jinshengjinrong 2025 Review: Everything You Need to Know

Summary

This jinshengjinrong review gives you a complete look at a broker that has faced serious problems in financial markets. Based on what we know, jinshengjinrong works as a foreign exchange and precious metals trading platform, offering MetaTrader 4 and their own Jinsheng Precious Metal APP to clients. The company says it specializes in precious metals investment, targeting traders who want to buy gold, silver, and other valuable items.

However, our research shows serious concerns about how this broker operates. Many reports point to fraud claims against jinshengjinrong, with users having trouble with money management and platform problems. The broker's legal status stays unclear, even though they claim Hong Kong registration. User feedback always points out problems with customer service quality and money security, raising big red flags for potential investors.

The main users seem to be traders interested in precious metals investment, though we strongly tell you to be very careful given the reported issues. While the platform offers familiar trading tools through MT4, the overall risk makes this broker wrong for most regular investors seeking reliable trading conditions.

Important Notice

This review focuses on jinshengjinrong's operations based on available market information and user feedback. Potential clients should know that legal oversight may vary a lot across different areas, and the broker's Hong Kong registration claims need independent checking due to ongoing fraud claims.

Our review method uses user stories, legal information, and platform analysis to provide an objective evaluation. However, traders should do their own research and consider the big risks highlighted in this review before making any investment decisions with this broker.

Rating Framework

Broker Overview

jinshengjinrong has worked in financial markets for about 5-10 years, setting itself up as a foreign exchange broker with a special focus on precious metals trading. The company presents itself as committed to providing high-quality trading platforms for investors seeking exposure to gold, silver, and other valuable items. Their business model centers around helping forex and precious metals transactions through established trading platforms.

The broker's main trading setup consists of the widely-recognized MetaTrader 4 platform alongside their own Jinsheng Precious Metal APP. This jinshengjinrong review finds that while the company specializes in precious metals investment, their asset offerings appear limited compared to complete multi-asset brokers. The firm claims registration in Hong Kong, though big concerns exist regarding their legal compliance and operational legitimacy due to documented fraud claims and negative user experiences.

Regulatory Status: jinshengjinrong claims registration in Hong Kong, but serious fraud claims have been reported against the company, casting doubt on their legal compliance and operational legitimacy.

Deposit and Withdrawal Methods: Specific information regarding funding options is not detailed in available materials, which itself raises concerns about transparency.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit amounts, making it difficult for potential clients to assess entry requirements.

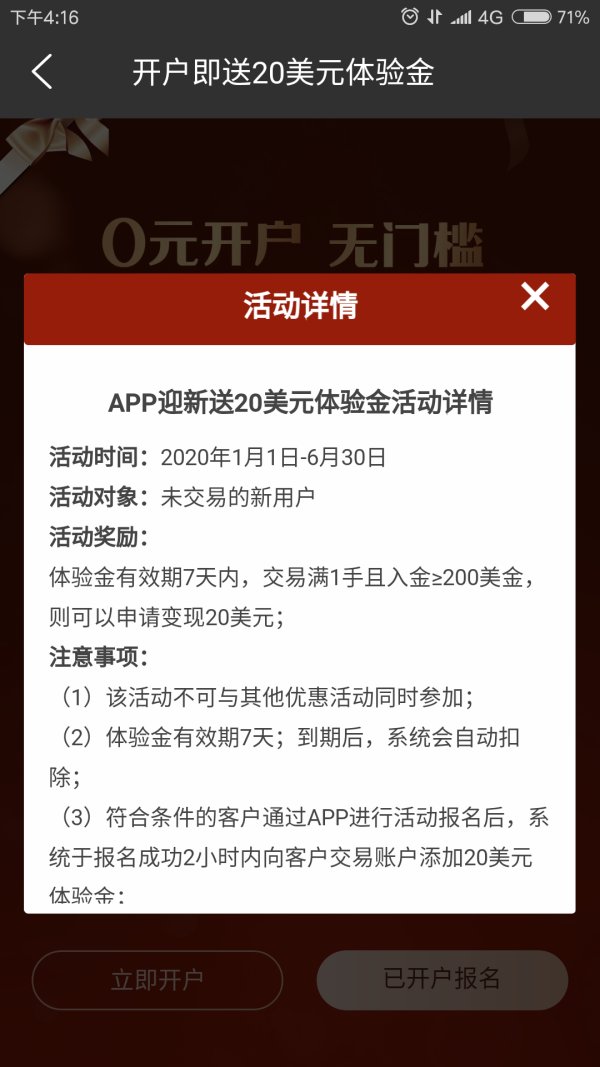

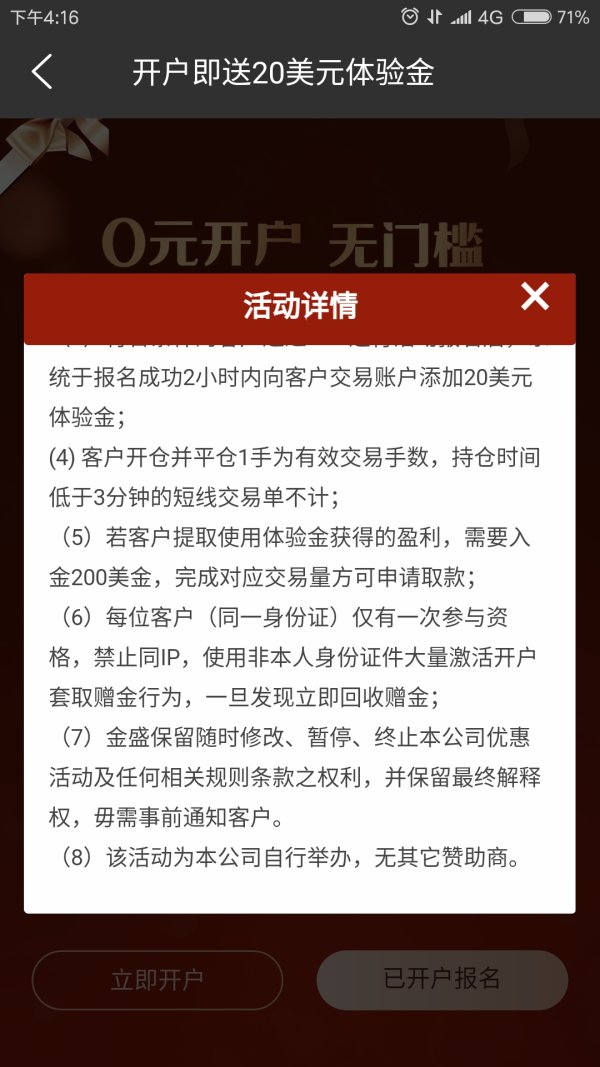

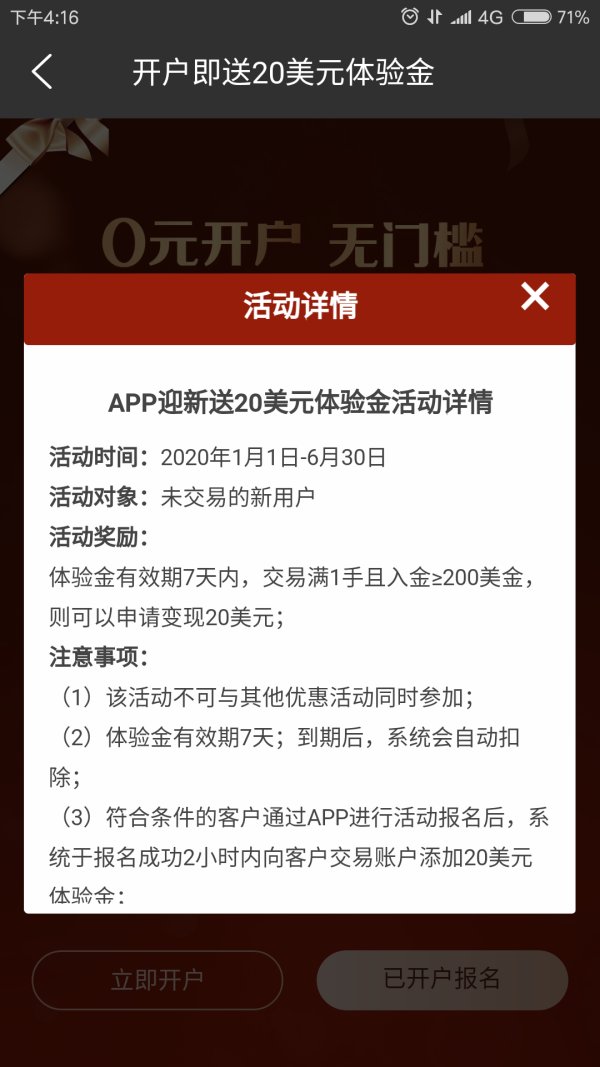

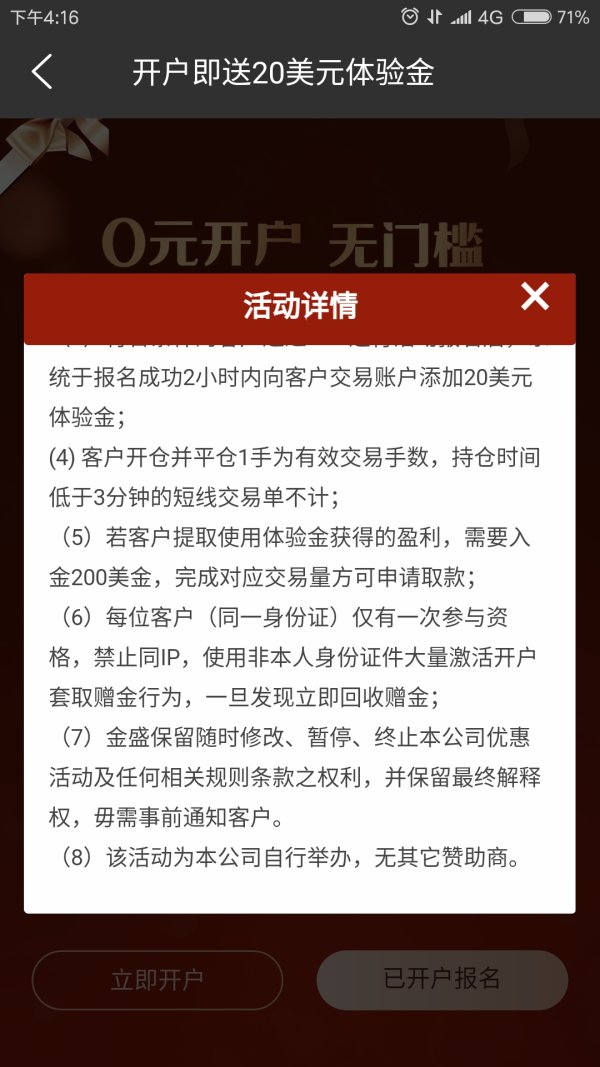

Bonus and Promotions: No information about promotional offers or bonus structures is available in current documentation.

Tradeable Assets: The platform mainly focuses on precious metals investment, offering trading opportunities in gold, silver, and related items through their specialized applications.

Cost Structure: Commission charges are reportedly based on trading volume, though specific spread information and fee schedules are not clearly disclosed. This lack of clarity regarding costs represents a big concern for potential traders.

Leverage Ratios: Specific leverage offerings are not detailed in available information, limiting traders' ability to assess risk management options.

Platform Options: The broker provides access to MetaTrader 4 and their own Jinsheng Precious Metal APP for trading activities.

Geographic Restrictions: Information about regional limitations or accessibility restrictions is not specified in available materials.

Customer Support Languages: Details about multilingual support options are not provided in current documentation.

This jinshengjinrong review highlights the concerning lack of transparency in many basic areas that professional traders typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by jinshengjinrong present several big limitations that contribute to its poor rating in this category. The broker has failed to provide clear information about account types, their specific features, or the benefits associated with different tier levels. This lack of transparency makes it extremely difficult for potential clients to understand what they can expect from their trading accounts.

Most concerning is the absence of clearly stated minimum deposit requirements. Professional brokers typically provide clear information about funding requirements, allowing traders to make informed decisions about their investment capacity. The failure to disclose these basic details suggests either poor business practices or deliberate hiding of important terms.

User feedback consistently indicates problems with fund management, with reports of money not properly entering trading markets. This represents a basic failure in account functionality that directly impacts traders' ability to execute their investment strategies. The account opening process details are also not clearly documented, creating additional barriers for potential clients.

Furthermore, there is no information available about specialized account features such as Islamic accounts for Sharia-compliant trading, which limits the broker's appeal to diverse trader demographics. This jinshengjinrong review finds that the overall account conditions fall far short of industry standards for transparency and functionality.

jinshengjinrong receives a moderate rating for tools and resources mainly due to their provision of the MetaTrader 4 platform, which is widely recognized as a professional-grade trading tool. MT4 offers complete charting capabilities, automated trading support through Expert Advisors, and a strong suite of technical analysis indicators that meet the needs of both novice and experienced traders.

The broker also provides their own Jinsheng Precious Metal APP, which appears specifically designed for precious metals trading. While this specialization could be valuable for traders focused on gold and silver markets, the limited scope reduces the platform's appeal for those seeking diversified trading opportunities across multiple asset classes.

However, big gaps exist in the broker's resource offerings. There is no available information about research and analysis resources, which are crucial for informed trading decisions. Educational materials, market commentary, and basic analysis tools appear to be absent from their service portfolio.

The lack of detailed information about automated trading support beyond basic MT4 functionality also represents a missed opportunity. Modern traders increasingly expect sophisticated algorithmic trading capabilities and advanced order management tools that don't appear to be prominently featured in jinshengjinrong's offerings.

Customer Service and Support Analysis (Score: 2/10)

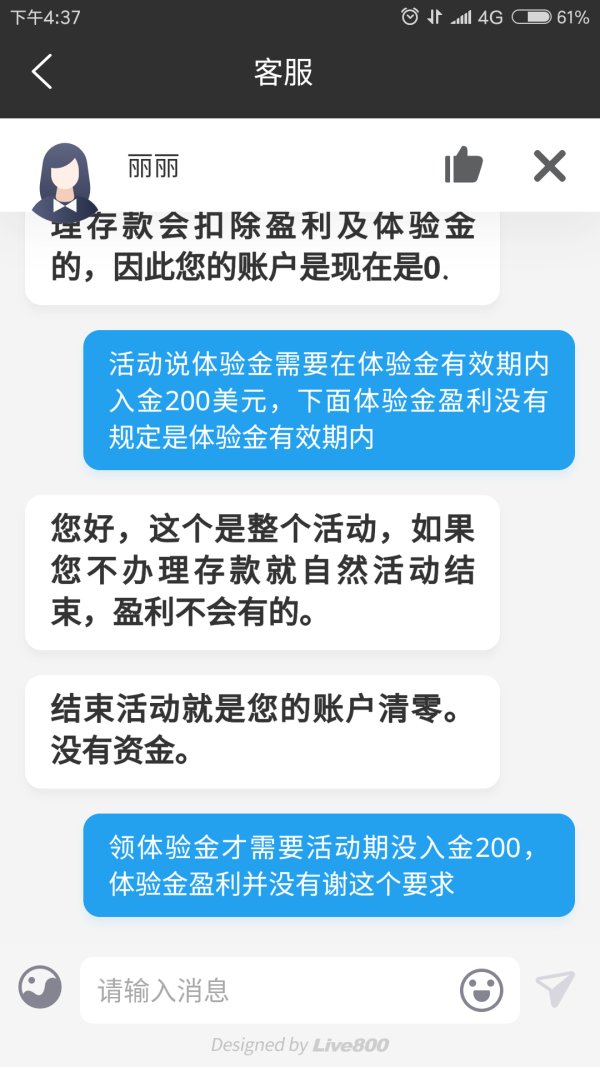

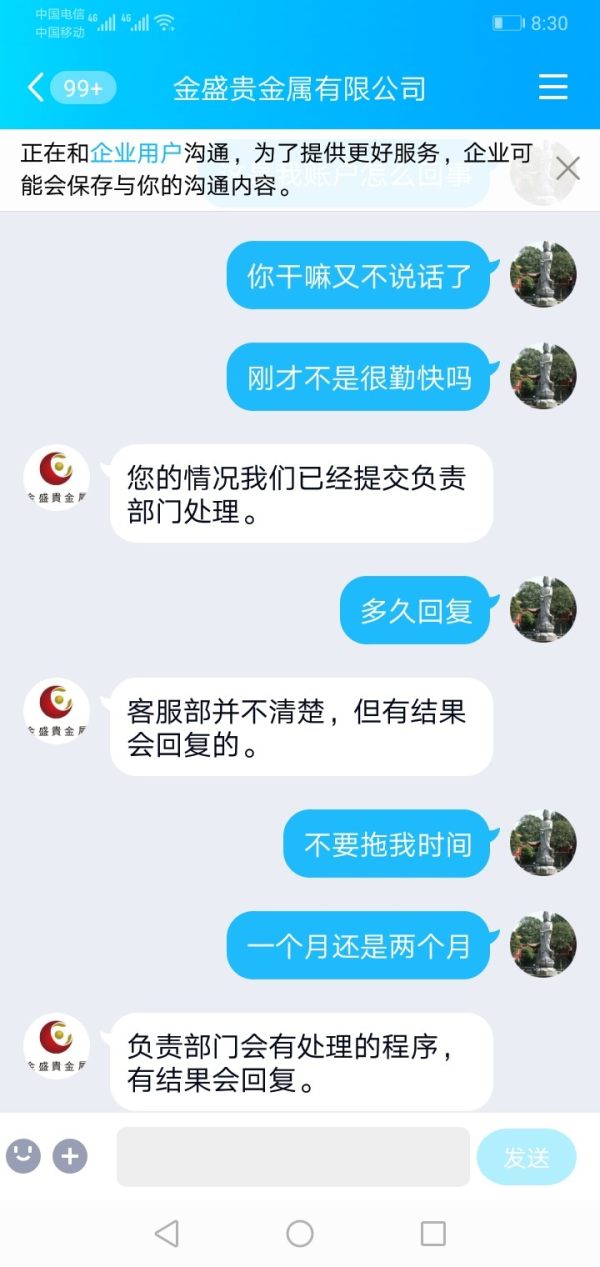

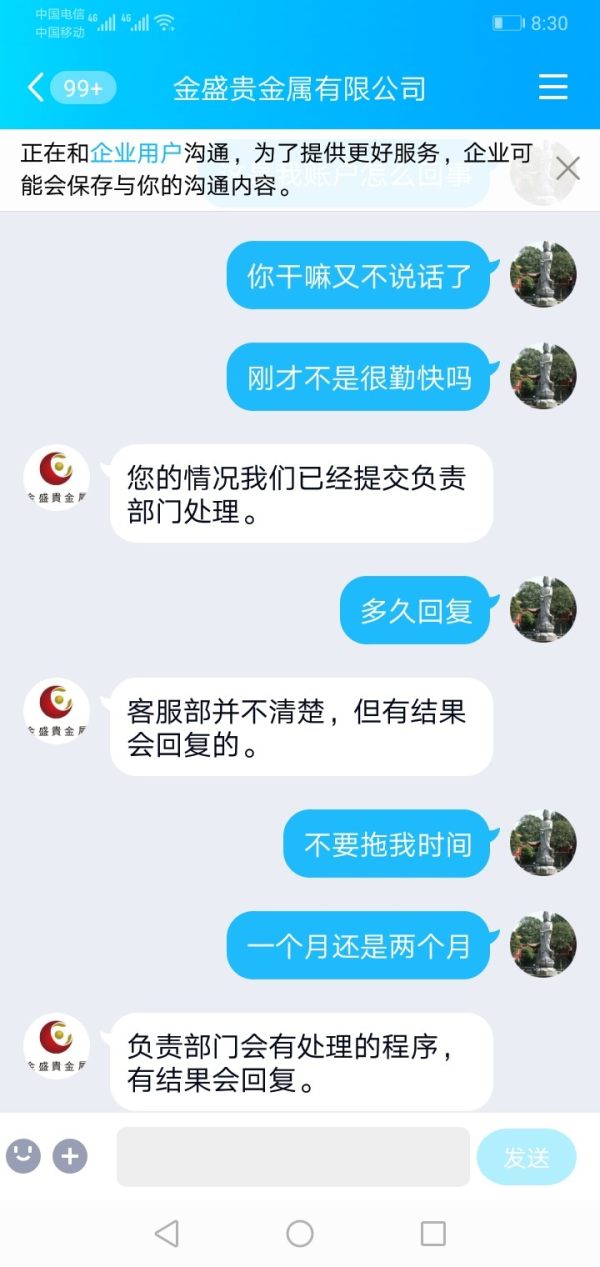

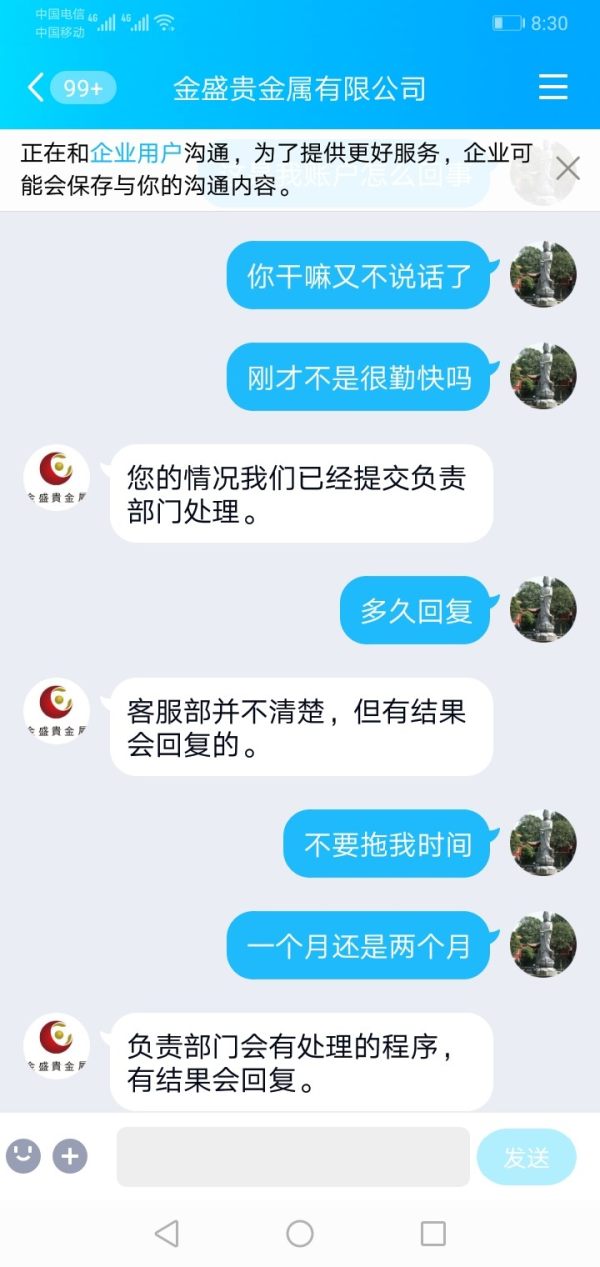

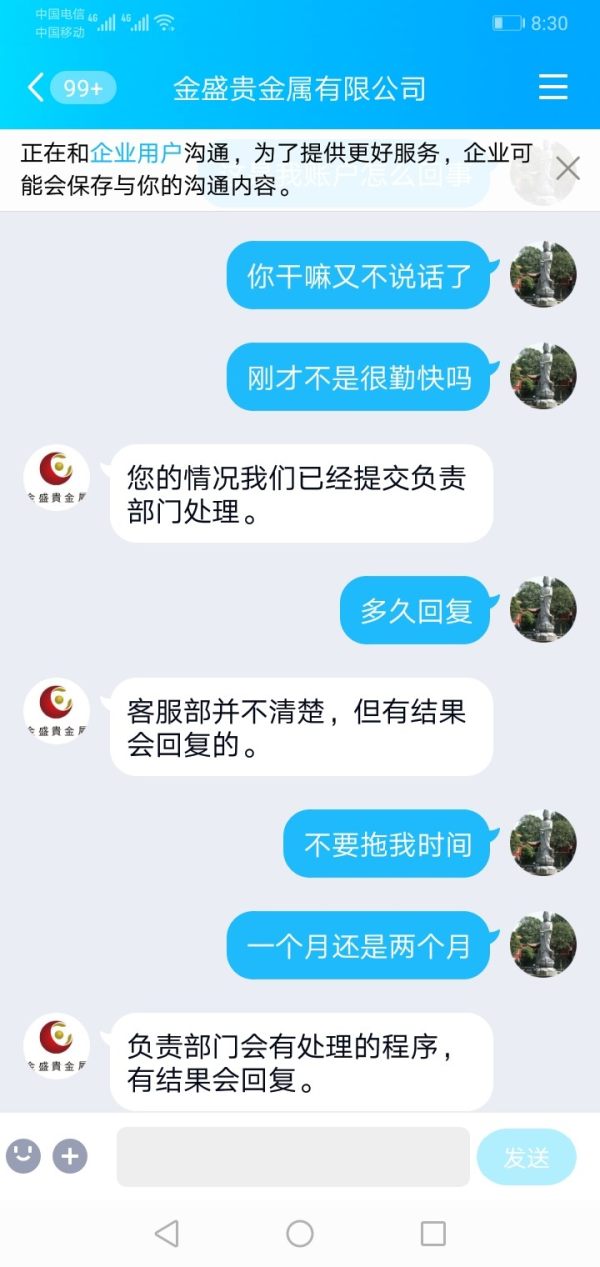

Customer service represents one of jinshengjinrong's most significant weaknesses, earning an extremely poor rating based on available user feedback and operational transparency. Multiple user reports indicate big problems with service quality, responsiveness, and problem resolution capabilities.

The broker has not clearly communicated their customer support channels, operating hours, or availability standards. This lack of transparency about how clients can access help when needed creates immediate concerns about the company's commitment to customer care. Professional brokers typically provide multiple contact methods including phone, email, live chat, and sometimes social media support.

Response times and service quality have received consistently negative feedback from users who have attempted to resolve issues with the platform. Reports suggest that customer service representatives have been unable or unwilling to address basic problems, particularly those related to fund management and trading execution issues.

The absence of information about multilingual support capabilities further limits the broker's accessibility to international clients. In today's global trading environment, quality customer service should include support in multiple languages with culturally appropriate communication styles.

Most critically, user testimonials indicate that the customer service team has been ineffective in resolving serious issues related to fund security and trading functionality, which represents a basic failure in their support obligations.

Trading Experience Analysis (Score: 4/10)

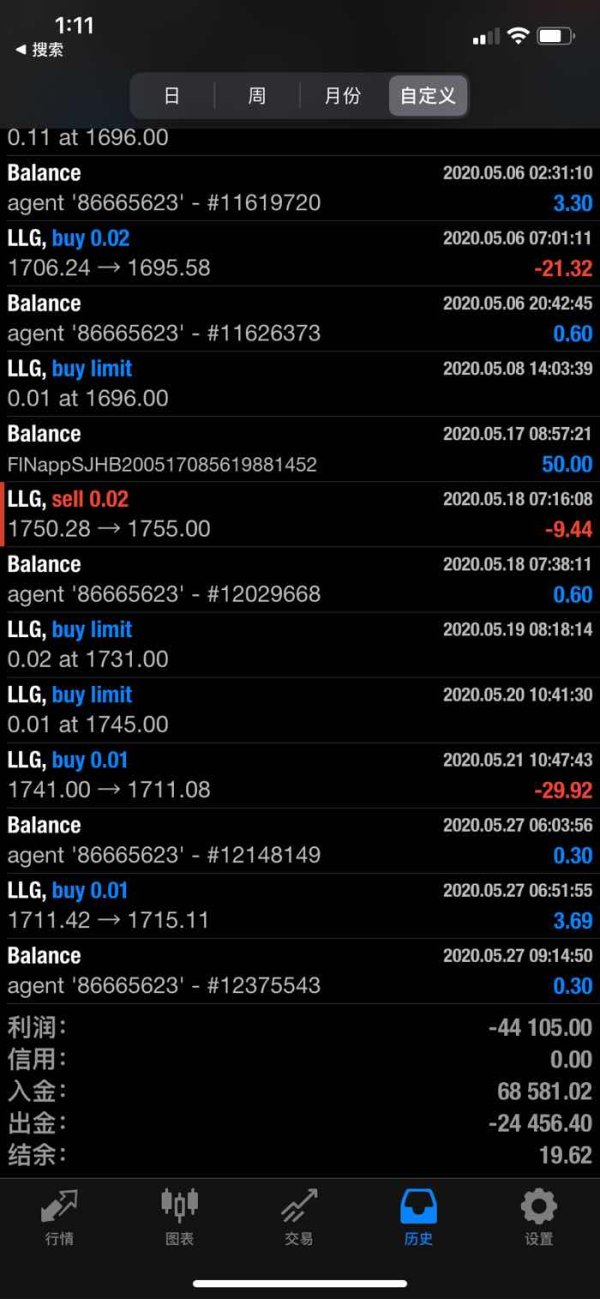

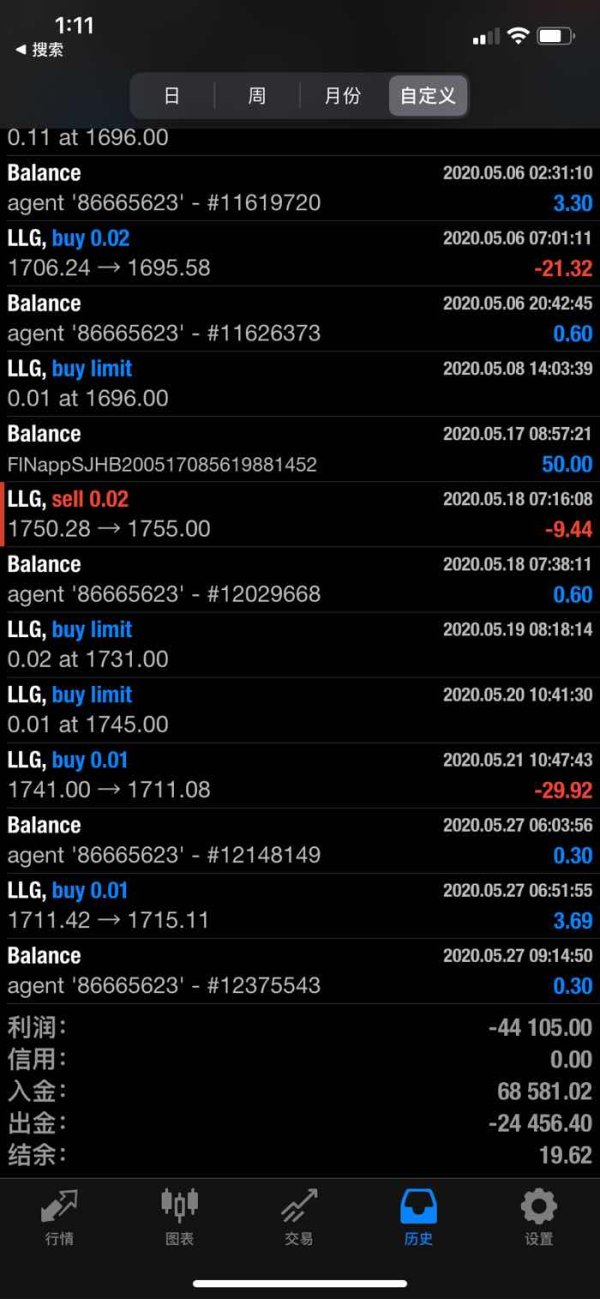

The trading experience with jinshengjinrong presents mixed results, with some positive elements offset by big operational concerns. User feedback indicates that funds have not properly entered trading markets, which represents a basic failure in the most basic requirement of any trading platform - the ability to execute trades with client funds.

Platform stability appears to be a concern based on user reports, though specific technical performance data is not available for detailed analysis. The provision of MetaTrader 4 should theoretically provide a stable trading environment, as MT4 is a well-established platform with proven reliability. However, the broker's implementation or infrastructure may be causing the reported issues.

The mobile trading experience through the Jinsheng Precious Metal APP lacks detailed user reviews or performance assessments. While mobile trading capability is essential in modern markets, the effectiveness of their own application remains unclear based on available information.

Order execution quality has not been specifically documented, but user complaints about funds not reaching markets suggest potential problems with trade processing and settlement procedures. This jinshengjinrong review finds that these basic operational issues significantly impact the overall trading experience regardless of platform features.

The limited asset focus on precious metals may provide a streamlined experience for specialized traders, but it also restricts diversification opportunities that many traders expect from their brokers.

Trustworthiness Analysis (Score: 1/10)

Trustworthiness represents jinshengjinrong's most critical weakness, earning the lowest possible rating due to documented fraud claims and consistently negative user experiences. The broker's regulatory status claims require serious scrutiny, as Hong Kong registration alone does not guarantee legitimate operations or adequate investor protection.

Multiple fraud claims have been reported against jinshengjinrong, creating immediate and serious concerns about the safety of client funds and the legitimacy of their operations. These claims, combined with user reports of fund management problems, suggest systematic issues with the broker's business practices.

The company's transparency regarding fund safety measures is severely lacking. Professional brokers typically provide clear information about client fund segregation, insurance coverage, and regulatory protections. jinshengjinrong's failure to communicate these critical safety measures raises red flags about their commitment to client protection.

Industry reputation appears to be significantly damaged based on available feedback and claims. The accumulation of negative reports and fraud claims creates a pattern that suggests serious operational and ethical problems rather than isolated incidents.

The broker's handling of user complaints and negative events appears inadequate based on continuing reports of unresolved issues. Legitimate brokers typically have established procedures for addressing client concerns and resolving disputes, but such mechanisms do not appear to be functioning effectively with jinshengjinrong.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with jinshengjinrong appears to be consistently poor based on available feedback and documented issues. Users have reported basic problems with basic platform functionality, particularly regarding fund management and market access, which represents a failure in the most essential aspects of the trading experience.

The user interface design and ease of use for both the MT4 platform and proprietary applications have not received detailed feedback in available materials. However, the underlying operational problems suggest that even well-designed interfaces cannot compensate for basic business practice issues.

Registration and account verification processes are not clearly documented, which creates uncertainty for potential users about what to expect when opening accounts. This lack of transparency in onboarding procedures adds to the overall poor user experience.

Fund operation experiences have been particularly problematic, with multiple reports of money not properly entering trading markets. This represents a critical failure in user experience that directly impacts traders' ability to achieve their investment objectives.

Common user complaints center around fund security, customer service responsiveness, and platform reliability. The consistency of these negative reports across multiple areas suggests systematic problems rather than isolated technical issues. The user demographic appears to consist mainly of precious metals investors who have been attracted by the specialized focus but subsequently disappointed by operational realities.

Conclusion

This comprehensive jinshengjinrong review reveals a broker with basic operational and trustworthiness issues that make it unsuitable for most retail investors. While the company offers some positive elements such as MetaTrader 4 platform access and specialization in precious metals trading, these advantages are completely overshadowed by serious fraud claims and consistently negative user experiences.

The broker's extremely poor trustworthiness rating, combined with big problems in customer service and account functionality, creates an unacceptable risk profile for traders seeking reliable market access. The lack of transparency in critical areas such as regulatory compliance, fee structures, and fund safety measures further compounds these concerns.

We strongly advise potential clients to seek alternative brokers with established regulatory compliance, transparent business practices, and positive user feedback. The documented issues with jinshengjinrong represent serious red flags that experienced traders should recognize as indicators of potential fraud or operational incompetence that could result in significant financial losses.