Is Pandora Finance safe?

Pros

Cons

Is Pandora Finance Safe or Scam?

Introduction

Pandora Finance, a brokerage firm operating in the foreign exchange (forex) market, has garnered attention for its offerings of forex and contracts for difference (CFDs). Established in China, the firm aims to provide traders with access to various financial instruments. However, as with any brokerage, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging in trading activities. The forex market is rife with potential risks and scams, making it essential for traders to assess the credibility and safety of their chosen brokers. This article aims to investigate the legitimacy of Pandora Finance, employing a structured evaluation framework that encompasses regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulatory Status and Legitimacy

The regulatory landscape is a vital aspect of any brokerage's credibility. A regulated broker is typically subject to oversight by recognized financial authorities, which can provide a safety net for traders. Unfortunately, Pandora Finance is not regulated by any major financial authorities, raising significant concerns regarding its legitimacy. The absence of regulation means that there is no guarantee of the safety of client funds or adherence to industry standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulatory oversight is alarming, especially considering the high potential for fraudulent practices in the unregulated forex market. Regulatory bodies are designed to protect investors, and without such protection, traders may find themselves vulnerable to scams or mismanagement of their funds. The historical compliance record of Pandora Finance is also nonexistent, further emphasizing the risks associated with trading with this broker.

Company Background Investigation

Pandora Finance Co., Limited was founded approximately 2 to 5 years ago and is registered in Hong Kong. However, the lack of substantial information regarding its ownership structure and management team raises questions about its transparency. A reputable brokerage typically provides detailed information about its management, including their professional backgrounds and experience in the financial industry. Unfortunately, Pandora Finance does not disclose relevant details about its management team, which is a significant red flag for potential investors.

Moreover, the companys official website has been reported as non-functional at times, limiting access to essential information that traders need to make informed decisions. This lack of transparency about the company's operations and its failure to provide adequate information about its management team contribute to the growing concerns about its credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for any trader. Pandora Finance claims to provide a variety of trading instruments, including forex and CFDs. However, the firm does not disclose specific details about its fee structure or trading costs, which can lead to unexpected expenses for traders.

| Fee Type | Pandora Finance | Industry Average |

|---|---|---|

| Spread on Major Pairs | Over 1.0 pips | 0.1 - 0.5 pips |

| Commission Structure | Not disclosed | Varies by broker |

| Overnight Interest Rate | Not disclosed | Varies by broker |

The high spreads and lack of transparency regarding commissions can be particularly concerning for traders, as they may not fully understand the costs associated with their trades. Additionally, the absence of clear information about overnight interest rates can lead to unexpected charges, impacting overall profitability.

Client Fund Safety

The safety of client funds is paramount when selecting a broker. Pandora Finances lack of regulation raises significant concerns regarding the safety of client funds. There is no available information on whether the broker employs measures such as segregated accounts to protect client deposits. Without such measures, clients' funds could be at risk in the event of financial instability or fraud.

Furthermore, the absence of investor protection schemes, which are typically provided by regulated brokers, means that traders have limited recourse in the event of a dispute or if the broker were to become insolvent. The historical context surrounding Pandora Finance also reveals no significant incidents regarding fund safety, but the lack of transparency makes it difficult to assess the overall risk.

Customer Experience and Complaints

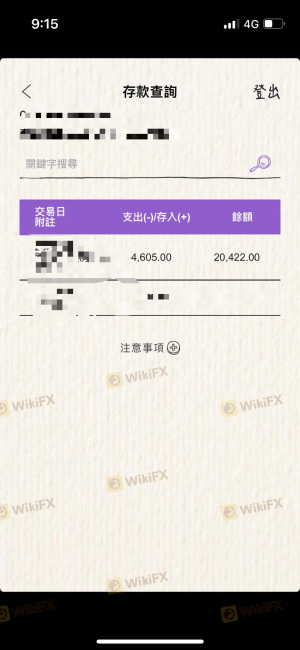

Customer feedback is an essential component of evaluating a broker's reliability. Reviews and reports from users indicate that Pandora Finance has received multiple complaints related to scams and difficulties in withdrawing funds. Such complaints are serious red flags that potential traders should consider before engaging with this broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor communication |

| Scam Allegations | High | No response |

Typical complaints revolve around withdrawal difficulties, where clients report being unable to access their funds after making deposits. The company's response to these complaints has been described as inadequate, with many users feeling ignored or dismissed. This pattern of complaints not only highlights the potential risks associated with trading with Pandora Finance but also raises questions about the broker's commitment to customer service.

Platform and Trade Execution

The trading platform provided by Pandora Finance is based on the popular MetaTrader 5 (MT5) software, which is known for its robust features and user-friendly interface. However, the performance and reliability of the platform are crucial for successful trading. Reports from users suggest that there have been issues with order execution, including slippage and rejected orders.

Traders have expressed concerns about the quality of trade execution, which can significantly impact their trading outcomes. If a brokers platform frequently experiences slippage or fails to execute orders promptly, it can lead to substantial financial losses for traders.

Risk Assessment

Engaging with an unregulated broker like Pandora Finance carries inherent risks. The absence of regulatory oversight, coupled with numerous complaints regarding fund safety and withdrawal issues, presents a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulation, high risk |

| Fund Safety | High | No investor protection |

| Customer Service | Medium | Poor response to complaints |

To mitigate these risks, potential traders should conduct thorough research, consider using regulated brokers, and avoid investing more than they can afford to lose.

Conclusion and Recommendations

Based on the available evidence, Pandora Finance raises significant concerns regarding its legitimacy and safety. The lack of regulation, combined with numerous user complaints and a non-transparent operational model, suggests that traders should exercise extreme caution when considering this broker.

For traders looking for alternatives, it is advisable to explore regulated brokers with a proven track record of reliability, transparency, and customer support. Some recommended options include brokers that are regulated by top-tier authorities such as the FCA, ASIC, or CySEC, which provide a safer trading environment and better protections for client funds.

In summary, is Pandora Finance safe or a scam? The evidence points towards a high level of risk, and potential traders should be wary of engaging with this broker without conducting thorough due diligence.

Is Pandora Finance a scam, or is it legit?

The latest exposure and evaluation content of Pandora Finance brokers.

Pandora Finance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pandora Finance latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.