Is IRA Crown safe?

Business

License

Is IRA Crown Safe or a Scam?

Introduction

IRA Crown is an online forex broker that has recently garnered attention in the trading community. Positioned in the competitive landscape of forex trading, it claims to offer a wide range of trading instruments, including forex, cryptocurrencies, commodities, and indices. However, the increasing number of unregulated and potentially fraudulent brokers in the industry necessitates a cautious approach for traders. This article aims to provide a comprehensive evaluation of IRA Crown, focusing on its regulatory status, company background, trading conditions, customer safety measures, and overall client experience. Our investigation is based on multiple sources, including expert reviews and user feedback, to assess whether IRA Crown is indeed a safe trading option or a potential scam.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and protect client funds. Unfortunately, IRA Crown lacks a valid regulatory license. According to various reviews, including those from BrokersView and FXStreet, IRA Crown is not registered with the UK Financial Conduct Authority (FCA), which is the primary regulatory body overseeing financial services in the UK. This absence of regulation raises significant red flags about the safety of trading with this broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Unregulated |

The lack of oversight from reputable regulatory bodies means that traders' funds are not protected by any legal framework. This situation often leads to risky trading environments where brokers can engage in unethical practices without fear of repercussions. The consensus among financial experts is clear: never invest with unregulated brokers like IRA Crown, as they pose a high risk to your capital.

Company Background Investigation

IRA Crown claims to be a legally registered entity in the UK, operating under the name IRA Crown Group Ltd. Established in 2019, the company has not provided substantial information regarding its ownership or management team. The available data indicates that its business activities are categorized as "financial intermediation not elsewhere classified," a vague description that allows the broker to avoid stricter regulations.

The management team's background is also unclear, with no publicly available information detailing their qualifications or experience in the financial markets. This lack of transparency is concerning, as a reputable broker typically showcases its leadership team's credentials to build trust with potential clients. Furthermore, the absence of detailed information about the company's operations and history raises questions about its legitimacy and operational integrity. In summary, the opacity surrounding IRA Crown's corporate structure and management is a significant cause for concern when evaluating whether IRA Crown is safe.

Trading Conditions Analysis

When assessing a forex broker, understanding the trading conditions is crucial. IRA Crown offers various account types with minimum deposits starting at $100, which is relatively standard in the industry. However, the broker's fee structure is less transparent, with reports of high spreads and commissions that are not clearly outlined on its website.

| Fee Type | IRA Crown | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 0.5 - 1.0 pips |

| Commission Model | $8 per lot | $5 per lot |

| Overnight Interest Range | N/A | Varies |

The spreads offered by IRA Crown are notably higher than the industry average, which could significantly impact trading profitability. Additionally, the lack of clarity regarding overnight interest rates and other potential fees is alarming. Traders should be wary of hidden costs that can erode their capital over time. In conclusion, the overall trading conditions at IRA Crown do not inspire confidence, leading to further doubts about whether IRA Crown is safe for trading.

Client Funds Safety

The safety of client funds is paramount when choosing a forex broker. IRA Crown's website does not provide clear information regarding its fund safety measures, such as segregated accounts or investor protection schemes. Without these safeguards, clients are at risk of losing their deposits in the event of the broker's insolvency.

Furthermore, the absence of negative balance protection adds another layer of risk, as traders could end up owing money beyond their initial investment. Historical data and user experiences indicate that unregulated brokers often have a poor track record when it comes to returning client funds, especially during withdrawal requests. Given these factors, it is evident that IRA Crown does not prioritize client fund safety, raising serious concerns about whether IRA Crown is a scam.

Customer Experience and Complaints

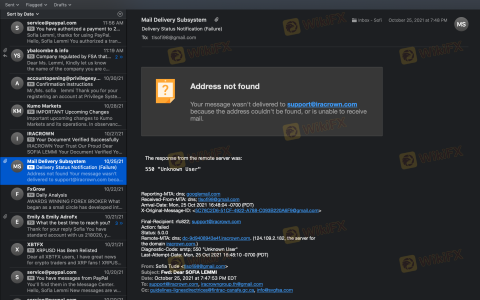

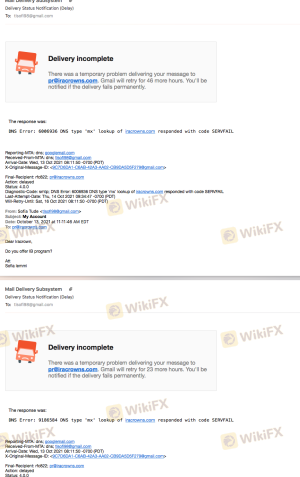

User feedback is a valuable resource for assessing a broker's reliability. Reviews of IRA Crown frequently highlight issues related to withdrawal difficulties and poor customer service. Common complaints include unresponsive support and delays in processing withdrawal requests, which are significant red flags for potential investors.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

Several users have reported experiences where their withdrawal requests were either denied or took an excessively long time to process. These complaints are indicative of a broader pattern of poor customer service and operational inefficiency. Furthermore, the overall sentiment among users is that IRA Crown lacks the necessary support to address client concerns effectively. This negative feedback reinforces the notion that IRA Crown may not be a safe trading option.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for a successful trading experience. IRA Crown claims to offer access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). However, user reviews suggest that the platforms may not function as intended, with reports of connection issues and execution delays.

These problems can lead to slippage and rejected orders, both of which can adversely affect trading outcomes. Moreover, there are indications that IRA Crown may be using demo versions of these platforms rather than providing a fully operational trading environment. Such practices raise concerns about potential platform manipulation and unfair trading conditions, further questioning whether IRA Crown is safe for traders.

Risk Assessment

Trading with IRA Crown presents several risks that traders must consider. The lack of regulation, unclear fee structures, and poor customer feedback all contribute to a high-risk trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Potential for hidden fees and poor fund safety. |

| Operational Risk | Medium | Issues with platform reliability and execution. |

To mitigate these risks, traders should approach IRA Crown with caution. It is advisable to conduct thorough research, consider starting with a minimal investment, and be prepared for the possibility of withdrawal difficulties. Additionally, traders may want to explore alternative brokers with better regulatory oversight and customer reviews.

Conclusion and Recommendations

In conclusion, the evidence gathered throughout this investigation strongly suggests that IRA Crown is not a safe trading option. The absence of regulation, unclear trading conditions, and negative customer experiences raise significant concerns about its legitimacy. Traders should be particularly wary of potential scams and consider alternative brokers that offer a more transparent and secure trading environment.

For those seeking reliable trading options, consider brokers that are well-regulated, have positive user feedback, and demonstrate a commitment to client fund safety. Ultimately, when it comes to your financial security, it is crucial to prioritize safety over potential gains, and based on the findings, IRA Crown does not meet those safety standards.

Is IRA Crown a scam, or is it legit?

The latest exposure and evaluation content of IRA Crown brokers.

IRA Crown Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IRA Crown latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.