Is M-Group safe?

Pros

Cons

Is M Group Safe or Scam?

Introduction

M Group is a forex broker that has garnered attention in the trading community for its promises of competitive trading conditions and a user-friendly platform. As with any financial service, it is crucial for traders to conduct thorough assessments before committing their funds. The forex market is notorious for its volatility and the presence of unscrupulous brokers, making it essential for traders to evaluate the legitimacy of their chosen broker carefully. In this article, we will investigate whether M Group is a safe trading option or if it raises red flags that could indicate a scam. Our analysis is based on a review of regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

When considering a forex broker, regulatory oversight is one of the most critical factors in determining its legitimacy. M Group currently operates without any recognized regulatory authority, which raises significant concerns. A lack of regulation can expose traders to various risks, including the potential for fraud and mismanagement of funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory body overseeing M Group's operations means that traders have limited recourse in the event of disputes or financial loss. Regulatory bodies enforce strict standards to protect investors, and without such oversight, M Group's operations remain shrouded in uncertainty. Furthermore, the lack of historical compliance records exacerbates these concerns, suggesting that traders should approach M Group with caution.

Company Background Investigation

M Group claims to have been established with the goal of providing exceptional trading services to clients. However, details surrounding its history and ownership structure remain vague. The broker's website provides minimal information about its founding members or management team, which is often a red flag for potential investors.

Transparency is a cornerstone of trust in the financial industry, and M Group's lack of clear information about its leadership and operational history raises questions about its credibility. A thorough background check on the management team reveals no significant experience in the financial services sector, further casting doubt on the firm's ability to manage client funds responsibly.

In summary, the lack of transparency regarding M Group's company structure and management team is concerning. The absence of publicly available information about its operations and ownership suggests that potential traders should be cautious when considering this broker.

Trading Conditions Analysis

M Group advertises various trading conditions, including competitive spreads and low fees. However, without regulatory oversight, it is challenging to verify these claims. Traders should be wary of brokers that promise unusually low fees, as these can often be a tactic to attract unsuspecting clients.

| Fee Type | M Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of clear information on trading costs can lead to unexpected charges, which may not be disclosed until after a trader has already opened an account. Additionally, traders should be cautious of any hidden fees that may not be apparent at first glance. Such practices are often seen in less reputable brokers and should be avoided.

Customer Fund Safety

The safety of customer funds is another critical area to examine when assessing whether M Group is safe. Without regulatory oversight, there are no guarantees regarding the protection of client deposits. Reputable brokers typically implement measures such as segregated accounts to ensure that client funds are kept separate from the company's operational funds.

M Group's website does not provide sufficient information about its customer fund safety policies, including whether it offers negative balance protection or investor compensation schemes. The lack of clear policies in this area is a significant concern for potential traders, as it exposes them to the risk of losing their entire investment without any recourse.

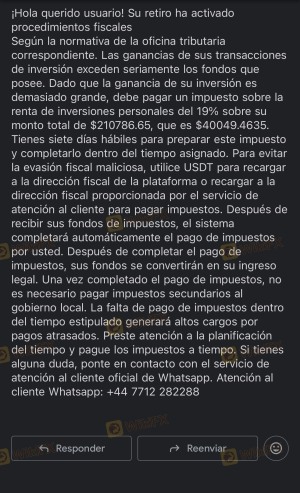

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. Reviews and testimonials from existing clients can provide insights into the broker's operational practices and customer service quality. However, M Group has received mixed reviews, with many users expressing dissatisfaction with the trading platform's performance and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Platform Stability | Medium | Inconsistent |

| Customer Service | High | Unresponsive |

Common complaints include difficulties in withdrawing funds, slow customer service response times, and issues with platform stability. These complaints indicate that M Group may not prioritize customer satisfaction, which is a critical aspect of a trustworthy broker.

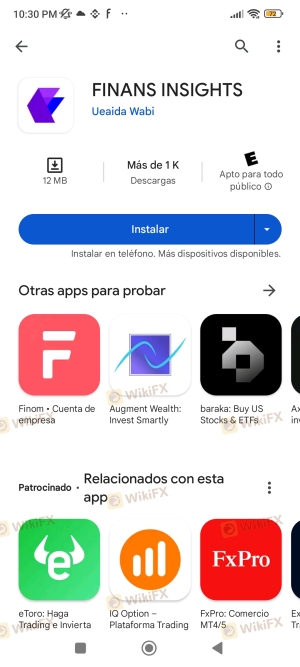

Platform and Execution

The trading platform provided by M Group is another area of concern. Users have reported issues with execution quality, including slippage and order rejections. Such problems can significantly impact a trader's profitability and overall experience.

A reliable trading platform should offer fast execution speeds, minimal slippage, and a user-friendly interface. However, reports of technical glitches and performance issues suggest that M Group's platform may not meet these essential criteria. Traders should be cautious about relying on a broker that does not provide a stable and efficient trading environment.

Risk Assessment

Using M Group presents several risks that traders should consider. The lack of regulation is perhaps the most significant risk, as it exposes traders to potential fraud and financial mismanagement.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Security Risk | High | Lack of clear fund protection policies. |

| Platform Stability Risk | Medium | Reports of technical issues and order execution problems. |

To mitigate these risks, traders should approach M Group with extreme caution. It is advisable to consider alternative brokers that are regulated and have a proven track record of reliability and customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence suggests that M Group may not be a safe trading option. The absence of regulatory oversight, unclear trading conditions, and negative customer feedback all point to significant risks. Potential traders should be wary of engaging with M Group, as the lack of transparency and regulatory compliance raises serious concerns about the legitimacy of its operations.

For traders seeking reliable alternatives, it is advisable to explore brokers that are regulated by reputable authorities and have established a positive reputation in the industry. Always prioritize safety and due diligence when choosing a forex broker to protect your investments effectively.

Is M-Group a scam, or is it legit?

The latest exposure and evaluation content of M-Group brokers.

M-Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

M-Group latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.