Regarding the legitimacy of JINSHENGJINRONG forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is JINSHENGJINRONG safe?

Business

License

Is JINSHENGJINRONG markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

香港金盛貴金屬有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://vip.golday47.comExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀廣東道9號港威大廈第六座16樓05-06室Phone Number of Licensed Institution:

37582888Licensed Institution Certified Documents:

Is Jinshengjinrong Safe or Scam?

Introduction

Jinshengjinrong, a broker operating in the forex market, has garnered attention for its various trading services and account types. However, as with any financial service provider, it is essential for traders to exercise caution and conduct thorough evaluations before investing their hard-earned money. The forex market can be fraught with risks, including potential scams and unregulated brokers, making it crucial for traders to assess the legitimacy and safety of their chosen broker. This article aims to investigate whether Jinshengjinrong is a safe trading option or if it raises red flags that warrant concern. Our investigation is based on a comprehensive analysis of available data, including regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy and safety. Jinshengjinrong operates under the auspices of Jinrong China Financial Industry Co., Ltd., but it does not appear to be regulated by any reputable financial authority. This lack of regulation raises significant concerns about the broker's credibility and the safety of client funds. The following table summarizes the core regulatory information regarding Jinshengjinrong:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that clients of Jinshengjinrong do not have the protections typically offered by regulated brokers, such as segregated accounts and compensation schemes. Furthermore, the lack of transparency regarding the companys operational history and compliance with financial regulations adds to the skepticism surrounding its legitimacy. Historical compliance issues, including warnings from authorities like the FCA regarding fraudulent activities, further complicate the broker's standing in the market.

Company Background Investigation

Jinshengjinrong is affiliated with Jinrong China Financial Industry Co., Ltd., which is based in Hong Kong. However, there is limited information available regarding the company's history, ownership structure, and management team. The lack of publicly available details raises questions about the broker's transparency and accountability. A reputable broker typically provides comprehensive information about its founders, management team, and corporate structure, which is essential for building trust with potential clients.

The management teams background and expertise are crucial in assessing the broker's reliability. Unfortunately, Jinshengjinrong does not provide adequate information about its leadership, which leaves potential investors in the dark about the qualifications and experience of those managing their funds. This opacity is concerning, as it can indicate a lack of professionalism and accountability. Overall, the limited information available about Jinshengjinrong's company background contributes to the perception that it may not be a trustworthy broker.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. Jinshengjinrong offers several account types with varying minimum deposit requirements, which can be appealing to traders with different levels of experience. However, the overall fee structure and any unusual policies should be scrutinized. Below is a comparison of core trading costs associated with Jinshengjinrong:

| Fee Type | Jinshengjinrong | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of clear information regarding spreads, commissions, and overnight interest rates is concerning. Traders should be wary of brokers that do not transparently disclose their fee structures, as hidden fees can significantly impact trading profitability. Additionally, any unusual or excessive fees should be critically examined, as they may indicate a lack of fairness in the broker's practices.

Customer Funds Security

The security of client funds is paramount when considering a broker. Jinshengjinrong's lack of regulation raises serious concerns about its ability to safeguard client assets. A reputable broker typically implements measures such as segregated accounts, investor protection schemes, and negative balance protection policies to ensure the safety of client funds. However, Jinshengjinrong has not provided sufficient information regarding its security measures.

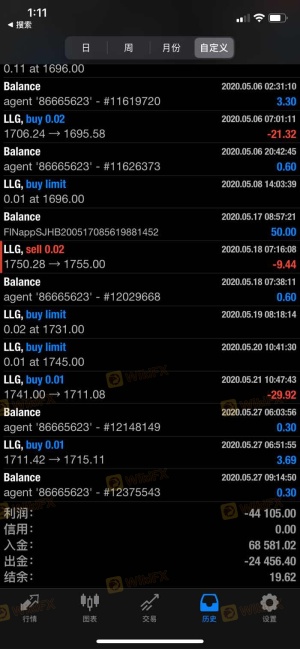

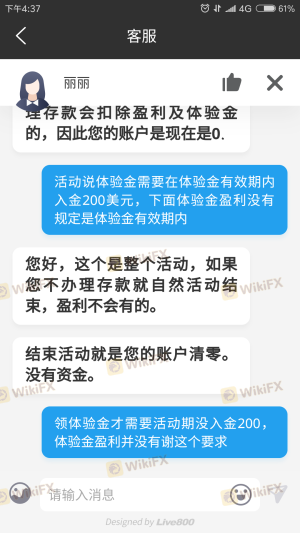

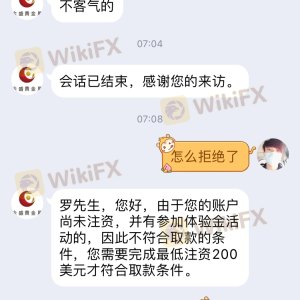

Without clear policies on fund segregation and investor protection, clients may find themselves at risk of losing their investments without recourse. Additionally, there have been reports of clients experiencing difficulties in withdrawing their funds, which raises concerns about the broker's integrity and operational practices. Historical issues related to fund security further exacerbate these concerns, making it imperative for potential clients to consider the risks associated with trading with Jinshengjinrong.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Jinshengjinrong reveal a mixed bag of experiences, with many users expressing frustration over withdrawal issues and lack of responsive customer support. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Average |

| Transparency Concerns | High | Poor |

Typical complaints include difficulties in accessing funds, slow response times from customer service, and a general lack of transparency in operations. These issues suggest that Jinshengjinrong may not prioritize customer satisfaction or efficient service delivery. For potential traders, these complaints serve as critical warning signs that the broker may not be the safest choice for their trading activities.

Platform and Execution

The performance of a trading platform is essential for a smooth trading experience. Jinshengjinrong offers access to popular trading platforms like MetaTrader 4, but user reviews indicate mixed experiences regarding platform stability and order execution. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes.

While the platform may offer various features, the quality of execution and reliability of service are paramount. Any signs of platform manipulation or technical issues can raise serious concerns about the broker's integrity and the safety of client funds.

Risk Assessment

Using Jinshengjinrong presents several risks that potential traders should consider. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation poses significant risks to clients. |

| Fund Security Risk | High | Insufficient information on fund protection measures. |

| Customer Service Risk | Medium | Reports of poor customer support may hinder conflict resolution. |

Given the high-risk levels associated with Jinshengjinrong, potential traders are advised to exercise extreme caution. It is crucial to implement risk mitigation strategies, such as setting strict limits on investments and considering alternative, more reputable brokers.

Conclusion and Recommendations

In conclusion, the evidence suggests that Jinshengjinrong raises several red flags that warrant caution. The lack of regulation, insufficient transparency, and numerous customer complaints indicate that this broker may not be a safe option for trading. Traders should be particularly wary of the potential difficulties in withdrawing funds and the overall lack of accountability.

For those seeking a more secure trading environment, it is advisable to explore alternative brokers that are well-regulated and have a proven track record of reliability and customer satisfaction. Consider brokers that offer solid regulatory oversight, transparent fee structures, and robust customer support. In light of the findings, it is clear that Jinshengjinrong is not a safe choice for forex trading, and potential clients should proceed with caution or seek more reputable alternatives.

Is JINSHENGJINRONG a scam, or is it legit?

The latest exposure and evaluation content of JINSHENGJINRONG brokers.

JINSHENGJINRONG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JINSHENGJINRONG latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.