Is IDG Trading safe?

Business

License

Is IDG Trading Safe or a Scam?

Introduction

IDG Trading positions itself as a global entity in the forex market, offering a platform for traders to engage in various financial instruments. However, the influx of complaints and negative reviews surrounding IDG Trading raises concerns about its legitimacy and reliability. In an industry rife with scams, it is imperative for traders to conduct thorough evaluations of forex brokers before committing their funds. This article aims to provide an objective assessment of IDG Trading, focusing on its regulatory status, company background, trading conditions, client fund safety, and user experiences. The analysis is based on a review of multiple sources, including user feedback, regulatory databases, and expert opinions.

Regulation and Legitimacy

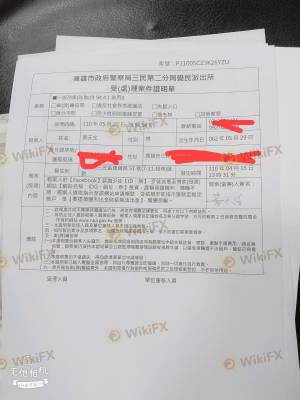

The regulatory status of a forex broker is a critical factor in assessing its safety. IDG Trading has come under scrutiny for its lack of regulation, which is a significant red flag for potential investors. Without oversight from recognized financial authorities, traders are left vulnerable to potential fraud and unethical practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a valid regulatory framework means that IDG Trading does not adhere to the stringent standards that protect investors. Regulatory bodies, such as the FCA (Financial Conduct Authority) in the UK and ASIC (Australian Securities and Investments Commission) in Australia, enforce rules that ensure brokers operate transparently and fairly. The lack of oversight raises concerns about the potential for mismanagement of client funds and the overall integrity of the trading environment.

Moreover, historical compliance issues have plagued IDG Trading, with numerous reports indicating that clients have faced difficulties in withdrawing their funds. This lack of regulatory oversight and history of compliance issues suggest that IDG Trading may not be a safe option for traders looking to invest in the forex market.

Company Background Investigation

IDG Trading's company history and ownership structure provide additional context for its credibility. The company claims to have a global presence, with offices in various regions, including Canada, the UK, and Singapore. However, the lack of transparency regarding its ownership and management team raises questions about its operational integrity.

The management team‘s background is crucial in assessing the company’s reliability. A lack of information about the teams qualifications and experience can be a cause for concern. In an industry where expertise and accountability are paramount, IDG Trading's opacity may indicate potential risks for investors.

Additionally, the company has faced numerous complaints from users regarding its communication practices and responsiveness. Transparency in operations and clear communication channels are vital for building trust with clients. The absence of these elements in IDG Trading's operations suggests that it may not prioritize client relations or uphold the standards expected of a reputable trading platform.

Trading Conditions Analysis

When evaluating whether IDG Trading is safe, it is essential to analyze its trading conditions and fee structure. The overall cost of trading with a broker can significantly impact a trader's profitability. IDG Trading's fee structure has raised eyebrows, with reports indicating hidden fees and unusual withdrawal requirements.

| Fee Type | IDG Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Structure | Unclear | Standard |

| Overnight Interest Range | Variable | Consistent |

The high spreads associated with IDG Trading can erode potential profits, making it a less attractive option for traders, particularly those who engage in frequent trading. Additionally, the unclear commission structure raises concerns about unexpected charges that may arise during the trading process.

Traders should be wary of any broker that imposes excessive fees or complex withdrawal requirements, as these can be indicative of a scam. The lack of clarity in IDG Tradings fee structure suggests that it may not be a safe environment for traders seeking straightforward and transparent trading conditions.

Client Fund Safety

The safety of client funds is a paramount concern for any trader considering a broker. In the case of IDG Trading, the absence of regulatory oversight raises significant concerns regarding the safety of client funds.

IDG Trading's policies on fund segregation, investor protection, and negative balance protection are unclear. Regulatory bodies typically require brokers to maintain client funds in segregated accounts, ensuring that client money is not used for operational expenses. Without such measures, clients risk losing their investments in the event of the broker's insolvency.

Furthermore, the lack of historical data regarding any past fund safety issues or controversies surrounding IDG Trading raises alarm bells. A broker's track record in managing client funds is a crucial aspect of assessing its safety. The absence of positive historical data suggests that potential investors should exercise extreme caution when considering IDG Trading as a viable trading option.

Client Experience and Complaints

Analyzing client feedback and experiences is essential in determining whether IDG Trading is safe. Numerous complaints have surfaced, highlighting issues such as difficulties in withdrawing funds, poor customer service, and lack of responsiveness from the company.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inadequate |

| Transparency | High | Lacking |

Common patterns in complaints indicate that clients often encounter significant hurdles when attempting to withdraw their funds, leading to frustration and dissatisfaction. The company's lack of effective communication and resolution strategies further exacerbates these issues, leading many to question IDG Trading's reliability.

For example, one user reported that after making a deposit, they faced continuous requests for additional fees before being allowed to withdraw their initial investment. Such experiences paint a concerning picture of IDG Trading's operational practices and suggest that it may not be a safe choice for traders.

Platform and Trade Execution

The performance of a trading platform is crucial for the overall trading experience. IDG Trading's platform has received mixed reviews, with users reporting issues related to stability and execution quality.

Traders have expressed concerns about order execution speed, slippage, and instances of rejected orders. These factors can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies. Furthermore, any signs of platform manipulation, such as frequent rejections of profitable trades, can indicate a lack of integrity in the broker's operations.

A reliable trading platform should provide seamless execution and minimal slippage. The reported issues with IDG Trading's platform suggest that it may not deliver the level of service that traders expect, raising further doubts about its safety.

Risk Assessment

Using IDG Trading presents several risks that potential investors should consider before proceeding.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of fund segregation and protection policies. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

| Customer Service Risk | High | Poor response to client complaints and issues. |

Given the high-risk levels associated with IDG Trading, traders should approach with caution. It is advisable to conduct thorough research and consider alternative brokers that offer regulated environments and transparent practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that IDG Trading raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, coupled with numerous client complaints and a problematic fee structure, indicates that potential investors should exercise extreme caution.

For traders seeking a secure and reliable trading environment, it is advisable to consider alternative brokers that are regulated and have established a positive track record. Brokers such as IG, OANDA, and Forex.com are examples of reputable options that provide a safer trading experience.

Ultimately, the question of “Is IDG Trading safe?” leans toward a negative response, as the risks associated with this broker outweigh the potential benefits. Traders should prioritize their financial security and choose brokers that adhere to regulatory standards and demonstrate a commitment to transparency and client satisfaction.

Is IDG Trading a scam, or is it legit?

The latest exposure and evaluation content of IDG Trading brokers.

IDG Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IDG Trading latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.