Is FX Daily safe?

Pros

Cons

Is FX Daily Safe or a Scam?

Introduction

FX Daily is a forex broker that positions itself in the competitive landscape of online trading, offering a platform for traders to engage in currency exchange. As the forex market continues to grow, traders are increasingly drawn to the potential for profit. However, this allure is accompanied by risks, particularly the presence of unregulated or fraudulent brokers. Given the prevalence of scams in the industry, it is crucial for traders to conduct thorough due diligence before committing their funds. This article aims to evaluate the legitimacy and safety of FX Daily by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this analysis, we utilized a comprehensive approach that includes a review of regulatory information, user feedback, and industry standards. The goal is to provide a balanced view of whether FX Daily is a safe trading option or if it raises red flags that warrant caution.

Regulation and Legitimacy

The regulatory environment in which a broker operates is critical to its legitimacy and the safety of traders' funds. A well-regulated broker is subject to stringent oversight, which helps protect investors from fraud and malpractice. In the case of FX Daily, the regulatory landscape appears ambiguous, as there is no clear evidence of oversight by a recognized authority.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Not Verified |

The absence of a regulatory license is a significant concern when assessing if FX Daily is safe. Regulatory bodies such as the FCA (UK), ASIC (Australia), and CySEC (Cyprus) enforce strict guidelines that brokers must adhere to. These regulations are designed to ensure transparency, protect client funds, and maintain fair trading practices. Without such oversight, traders may be exposed to higher risks, including the potential loss of funds due to mismanagement or fraudulent activities.

Moreover, the lack of historical compliance records for FX Daily raises questions about its operational integrity. Traders should be wary of unregulated brokers, as they often lack the necessary safeguards to protect client investments. In conclusion, the regulatory status of FX Daily does not inspire confidence, making it imperative for potential users to exercise caution when considering this broker.

Company Background Investigation

Understanding the background of a broker is essential for evaluating its trustworthiness. FX Daily's history, ownership structure, and management team play a pivotal role in determining its credibility. Unfortunately, detailed information about FX Daily is scarce, which can be a red flag in itself.

The company appears to operate without a transparent ownership structure, and the identities of its founders or key executives are not readily available. This lack of transparency can be concerning, as reputable brokers typically provide information about their leadership team and organizational history. A well-established broker often has a clear and documented history, which includes milestones in its development and operational achievements.

Moreover, the absence of a physical address or contact information can make it challenging for traders to reach out for support or resolve issues. A reliable broker should offer multiple channels for customer service, including phone, email, and live chat. The lack of such options at FX Daily further complicates the assessment of its legitimacy and raises concerns about customer support.

In summary, the limited information regarding FX Daily's background and management does not contribute positively to its credibility. Traders are advised to be cautious and consider the implications of engaging with a broker that lacks transparency and clear accountability.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, are critical factors that influence a trader's decision. In the case of FX Daily, the overall fee structure and trading conditions need to be scrutinized closely to determine if they align with industry standards.

FX Daily offers various trading instruments, but the specifics of its fee structure remain unclear. Traders should be particularly vigilant about any unusual or hidden fees that could erode their profits. Heres a comparative overview of the core trading costs associated with FX Daily:

| Fee Type | FX Daily | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0 - 1.5 pips |

| Commission Model | TBD | $3 - $7 per lot |

| Overnight Interest Range | TBD | Varies by broker |

The lack of transparency regarding spreads and commissions raises concerns about the potential for excessive costs. Many brokers provide clear details about their trading fees, enabling traders to make informed decisions. If FX Daily does not offer competitive spreads or has a complex commission structure, it may not be the best choice for cost-conscious traders.

Traders should also be aware of any additional charges, such as deposit or withdrawal fees, which can significantly impact overall profitability. Without a clear understanding of FX Daily's trading conditions, potential users may face unexpected costs that could jeopardize their trading success.

Customer Funds Security

The safety of client funds is paramount when evaluating any forex broker. FX Daily's measures for safeguarding customer deposits warrant careful examination. A reputable broker typically implements strict security protocols, including segregating client funds from company assets and offering negative balance protection.

Unfortunately, FX Daily's policies in this regard are not well-documented. The absence of clear information about fund segregation and investor protection mechanisms raises concerns about the safety of deposits. Traders should be cautious if a broker does not provide adequate assurances regarding the security of their funds.

Moreover, any history of financial disputes or issues related to fund safety can indicate potential risks. If FX Daily has faced any controversies regarding the management of client funds, it would be a significant red flag for potential users. Traders should prioritize brokers that demonstrate a strong commitment to fund security and transparency.

Customer Experience and Complaints

Customer feedback provides valuable insights into the reliability of a broker. In the case of FX Daily, user reviews and complaints can shed light on the overall trading experience. A thorough analysis of customer experiences reveals common patterns and concerns that potential traders should be aware of.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow to respond |

| Platform Stability | High | No acknowledgment |

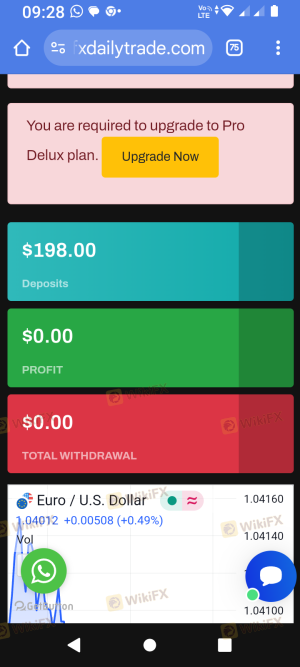

Common complaints about FX Daily include issues with withdrawals and inadequate customer support. Traders have reported difficulties in accessing their funds, which is a significant concern when evaluating if FX Daily is safe. A broker that does not facilitate smooth withdrawals poses a risk to traders' investments.

Additionally, the quality of customer support is crucial for resolving issues and ensuring a positive trading experience. If FX Daily has demonstrated slow response times or a lack of effective support channels, it may not be the best option for traders, especially those who are new to the forex market.

A couple of notable cases highlight these concerns. In one instance, a trader reported being unable to withdraw funds for several weeks, leading to frustration and distrust. Another user mentioned that customer support was unresponsive when they sought assistance with technical issues on the trading platform. Such experiences can significantly impact a trader's confidence in FX Daily.

Platform and Trade Execution

The performance of a trading platform is a critical factor for any forex broker. FX Daily's platform stability, order execution quality, and overall user experience should be assessed to determine if it meets the expectations of traders.

Traders expect a seamless and reliable trading experience, characterized by quick order execution and minimal slippage. If FX Daily's platform fails to deliver in these areas, it could result in significant losses for traders. Unfortunately, user feedback regarding FX Daily's platform has been mixed, with reports of occasional downtimes and execution delays.

Additionally, any signs of platform manipulation, such as frequent re-quotes or unjustified slippage, should raise alarms for potential users. A reputable broker should provide a transparent trading environment where traders can execute orders with confidence.

Risk Assessment

Engaging with FX Daily involves various risks that traders must consider. A comprehensive risk assessment can help potential users make informed decisions about whether to proceed with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | Unclear fee structure |

| Operational Risk | High | Platform stability issues |

| Customer Service Risk | High | Poor support and response times |

The lack of regulatory oversight is a significant risk factor, as it exposes traders to potential fraud and malpractice. Additionally, the unclear fee structure and reports of operational issues further complicate the risk landscape. Traders should approach FX Daily with caution and consider alternative brokers with more robust regulatory frameworks.

Risk Mitigation Suggestions

To mitigate risks associated with FX Daily, traders should:

- Conduct thorough research on the broker's reputation and user experiences.

- Consider starting with a small deposit to test the platform before committing larger amounts.

- Explore alternative brokers that offer better regulatory protections and customer support.

Conclusion and Recommendations

After a comprehensive analysis of FX Daily, it is evident that several red flags warrant caution. The lack of regulatory oversight, unclear trading conditions, and mixed customer feedback suggest that FX Daily may not be a safe choice for traders.

In conclusion, while FX Daily may offer trading opportunities, the potential risks associated with this broker cannot be overlooked. Traders are advised to consider alternative options that provide better regulatory protection and a more transparent trading environment. Recommended brokers include those that are well-regulated, offer competitive trading conditions, and have a proven track record of positive customer experiences. Always prioritize safety and due diligence when selecting a forex broker to ensure a secure trading experience.

Is FX Daily a scam, or is it legit?

The latest exposure and evaluation content of FX Daily brokers.

FX Daily Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX Daily latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.