Regarding the legitimacy of Mahamudra forex brokers, it provides HKGX, FSPR and WikiBit, (also has a graphic survey regarding security).

Is Mahamudra safe?

Business

License

Is Mahamudra markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

香港高地集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://thegoldenholdings.comExpiration Time:

--Address of Licensed Institution:

香港港灣道26號華潤大廈29樓2907-08室Phone Number of Licensed Institution:

24960066Licensed Institution Certified Documents:

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

BHP TRADING GROUP LIMITED

Effective Date:

2017-10-06Email Address of Licensed Institution:

solomonpac@yahoo.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Unit B, Level 13, 20 Waterloo Quadrant, Auckland Central, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

+61 405 939 933Licensed Institution Certified Documents:

Is Mahamudra Safe or a Scam?

Introduction

Mahamudra is a forex trading platform that has been operational for approximately 5 to 10 years, primarily targeting traders in the foreign exchange market. As a broker, it offers access to popular trading tools and platforms, including MetaTrader 4 (MT4), which is favored by many traders for its user-friendly interface and robust features. However, the legitimacy of Mahamudra has come under scrutiny, prompting potential investors to exercise caution when evaluating this broker. In the volatile forex market, where risks are inherent, traders must thoroughly assess the credibility and safety of their chosen brokers. This article aims to investigate whether Mahamudra is a safe trading option or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experiences, and risk factors. The evaluation is based on a comprehensive review of available data, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. In the case of Mahamudra, the broker claims to be regulated by the Financial Service Providers Register (FSPR) in New Zealand and the Chinese Gold & Silver Exchange Society (CGSE). However, both of these licenses have been flagged as potentially suspicious clones, raising serious questions about the broker's regulatory status and operational integrity. The following table summarizes the core regulatory information regarding Mahamudra:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 572807 | New Zealand | Suspicious Clone |

| CGSE | 192 | Hong Kong | Suspicious Clone |

The lack of a valid regulatory framework significantly impacts the safety of traders' funds. Allegations suggest that the office in New Zealand is non-existent, and the CGSE license lacks transparency, with no effective or expiry dates available. This absence of credible regulation poses considerable risks for potential clients, as unregulated brokers often engage in unethical practices without accountability. Given these findings, the question of "Is Mahamudra safe?" leans towards a negative response.

Company Background Investigation

Mahamudra Company Limited, registered in New Zealand, has a complex history marked by allegations and suspicions. The company's ownership structure is not clearly defined in publicly available documents, which adds to the opacity surrounding its operations. Additionally, there is limited information regarding the qualifications and experience of the management team, raising red flags about the broker's credibility. Transparency is crucial in the financial sector, and the lack of accessible information about Mahamudras management undermines its legitimacy.

Moreover, the company's official website is currently non-functional, which restricts access to essential information about its services and operations. This lack of transparency can lead to distrust among prospective clients, making it difficult for them to verify the broker's claims or assess its legitimacy. Given the significant concerns surrounding its regulatory status and company background, potential investors should carefully consider whether Mahamudra is a safe trading option or a potential scam.

Trading Conditions Analysis

Mahamudra's trading conditions raise further concerns about its legitimacy. The broker's fee structure and trading costs are not prominently displayed, which could lead to unexpected charges for traders. Transparency in fee structures is essential for traders to make informed decisions. The following table outlines the core trading costs associated with Mahamudra:

| Fee Type | Mahamudra | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Unknown | 1-2 pips |

| Commission Model | Unknown | $0 - $10 per trade |

| Overnight Interest Range | Unknown | Varies |

The absence of clear information regarding spreads, commissions, and overnight interest rates may indicate a lack of transparency, which is often a tactic used by less scrupulous brokers. Traders need to be aware of all potential costs associated with their trades to avoid unpleasant surprises that could erode their profits. Furthermore, the lack of information on these critical aspects may lead to traders questioning the broker's integrity and reliability. Therefore, the question "Is Mahamudra safe?" remains a pressing concern for potential clients.

Customer Funds Safety

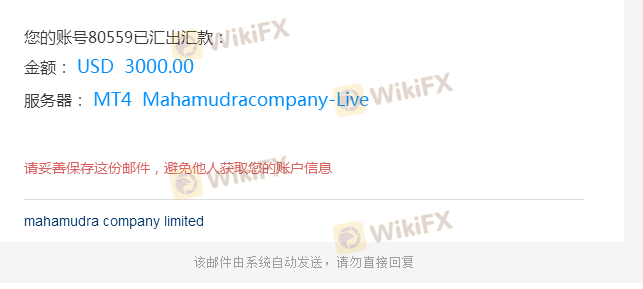

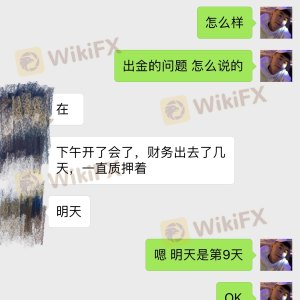

When it comes to the safety of customer funds, Mahamudra has several shortcomings. The broker has not provided detailed information regarding its fund segregation policies, investor protection measures, or negative balance protection. These elements are vital for ensuring that traders' funds are secure and protected from potential broker insolvency or misuse. Historically, there have been complaints from users regarding their inability to withdraw funds from Mahamudra, with reports of substantial amounts being stuck in the system. Such issues raise serious concerns about the broker's operational integrity and the safety of customer funds. If a broker cannot guarantee the safety and accessibility of client funds, it creates a significant risk for traders, making it imperative to investigate their practices thoroughly.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. In the case of Mahamudra, numerous complaints have been reported by users, primarily concerning withdrawal issues and inadequate customer support. Many clients have expressed frustration over delayed responses from the broker's customer service team, leading to dissatisfaction and distrust. The following table summarizes the major complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

For instance, one user reported attempting to withdraw a significant amount of money, only to be met with silence from the broker, prompting them to involve law enforcement. Such cases highlight the potential risks associated with trading through Mahamudra and the importance of choosing a broker with a solid reputation for customer service and support. Given the negative feedback and the question, "Is Mahamudra safe?" potential clients should proceed with caution.

Platform and Trade Execution

The trading platform provided by Mahamudra is the widely recognized MetaTrader 4 (MT4), known for its robust features and user-friendly interface. However, reports of slippage and order rejections have surfaced, raising concerns about the broker's execution quality. Traders have a right to expect efficient order execution and minimal slippage, especially in a volatile market. If a broker fails to provide reliable execution, it can significantly impact trading outcomes and lead to losses. The potential for platform manipulation is another area of concern, as traders need to feel confident that their trades are being executed fairly and transparently. Therefore, the question "Is Mahamudra safe?" is further complicated by the quality of its platform and trade execution.

Risk Assessment

Using Mahamudra as a trading platform involves several risks that potential clients should be aware of. The following risk assessment summarizes the key risk areas associated with Mahamudra:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of credible regulation raises significant concerns. |

| Fund Safety | High | History of withdrawal issues indicates potential risks. |

| Customer Support | Medium | Poor response times may lead to unresolved issues. |

To mitigate these risks, traders should conduct thorough research before engaging with Mahamudra. Seeking alternative brokers with a solid regulatory framework, transparent fee structures, and positive customer reviews is advisable. The question "Is Mahamudra safe?" is answered with caution, as the risks associated with this broker are considerable.

Conclusion and Recommendations

In conclusion, Mahamudra presents several red flags that suggest it may not be a safe choice for traders. The suspicious regulatory status, lack of transparency regarding company background, unclear trading conditions, and significant customer complaints all contribute to a concerning picture. Given these findings, potential investors are advised to exercise caution when considering Mahamudra as a trading platform. For those seeking reliable alternatives, brokers with established regulatory oversight and positive customer feedback should be prioritized. Always ensure that any broker you choose offers the necessary protections for your funds and provides a transparent trading environment. Ultimately, the question of "Is Mahamudra safe?" leans towards a negative response, and traders should carefully weigh their options before proceeding.

Is Mahamudra a scam, or is it legit?

The latest exposure and evaluation content of Mahamudra brokers.

Mahamudra Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Mahamudra latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.