Is CityIndex safe?

Pros

Cons

Is City Index A Scam?

Introduction

City Index, founded in 1983, is a well-established broker in the foreign exchange (forex) and Contracts for Difference (CFD) markets. With over 40 years of experience, it operates under the umbrella of the Stonex Group, a publicly traded company on NASDAQ. City Index has positioned itself as a reliable trading platform offering access to a wide range of financial instruments, including forex, indices, commodities, and shares. However, the forex trading environment is fraught with potential pitfalls, making it imperative for traders to carefully evaluate the legitimacy and reliability of their brokers. This article aims to provide an in-depth analysis of City Index, assessing its safety and reliability through a combination of regulatory scrutiny, company background evaluation, trading conditions analysis, and customer feedback. Our investigation is based on a comprehensive review of various reputable sources, including regulatory filings, user reviews, and expert assessments.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining whether a broker is safe or a potential scam. City Index is regulated by several top-tier financial authorities, which adds a layer of security for its clients. The following table summarizes the core regulatory information for City Index:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 113942 | United Kingdom | Verified |

| ASIC | 345646 | Australia | Verified |

| MAS | CMS100648-1 | Singapore | Verified |

| CFTC | N/A | United States | Not Applicable |

| NFA | N/A | United States | Not Applicable |

City Index operates under strict regulations from the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS). These regulators enforce stringent requirements, including maintaining client funds in segregated accounts and adhering to transparent trading practices. The FCA, in particular, provides a safety net for UK clients through the Financial Services Compensation Scheme (FSCS), which protects deposits up to £85,000 in the event of broker insolvency. The strong regulatory framework and compliance history of City Index indicate that it is a safe broker, rather than a scam.

Company Background Investigation

City Index has a rich history dating back to its founding in 1983. Originally established as a spread betting firm, it quickly adapted to the evolving financial landscape by incorporating CFD trading in 2001. Over the years, City Index has undergone several acquisitions, most notably being purchased by Gain Capital in 2014, which has allowed it to expand its reach and offerings significantly. The parent company, Stonex Group, is a Fortune 100 company that provides a solid financial backing to City Index.

The management team at City Index comprises seasoned professionals with extensive experience in the financial services industry. Their expertise and strategic vision have contributed to the broker's stability and growth over the decades. Furthermore, City Index has consistently emphasized transparency, regularly publishing financial reports and updates on its operations. This level of transparency is critical in building trust with clients and further solidifies the broker's reputation as a legitimate entity in the forex market.

Trading Conditions Analysis

When evaluating whether City Index is safe or a scam, it's essential to analyze its trading conditions, including fees and commissions. City Index offers a competitive fee structure, particularly for forex trading, which is often a significant concern for traders. The following table outlines the core trading costs associated with City Index:

| Fee Type | City Index | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 - 1.0 pips | 1.0 - 2.0 pips |

| Commission Model | None for CFDs (except shares) | Varies widely |

| Overnight Interest Range | 3.33% | 2.5% - 4% |

City Index does not charge commissions for trading CFDs, except for share CFDs, which is a common practice among brokers. The spreads offered are competitive, particularly for major currency pairs, making it an attractive option for traders looking to minimize trading costs. However, it's important to note that City Index imposes an inactivity fee of £12 per month after 12 months of inactivity, which may be considered a downside for infrequent traders.

Client Funds Safety

The safety of client funds is paramount when assessing whether City Index is safe or a scam. City Index implements several robust measures to ensure the security of client funds. Firstly, all client funds are held in segregated accounts, separate from the broker's operational funds. This practice protects clients' money in the unlikely event that City Index faces financial difficulties. Additionally, City Index offers negative balance protection, ensuring that clients cannot lose more than their deposited amount, a crucial feature when trading leveraged products.

Historically, City Index has maintained a solid reputation regarding fund safety, with no significant incidents of fund mismanagement or insolvency. The combination of regulatory oversight, segregated accounts, and negative balance protection contributes to a secure trading environment for clients.

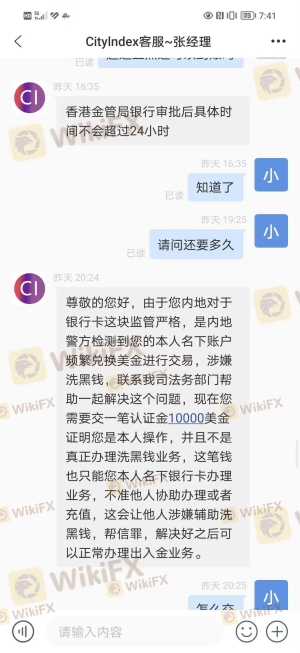

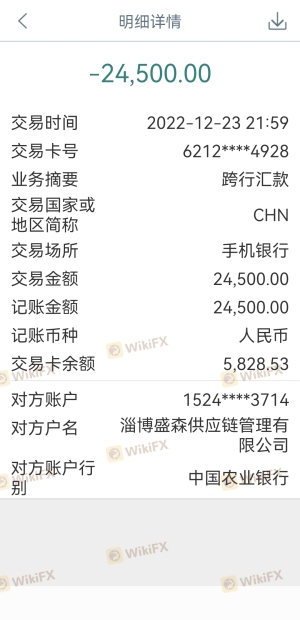

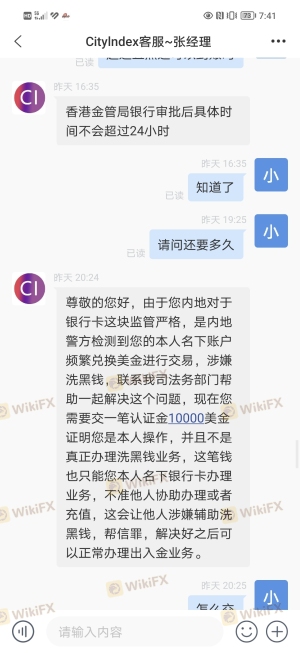

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. City Index has received a mix of reviews from users, with many praising its trading platform and customer support. However, like any broker, it has also faced some complaints. The following table summarizes the main types of complaints received about City Index:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Account Verification Issues | High | Addressed promptly |

| Platform Stability | Moderate | Ongoing improvements |

Typical complaints include withdrawal delays and account verification issues, which are common in the industry. However, City Index has been noted for its responsive customer service, addressing most issues promptly. For instance, one user reported a delay in withdrawal but received assistance from customer service, which resolved the issue within a few days. Overall, while there are occasional complaints, City Index appears to maintain a satisfactory level of customer service.

Platform and Trade Execution

The trading platform is a critical aspect of any broker's service. City Index offers a variety of trading platforms, including its proprietary web trader, mobile app, and the popular MetaTrader 4 (MT4). Users generally report a positive experience with the platform's performance, noting its stability and user-friendly interface. The average execution speed is approximately 0.05 seconds, with a high success rate of 99.99% for trade executions.

However, some users have reported instances of slippage and occasional platform malfunctions during high volatility periods. Despite these minor issues, there is no substantial evidence to suggest any manipulative practices, making City Index a reliable choice for traders.

Risk Assessment

Using City Index comes with certain risks, as is the case with any trading platform. The following risk assessment summarizes key risk areas associated with trading at City Index:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight |

| Trading Risk | High | High leverage can amplify losses |

| Operational Risk | Medium | Occasional platform issues |

While City Index is well-regulated and provides a secure trading environment, the inherent risks of trading, particularly with leverage, remain significant. Traders should employ proper risk management strategies, such as setting stop-loss orders and not over-leveraging their accounts.

Conclusion and Recommendations

In conclusion, City Index is not a scam; it is a legitimate broker with a long-standing history and robust regulatory oversight. The combination of strong regulatory bodies, transparent operations, and a variety of trading instruments makes it a safe option for traders. However, potential clients should be aware of the risks associated with trading, particularly the use of leverage, which can lead to significant losses.

For new traders, City Index offers a wealth of educational resources and a user-friendly platform, making it suitable for those looking to enter the forex market. Experienced traders will also find value in the competitive spreads and advanced trading tools available.

If you are considering alternatives, brokers such as IG and CMC Markets also offer strong regulatory oversight and competitive trading conditions. Ultimately, it is essential to assess your trading needs and risk tolerance before choosing a broker.

Is CityIndex a scam, or is it legit?

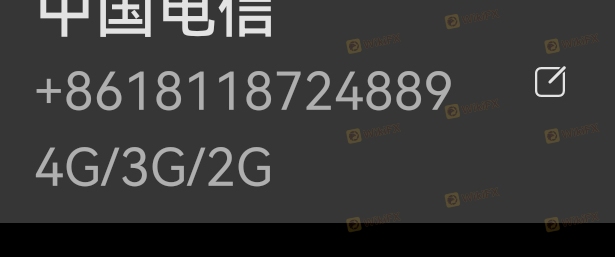

The latest exposure and evaluation content of CityIndex brokers.

CityIndex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CityIndex latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.