Is TALLINEX safe?

Pros

Cons

Is Tallinex A Scam?

Introduction

Tallinex is an online forex broker that positions itself as an ECN/STP trading platform, catering primarily to retail traders. Founded in 2012 and based in Saint Vincent and the Grenadines, Tallinex claims to offer competitive trading conditions, including high leverage and low spreads. However, the forex market is fraught with risks, and it is crucial for traders to carefully evaluate the brokers they choose to engage with. A thorough assessment of a broker's regulatory status, company background, trading conditions, and customer experiences is essential to avoid potential scams and ensure the safety of ones investments. This article uses a comprehensive evaluation framework based on multiple sources, including regulatory databases, user reviews, and expert analyses to determine whether Tallinex is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is paramount in assessing its legitimacy and reliability. Tallinex is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. This raises concerns about the broker's accountability and the protections available to traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unverified |

Tallinex does not hold a license from any top-tier regulatory authority, such as the FCA (UK) or ASIC (Australia), which are known for enforcing stringent regulations. The lack of regulation means that traders have limited recourse in case of disputes or issues with withdrawals. Furthermore, Tallinex has faced regulatory scrutiny in the past, including a fine from the CFTC in 2018 for operating as an unregistered foreign exchange dealer in the U.S. This history of non-compliance and lack of oversight is a significant red flag when evaluating whether Tallinex is safe for trading.

Company Background Investigation

Tallinex Limited, the entity behind the broker, was established in 2012. While the company claims to have a solid operational history, the lack of detailed information regarding its ownership and management raises concerns about transparency. There is minimal publicly available information about the management team, their qualifications, or their experience in the financial services industry.

The absence of a clear ownership structure and the limited transparency can lead to questions about the broker's accountability and operational integrity. In an industry where trust is paramount, such opacity can deter potential clients. Moreover, the company's registration in an offshore jurisdiction, combined with its lack of regulation, suggests that it may not adhere to the same standards of conduct expected of more reputable brokers.

Trading Conditions Analysis

Tallinex advertises competitive trading conditions, including high leverage and low spreads, which can be attractive to traders. However, it is essential to scrutinize the overall cost structure and any hidden fees that may affect profitability.

| Fee Type | Tallinex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips (minimum) | 1.2-2.0 pips |

| Commission Model | $6 per lot (ECN Pro) | $5-10 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Tallinex start at 1.8 pips for major currency pairs, which is on par with industry standards. However, the commission structure for the ECN Pro account is slightly higher than average, which could deter high-volume traders. Additionally, the broker has not provided clear information regarding overnight interest rates and any potential fees associated with inactivity, which could lead to unexpected costs for traders. Overall, while Tallinex's trading conditions may seem competitive at first glance, the lack of transparency regarding fees and commissions is a concern.

Client Funds Security

The safety of client funds is a critical aspect when evaluating a broker's reliability. Tallinex claims to segregate client funds from its operational capital, which is a standard practice intended to protect traders' investments. However, the effectiveness of these measures can be questioned given the broker's unregulated status.

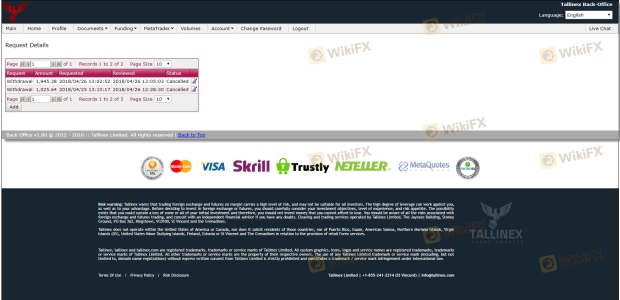

Tallinex does not provide negative balance protection, which means that traders could potentially lose more than their initial investment. This lack of a safety net increases the risk of trading with Tallinex, especially in a volatile market. Additionally, there have been historical issues regarding fund withdrawals, with multiple complaints from users about delays and difficulties in accessing their funds. Such incidents raise alarms about the broker's financial stability and commitment to safeguarding client assets.

Customer Experience and Complaints

Customer feedback is an essential component in assessing a broker's reliability. Reviews of Tallinex reveal a mixed bag of experiences, with numerous complaints about withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Average |

| Transparency Issues | High | Poor |

Many users have reported significant delays in processing withdrawals, with some waiting for weeks or even months to access their funds. This has led to frustrations and allegations of the broker engaging in unethical practices. Furthermore, the quality of customer support has been criticized, with users often reporting slow response times and unhelpful assistance. These patterns of complaints highlight potential operational weaknesses and suggest that Tallinex may not prioritize customer satisfaction effectively.

Platform and Execution

The trading platform provided by Tallinex is MetaTrader 4, a widely used and respected platform in the trading community. However, the performance and reliability of the platform are crucial for traders, especially in fast-moving markets.

Users have reported mixed experiences with the platform's execution quality, with some experiencing slippage and order rejections during volatile market conditions. While Tallinex markets itself as an ECN broker, the presence of slippage and execution issues raises concerns about whether the broker effectively operates in the best interest of its clients. Any signs of platform manipulation or unfair practices can significantly undermine trust and lead to suspicions about the broker's legitimacy.

Risk Assessment

Trading with Tallinex presents several inherent risks, primarily due to its unregulated status and the historical issues surrounding client fund management and withdrawal processes.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No top-tier regulation or oversight. |

| Withdrawal Risk | High | Numerous complaints about fund access. |

| Execution Risk | Medium | Reports of slippage and rejections. |

Traders considering Tallinex should be aware of these risks and may want to employ additional risk management strategies, such as limiting their exposure and ensuring they do not invest more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Tallinex is not a safe trading option. The broker's lack of regulation, combined with numerous complaints regarding fund withdrawals and customer service, raises significant concerns about its legitimacy. While it may offer competitive trading conditions, the risks associated with trading through an unregulated broker outweigh the potential benefits.

For traders seeking reliable options, it is recommended to consider brokers regulated by top-tier authorities such as the FCA or ASIC, which provide better protection and transparency. Brokers like FP Markets or IC Markets may serve as suitable alternatives for those looking for a trustworthy trading environment. Always conduct thorough research and due diligence before committing funds to any trading platform.

Is TALLINEX a scam, or is it legit?

The latest exposure and evaluation content of TALLINEX brokers.

TALLINEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TALLINEX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.