Regarding the legitimacy of GTMMAR forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is GTMMAR safe?

Business

License

Is GTMMAR markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

Clone FirmLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Zhong Yang Securities Limited

Effective Date:

2016-03-04Email Address of Licensed Institution:

cs@zyzq.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.zyzq.com.hkExpiration Time:

--Address of Licensed Institution:

香港干諾道西118號1101室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is GTMMAR Safe or a Scam?

Introduction

GTMMAR, a forex broker based in Hong Kong, has recently attracted attention in the trading community. With a focus on providing access to various financial instruments such as forex, precious metals, and indices, GTMMAR positions itself as a competitive player in the forex market. However, the increasing number of scams in the financial sector necessitates that traders conduct thorough evaluations of brokers before committing their funds. This article aims to assess whether GTMMAR is a safe trading platform or if it exhibits characteristics of a scam. Our investigation utilizes a combination of regulatory analysis, company background checks, customer feedback, and risk assessments to provide a comprehensive overview.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. GTMMAR claims to be regulated by the Financial Conduct Authority (FCA) in the United Kingdom; however, this license is marked as a "suspicious clone." This raises significant concerns about the broker's legitimacy. Below is a summary of GTMMAR's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Suspicious Clone |

The importance of proper regulation cannot be overstated; it ensures that a broker adheres to strict standards and ethical practices. The FCA is known for its rigorous oversight, and any association with a clone firm can be detrimental to a broker's credibility. Historical compliance issues have also been noted, with reports indicating that GTMMAR has faced scrutiny over its operations, particularly in relation to its claims of regulatory oversight. As such, potential traders should approach GTMMAR with caution given its dubious regulatory status.

Company Background Investigation

GTMMAR's history and ownership structure also warrant a closer examination. The broker has been operational for approximately 5 to 10 years and is registered in Hong Kong. However, details regarding its ownership and management team remain vague, contributing to a lack of transparency. This opacity can be a red flag for traders, as a well-structured and transparent company is generally more trustworthy.

The management team's qualifications and professional experience are crucial in assessing the broker's reliability. Unfortunately, there is limited information available about the individuals behind GTMMAR, which raises concerns about their expertise and commitment to ethical trading practices. The absence of clear information regarding the company's operational history and management can lead to skepticism about its overall credibility.

Trading Conditions Analysis

When evaluating whether GTMMAR is safe, it is essential to consider its trading conditions, including fees and costs. The broker offers a variety of trading instruments, but its fee structure raises some eyebrows. Traders should be aware of any unusual or hidden fees that could eat into their profits. Below is a comparison of GTMMAR's core trading costs:

| Fee Type | GTMMAR | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | $6 per lot | $3-5 per lot |

| Overnight Interest Range | Variable | Variable |

The spread for major currency pairs can vary significantly, and traders should be cautious of the high commissions that GTMMAR charges per lot. Such fees can deter traders, particularly those who engage in high-frequency trading. Understanding the overall cost structure is vital for assessing the broker's competitiveness in the market.

Client Funds Security

The safety of client funds is a paramount concern for any trader. GTMMAR claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory status.

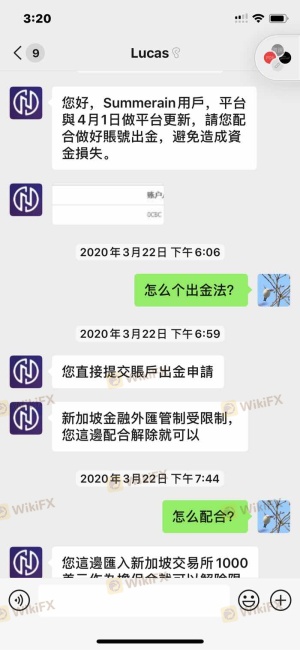

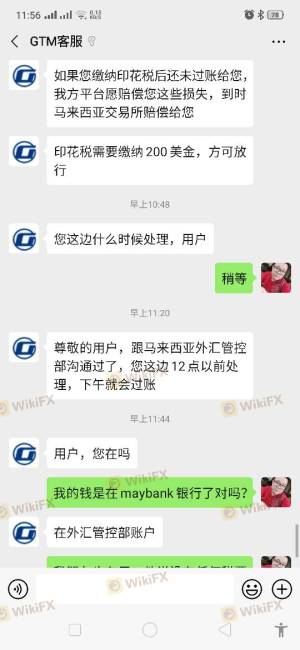

Historically, there have been reports of clients facing difficulties in withdrawing their funds, which raises alarms about the broker's financial stability and commitment to safeguarding client assets. A thorough examination of GTMMAR's funding security measures reveals that while they may have protocols in place, the lack of credible oversight diminishes the effectiveness of these protections.

Customer Experience and Complaints

Customer feedback is another critical factor in evaluating whether GTMMAR is safe or a scam. Numerous reviews indicate a pattern of complaints regarding withdrawal issues and lack of customer support. Below is a summary of common complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Slow |

Many users have reported being unable to withdraw their funds, with some alleging that the platform imposes additional fees or conditions before allowing withdrawals. These complaints suggest a troubling trend that potential traders should consider seriously. A couple of notable cases include users who claimed they were asked to pay additional fees to access their funds, which can be indicative of a scam.

Platform and Execution

Assessing the trading platform's performance is essential in determining whether GTMMAR is safe. The broker offers the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust features. However, concerns have been raised about order execution quality, including instances of slippage and order rejections.

A reliable trading platform should ensure minimal slippage and high execution speed; however, reports indicate that GTMMAR may not consistently meet these standards. Traders should be cautious and consider the potential for platform manipulation, which could adversely affect their trading experience.

Risk Assessment

Using GTMMAR involves several risks that potential traders should be aware of. Below is a summary of key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Suspicious licensing status. |

| Withdrawal Risk | High | History of withdrawal issues reported. |

| Transparency Risk | Medium | Lack of clear information about management. |

To mitigate these risks, traders should conduct thorough research and consider starting with a smaller investment to gauge the platform's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that GTMMAR exhibits several red flags that warrant caution. The broker's dubious regulatory status, history of customer complaints, and lack of transparency raise significant concerns about its safety. Is GTMMAR safe? Given the potential risks and issues highlighted in this analysis, traders should approach this broker with skepticism.

For those seeking to trade in a more secure environment, it is advisable to consider alternatives that are well-regulated and have a proven track record of positive customer experiences. Brokers regulated by reputable authorities, such as the FCA or ASIC, may provide a safer trading environment. Always prioritize due diligence and ensure that your chosen broker aligns with your trading needs and risk tolerance.

Is GTMMAR a scam, or is it legit?

The latest exposure and evaluation content of GTMMAR brokers.

GTMMAR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GTMMAR latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.