Is HOB safe?

Pros

Cons

Is HOB Safe or Scam?

Introduction

HOB is an online forex broker that positions itself in the competitive landscape of the foreign exchange market. As traders increasingly seek opportunities to invest and trade currencies, it becomes essential for them to evaluate the reliability and safety of the brokers they choose. This evaluation is crucial, as the forex market is rife with unregulated entities and potential scams. In this article, we will critically assess whether HOB is a safe broker or potentially a scam. Our investigation is based on comprehensive research, including regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

A broker's regulatory status is one of the most significant indicators of its legitimacy. Regulation ensures that brokers adhere to strict standards of conduct, providing a layer of protection for traders. In the case of HOB, it has been reported as an unregulated broker, raising serious concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of any regulatory oversight means that HOB does not have to comply with the stringent requirements set by recognized financial authorities, which can lead to potential risks for traders. Without regulation, investors' funds are not protected by any legal framework, making it imperative for traders to approach this broker with caution. Furthermore, past compliance records indicate that HOB has not been monitored by any recognized regulatory body, which raises further alarm bells for potential clients.

Company Background Investigation

HOB's history and ownership structure play a critical role in understanding its trustworthiness. Established in 2012, the broker claims to offer various trading services, including forex and CFDs. However, the lack of transparency regarding its ownership and management raises questions about its operational integrity.

The management teams credentials are also unclear, as there is limited information available about their professional backgrounds. A well-established broker typically provides detailed biographies of its executives, showcasing their expertise and experience in the financial industry. Unfortunately, HOB has not demonstrated this level of transparency, which is a red flag for potential investors.

In terms of information disclosure, HOB's website lacks comprehensive details about its operations, trading conditions, and risk factors, further complicating the assessment of its reliability. This lack of transparency can be a significant indicator of a scam, as legitimate brokers usually prioritize clear communication with their clients.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall value proposition. HOB's fee structure appears to be ambiguous, with reports indicating potential hidden fees that could affect traders' profitability.

| Fee Type | HOB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Range | Unspecified | Specified |

The lack of clarity surrounding HOB's commission structure and overnight interest rates raises concerns about potential hidden costs that could erode traders' profits. Moreover, the reported high spreads on major currency pairs are not competitive compared to industry standards, suggesting that traders may not receive the best execution prices. This lack of transparency in trading costs is a common tactic employed by fraudulent brokers to mislead clients.

Client Funds Safety

The safety of client funds is paramount when evaluating any broker. HOB has been criticized for its inadequate measures to protect client funds. There are no clear indications that HOB utilizes segregated accounts to separate client funds from its operational funds, which is a standard practice in the industry to enhance security.

Moreover, the absence of investor protection mechanisms, such as negative balance protection, leaves clients vulnerable to significant financial losses. Historical accounts of brokers like HOB indicate that clients may struggle to retrieve their funds in the event of a dispute. Such scenarios can lead to severe financial repercussions for traders, further emphasizing the need for caution when considering this broker.

Customer Experience and Complaints

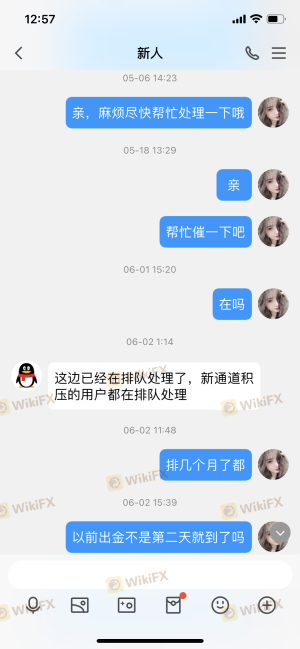

Analyzing customer feedback is crucial for understanding a broker's reputation. Reviews of HOB reveal a pattern of negative experiences among clients, particularly regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Inadequate |

Common complaints include difficulties in withdrawing funds and unresponsive customer support. The severity of these complaints suggests a systemic issue within the broker's operations. For instance, several users have reported that their withdrawal requests were either ignored or delayed, raising concerns about the broker's financial practices. Such complaints are typical of brokers that may not have the best interests of their clients at heart.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. HOB claims to offer a user-friendly platform, but user experiences tell a different story. Reports indicate that clients have faced issues with order execution, including slippage and rejected orders.

The execution quality is vital for traders, as poor execution can lead to significant losses. Additionally, there are concerns about potential platform manipulation, which could further compromise traders' positions. A reliable broker should provide a stable and efficient trading environment, but HOB's track record suggests that it may not meet these expectations.

Risk Assessment

Using HOB as a trading platform comes with inherent risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status |

| Financial Security Risk | High | Lack of fund protection |

| Customer Service Risk | Medium | Poor complaint handling |

Given the high levels of regulatory and financial security risks, traders should approach HOB with extreme caution. It is advisable to conduct thorough research and consider using alternative, regulated brokers that offer better protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that HOB is not a safe broker for forex trading. The lack of regulation, poor customer reviews, and inadequate security measures raise significant red flags. Traders should be wary of potential scams and consider alternative brokers that are regulated by reputable authorities.

For those seeking reliable trading options, it is recommended to explore brokers such as [insert recommended brokers here], which are known for their regulatory compliance and positive customer feedback. Ultimately, it is crucial for traders to prioritize their financial safety and choose brokers that demonstrate transparency and accountability in their operations.

In summary, is HOB safe? The overwhelming consensus is that it poses considerable risks, and potential clients should exercise extreme caution before engaging with this broker.

Is HOB a scam, or is it legit?

The latest exposure and evaluation content of HOB brokers.

HOB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HOB latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.