Is LMAXFX safe?

Business

License

Is LMAXFX A Scam?

Introduction

LMAXFX is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market, catering primarily to retail and institutional traders. Established under the umbrella of the LMAX Group, this broker claims to offer a transparent trading environment with access to deep liquidity and advanced trading technology. However, the forex market is notoriously rife with scams and unreliable brokers, making it imperative for traders to conduct thorough due diligence before committing their funds. In this article, we will explore the safety and legitimacy of LMAXFX by analyzing its regulatory status, company background, trading conditions, customer fund security, and user experiences. Our investigation relies on a comprehensive review of available data, user testimonials, and expert analyses to provide a balanced assessment of whether LMAXFX is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and trustworthiness. LMAXFX claims to operate under several regulatory frameworks, which can enhance its credibility in the eyes of potential clients. Below is a summary of LMAXFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 509778 | United Kingdom | Verified |

| CySEC | 310/16 | Cyprus | Verified |

| FMA | - | New Zealand | Verified |

| FSC | - | Mauritius | Verified |

LMAXFX is regulated by tier-1 authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulators impose strict compliance standards to ensure financial stability and protect investors. The presence of these regulatory bodies suggests that LMAXFX adheres to rigorous operational guidelines, which is a positive indicator of its legitimacy.

However, it is essential to note that while LMAXFX is regulated, some reviews indicate concerns about the legitimacy of its operations, particularly regarding the Gibraltar entity, which may not be fully compliant with financial regulations. Therefore, while LMAXFX appears to be regulated, potential clients should exercise caution and conduct further research to ensure they are dealing with the correct entity.

Company Background Investigation

LMAXFX is part of the LMAX Group, which has been operational since 2010 and has established itself as a significant player in the forex and cryptocurrency markets. The company operates multiple trading venues, including the LMAX Exchange, which is known for its high-speed trading capabilities and transparent execution. The ownership structure of LMAXFX is relatively straightforward, as it is owned by LMAX Limited, a company registered in the UK.

The management team at LMAXFX consists of experienced professionals with backgrounds in finance and technology. This expertise is crucial for maintaining a competitive edge in the fast-paced forex market. The company's commitment to transparency is evident in its regular updates and disclosures regarding its operations and trading conditions.

However, despite its robust background, there have been instances where clients have raised concerns about the accessibility of information regarding certain trading practices and fees. This lack of transparency can lead to distrust among potential clients, which is a crucial factor to consider when assessing whether LMAXFX is safe or a potential scam.

Trading Conditions Analysis

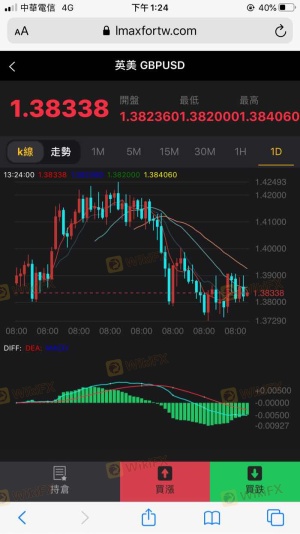

When evaluating a forex broker, understanding the trading conditions is vital for assessing overall cost-effectiveness and potential profitability. LMAXFX offers a range of trading instruments, including forex, commodities, and cryptocurrencies. The broker's fee structure is designed to be competitive, but it is essential to scrutinize any unusual fees that could impact trading performance.

| Fee Type | LMAXFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 - 0.5 pips | 0.5 - 1.0 pips |

| Commission Model | $2.5 - $4.5 per $100,000 | $2.0 - $5.0 per $100,000 |

| Overnight Interest Range | Varies | Varies |

LMAXFX's spreads on major currency pairs are competitive, often starting as low as 0.2 pips during peak trading hours. However, some reviews indicate that spreads may widen significantly during periods of high volatility, which could lead to increased trading costs for clients.

Additionally, the commission structure at LMAXFX varies based on the trading volume, which is a common practice among forex brokers. However, clients should be aware of any additional fees that may not be immediately apparent, such as withdrawal fees or inactivity fees, which could affect their overall trading experience.

Customer Fund Security

The safety of customer funds is paramount when evaluating any forex broker. LMAXFX implements several measures to ensure the security of client funds, including segregated accounts and investor protection schemes. Segregated accounts are essential as they keep client funds separate from the company's operational funds, thereby protecting traders in the event of financial difficulties.

Additionally, LMAXFX is a member of the Financial Services Compensation Scheme (FSCS) in the UK, which provides protection for eligible clients up to £85,000 in case of the broker's insolvency. Furthermore, the broker offers negative balance protection, ensuring that clients cannot lose more than their deposited funds, which is a critical safeguard for traders.

Despite these protective measures, there have been reports of issues related to fund withdrawals and delays. Such incidents raise concerns about the broker's operational integrity and whether it can be considered safe for traders.

Customer Experience and Complaints

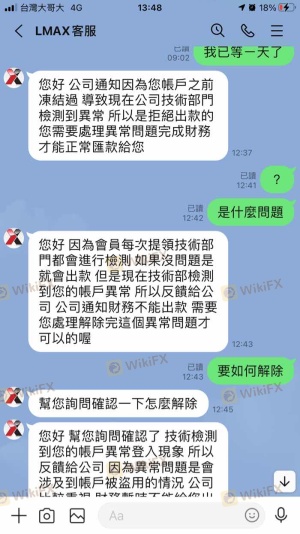

User feedback is a valuable source of information when assessing a broker's reliability. Many clients have shared their experiences with LMAXFX, highlighting both positive and negative aspects of the trading platform. Common complaints include issues with withdrawal processing times and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Customer Support Issues | Medium | Mixed Feedback |

In some cases, clients have reported being unable to withdraw funds, which raises significant concerns about the broker's operational practices. While LMAXFX has responded to some complaints, the quality and speed of their responses have been inconsistent, leading to frustration among users.

One notable case involved a trader who reported delays in processing a withdrawal request, resulting in significant financial distress. The broker's customer support team was slow to respond, further exacerbating the situation. Such experiences highlight the importance of evaluating a broker's customer service quality alongside its regulatory status.

Platform and Execution

The trading platform offered by LMAXFX is designed to provide a seamless trading experience, but user experiences vary widely. Many traders appreciate the platform's functionality and speed, particularly in terms of order execution. However, there have been reports of slippage and rejected orders, which can be detrimental to trading performance.

The overall execution quality is generally regarded as high, with average execution times reportedly around 3 milliseconds. Nevertheless, some traders have raised concerns about instances of slippage, particularly during volatile market conditions, which can significantly impact trading outcomes.

Risk Assessment

Using LMAXFX involves several risks that potential traders should consider before opening an account. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Regulated by FCA and CySEC |

| Withdrawal Issues | High | Reports of delayed withdrawals |

| Customer Support | Medium | Mixed feedback on responsiveness |

| Trading Costs | Medium | Competitive but variable costs |

To mitigate these risks, traders should ensure they fully understand the broker's fee structure, maintain clear communication with customer support, and consider starting with a demo account to familiarize themselves with the platform.

Conclusion and Recommendations

Based on the analysis presented, LMAXFX demonstrates several positive attributes, including regulatory oversight and a commitment to customer fund security. However, the existence of withdrawal issues and mixed customer feedback raises concerns about the broker's overall reliability.

Therefore, while LMAXFX is not outright a scam, potential traders should approach with caution. It is advisable for inexperienced traders to consider alternative brokers with a proven track record of reliable withdrawals and responsive customer service. Recommended alternatives include brokers like IG, Saxo Bank, and CMC Markets, which have established reputations and robust regulatory frameworks.

In summary, is LMAXFX safe? While it has regulatory backing and offers various protective measures, the reported issues with withdrawals and customer support suggest that traders should carefully evaluate their options before committing to this broker.

Is LMAXFX a scam, or is it legit?

The latest exposure and evaluation content of LMAXFX brokers.

LMAXFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LMAXFX latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.