Is Profiforex safe?

Pros

Cons

Is Profiforex A Scam?

Introduction

Profiforex is an offshore forex broker that has been operating since 2010, primarily targeting both novice and experienced traders in the forex market. With a wide array of trading instruments, including currency pairs, commodities, and cryptocurrencies, Profiforex positions itself as a competitive player in the industry. However, the necessity for traders to perform due diligence when selecting a broker cannot be overstated. The forex market is rife with both legitimate and fraudulent entities, making it crucial for traders to assess the safety and reliability of their chosen platforms.

This article aims to provide an objective analysis of Profiforex by evaluating its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. The information is gathered from various credible sources, including reviews, regulatory databases, and user feedback, ensuring a comprehensive evaluation of whether Profiforex is safe or a potential scam.

Regulation and Legality

The regulatory landscape of a forex broker is critical for ensuring the safety of client funds and the integrity of trading practices. Profiforex claims to be registered in Seychelles, but it does not hold a license from any reputable regulatory authority. This lack of regulation raises significant concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Seychelles | Unregulated |

The absence of a regulatory framework means that Profiforex is not subject to the oversight that protects traders from fraud and malpractice. Regulated brokers are required to adhere to stringent guidelines, including maintaining segregated accounts for client funds and providing transparency regarding fees and trading conditions. In contrast, Profiforex operates without these checks, which is a major red flag for potential investors.

Historically, unregulated brokers have been associated with various compliance issues, including delayed withdrawals, price manipulation, and other fraudulent activities. Therefore, the lack of regulatory oversight at Profiforex significantly undermines the broker's credibility and raises the question: Is Profiforex safe? Given these factors, it is advisable for traders to exercise extreme caution before engaging with this broker.

Company Background Investigation

Profiforex was established by a group of traders with the aim of providing a reliable trading environment. However, the company's ownership structure, which is linked to Tim Group Inc. based in Belize, raises questions about its operational transparency. The management teams background is not well-documented, making it difficult to assess their experience and qualifications in the forex trading industry.

The information disclosure from Profiforex is limited, which further diminishes trust. A reputable broker typically provides detailed information about its management and operational practices to instill confidence among traders. The lack of such transparency at Profiforex is concerning and leads to skepticism about the broker's overall legitimacy.

In assessing whether Profiforex is safe, the limited information available about the companys operations and its management team suggests a lack of accountability, which is often a characteristic of less trustworthy brokers. Therefore, potential traders should be wary and consider the implications of such opacity when deciding to invest their funds.

Trading Conditions Analysis

Profiforex offers a range of trading conditions that may initially appear attractive to traders. The broker provides a low minimum deposit requirement of just $1, which is appealing for beginners. However, the overall fee structure raises several concerns that warrant further examination.

| Fee Type | Profiforex | Industry Average |

|---|---|---|

| Spread on Major Pairs | Variable (0.1 to 3 pips) | 1-2 pips |

| Commission Model | Varies by account type | $5 per lot (ECN) |

| Overnight Interest Range | 0.017% | 0.5% |

The variable spreads offered by Profiforex can be competitive, but the lack of clarity regarding commissions and additional fees can lead to unexpected costs for traders. Moreover, the presence of a high leverage ratio of up to 1:500, while enticing, poses substantial risks, particularly for inexperienced traders. Such leverage can amplify losses as easily as it can enhance gains, raising further questions about the safety of trading with Profiforex.

Additionally, the absence of a clear and transparent fee structure is a significant concern. Traders should be cautious of any broker that does not openly disclose all potential costs associated with trading. This lack of transparency can lead to disputes and dissatisfaction, making it imperative for traders to ask themselves: Is Profiforex safe? Given the potential for hidden fees and unclear commission structures, it is advisable for traders to proceed with caution.

Client Fund Security

The security of client funds is a paramount concern for any trader. Profiforex claims to maintain segregated accounts, which is a positive aspect. However, the lack of regulatory oversight means that there is no assurance that these measures are effectively implemented.

The broker does not provide any investor protection schemes, which are typically established by regulated entities to safeguard client funds in the event of insolvency or operational failures. Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial investment, increasing the risk of financial loss.

Historically, unregulated brokers like Profiforex have faced scrutiny for their handling of client funds. Numerous complaints have surfaced regarding difficulties in withdrawing funds, with many users reporting lengthy delays or outright refusals to process withdrawal requests. Such issues raise serious questions about the safety of trading with Profiforex and whether the broker can be trusted to handle client funds responsibly.

Given these factors, potential traders must seriously consider whether Profiforex is safe for their investments. The combination of insufficient regulatory oversight, lack of investor protection, and historical complaints about fund withdrawals suggests a high degree of risk associated with this broker.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of any broker. Reviews of Profiforex reveal a mixed bag of experiences, with a significant number of complaints highlighting serious issues.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Manipulation | High | Poor |

| Customer Service | Medium | Average |

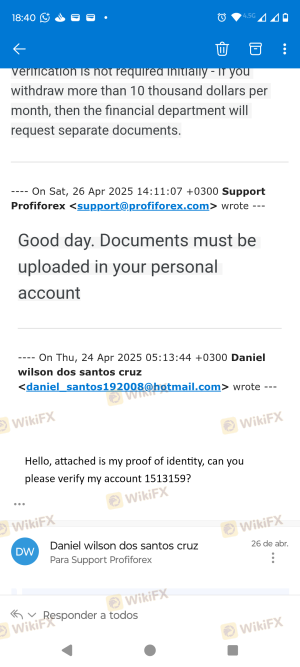

Common complaints include difficulties in withdrawing funds, with many users reporting that their requests are either delayed or denied without explanation. Additionally, there are allegations of account manipulation, where profitable trades are adjusted or voided, leading to significant losses for traders. The companys response to these complaints has been criticized as inadequate, with many users feeling ignored or dismissed.

For instance, one user reported waiting for over a month for a withdrawal, only to receive minimal communication from customer support. Another trader experienced account manipulation that resulted in a negative balance, raising concerns about the broker's integrity.

These patterns of complaints strongly suggest that potential traders should approach Profiforex with caution. The question remains: Is Profiforex safe? Given the historical issues with withdrawals and account handling, it is prudent for traders to consider alternative brokers with better reputations for customer service and fund management.

Platform and Execution

The trading platform offered by Profiforex, primarily MetaTrader 4 (MT4), is widely recognized and favored by many traders for its functionality and user-friendly interface. However, the performance and execution quality of the platform are critical factors that can significantly impact trading success.

Traders have reported mixed experiences regarding order execution, with some citing instances of slippage and re-quotes, which can be detrimental to trading strategies. Moreover, the potential for platform manipulation, although not definitively proven, remains a concern, particularly given the broker's unregulated status.

While MT4 itself is a reliable platform, the execution quality can vary based on the broker's practices. Instances of delayed execution or price manipulation can lead to significant financial losses, particularly for traders employing automated strategies or scalping techniques.

In evaluating whether Profiforex is safe, the mixed reviews regarding platform performance and execution quality warrant careful consideration. Traders should be aware of the risks associated with using a broker that lacks regulatory oversight and may not prioritize fair execution practices.

Risk Assessment

The overall risk associated with trading through Profiforex is considerable, particularly given its unregulated status and the numerous complaints from users.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Potential for loss exceeds initial investment. |

| Operational Risk | Medium | Complaints about withdrawal issues and account manipulation. |

| Customer Support Risk | Medium | Poor responsiveness to client inquiries. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers that are regulated and have a proven track record of reliability. Traders should also implement risk management strategies, such as setting stop-loss orders and limiting exposure to any single investment.

In conclusion, the question of whether Profiforex is safe remains complex. The high levels of risk associated with this broker suggest that traders should be cautious and consider alternative options.

Conclusion and Recommendations

In summary, the evidence gathered indicates that Profiforex operates as an unregulated broker, which raises significant concerns regarding its safety and reliability. The lack of regulatory oversight, combined with numerous complaints about withdrawal issues and account manipulation, suggests that traders should approach this broker with caution.

Given the findings, it is advisable for traders to seek alternative brokers that are well-regulated and have a reputation for transparency and customer service. Some recommended alternatives include brokers regulated by the FCA or ASIC, which offer better investor protection and a more secure trading environment.

Ultimately, while Profiforex may present attractive trading conditions, the associated risks and historical issues highlight the importance of thorough due diligence before committing funds. The question remains: Is Profiforex safe? Based on the available evidence, the answer is a resounding no, and traders are encouraged to consider more reputable options for their trading needs.

Is Profiforex a scam, or is it legit?

The latest exposure and evaluation content of Profiforex brokers.

Profiforex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Profiforex latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.