Is PGOL safe?

Pros

Cons

Is Pgol Safe or Scam?

Introduction

Pgol, a forex broker, has become increasingly recognized in the trading community for its offerings in the foreign exchange market. However, as with any financial service provider, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging. The forex trading landscape is rife with potential pitfalls, including scams and unreliable brokers. Therefore, understanding the legitimacy and safety of a broker like Pgol is essential for protecting one's investments. In this article, we will investigate Pgol's regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment to determine if Pgol is indeed safe or if it exhibits characteristics of a scam.

Regulation and Legitimacy

The regulatory landscape of forex brokers plays a vital role in ensuring a safe trading environment. A broker's regulation status can significantly affect its legitimacy and reliability. Pgol's regulatory status is a crucial factor in assessing whether it is safe for traders. Currently, Pgol operates without oversight from any top-tier regulatory authority, which raises some red flags regarding its credibility.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Top-tier regulators, such as the U.S. Securities and Exchange Commission (SEC) or the UK's Financial Conduct Authority (FCA), enforce strict compliance standards to protect traders. The absence of such regulation for Pgol suggests that it may not adhere to the high standards expected of reputable brokers. Furthermore, without a governing body, traders may find it challenging to seek recourse in case of disputes or issues with fund withdrawals. Historical compliance records and regulatory scrutiny are essential to gauge a broker's reliability, and Pgol's lack of regulation poses a significant risk to potential investors.

Company Background Investigation

Understanding the company behind the broker is equally important in assessing whether Pgol is safe. Founded relatively recently, Pgol has not established a long track record in the industry, which can be a concern for traders seeking a reliable partner. The ownership structure of Pgol remains somewhat opaque, making it difficult to ascertain who is behind the operations and what their motivations might be.

The management team's background is another critical aspect. Ideally, a trustworthy broker should have a team with extensive experience in finance and trading. However, information regarding the qualifications and professional history of Pgol's management is limited. This lack of transparency can be alarming for traders, as it raises questions about the broker's commitment to ethical practices and customer service. Without a clear understanding of the company's history and leadership, it becomes challenging to determine if Pgol is truly a safe option for traders.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, can significantly impact the overall trading experience. For Pgol, the overall fee structure appears to be higher than the industry average, which could deter potential clients.

| Fee Type | Pgol | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1.5 pips |

| Commission Model | $10 per trade | $5 per trade |

| Overnight Interest Range | 2% | 1% |

The spreads offered by Pgol are notably wider than those provided by many competitors, which can eat into profits, especially for day traders or those executing multiple trades. Additionally, the commission structure seems to be on the higher side, which could deter less active traders. Such unfavorable trading conditions can lead to a perception that Pgol might not prioritize its clients' best interests, raising concerns about its overall safety as a broker.

Customer Fund Security

The safety of client funds is paramount for any broker, and it is essential to evaluate the measures Pgol has in place to protect traders' investments. Pgol claims to implement certain security measures, but the specifics are vague and lack independent verification.

For instance, the lack of segregation of client funds from the company's operational funds poses a significant risk. In the event of financial difficulties, traders' funds could be at risk. Moreover, the absence of negative balance protection means clients could potentially lose more than their initial investment, which is a common safety feature among regulated brokers.

Historically, there have been reports of issues related to fund security in unregulated brokers, leading to significant losses for traders. Without robust security measures and transparency regarding fund management, it is difficult to conclude that Pgol is a safe option for traders looking to protect their investments.

Customer Experience and Complaints

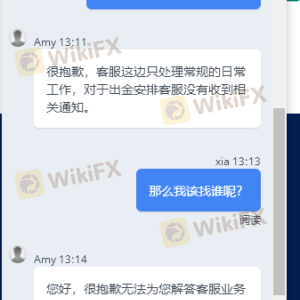

Customer feedback is an essential component of evaluating a broker's reliability. In the case of Pgol, user reviews are mixed, with several complaints surfacing regarding withdrawal issues and customer support quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow to respond |

| Lack of Transparency | High | No clear answers |

Common complaints include delays in processing withdrawals, which can be a significant red flag for traders. A broker that does not facilitate timely access to funds may be perceived as untrustworthy. Additionally, the quality of customer support has been criticized, with users reporting slow response times and vague answers to inquiries. These issues can lead to frustration and a sense of insecurity for traders, further questioning whether Pgol is safe.

Platform and Execution

The trading platform's performance is another critical aspect to consider. Pgols platform has received mixed reviews regarding stability and user experience. Users have reported occasional outages and lag during high volatility periods, which can severely impact trading outcomes.

Furthermore, concerns about order execution quality, including slippage and rejections, have been noted. Traders have expressed frustration over experiencing slippage during critical market movements, which can lead to unexpected losses. Such platform-related issues could indicate potential manipulation or inefficiencies, raising further doubts about whether Pgol can be trusted as a reliable trading partner.

Risk Assessment

When evaluating the overall risk of using Pgol, several factors must be considered. The lack of regulation, unfavorable trading conditions, and mixed customer feedback contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No top-tier regulation |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Platform stability issues |

| Customer Service Risk | High | Poor response to complaints |

Given these factors, traders should approach Pgol with caution. It is advisable to conduct thorough research and consider alternative brokers with better regulatory oversight and customer feedback.

Conclusion and Recommendations

After a comprehensive evaluation of Pgol, it is clear that there are significant concerns regarding its safety and reliability. The absence of regulation, coupled with unfavorable trading conditions, raises red flags that cannot be ignored. Moreover, the mixed customer feedback and platform issues further exacerbate the perception that Pgol may not be the safest choice for traders.

For those considering trading with Pgol, it is crucial to weigh these factors carefully. Traders may want to explore alternative brokers that are regulated by reputable authorities and offer better customer service and trading conditions. Some recommended options include brokers regulated by the FCA or ASIC, which provide a safer trading environment and greater peace of mind.

In conclusion, while Pgol may offer certain trading opportunities, the risks associated with using this broker suggest that it is prudent to proceed with caution. Ultimately, ensuring the safety of your investments should be the top priority, and choosing a well-regulated broker is a critical step in achieving that goal.

Is PGOL a scam, or is it legit?

The latest exposure and evaluation content of PGOL brokers.

PGOL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PGOL latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.