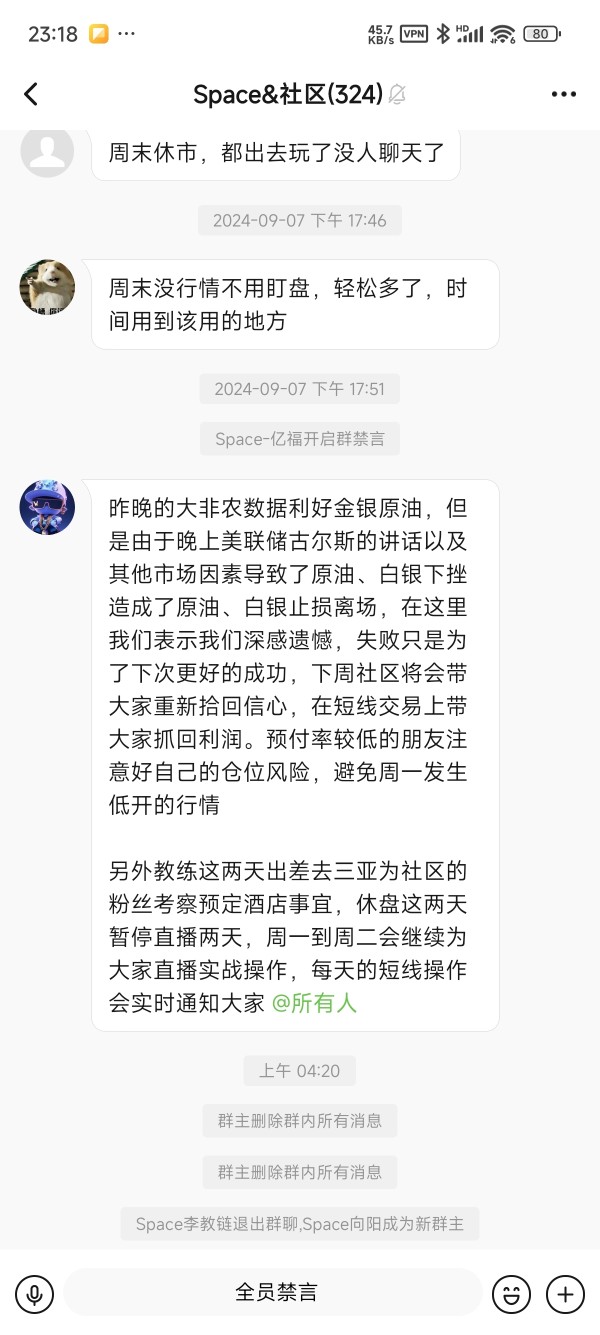

Trust and Safety Analysis

Trust and safety represent the most significant concerns in this Mc Trading review. The broker's unregulated status immediately raises red flags about fund security and operational oversight. While MC Trading claims to be regulated by relevant authorities, no concrete evidence of legitimate regulatory credentials from recognized financial supervisory bodies has been identified.

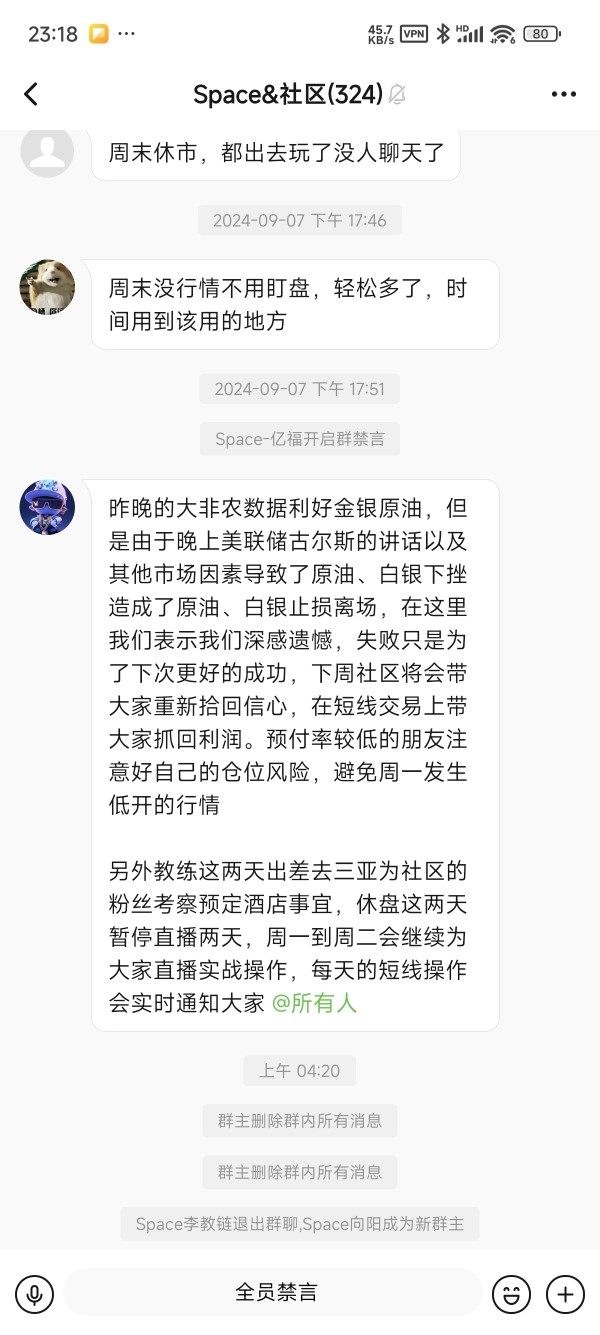

The absence of regulatory oversight means there are likely no investor compensation schemes, segregated client fund requirements, or regular financial audits that typically protect traders' interests. This regulatory gap creates substantial risks for client fund security and provides limited recourse options in case of disputes or operational issues. User reports on platforms like WikiFX mention potential fraudulent activities, though the credibility and specificity of these claims vary.

The lack of transparent company information, including detailed management profiles, financial statements, or operational history, further undermines confidence in the broker's legitimacy. Without proper regulatory backing and transparent operational practices, traders face significant risks when depositing funds or engaging in trading activities with this platform.

User Experience Analysis

User experience assessment for MC Trading reveals mixed signals with limited reliable data points. Some positive ratings appear on platforms like Justdial, where users have given relatively high scores, though the small number of reviews raises questions about their representativeness and authenticity. The limited volume of feedback makes it difficult to establish consistent patterns in user satisfaction.

Interface design and platform usability information is not readily available, preventing assessment of how intuitive or user-friendly the trading environment might be. Registration and account verification processes are not detailed in accessible materials, leaving potential traders uncertain about the complexity or time requirements for account setup. Fund operation experiences, including deposit and withdrawal convenience, processing times, and associated fees, lack comprehensive user feedback.

The absence of detailed user testimonials about actual trading experiences, customer service interactions, or problem resolution creates information gaps that potential clients should consider carefully. The target user profile appears to be traders seeking high leverage and diversified investment instruments, though the lack of regulatory protection and transparency issues suggest that this platform may not be suitable for traders prioritizing security and regulatory compliance. Improvement recommendations would focus primarily on obtaining legitimate regulatory oversight and increasing operational transparency.

Conclusion

This comprehensive Mc Trading review reveals a broker with significant limitations and potential risks that prospective traders should carefully consider. While MC Trading offers an apparently diverse selection of over 500 trading instruments and high leverage options that might appeal to certain trader segments, the fundamental lack of regulatory oversight creates substantial concerns about fund security and operational legitimacy.

The broker appears most suitable for traders specifically seeking high leverage and diversified investment tools, though the absence of regulatory protection makes it difficult to recommend for any trader category prioritizing security and compliance. The primary advantages include the variety of available instruments and the provision of demo accounts for testing, while the critical disadvantages center on the lack of regulation, limited transparency, and insufficient detailed information about trading conditions and costs. Given the mixed user feedback, unverified regulatory claims, and significant information gaps identified throughout this review, potential clients should exercise extreme caution and thoroughly consider the risks before engaging with this platform.