Is Kodin Capital Markets safe?

Business

License

Is Kodin Capital Markets A Scam?

Introduction

Kodin Capital Markets, established in 2023, positions itself as a modern forex broker offering a variety of trading instruments, including cryptocurrencies, forex, and commodities. As trading platforms become increasingly accessible, it is essential for traders to exercise caution when selecting a broker. The potential for scams in the forex market remains high, making it crucial for investors to conduct thorough evaluations of any trading entity they consider working with. This article investigates the legitimacy of Kodin Capital Markets by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. Our evaluation framework incorporates data from multiple sources, including user reviews, regulatory databases, and financial reports, aiming to provide an objective overview of whether Kodin Capital Markets is safe or a potential scam.

Regulation and Legitimacy

The regulatory landscape is a critical factor in determining a broker's legitimacy. Kodin Capital Markets operates without any significant regulatory oversight, which raises red flags regarding its operational integrity. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a valid regulatory license means that Kodin Capital Markets does not adhere to the stringent requirements imposed by recognized regulatory bodies like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). Such regulations typically include measures for client fund protection, ensuring fair trading practices, and maintaining transparency in operations. Without these safeguards, traders may find themselves vulnerable to fraudulent activities, making it imperative to question: Is Kodin Capital Markets safe? The lack of regulatory oversight significantly increases the risk of fund loss and exploitation, leading to an unfavorable trading environment for clients.

Company Background Investigation

Kodin Capital Markets Limited is a relatively new entity in the forex trading landscape, having been founded in Mauritius. The company claims to offer a range of trading accounts and services tailored to various trader needs. However, the opacity surrounding its ownership structure and management team raises concerns about its credibility. Limited information is available regarding the individuals behind the company, which is crucial for establishing trust.

A transparent company typically provides details about its founders, management team, and operational history. In this case, the lack of such information may suggest a deliberate effort to obscure its true nature. This raises questions about the company's accountability and reliability. Furthermore, the absence of a solid track record can make it difficult for potential clients to assess the broker's performance and reputation in the industry. Therefore, the question remains: Is Kodin Capital Markets safe? Without clear disclosure of its management team or operational history, potential clients may want to approach with caution.

Trading Conditions Analysis

Kodin Capital Markets offers various trading accounts with different fee structures, including micro, mini, premium, and ECN accounts. While the broker advertises competitive trading conditions, such as low spreads and high leverage, a closer examination reveals potential pitfalls. Below is a comparison of key trading costs:

| Fee Type | Kodin Capital Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.2 pips | From 0.1 pips |

| Commission Structure | $3 per lot (ECN) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads for ECN accounts appear attractive, the commissions can erode profitability, especially for high-frequency traders. Additionally, the broker's minimum deposit requirements, starting at $100 for micro accounts, may seem appealing but could lead to higher risks if leveraged trading is employed. The high leverage options (up to 1:500) offered by Kodin Capital Markets can amplify both gains and losses, emphasizing the need for traders to understand the risks involved. Consequently, it is essential for potential clients to consider whether Kodin Capital Markets is safe for their trading activities, given the potential for hidden costs and unfavorable trading conditions.

Client Fund Security

The security of client funds is paramount when evaluating a broker. Kodin Capital Markets claims to maintain segregated accounts for client deposits; however, the lack of regulatory oversight raises concerns about the actual implementation of these measures. Without a regulatory body to enforce standards for fund protection, traders may find their investments at risk.

Additionally, the absence of negative balance protection means that clients could lose more than their initial investments, particularly in volatile market conditions. Historical data indicates that unregulated brokers often face issues related to fund mismanagement and withdrawal difficulties, further complicating the security landscape. Therefore, it is critical for potential clients to assess whether Kodin Capital Markets is safe for their funds, especially considering the potential for financial loss without adequate safeguards in place.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reputation. Reviews for Kodin Capital Markets reveal a mix of experiences, with several clients expressing dissatisfaction regarding withdrawal processes and customer support responsiveness. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

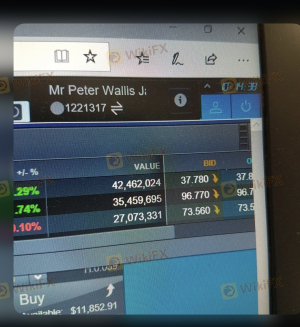

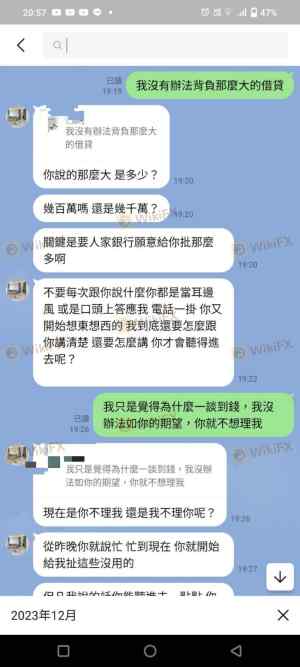

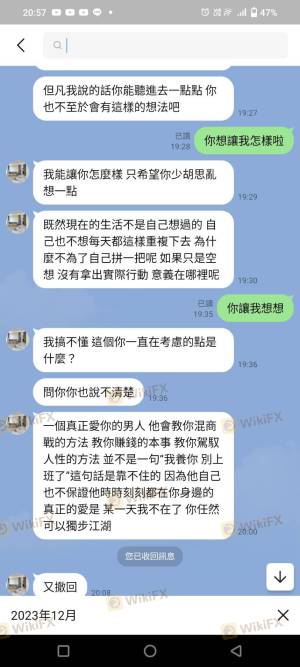

Two notable case studies illustrate these issues. In one instance, a trader reported being unable to withdraw funds after repeated requests, citing vague explanations from the support team. Another client mentioned aggressive sales tactics encouraging additional deposits, only to face difficulties when attempting to withdraw. These patterns raise concerns about the broker's reliability and responsiveness, leading to the question: Is Kodin Capital Markets safe for traders seeking a trustworthy platform?

Platform and Execution

Kodin Capital Markets utilizes the MetaTrader 4 and MetaTrader 5 platforms, both of which are well-regarded in the industry for their functionality and user experience. However, the performance of these platforms can vary based on the broker's execution quality. Traders have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes.

The execution quality is critical for traders, especially those employing strategies that rely on precise timing. Signs of potential platform manipulation or poor execution can further exacerbate concerns about the broker's integrity. Therefore, it is essential for potential clients to consider whether Kodin Capital Markets is safe in terms of trading execution and overall platform reliability.

Risk Assessment

Engaging with Kodin Capital Markets entails several risks that traders must consider. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the likelihood of fraud. |

| Fund Security Risk | High | Lack of clear fund protection measures raises concerns. |

| Execution Risk | Medium | Reports of slippage and order rejections can impact trading outcomes. |

| Customer Service Risk | High | Poor response to complaints can lead to unresolved issues. |

To mitigate these risks, traders should conduct thorough due diligence, consider using regulated alternatives, and remain vigilant regarding their investments. Understanding these risks is crucial in determining whether Kodin Capital Markets is safe for trading.

Conclusion and Recommendations

In summary, the evidence suggests that Kodin Capital Markets operates without the necessary regulatory oversight, significantly increasing the risks associated with trading on its platform. The lack of transparency regarding its management, coupled with customer complaints about withdrawal difficulties and poor support, raises serious concerns about its legitimacy.

For traders considering their options, it is advisable to approach Kodin Capital Markets with caution. Those seeking a more secure trading environment may want to explore regulated alternatives that offer robust client protections and transparent operations. Ultimately, the question remains: Is Kodin Capital Markets safe? Given the available evidence, potential clients should carefully weigh the risks before engaging with this broker.

Is Kodin Capital Markets a scam, or is it legit?

The latest exposure and evaluation content of Kodin Capital Markets brokers.

Kodin Capital Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Kodin Capital Markets latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.