Is Izanmarket safe?

Business

License

Is Izanmarket Safe or a Scam?

Introduction

Izanmarket is a forex broker that has gained attention in the trading community for its offerings in the foreign exchange market. As with any financial service provider, it is crucial for traders to conduct thorough evaluations before committing their funds. The forex market is known for its volatility and risks, making it essential for traders to ensure that their broker is reliable and trustworthy. In this article, we will explore whether Izanmarket is safe or a scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. Our investigation is based on a comprehensive analysis of available data and user feedback, aiming to provide a balanced view of Izanmarket's legitimacy.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant factors that determine its safety and reliability. A well-regulated broker is more likely to adhere to strict guidelines that protect traders' interests. Unfortunately, Izanmarket does not appear to hold a license from a reputable regulatory authority.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight raises red flags regarding Izanmarket's operations. Without a regulatory framework, traders have little recourse in the event of disputes or fund mismanagement. Moreover, the lack of valid regulatory information suggests that the broker may not be committed to maintaining industry standards. This situation poses a high potential risk for traders, as they could be exposed to unfair trading practices or even outright fraud. Thus, it is critical for prospective clients to consider these factors when assessing whether Izanmarket is safe.

Company Background Investigation

Izanmarket is operated by Liri Ozan Limited, a company that lacks substantial public information regarding its history or ownership structure. The lack of transparency surrounding the company's background is concerning, as it makes it difficult for traders to assess the legitimacy of the broker.

The management team behind Izanmarket also remains largely unknown, which further complicates the evaluation of the broker's credibility. A reliable broker typically provides information about its executives and their qualifications, which helps build trust among traders. The absence of such disclosures raises questions about the broker's operational integrity and commitment to client safety.

In summary, the limited information available about Izanmarket's history, management, and ownership does not inspire confidence. Traders should be cautious and consider the implications of engaging with a broker that lacks transparency and a verifiable track record.

Trading Conditions Analysis

When assessing whether Izanmarket is safe, it is also essential to examine its trading conditions, including fees and spreads. A transparent and fair fee structure is indicative of a reliable broker. However, Izanmarket's fee structure appears to be less than straightforward.

| Fee Type | Izanmarket | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1-2 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

The lack of clear information regarding spreads and commissions can be a warning sign. Traders may encounter unexpected fees that could erode their profits, making it crucial to scrutinize the broker's cost structure before trading. Furthermore, any unusual or opaque fees could indicate that the broker is not acting in the best interests of its clients.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. Izanmarket's approach to fund security is a critical factor in determining whether Izanmarket is safe.

The broker does not provide clear information about fund segregation, investor protection, or negative balance protection policies. These are essential features that reputable brokers typically offer to safeguard client funds. The absence of such measures raises concerns about the potential for fund mismanagement or loss.

Additionally, any historical issues related to fund security or disputes with clients would be a red flag. Unfortunately, there is limited information about such incidents, which further complicates the evaluation of Izanmarket's trustworthiness.

Customer Experience and Complaints

Customer feedback is a valuable resource for gauging the reliability of a broker. Analyzing user experiences can reveal common patterns and issues that may not be apparent in official communications.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

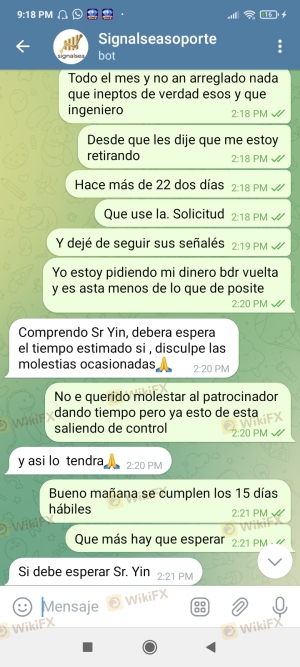

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

| Misleading Information | High | No Clarification |

Common complaints about Izanmarket include difficulties with withdrawals and inadequate customer support. These issues can significantly impact a trader's experience and trust in the broker. Moreover, reports of unresponsive support teams can exacerbate frustrations, particularly when traders need assistance with urgent matters.

In conclusion, the overall customer experience with Izanmarket raises concerns about its reliability. The presence of unresolved complaints and a lack of proactive customer service indicate that traders should approach this broker with caution.

Platform and Trade Execution

The performance of a trading platform is crucial for successful trading. A reliable platform should offer stability, speed, and user-friendly features. However, there are limited details available regarding the specifics of Izanmarket's trading platform.

Additionally, order execution quality, slippage rates, and instances of order rejections are also vital metrics to consider. Without transparent data on these aspects, it is challenging to assess whether traders can expect a smooth and efficient trading experience. Any signs of platform manipulation or technical issues could further undermine confidence in the broker.

Risk Assessment

Using Izanmarket carries inherent risks that traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of clear fund protection measures |

| Customer Support Risk | Medium | Complaints about unresponsiveness |

Given these risks, it is advisable for traders to consider alternative options that offer better security and transparency.

Conclusion and Recommendations

In summary, the evidence suggests that Izanmarket is not a safe choice for forex trading. The lack of regulatory oversight, transparency regarding company operations, unclear trading conditions, and negative customer experiences indicate that traders should exercise caution.

For those seeking reliable alternatives, consider brokers that are regulated by reputable authorities such as the FCA, ASIC, or NFA. These brokers typically provide better security measures, transparent fee structures, and responsive customer support. Ultimately, it is crucial for traders to prioritize safety and due diligence when selecting a forex broker.

Is Izanmarket a scam, or is it legit?

The latest exposure and evaluation content of Izanmarket brokers.

Izanmarket Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Izanmarket latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.