Is HKS Trading safe?

Business

License

Is HKS Trading Safe or a Scam?

Introduction

HKS Trading is a forex broker that has emerged in the competitive landscape of online trading, promising access to various financial markets and trading instruments. As the foreign exchange market continues to grow, traders are increasingly faced with the challenge of discerning which brokers are trustworthy and which may pose risks to their investments. Evaluating the safety and legitimacy of a broker like HKS Trading is paramount for traders to protect their hard-earned money. This article aims to provide an objective analysis of HKS Trading, assessing its regulatory status, company background, trading conditions, customer experiences, and overall risks involved. Our investigation is based on multiple sources, including regulatory databases, user reviews, and expert assessments.

Regulation and Legitimacy

The regulatory environment surrounding forex brokers is critical in determining their legitimacy and the safety of client funds. HKS Trading has come under scrutiny for its lack of regulation, which is a significant red flag for potential investors. An unregulated broker operates without oversight from a recognized financial authority, leaving clients vulnerable to unethical practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of any regulatory oversight from established authorities such as the Financial Conduct Authority (FCA) or the Hong Kong Securities and Futures Commission (HKSFC) raises concerns about the broker's operational integrity. Regulatory bodies enforce strict guidelines to protect investors, and the lack of such oversight suggests that HKS Trading may not adhere to industry standards. Historical compliance data indicates that many unregulated brokers have faced allegations of fraud, making it crucial for traders to be cautious. In the case of HKS Trading, the lack of a regulatory framework significantly undermines its credibility, leading to questions about whether HKS Trading is safe for traders.

Company Background Investigation

Understanding the companys history and ownership structure is vital for assessing its reliability. HKS Trading Limited was incorporated in July 2021, but it has already faced serious allegations of fraudulent activities. The company has a relatively short history, which raises concerns about its sustainability and trustworthiness. Furthermore, the management team behind HKS Trading has not been transparent about their qualifications or experience in the financial sector, which is essential for building trust with potential clients.

Transparency and information disclosure are crucial in the financial industry. Potential investors should be able to access detailed information about the company's operations, management, and financial health. Unfortunately, HKS Trading has not provided sufficient information to instill confidence in its operations. The lack of a well-defined corporate structure and transparency further contributes to the perception that HKS Trading may not be a safe option for traders.

Trading Conditions Analysis

When evaluating whether HKS Trading is safe, it is essential to analyze its trading conditions, including fees and spreads. The broker claims to offer competitive trading costs, but the absence of transparent information regarding its fee structure raises concerns. Traders should be wary of hidden fees that could erode their profits.

| Fee Type | HKS Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information on spreads and commissions can be indicative of potentially unfavorable trading conditions. Traders should be cautious if the broker does not provide detailed information on its fee structure, as this could lead to unexpected costs. Furthermore, the absence of a transparent commission model can make it difficult for traders to assess the overall cost of trading with HKS Trading. These factors contribute to the perception that HKS Trading may not be a safe choice for traders seeking clarity and transparency.

Client Fund Security

The safety of client funds is a primary concern for any trader. HKS Trading's approach to fund security is under scrutiny, particularly due to its lack of regulation. Regulated brokers are required to implement measures such as segregating client funds from operational funds, providing a layer of protection against insolvency.

HKS Trading has not disclosed information regarding its fund security measures, which raises significant concerns. Without details about fund segregation, investor protection policies, or negative balance protection, traders are left vulnerable. Historical data shows that unregulated brokers often face issues related to fund mismanagement, leading to significant losses for clients. Therefore, the lack of transparency regarding fund security at HKS Trading is a critical factor that suggests it may not be safe for traders.

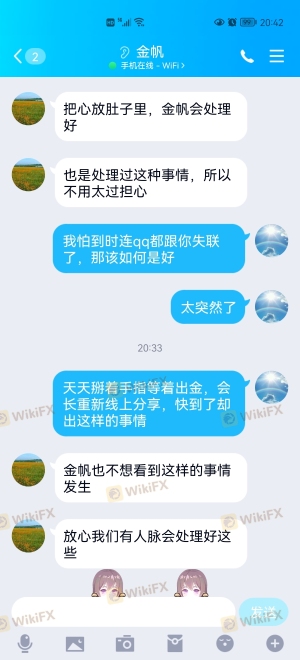

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience with a broker. Reviews of HKS Trading reveal a concerning trend of negative experiences among clients. Common complaints include issues with withdrawals, unresponsive customer service, and allegations of deceptive practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Deceptive Practices | High | Poor |

Several users have reported difficulties in withdrawing their funds, with claims that requests were ignored or delayed. Additionally, the company's response to complaints has been largely inadequate, indicating a lack of commitment to customer service. These patterns of complaints suggest that HKS Trading may not prioritize client satisfaction, further casting doubt on its legitimacy and safety.

Platform and Execution

The performance of a trading platform is crucial for a trader's success. HKS Trading claims to offer a user-friendly platform, but there are concerns regarding its stability and execution quality. Reports of slippage and rejected orders have surfaced, which can significantly impact trading outcomes.

The absence of transparency regarding the platform's performance raises questions about whether HKS Trading is safe for traders. If a broker's platform is prone to technical issues, it can lead to missed opportunities and financial losses. Traders should be cautious if there are indications of potential manipulation or instability within the trading platform.

Risk Assessment

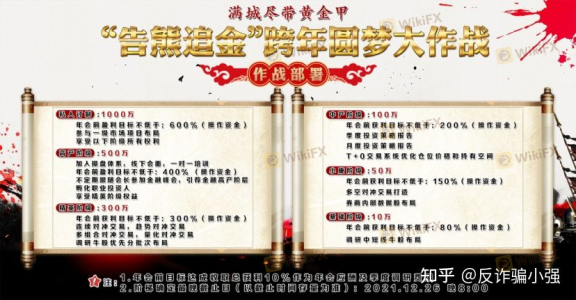

Using HKS Trading entails various risks, primarily due to its lack of regulation and transparency. Traders should be aware of the following risk factors:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of transparency on fund safety |

| Customer Service Risk | Medium | Poor response to client complaints |

To mitigate risks associated with trading with HKS Trading, potential clients are advised to conduct thorough research, avoid investing large sums, and consider alternative, regulated brokers.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that HKS Trading raises several red flags that indicate it may not be a safe option for traders. The lack of regulation, transparency regarding fees, and negative customer experiences highlight significant concerns. While HKS Trading may present itself as a viable trading platform, the risks associated with investing with an unregulated broker cannot be overlooked.

For traders seeking safer alternatives, it is advisable to consider brokers that are regulated by reputable authorities, such as the FCA or HKSFC. These brokers offer greater transparency, security, and a commitment to client protection. Ultimately, traders should prioritize their financial safety and choose brokers that align with established industry standards.

Is HKS Trading a scam, or is it legit?

The latest exposure and evaluation content of HKS Trading brokers.

HKS Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HKS Trading latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.