Regarding the legitimacy of HGNH INTERNATIONAL forex brokers, it provides SFC, SFC, FCA, NFA, MAS and WikiBit, (also has a graphic survey regarding security).

Is HGNH INTERNATIONAL safe?

Business

Risk Control

Is HGNH INTERNATIONAL markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

HGNH International Forex Co., Limited

Effective Date:

2014-04-04Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

HGNH International Futures Co., Limited

Effective Date:

2007-06-26Email Address of Licensed Institution:

compliance@hgnh.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.henghua.hkExpiration Time:

--Address of Licensed Institution:

香港灣仔告士打道181-185號中怡大廈17/FPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

NANHUA FINANCIAL (UK) CO LIMITED

Effective Date:

2019-06-10Email Address of Licensed Institution:

nanhuauk@nhfinancial.co.uk, vladimir.kisyov@nhfinancial.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.nanhuafinancial.co.ukExpiration Time:

--Address of Licensed Institution:

4th Floor 60 Moorgate London EC2R 6EJ UNITED KINGDOMPhone Number of Licensed Institution:

+442037466446Licensed Institution Certified Documents:

NFA Derivatives Trading License (AGN)

National Futures Association

National Futures Association

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

NANHUA USA LLC

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

30 South Wacker Dr Suite 3850 Chicago, IL 60606 United StatesPhone Number of Licensed Institution:

(312) 374-4885Licensed Institution Certified Documents:

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

NANHUA SINGAPORE PTE.LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

4 SHENTON WAY #18-04 SGX CENTRE 2 068807Phone Number of Licensed Institution:

+65 69329800Licensed Institution Certified Documents:

Is HGNH Safe or a Scam?

Introduction

HGNH, also known as Henghua International Financial Corporation Limited, operates in the forex market, primarily targeting clients in Asia and beyond. As the trading landscape becomes increasingly saturated with various brokers, traders must exercise caution when selecting a platform to invest their hard-earned money. The potential for scams and unregulated brokers poses significant risks, making it vital for traders to conduct thorough evaluations of any potential trading partner. In this article, we will investigate whether HGNH is a safe trading option or a scam. Our analysis is based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulatory and Legitimacy

The regulatory environment in which a broker operates is crucial in determining its legitimacy and safety. A well-regulated broker is typically held to higher standards, providing a layer of protection for clients. In the case of HGNH, the broker claims to be regulated by the Securities and Futures Commission (SFC) in Hong Kong. However, various sources indicate discrepancies regarding its regulatory status.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | AOU118 | Hong Kong | Active |

While HGNH has a license from the SFC, there are concerns about its compliance history and the overall reputation of the regulatory body. The SFC has revoked licenses in the past, raising questions about the broker's adherence to regulatory standards. Furthermore, the lack of transparency regarding its operational practices and the absence of clear communication about its regulatory status have led to skepticism among potential investors. Thus, while HGNH is technically regulated, the quality of that regulation remains questionable, and traders should be cautious when considering whether HGNH is safe.

Company Background Investigation

HGNH was established in 2006 and is headquartered in Hong Kong. The company is a subsidiary of China Nanhua Futures Co., Ltd., which has a more extensive history in the financial services industry. Despite its long-standing presence, there is limited information regarding the management team and their professional backgrounds. Transparency is a critical factor in assessing a broker's reliability, and HGNH's lack of detailed disclosures about its leadership raises red flags.

The ownership structure suggests a connection to a larger organization, which may provide some level of stability. However, the company's overall transparency and information disclosure practices are subpar, making it difficult for potential clients to gauge the broker's integrity. Without clear insights into the management's qualifications and the company's operational history, traders might question whether HGNH is safe for their investments.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is essential. HGNH offers a variety of trading instruments, including forex, CFDs, and commodities. The fee structure appears competitive at first glance, but further scrutiny reveals some inconsistencies.

| Fee Type | HGNH | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1.5% |

Despite offering a commission-free model, the spreads on major currency pairs are slightly higher than the industry average. Additionally, the overnight interest rates can be significant, impacting long-term traders. These factors contribute to a higher overall cost of trading, which may deter potential clients. Therefore, while HGNH's trading conditions may seem appealing, traders should be wary of hidden costs, leading to the question of whether HGNH is safe for long-term investment strategies.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. HGNH claims to implement various measures to protect client deposits, including segregated accounts and investor protection schemes. However, the effectiveness of these measures is often scrutinized.

The broker's commitment to fund security is questionable, given its limited disclosures regarding the specifics of these protections. Additionally, the absence of a clear investor compensation scheme raises concerns about what would happen in the event of financial difficulties. Historical reports of fund mismanagement or disputes further exacerbate these worries. Without robust safety measures in place, potential clients should be cautious and consider whether HGNH is safe for their investments.

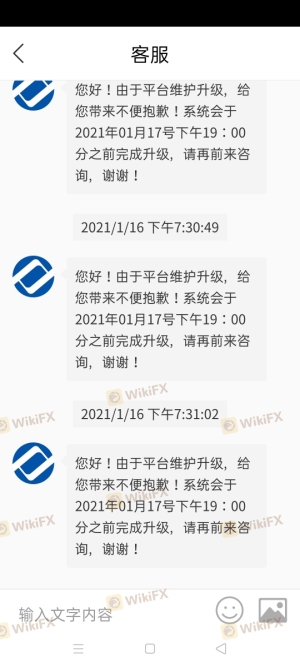

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of HGNH reveal a mixed bag of experiences, with numerous complaints regarding withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Fair |

| Account Management | High | Poor |

Common complaints include difficulties in withdrawing funds after initial deposits, leading many to question the broker's legitimacy. Furthermore, the company's response to these complaints has been less than satisfactory, with many users reporting slow or inadequate support. These patterns of dissatisfaction raise significant concerns about the overall trustworthiness of HGNH, prompting traders to consider whether HGNH is safe for their trading needs.

Platform and Trade Execution

The trading platform offered by HGNH is another critical factor in assessing its reliability. The broker provides access to various trading tools and features, but reviews suggest that the platform's performance can be inconsistent. Users have reported issues such as slippage during high volatility periods and occasional platform outages.

The quality of order execution is crucial for traders, and any signs of manipulation or unfair practices can significantly impact trading outcomes. While HGNH claims to offer a user-friendly interface, the execution quality has been criticized, suggesting that traders may face challenges when attempting to execute trades quickly and efficiently. This inconsistency further contributes to doubts about whether HGNH is safe for serious investors.

Risk Assessment

Engaging with HGNH presents several risks that potential clients should consider. The overall regulatory environment, customer feedback, and trading conditions contribute to a complex risk landscape.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Questionable oversight from the SFC. |

| Fund Security | Medium | Limited transparency in protective measures. |

| Customer Service | High | Numerous complaints about response times and effectiveness. |

Given the elevated risks associated with HGNH, potential clients should approach with caution. It is advisable to conduct thorough research and consider alternative brokers with better reputations and regulatory oversight to mitigate potential losses. The question of whether HGNH is safe remains open, emphasizing the need for careful consideration.

Conclusion and Recommendations

Based on the comprehensive analysis, it is evident that HGNH presents several red flags that warrant concern. The combination of questionable regulatory status, customer complaints, and inconsistent trading conditions raises significant doubts about the broker's reliability. While there are elements of legitimacy, the risks associated with trading through HGNH cannot be overlooked.

For traders seeking a safe and reliable trading environment, it may be prudent to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Overall, while HGNH may not be outright fraudulent, it is essential to weigh the potential risks before proceeding. Thus, traders must remain vigilant and ask themselves if HGNH is safe for their trading activities.

Is HGNH INTERNATIONAL a scam, or is it legit?

The latest exposure and evaluation content of HGNH INTERNATIONAL brokers.

HGNH INTERNATIONAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HGNH INTERNATIONAL latest industry rating score is 5.63, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.63 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.